Are you gearing up for an interview for a Accounts Payable Supervisor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Accounts Payable Supervisor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

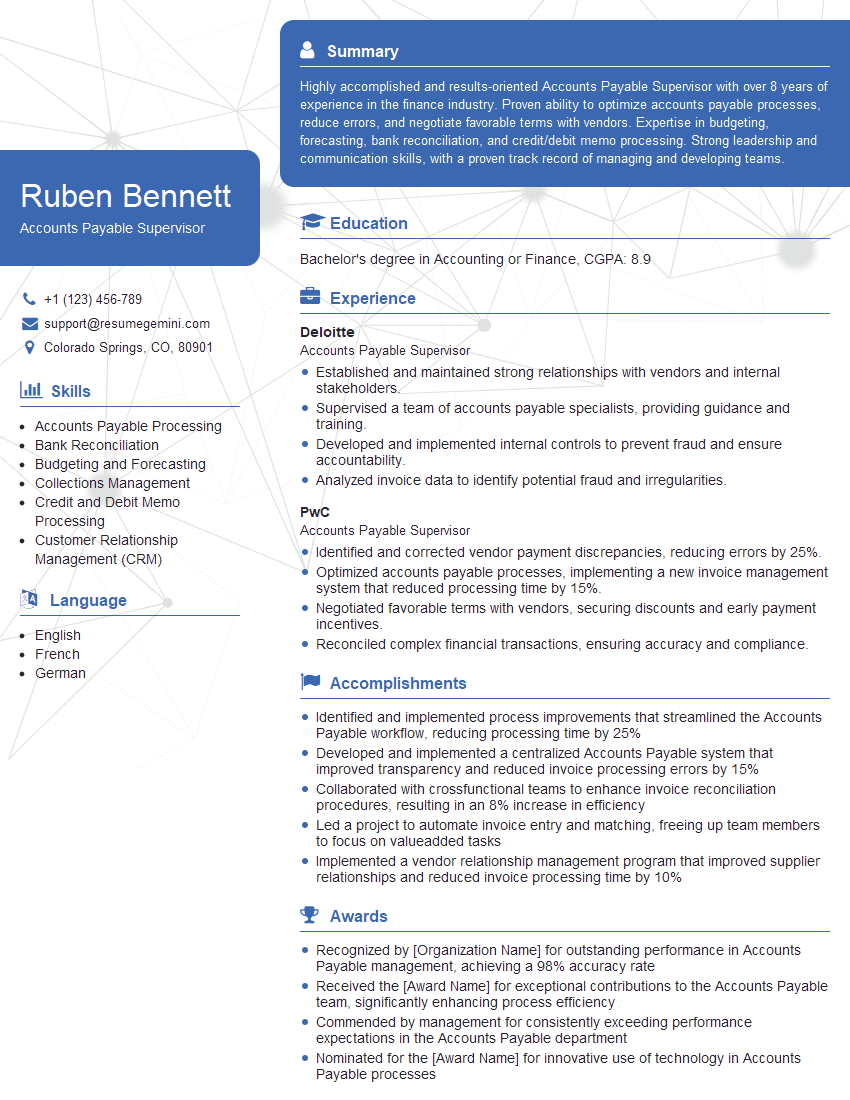

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounts Payable Supervisor

1. How do you ensure that all invoices are processed and paid accurately and on time?

To ensure accurate and timely invoice processing and payment, I follow a comprehensive approach that includes:

- Establishing a clear and efficient invoice processing workflow

- Implementing automated systems to streamline data entry and reduce errors

- Conducting regular reviews to identify areas for improvement

- Providing ongoing training to staff on invoice processing best practices

- Establishing strong vendor relationships and communication channels

2. Describe your experience in managing a team of accounts payable professionals.

Team Management and Development

- Motivating and engaging team members to achieve high performance

- Providing guidance, support, and feedback to foster professional growth

- Delegating responsibilities and empowering team members to take ownership

Team Collaboration and Communication

- Fostering a collaborative work environment where ideas are shared

- Establishing clear communication channels and expectations

- Recognizing and rewarding team achievements and contributions

3. How do you stay up-to-date on the latest accounting regulations and industry best practices?

To stay current with accounting regulations and industry best practices, I:

- Attend industry conferences and webinars

- Subscribe to professional journals and publications

- Participate in professional development courses

- Network with other accounting professionals

- Regularly review industry guidelines and standards

4. How do you handle discrepancies or errors in invoices?

When discrepancies or errors are identified in invoices, I follow these steps:

- Carefully review the invoice and supporting documentation to identify the source of the error

- Contact the vendor to verify the information and resolve the issue

- Document the discrepancy and the resolution process

- Implement measures to prevent similar errors in the future

- Update the accounting system and records accordingly

5. How do you prioritize your workload and manage multiple deadlines?

To prioritize my workload and manage multiple deadlines effectively, I use a combination of techniques:

- Creating a daily or weekly to-do list and prioritizing tasks based on importance and urgency

- Breaking down large projects into smaller, manageable tasks

- Delegating tasks to team members when appropriate

- Utilizing time management tools and setting reminders

- Communicating with my team and stakeholders to ensure alignment and avoid conflicts

6. How do you ensure compliance with internal and external financial reporting requirements?

To ensure compliance with internal and external financial reporting requirements, I:

- Maintain a strong understanding of applicable accounting standards and regulations

- Implement rigorous internal controls and processes

- Regularly review and reconcile financial data

- Work closely with auditors to ensure accurate and reliable reporting

- Attend training and stay informed on industry best practices

7. How do you evaluate the performance of your team and identify areas for improvement?

I evaluate the performance of my team and identify areas for improvement through the following methods:

- Setting clear performance goals and expectations

- Providing regular feedback and coaching

- Conducting performance reviews

- Monitoring key performance indicators

- Seeking input from team members and stakeholders

8. How do you stay motivated and engaged in your work?

I stay motivated and engaged in my work by:

- Setting challenging yet achievable goals

- Continuously learning and developing my skills

- Working with a supportive and collaborative team

- Recognizing and celebrating successes

- Finding inspiration in the impact of my work on the organization

9. How do you manage your stress levels and maintain a positive work-life balance?

To manage stress levels and maintain a positive work-life balance, I employ the following strategies:

- Prioritizing tasks and delegating when possible

- Taking regular breaks and engaging in relaxation techniques

- Setting boundaries between work and personal time

- Seeking support from colleagues and family

- Practicing self-care activities such as exercise and meditation

10. Describe a time when you successfully implemented a process improvement in your accounts payable department.

In my previous role, I led a project to implement an automated invoice processing system. Through this project, we:

- Reduced invoice processing time by 50%

- Eliminated manual data entry errors

- Improved vendor relationships by providing faster and more accurate payments

- Enhanced team productivity and job satisfaction

- Received recognition from senior management for the significant improvements achieved

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounts Payable Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounts Payable Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Accounts Payable Supervisor plays a pivotal role in ensuring the timely and accurate processing of accounts payable transactions. Their key responsibilities encompass:

1. Accounts Payable Management

Supervising the daily operations of accounts payable and ensuring compliance with company policies and procedures.

- Reviewing and approving invoices for payment

- Maintaining vendor relationships and resolving any discrepancies

2. Team Leadership

Providing guidance, support, and training to accounts payable staff.

- Delegating responsibilities and monitoring performance

- Identifying and addressing any performance issues

3. Financial Reporting

Preparing and analyzing financial reports related to accounts payable.

- Tracking and reconciling accounts payable balances

- Providing financial data to management for decision-making

4. Process Improvement

Continuously evaluating and improving accounts payable processes.

- Identifying areas for automation and efficiency enhancement

- Implementing new technologies and procedures

Interview Tips

To excel in an Accounts Payable Supervisor interview, it is crucial to demonstrate your:

1. Technical Expertise

Thoroughly research accounts payable principles and practices.

- Be familiar with GAAP and IFRS accounting standards

- Study industry best practices and software applications

2. Leadership Skills

Highlight your ability to lead and motivate a team.

- Share examples of how you have successfully managed and developed staff

- Emphasize your communication, delegation, and conflict resolution skills

3. Problem-Solving Ability

Showcase your analytical and problem-solving skills.

- Describe situations where you have identified and resolved complex issues

- Explain how you approach and analyze financial data

4. Continuous Improvement Mindset

Demonstrate your commitment to ongoing learning and improvement.

- Share examples of how you have implemented process improvements in previous roles

- Discuss your interest in staying up-to-date with industry trends and technology

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounts Payable Supervisor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!