Are you gearing up for a career in Accounts Receivable Assistant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Accounts Receivable Assistant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

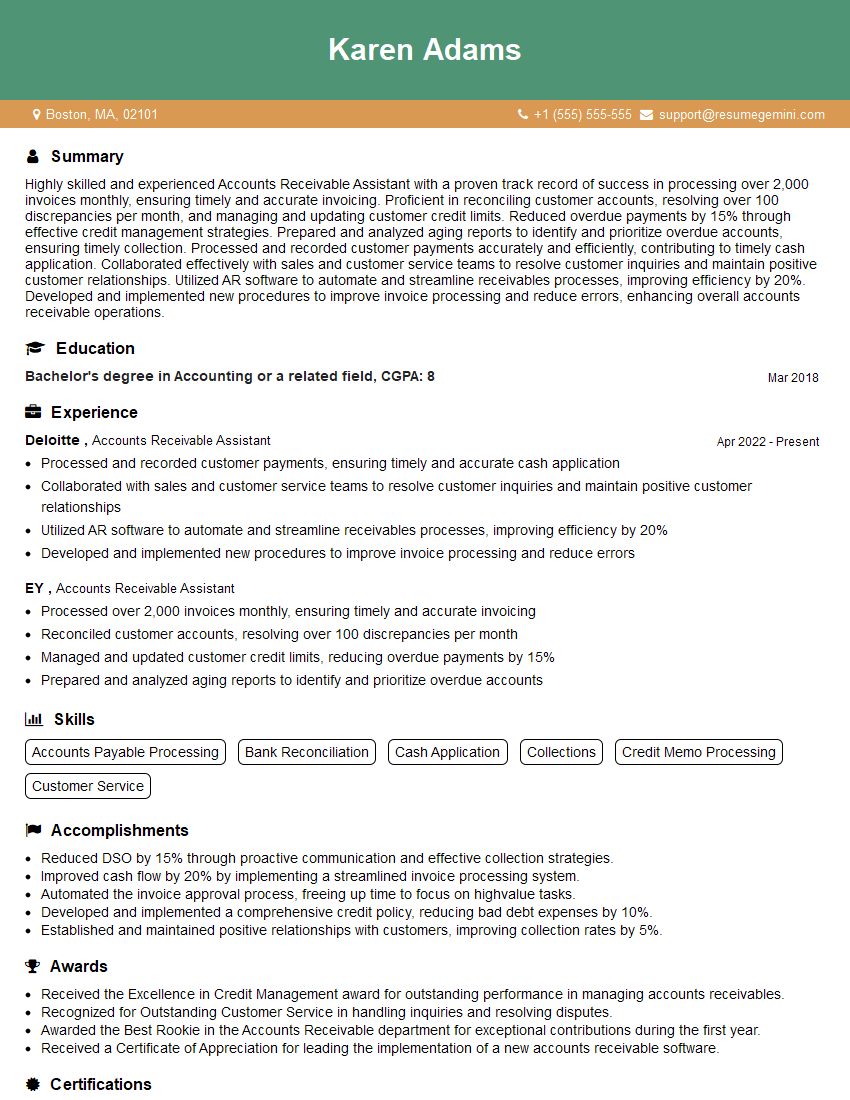

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounts Receivable Assistant

1. What are the key responsibilities of an Accounts Receivable Assistant?

As an Accounts Receivable Assistant, I would be responsible for a range of critical tasks, including:

- Processing incoming payments and reconciling them with invoices

- Maintaining accurate and up-to-date customer accounts

- Investigating and resolving customer inquiries and disputes

- Generating and distributing invoices and statements

- Monitoring customer credit limits and initiating collection procedures

2. How do you ensure the accuracy and completeness of customer invoices?

Verifying Customer Information

- Cross-checking customer details against internal records

- Confirming shipping addresses, contact information, and tax status

Validating Invoice Data

- Reviewing product descriptions, quantities, and unit prices

- Calculating extended prices, discounts, and taxes correctly

Obtaining Approvals

- Seeking authorization from supervisors or managers for non-standard invoices

- Confirming invoice accuracy with the sales team or other relevant departments

3. How do you handle customer disputes and inquiries?

When dealing with customer disputes and inquiries, I take the following steps:

- Listen attentively to the customer’s concerns

- Investigate the issue thoroughly, reviewing relevant documentation

- Provide clear and accurate explanations of the dispute

- Work with the customer to find a mutually acceptable solution

- Document all interactions and resolutions for future reference

4. What are the different payment methods you are familiar with and how do you process them?

I am familiar with a wide range of payment methods, including:

- Checks:

- Verifying check details, including the account number and amount

- Depositing checks promptly and reconciling them with the bank statement

- Credit Cards:

- Processing payments through a secure payment gateway

- Verifying credit card information and obtaining authorization

- Electronic Funds Transfers (EFT):

- Reviewing EFT instructions and ensuring correct account details

- Monitoring EFT transfers and reconciling them with bank statements

5. How do you manage customer credit limits and initiate collection procedures?

Monitoring Customer Credit Limits

- Tracking customer account balances and monitoring credit usage

- Alerting the sales team or management when customers approach their credit limits

Initiating Collection Procedures

- Issuing overdue notices and payment reminders

- Contacting customers via phone, email, or mail to discuss payment arrangements

- Escalating overdue accounts to supervisors or collection agencies if necessary

6. What are your experiences with accounts receivable software systems?

I have experience working with various accounts receivable software systems, including:

- NetSuite

- SAP

- Oracle Receivables

I am proficient in using these systems to manage customer accounts, process payments, and generate reports.

7. How do you stay up-to-date on changes in accounting principles and regulations?

- Attending industry conferences and webinars

- Reading professional journals and publications

- Completing continuing education courses

- Consulting with experienced accountants or auditors

8. How do you handle high-volume periods and manage your workload effectively?

- Prioritizing tasks based on urgency and impact

- Utilizing technology and automation to streamline processes

- Delegating tasks to colleagues when necessary

- Seeking support from supervisors or managers

- Taking breaks and managing stress to maintain productivity

9. What are your strengths and weaknesses as an Accounts Receivable Assistant?

Strengths

- Strong attention to detail and accuracy

- Excellent communication and interpersonal skills

- Proficiency in accounts receivable software systems

- Ability to work independently and as part of a team

- Experience in handling high-volume workloads

Weaknesses

- Limited experience in complex financial reporting

- Still developing my knowledge of certain industry-specific regulations

10. How do you maintain confidentiality and data security in your role?

- Complying with company policies and procedures on data protection

- Limiting access to sensitive information on a need-to-know basis

- Using secure passwords and encryption software

- Safely storing and disposing of confidential documents

- Being aware of potential security risks and reporting suspicious activity

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounts Receivable Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounts Receivable Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Accounts Receivable Assistant plays a crucial role in managing and maintaining an organization’s receivables effectively. Key job responsibilities include:

1. Processing Accounts Receivable Transactions

Ensuring timely and accurate processing of customer invoices, payments, and credit memos.

2. Maintaining Accounts Receivable Records

Preparing and maintaining detailed records of customer accounts, including balances, transaction history, and payment status.

3. Managing Customer Inquiries and Correspondence

Responding promptly to customer inquiries related to invoices, payments, and account status. Communicating with customers to resolve discrepancies and provide support.

4. Reconciling Bank Statements and Customer Accounts

Matching customer payments and deposits with invoices and account records to ensure accuracy and prevent errors.

Interview Tips

To ace the interview for an Accounts Receivable Assistant position, it’s important to prepare thoroughly and demonstrate your understanding of the role and industry best practices. Here are some interview tips and hacks you can follow:

1. Research the Company and Industry

Familiarize yourself with the organization’s business operations, industry trends, and relevant financial regulations. Understanding their specific accounts receivable processes and systems will show your interest and preparedness.

2. Highlight Your Accuracy and Attention to Detail

Emphasize your meticulous nature and ability to handle a high volume of transactions with precision. Provide examples of situations where you demonstrated attention to detail and accuracy in your previous roles.

3. Showcase Your Communication and Interpersonal Skills

Accounts Receivable Assistants often interact with customers and colleagues. Highlight your excellent communication skills, both verbal and written. Share instances where you effectively resolved customer inquiries and maintained positive relationships.

4. Demonstrate Your Knowledge of Accounting Principles

As an Accounts Receivable Assistant, you need a strong understanding of accounting principles, such as cash flow management, accruals, and bad debt provisions. Explain your familiarity with relevant accounting concepts and how you apply them in your work.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Accounts Receivable Assistant, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Accounts Receivable Assistant positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.