Are you gearing up for an interview for a Accounts Receivable Coordinator position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Accounts Receivable Coordinator and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

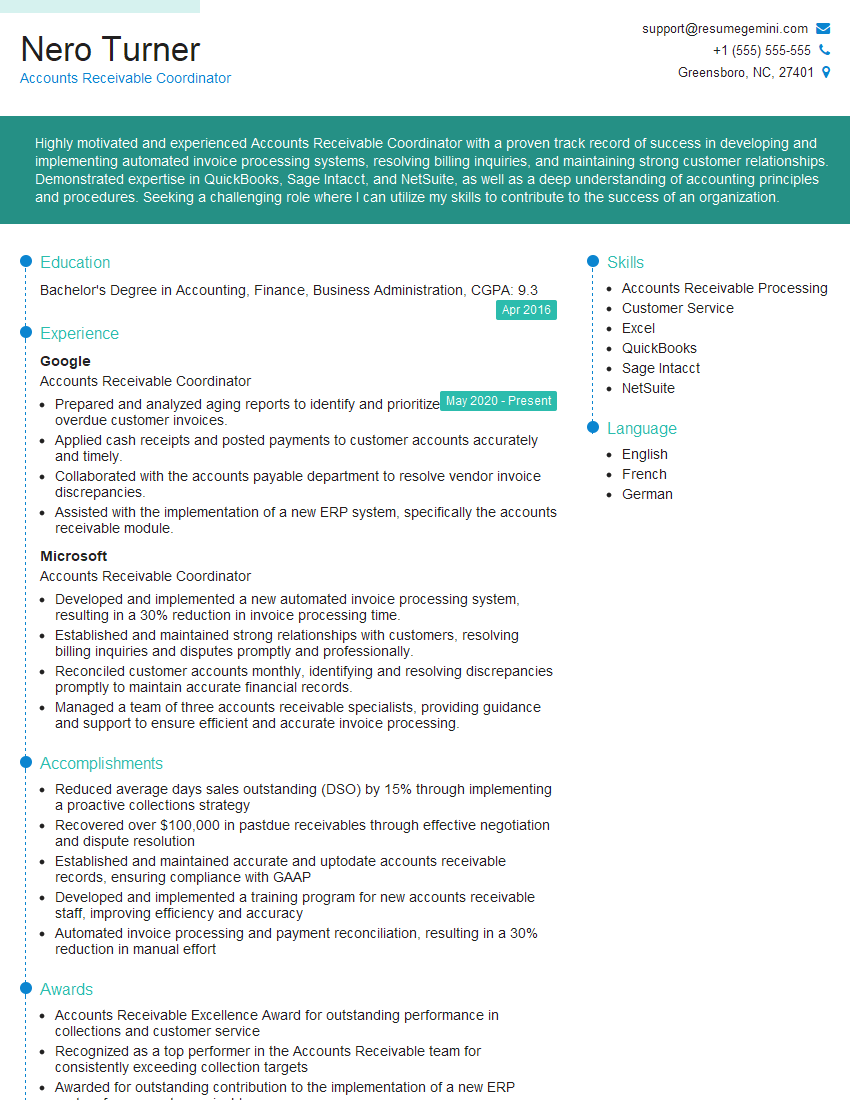

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounts Receivable Coordinator

1. What are the key responsibilities of an Accounts Receivable Coordinator?

- Processing customer invoices and payments

- Maintaining customer accounts and balances

- Resolving customer inquiries and disputes

- Preparing and distributing monthly statements

- Reconciling bank statements and identifying discrepancies

2. What are the essential skills and qualifications required for this role?

Technical skills

- Proficient in accounting software (e.g., QuickBooks, NetSuite)

- Excellent communication and interpersonal skills

- Strong attention to detail and accuracy

- Ability to work independently and as part of a team

Qualifications

- Bachelor’s degree in Accounting or related field

- 2+ years of experience in accounts receivable

- Certifications (e.g., QuickBooks ProAdvisor, Accounts Receivable Specialist)

3. What are the common challenges faced by Accounts Receivable Coordinators?

- Managing large volumes of invoices and payments

- Dealing with customer disputes and inquiries

- Ensuring accurate and timely financial reporting

- Staying up-to-date with accounting regulations and procedures

- Maintaining strong relationships with customers

4. How do you stay organized and prioritize your work in a fast-paced environment?

- Use a to-do list or task management system

- Set priorities and focus on the most important tasks first

- Break down large tasks into smaller, more manageable ones

- Delegate tasks to others when possible

- Take breaks and avoid burning out

5. What is your experience with resolving customer disputes and inquiries?

- Listen attentively to the customer’s concerns

- Research the issue and gather all relevant information

- Explain the issue and resolution to the customer in a clear and concise manner

- Document the resolution and follow up with the customer

- Resolve disputes in a timely and effective manner

6. How do you handle discrepancies when reconciling bank statements?

- Review the bank statement and identify the discrepancies

- Compare the bank statement with the company’s records

- Investigate the cause of the discrepancy (e.g., errors, fraud)

- Correct the discrepancy and document the resolution

- Follow up with the bank and customer as necessary

7. What is your understanding of the Sarbanes-Oxley Act (SOX) and how does it relate to your role?

- SOX is a federal law that aims to improve the accuracy and reliability of financial reporting

- As an Accounts Receivable Coordinator, I am responsible for ensuring that the company’s financial records are accurate and complete

- I follow SOX guidelines by maintaining accurate and up-to-date records, adhering to internal controls, and cooperating with auditors

8. What are the best practices for preventing and detecting fraud in accounts receivable?

- Implement strong internal controls

- Regularly review accounts receivable balances

- Investigate any unusual or suspicious activity

- Train employees on fraud prevention

- Use technology to detect and prevent fraud

9. What are the key metrics that you track to measure your performance as an Accounts Receivable Coordinator?

- Days Sales Outstanding (DSO)

- Accounts Receivable Turnover Ratio

- Percentage of Bad Debt

- Customer Satisfaction

- Accuracy of Financial Reporting

10. How do you stay up-to-date with the latest accounting regulations and procedures?

- Attend industry conferences and webinars

- Read industry publications and blogs

- Network with other accounting professionals

- Take continuing education courses

- Stay informed about changes to accounting standards

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounts Receivable Coordinator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounts Receivable Coordinator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Accounts Receivable Coordinator is responsible for managing the receivables process, from invoice generation to cash collection. Key responsibilities include:

1. Invoice Processing

Ensuring accurate and timely invoice generation and distribution to customers.

- Verifying invoice details, including pricing, quantities, and terms.

- Resolving any discrepancies or errors promptly.

2. Accounts Receivable Reconciliation

Matching payments to invoices and reconciling accounts receivable records.

- Reviewing customer statements and identifying discrepancies.

- Investigating and resolving disputed invoices or payments.

3. Customer Communication

Communicating with customers regarding invoices, payments, and account balances.

- Responding to customer inquiries promptly and professionally.

- Negotiating payment arrangements if necessary.

4. Credit Management

Assessing customer creditworthiness and managing potential bad debts.

- Monitoring customer payment history and credit limits.

- Initiating collection efforts for overdue accounts.

Interview Tips

Preparation is key to acing an interview for an Accounts Receivable Coordinator position. Here are some tips to help you:

1. Research the Company

Learn about the company’s business, industry, and financial performance. This will help you understand their accounts receivable process and the specific challenges they may face.

- Visit the company’s website and social media pages.

- Read industry news and reports.

2. Practice Answering Common Interview Questions

Prepare for questions about your experience, skills, and knowledge of accounts receivable. Practice answering them concisely and confidently.

-

Example Outline:

Interview Question:

Tell me about your experience with accounts receivable reconciliation.

Brief Response:

- I have over 5 years of experience in accounts receivable reconciliation.

- In my previous role, I was responsible for matching payments to invoices, identifying discrepancies, and investigating disputed invoices.

I have a strong understanding of the importance of accurate and timely reconciliation to ensure the accuracy of the company’s financial records.

3. Showcase Your Soft Skills

Accounts Receivable Coordinators need strong communication, interpersonal, and analytical skills. Highlight these skills in your answers and provide examples from your experience.

-

Example Outline:

Interview Question:

How would you handle a difficult customer who is disputing an invoice?

Brief Response:

- I would approach the situation calmly and professionally.

- I would listen to the customer’s concerns and try to understand their perspective.

- I would then review the invoice and supporting documentation to determine if there is any validity to their claim.

- I would be willing to negotiate a payment arrangement if necessary, but I would also stand my ground and defend the company’s interests.

4. Dress Professionally and Arrive on Time

First impressions matter. Dress appropriately for the interview and arrive on time to show that you respect the interviewer’s time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounts Receivable Coordinator interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.