Feeling lost in a sea of interview questions? Landed that dream interview for Accounts Receivable Manager but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Accounts Receivable Manager interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

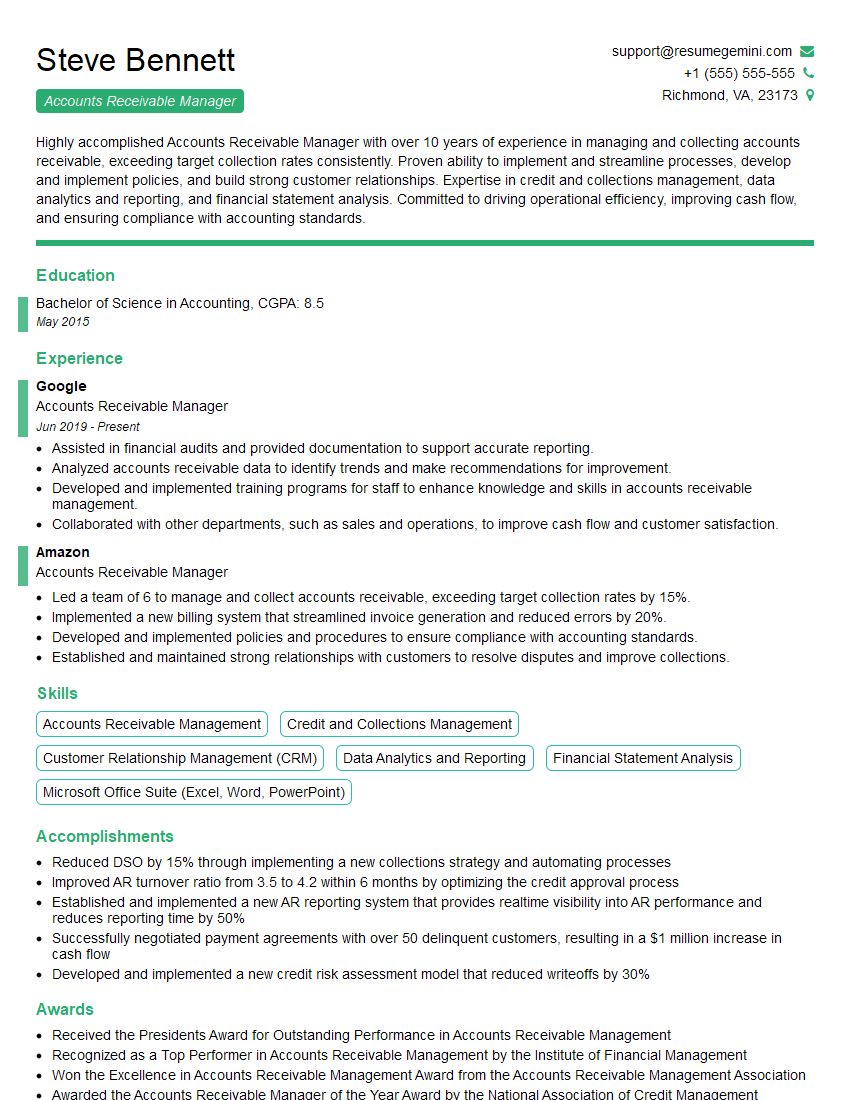

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounts Receivable Manager

1. Describe the key responsibilities of an Accounts Receivable Manager?

As an Accounts Receivable Manager, I would be responsible for:

- Managing and overseeing the accounts receivable department, including staff and processes.

- Developing and implementing policies and procedures to ensure efficient and effective accounts receivable management.

- Monitoring and analyzing accounts receivable performance metrics, identifying trends and areas for improvement.

- Working closely with customers to resolve disputes and ensure timely payments.

- Collaborating with other departments, such as sales, to improve the overall revenue collection process.

2. How do you ensure timely customer payments?

Establish Clear Payment Terms

- Communicating payment terms clearly to customers through invoices and contracts.

- Setting specific due dates and late payment policies.

Effective Invoicing

- Issuing invoices promptly and accurately.

- Providing clear and detailed information on invoices, including itemized charges, payment due dates, and contact details.

Regular Follow-Ups

- Reaching out to customers before payments are due to remind them and check on the status of payments.

- Using automated payment reminders or emails.

Incentives and Discounts

- Offering early payment discounts to encourage timely payments.

- Rewarding customers for meeting or exceeding payment goals.

3. What are the key metrics you track to measure the performance of the accounts receivable department?

- Days Sales Outstanding (DSO): This measures the average number of days it takes to collect payments.

- Customer Aging Analysis: This shows the percentage of accounts receivable in different aging categories, such as current, 30-60 days past due, and over 90 days past due.

- Collection Effectiveness: This measures the percentage of invoices collected within a certain period, such as 30 days.

- Bad Debt Expense: This represents the amount of money that is unlikely to be collected due to defaults or bankruptcies.

- Customer Satisfaction: This measures the level of customer satisfaction with the accounts receivable process.

4. Describe a challenging situation you faced in accounts receivable management and how you resolved it?

- Situation: A major customer disputed a large invoice, claiming that the goods were not received.

- Action:

- Contacted the customer to gather more information and review the order details.

- Collaborated with the shipping department to confirm the delivery.

- Provided documentation to the customer, including the delivery receipt and shipping records.

- Resolution: The customer acknowledged the error and agreed to pay the invoice in full.

5. What are some of the best practices for managing accounts receivable effectively?

- Automating processes to improve efficiency and reduce errors.

- Implementing a clear credit policy to assess customer creditworthiness and set payment terms.

- Providing multiple payment options to accommodate customer preferences.

- Regularly reviewing and updating accounts receivable processes to identify and address bottlenecks.

- Training staff on best practices for customer communication and dispute resolution.

6. How do you handle customer disputes and complaints?

- Listen actively: Allow the customer to fully explain their issue without interruption.

- Gather information: Obtain all relevant details, such as invoice number, payment history, and any supporting documentation.

- Investigate thoroughly: Review the customer’s account, check for errors, and consult with other departments if necessary.

- Communicate clearly: Explain the investigation findings and proposed resolution to the customer in a clear and concise manner.

- Resolve promptly: Take appropriate actions to resolve the dispute or complaint in a fair and timely manner.

7. How do you stay updated on the latest trends and best practices in accounts receivable management?

- Attending industry conferences and webinars.

- Reading trade publications and articles.

- Participating in professional organizations.

- Consulting with industry experts and vendors.

- Leveraging online resources and forums.

8. What are the key challenges currently facing accounts receivable management?

- Increased customer expectations and demand for flexible payment options.

- Global economic factors and their impact on payment patterns.

- Advancements in technology and the need to adapt to new systems and processes.

- Fraud and security concerns in digital payment channels.

- The need to balance efficiency with customer satisfaction.

9. How do you motivate and lead your team to achieve high performance?

- Set clear expectations: Communicate performance goals, roles, and responsibilities to the team.

- Provide regular feedback: Offer constructive criticism and recognition to motivate and guide team members.

- Foster a positive work environment: Create a supportive and collaborative atmosphere where team members feel valued and respected.

- Empower and delegate: Give team members the authority and resources to make decisions and take ownership of their tasks.

- Celebrate successes: Acknowledge and reward team achievements to boost morale and motivation.

10. Are you familiar with the latest technologies and software used in accounts receivable management?

- Enterprise Resource Planning (ERP) systems.

- Customer Relationship Management (CRM) software.

- Automated payment processing solutions.

- Data analytics tools for reporting and forecasting.

- Cloud-based accounting platforms.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounts Receivable Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounts Receivable Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities:

The Accounts Receivable Manager is a key member of the finance team and is responsible for all aspects of accounts receivable management. This includes developing and implementing credit policies, managing customer accounts, and collecting overdue payments.

1. Developing and Implementing Credit Policies

The Accounts Receivable Manager is responsible for developing and implementing credit policies that protect the company from bad debt.

- Analyzing customer credit history and financial statements

- Establishing credit limits for customers

- Monitoring customer accounts for signs of financial distress

2. Managing Customer Accounts

The Accounts Receivable Manager is responsible for managing customer accounts and ensuring that all payments are received on time.

- Processing customer invoices and payments

- Reconciling customer accounts

- Managing customer disputes

3. Collecting Overdue Payments

The Accounts Receivable Manager is responsible for collecting overdue payments from customers.

- Sending out past-due notices

- Making phone calls to customers

- Negotiating payment arrangements

4. Reporting and Analysis

The Accounts Receivable Manager is responsible for providing regular reports to management on the status of accounts receivable.

- Analyzing accounts receivable trends

- Identifying areas for improvement

- Making recommendations to management

Interview Tips:

Preparing for an interview for an Accounts Receivable Manager position can be daunting. Here are a few tips to help you ace the interview:

1. Research the Company and the Position

Before the interview, take some time to research the company and the specific position you are applying for. This will help you understand the company’s culture and the expectations for the role.

- Visit the company’s website

- Read recent news articles about the company

- Look up the company’s financial statements

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you can expect to be asked in an interview for an Accounts Receivable Manager position.

- Tell me about your experience in accounts receivable management.

- What are your strengths and weaknesses as an Accounts Receivable Manager?

- How do you handle difficult customers?

- What are your goals for this position?

Example Outline

When answering interview questions, it can be helpful to use the following outline:

- Situation: Briefly describe the situation or task that you were involved in.

- Action: Explain the actions that you took to address the situation or task.

- Result: Describe the positive results that you achieved as a result of your actions.

3. Be Prepared to Talk About Your Experience

In addition to practicing your answers to common interview questions, you should also be prepared to talk about your experience in accounts receivable management.

- Highlight your successes

- Quantify your results

- Use specific examples

4. Dress Professionally and Arrive on Time

First impressions matter. Make sure to dress professionally and arrive on time for your interview. This will show the interviewer that you are serious about the position.

- Wear a suit or business casual attire

- Be well-groomed

- Arrive at the interview location 10-15 minutes early

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounts Receivable Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!