Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Accounts Receivable Supervisor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

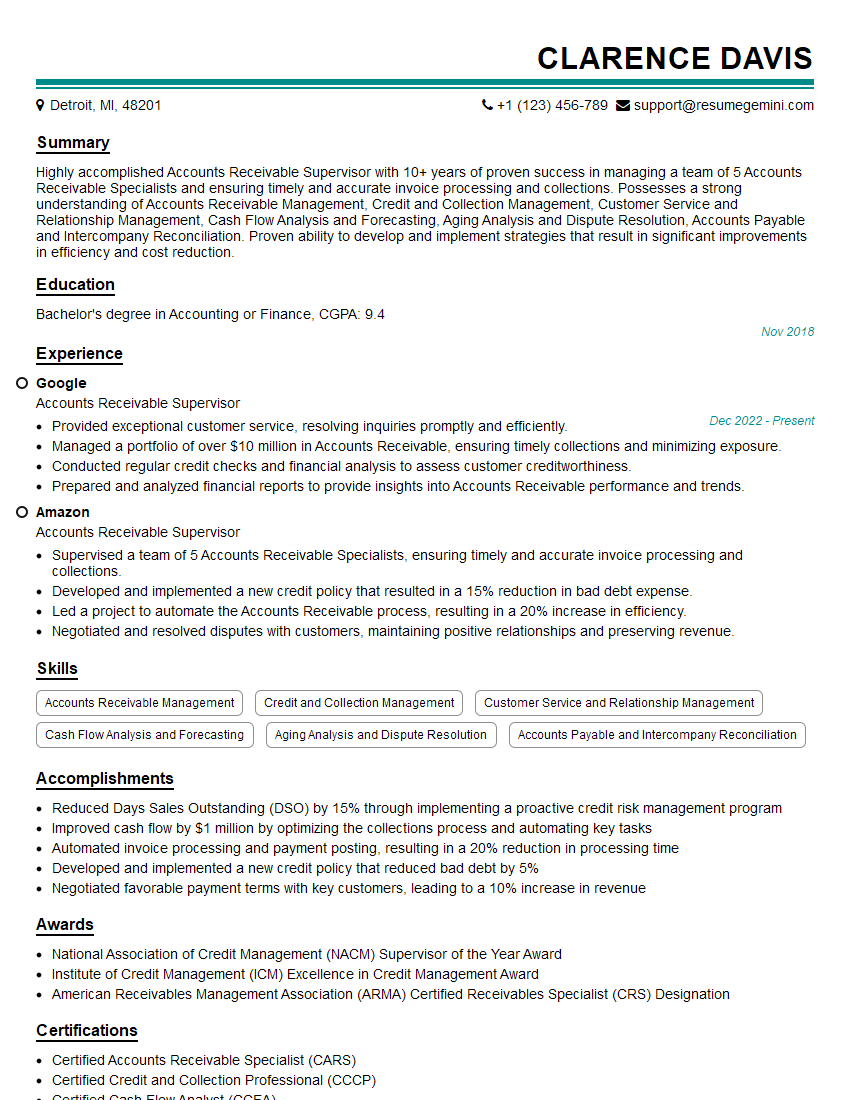

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounts Receivable Supervisor

1. How would you ensure efficient and accurate processing of invoices and payments?

- Implement automated systems for invoice generation and payment tracking.

- Establish clear policies and procedures for invoice review and approval.

- Provide regular training and support to staff on invoicing processes.

- Monitor key metrics such as days sales outstanding (DSO) and invoice accuracy rates.

- Collaborate with customers to resolve discrepancies and ensure timely payments.

2. Describe your strategies for managing customer credit and collections.

Credit Risk Assessment

- Implement credit scoring models to evaluate customer financial health.

- Establish credit limits and payment terms based on risk assessment.

Collections Process

- Develop and adhere to a proactive collections strategy.

- Use a combination of phone calls, emails, and letters to communicate with delinquent customers.

- Work with legal counsel to initiate legal action when necessary.

3. How do you handle disputes and discrepancies in customer accounts?

- Establish a formal process for handling disputes.

- Investigate and gather evidence to support the company’s position.

- Negotiate with customers to reach a mutually acceptable resolution.

- Document all resolutions and maintain records for future reference.

- Learn from disputes to improve processes and prevent future occurrences.

4. How would you implement and maintain strong internal controls over accounts receivable?

- Establish clear segregation of duties between invoice processing, cash handling, and accounting functions.

- Implement regular reconciliations of accounts receivable balances with bank statements and customer records.

- Perform periodic audits to ensure compliance with internal control policies.

- Provide training and awareness to staff on the importance of internal controls.

5. What key performance indicators (KPIs) would you use to measure the effectiveness of the accounts receivable department?

- Days Sales Outstanding (DSO)

- Invoice Accuracy Rate

- Collections Effectiveness Rate

- Customer Satisfaction Score

- Compliance with Internal Control Policies

6. How do you stay updated with industry best practices and regulatory changes related to accounts receivable?

- Attend industry conferences and workshops.

- Subscribe to professional journals and publications.

- Network with peers and participate in professional organizations.

- Review industry reports and whitepapers.

- Seek guidance from external consultants or auditors.

7. Describe your experience in analyzing and interpreting financial data to identify trends and improve accounts receivable processes.

- Used data analytics tools to identify aging balances and payment patterns.

- Analyzed customer credit histories and payment performance to predict potential risk.

- Developed reports and dashboards to track key performance indicators.

- Presented findings to management and recommended process improvements.

- Implemented changes based on data analysis to reduce DSO and improve cash flow.

8. How would you motivate and develop your team to achieve high performance?

- Set clear expectations and provide regular feedback.

- Recognize and reward successes and achievements.

- Provide opportunities for professional development and training.

- Foster a positive and collaborative work environment.

- Empower team members to take ownership of their roles.

9. Describe your experience working with cross-functional teams, such as sales, operations, and finance.

- Collaborated with sales team to ensure timely invoice delivery and accurate billing.

- Worked with operations team to resolve shipping discrepancies and delivery issues.

- Partnered with finance team to reconcile accounts and prepare financial statements.

- Contributed to cross-functional projects to improve processes and efficiency.

- Leveraged relationships to obtain necessary information and support.

10. How would you handle a high-volume of inquiries and correspondence from customers?

- Establish efficient processes for handling inquiries through phone, email, and chat.

- Train staff on effective communication and conflict resolution skills.

- Use technology tools such as customer relationship management (CRM) systems to track and manage inquiries.

- Prioritize and respond to inquiries promptly to maintain customer satisfaction.

- Identify and resolve recurring issues to prevent future inquiries.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounts Receivable Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounts Receivable Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Accounts Receivable Supervisors play a crucial role in ensuring the efficient collection of receivables and maintaining accurate financial records. Key job responsibilities include:

1. Accounts Receivable Management

Supervising the accounts receivable function, including invoice processing, payment tracking, and collections.

- Establishing and implementing policies and procedures to optimize receivables management.

- Monitoring customer accounts for timely payments, identifying and resolving discrepancies.

2. Credit Management

Evaluating and approving customer credit limits, monitoring credit risk, and initiating collection action when necessary.

- Assessing customer financial health and creditworthiness before extending credit.

- Developing and implementing credit control policies, including payment terms and debt collection strategies.

3. Collections Management

Managing and resolving delinquent accounts, including negotiation of payment plans and legal action when appropriate.

- Communicating with customers proactively to resolve payment issues and improve collection rates.

- Utilizing collection tools and techniques to ensure timely collection of outstanding receivables.

4. Process Improvement

Analyzing and improving accounts receivable processes, including automation, technology implementation, and process optimization.

- Identifying bottlenecks, inefficiencies, and areas for improvement in the AR process.

- Evaluating and implementing new technologies and systems to enhance efficiency and reduce costs.

5. Team Management

Supervising a team of accounts receivable professionals, providing guidance, support, and performance evaluations.

- Recruiting, training, and developing staff to ensure a high-performing team.

- Creating a positive and productive work environment that promotes teamwork and collaboration.

Interview Tips

To help candidates ace their interview for an Accounts Receivable Supervisor role, here are some preparation tips:

1. Research the Company and Position

Thoroughly research the company, their industry, and the specific job requirements to gain a comprehensive understanding of the role.

- Review the company’s website, social media, and recent news articles.

- Analyze the job description, noting key responsibilities, qualifications, and skills required.

2. Showcase Your Accounts Receivable Expertise

Emphasize your experience and skills in accounts receivable management, credit analysis, collections, and process improvement.

- Provide specific examples of your accomplishments in these areas, quantifying your results whenever possible.

- Discuss innovative strategies or initiatives you have implemented to enhance receivables performance.

3. Highlight Your Communication and Leadership Skills

Accounts Receivable Supervisors require strong communication skills to interact with customers, team members, and other stakeholders.

- Demonstrate your ability to communicate effectively in written and verbal form, particularly in difficult collection situations.

- Highlight your leadership experience, including your ability to motivate and inspire your team.

4. Prepare for Common Interview Questions

Anticipate common interview questions and prepare your answers ahead of time. Here are some examples:

- “Tell me about your experience in accounts receivable management and how you have handled challenging customer situations.”

- “Describe your approach to credit risk assessment and how you evaluate creditworthiness.”

- “What strategies have you implemented to improve collections and reduce Days Sales Outstanding (DSO)?”

5. Ask Informed Questions

Prepare thoughtful questions to ask the interviewer, demonstrating your interest and understanding of the role and company.

- Inquire about the company’s accounts receivable performance and any challenges or areas for improvement.

- Ask about the team structure and opportunities for professional development.

- Seek clarification on specific aspects of the job responsibilities or the company’s culture.

Next Step:

Now that you’re armed with the knowledge of Accounts Receivable Supervisor interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Accounts Receivable Supervisor positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini