Feeling lost in a sea of interview questions? Landed that dream interview for Accounts Supervisor but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Accounts Supervisor interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

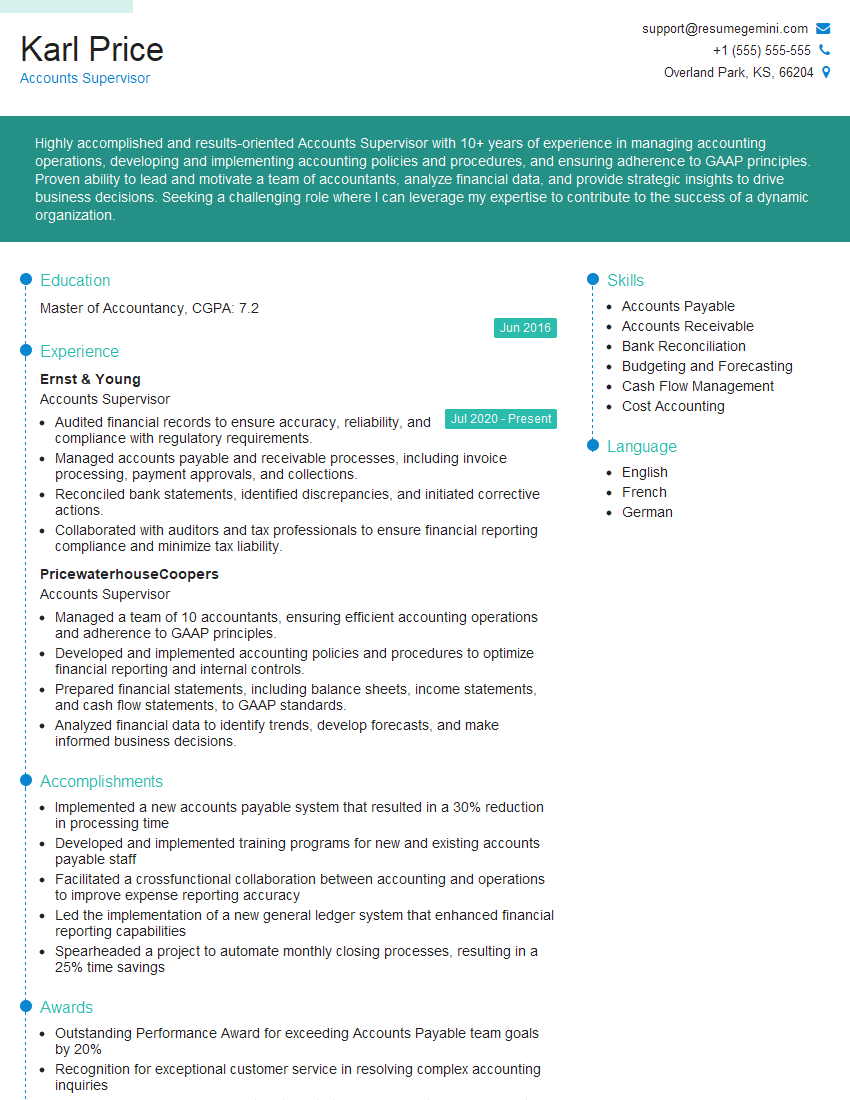

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Accounts Supervisor

1. Explain the key responsibilities of an Accounts Supervisor?

As an Accounts Supervisor, my key responsibilities include:

- Managing and supervising the accounting team, including training and development.

- Preparing and analysing financial statements, including balance sheets, income statements, and cash flow statements.

- Maintaining accounting records, including general ledger, accounts payable, and accounts receivable.

- Ensuring compliance with applicable accounting standards and regulations.

- Developing and implementing accounting policies and procedures.

- Internal and external audits.

- Budgeting and forecasting.

- Variance analysis.

- Developing and implementing internal controls.

- Liaising with external auditors.

2. Describe your experience in preparing and analysing financial statements?

Compilation of financial statements

- Collection of data from relevant sources, such as accounting system, sub-ledgers, and supporting documents.

- Verification of data and identification of any errors.

- Preparation of trial balance and ensuring its agreement.

- Preparation of financial statements in accordance with applicable accounting standards.

Analysis of financial statements

- Performing horizontal and vertical analysis.

- Identifying trends and ratios in financial data.

- Evaluating financial performance and position.

- Providing insights and recommendations based on the analysis.

3. How do you ensure accuracy and integrity of financial data?

I ensure the accuracy and integrity of financial data through the following measures:

- Establishing and maintaining a system of internal controls.

- Performing regular reconciliations of accounts.

- Reviewing and approving transactions before they are recorded.

- Monitoring the accounting system for unusual or unexpected activity.

- Implementing a system of segregation of duties.

- Providing training to accounting staff on the importance of accuracy and integrity.

- Regularly reviewing and evaluating existing policies and procedures.

4. What are the key elements of a strong internal control system?

The key elements of a strong internal control system include:

- Segregation of duties.

- Authorization of transactions.

- Proper documentation of transactions.

- Physical safeguards of assets.

- Periodic reconciliation of accounts.

- Internal audit function.

- Regular review and evaluation.

5. How do you stay updated on the latest accounting standards and regulations?

I stay updated on the latest accounting standards and regulations through the following methods:

- Reading professional journals and publications.

- Attending industry conferences and seminars.

- Taking continuing professional education courses.

- Participating in online forums and discussion groups.

- Networking with other accounting professionals.

6. What is your experience in budgeting and forecasting?

- Developing and maintaining budgets for various departments and functions.

- Forecasting revenue, expenses, and cash flow.

- Monitoring actual results against budgets and forecasts.

- Providing variance analysis and recommendations to management.

7. How do you manage a team of accounting professionals?

I manage a team of accounting professionals by:

- Providing clear direction and expectations.

- Delegating tasks and responsibilities.

- Providing regular feedback and support.

- Conducting performance evaluations.

- Encouraging professional development.

- Creating a positive and supportive work environment.

8. What are your strengths and weaknesses as an Accounts Supervisor?

Strengths

- Strong technical accounting skills.

- Excellent communication and interpersonal skills.

- Proven ability to manage a team.

- Up-to-date on the latest accounting standards and regulations.

- Highly motivated and results-oriented.

Weaknesses

- I am always seeking to improve my knowledge and skills in the field of accounting.

- I am sometimes too detail-oriented, which can lead to missed deadlines.

9. Why are you interested in this Accounts Supervisor position?

I am interested in this Accounts Supervisor position because I am confident that I have the skills and experience that you are looking for.

I am also attracted to the company’s reputation for excellence and its commitment to its employees.

10. What are your salary expectations?

My salary expectations are commensurate with my experience and qualifications.

I am confident that I can add value to your company and I am looking for a salary that is competitive with the market rate for similar positions.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Accounts Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Accounts Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As an Accounts Supervisor, your primary duty would be to lead, manage, and oversee all accounting and financial operations within the organization. This involves:

1. Financial Reporting and Analysis

You will be responsible for preparing and consolidating financial statements, reports, and other accounting documents used for internal and external purposes.

- Ensuring the accuracy and compliance of financial data in accordance with GAAP or relevant accounting standards.

- Providing insights, analysis, and recommendations on financial performance to management and stakeholders.

2. Budgeting and Forecasting

You will actively participate in preparing, executing, and monitoring budgets and financial forecasts. This involves:

- Developing and maintaining financial models for forecasting and planning purposes.

- Monitoring actual results against budgets and forecasts, and promptly identifying any variances or deviations.

3. Internal Control and Compliance

You will play a crucial role in safeguarding the organization’s assets and ensuring compliance with all applicable financial regulations and internal policies.

- Developing and implementing internal controls to prevent fraud, errors, and misstatements.

- Conducting regular audits and reviews to assess the effectiveness of internal control systems.

4. Team Management and Leadership

You will supervise and guide a team of accounting professionals. Your responsibilities include:

- Motivating and training team members, and providing constructive feedback to enhance their performance.

- Delegating tasks, setting priorities, and promoting teamwork and collaboration within the team.

Interview Tips

To ace your interview for the Accounts Supervisor position, consider these tips and preparation hacks:

1. Research and Knowledge

Demonstrate your understanding of accounting principles, financial reporting standards, and relevant software. Research the company’s industry and financial performance to show that you have a genuine interest.

- Example Outline:

- Brief overview of GAAP and IFRS

- Experience in using accounting software (such as SAP or Oracle)

- Understanding of financial ratios and key performance indicators

2. Communication and Presentation Skills

Highlight your ability to communicate complex financial information clearly and effectively to both technical and non-technical audiences.

- Example Outline:

- Experience in presenting financial reports to senior management

- Ability to simplify financial concepts for easy understanding

- Strong written communication skills (i.e., drafting reports, memos, and emails)

3. Team Leadership and Management

Emphasize your leadership qualities, ability to motivate teams, and experience in developing and implementing internal controls.

- Example Outline:

- Experience in leading and managing accounting teams

- Examples of successful team projects or initiatives you led

- Knowledge of risk management and internal control frameworks

4. Industry and Business Acumen

Showcase your understanding of the company’s industry, its competitors, and key business drivers. This demonstrates your ability to make informed decisions and contribute to the organization’s strategic direction.

- Example Outline:

- Knowledge of the company’s products, services, and target market

- Understanding of the industry’s regulatory environment

- Ability to identify and analyze industry trends

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Accounts Supervisor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!