Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Actuarial Associate interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Actuarial Associate so you can tailor your answers to impress potential employers.

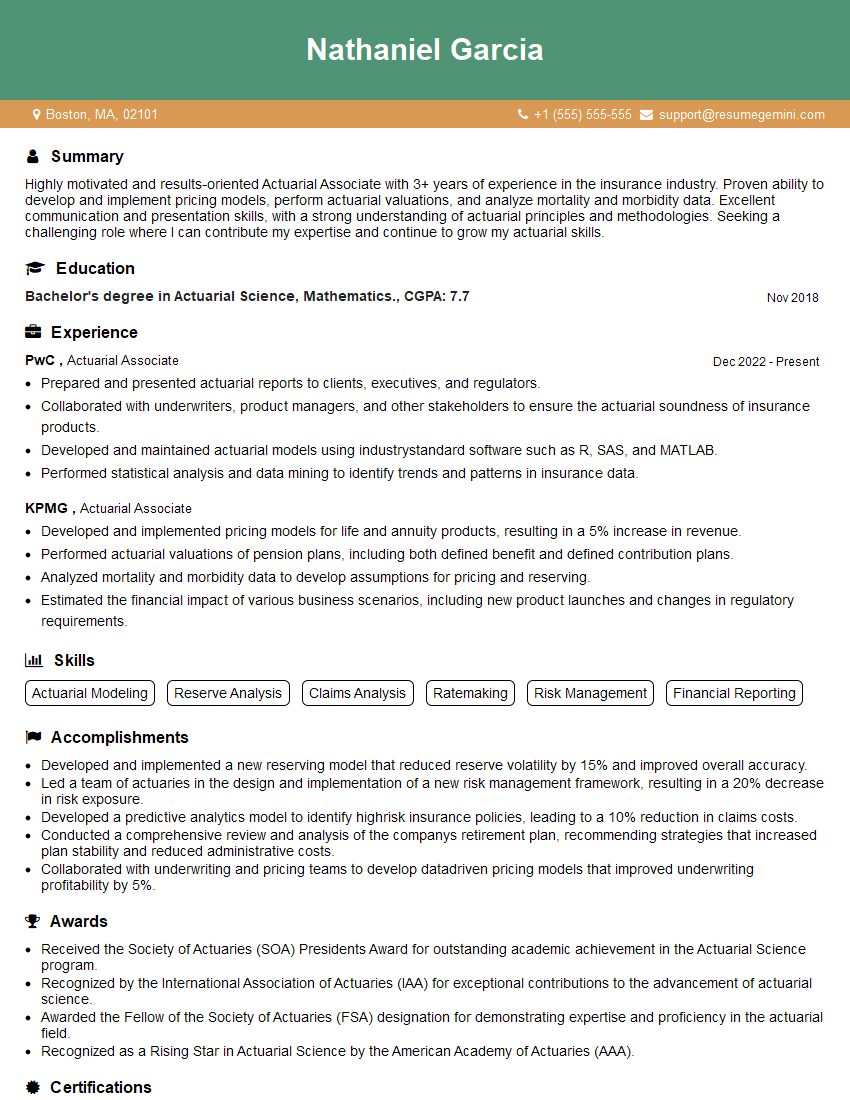

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Actuarial Associate

1. What are the key assumptions and limitations of the chain-ladder method?

The chain-ladder method is a widely used technique for forecasting future claim payments. It is based on the assumption that the pattern of claims payments over time will continue in the future. However, there are a number of limitations to the chain-ladder method

- It assumes that the claims data is complete and accurate.

- It assumes that the underlying factors affecting claims payments will not change significantly in the future.

- It can be sensitive to outliers in the claims data.

2. How do you calculate the expected value of a random variable?

- Point 1

- Point 2

3. What is the difference between a parametric and a non-parametric test?

- Point 1

- Point 2

4. What are the advantages and disadvantages of using a Bayesian approach to insurance pricing?

- Point 1

- Point 2

5. How would you design a risk management program for a large insurance company?

- Point 1

- Point 2

6. What are the ethical considerations that actuaries must take into account when making decisions?

- Point 1

- Point 2

7. What are the current trends in the insurance industry?

- Point 1

- Point 2

8. What are the challenges facing the actuarial profession?

- Point 1

- Point 2

9. What are your career goals?

- Point 1

- Point 2

10. Why do you want to work for our company?

- Point 1

- Point 2

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Actuarial Associate.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Actuarial Associate‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Actuarial Associates are responsible for performing a wide range of actuarial tasks under the supervision of a senior actuary. They play a crucial role in providing actuarial support for various business areas, including product development, pricing, risk assessment, and financial planning.

1. Actuarial Calculations and Modeling

Develop and maintain actuarial models and perform various calculations, such as premium pricing, reserve estimation, and risk analysis.

- Apply statistical techniques and actuarial principles to analyze data and make projections.

- Develop and implement actuarial models to assess financial risks and determine insurance premiums.

2. Data Analysis and Reporting

Collect, analyze, and interpret actuarial data to identify trends and patterns.

- Gather data from various sources, including policyholder records, claims data, and market statistics.

- Analyze data using statistical methods and actuarial techniques to extract meaningful insights.

3. Financial Reporting and Analysis

Prepare and present actuarial reports that summarize financial performance, risk exposure, and projections.

- Develop and maintain financial models to assess the impact of actuarial assumptions on financial results.

- Communicate actuarial findings and recommendations to senior management and stakeholders.

4. Regulatory Compliance and Reporting

Monitor and ensure compliance with relevant actuarial regulations and reporting requirements.

- Stay up-to-date with regulatory changes and industry best practices.

- Prepare and submit actuarial reports to regulatory authorities as required by law.

Interview Tips

Interviews for Actuarial Associate positions are highly competitive. To increase your chances of success, it’s important to prepare thoroughly and present yourself effectively.

1. Research the Company and Position

Take the time to learn about the company, its products or services, and the specific role you’re applying for. This will help you tailor your answers to the interviewer’s questions and demonstrate your genuine interest.

- Visit the company website, read news articles, and check social media pages.

- Review the job description and identify the key responsibilities and qualifications.

2. Practice Answering Common Interview Questions

There are several common interview questions that you’re likely to be asked in an Actuarial Associate interview. Practice answering these questions in advance so that you can deliver clear and concise responses.

- Tell me about your experience in actuarial modeling.

- How do you stay up-to-date on actuarial regulations and industry best practices?

- What is your understanding of risk management in the insurance industry?

3. Prepare Technical Questions

In addition to behavioral questions, you may be asked technical questions to assess your actuarial knowledge and skills. Be prepared to discuss your experience with actuarial software, statistical analysis techniques, and financial modeling.

- Review basic actuarial concepts, such as mortality rates, life tables, and premium pricing.

- Practice using actuarial software and demonstrate your proficiency in data analysis and modeling.

4. Highlight Your Communication and Presentation Skills

Actuaries often need to communicate complex technical information to non-technical audiences. In your interview, make sure to emphasize your ability to communicate clearly and effectively, both verbally and in writing.

- Provide examples of presentations or reports that you have prepared and delivered.

- Explain how you would communicate actuarial findings to stakeholders with varying levels of technical expertise.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Actuarial Associate interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.