Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Actuarial Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Actuarial Manager so you can tailor your answers to impress potential employers.

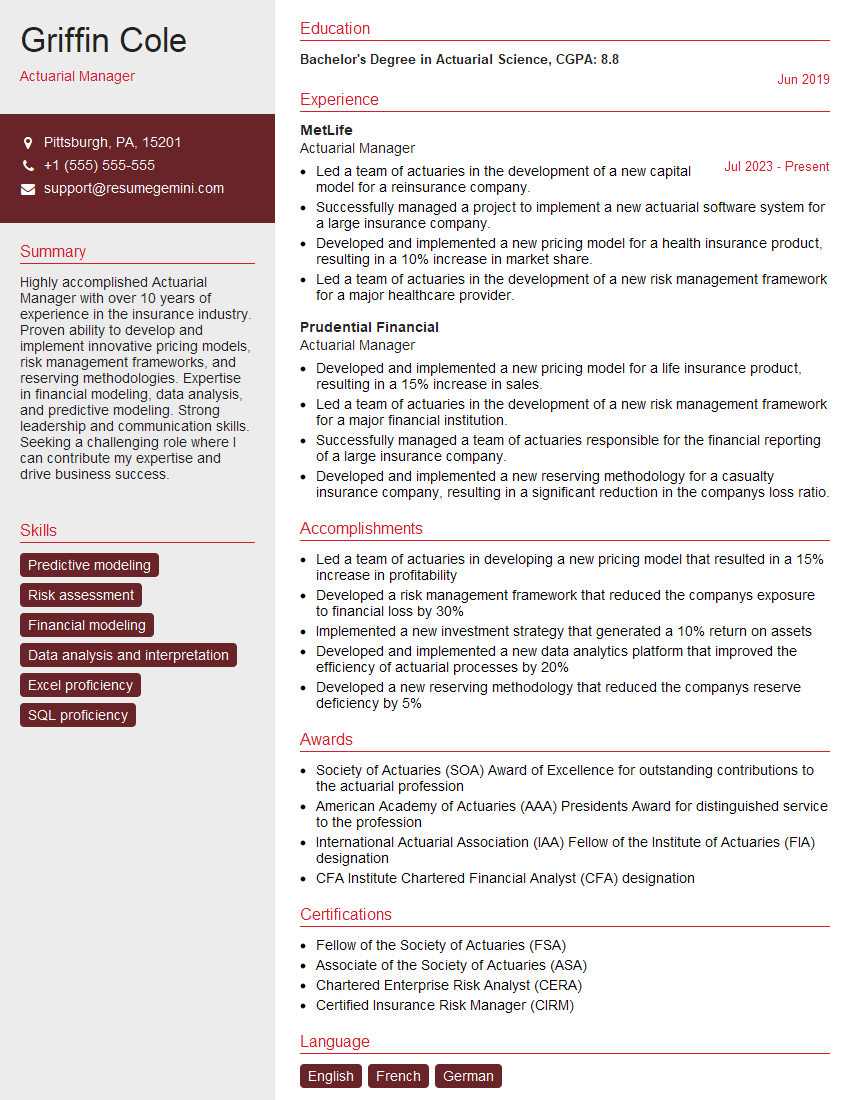

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Actuarial Manager

1. Describe the key components of an actuarial model for pricing a new insurance product.

- Premiums: The premiums are the payments made by the policyholders to the insurance company. The premiums should be set at a level that is sufficient to cover the expected claims and expenses, as well as provide a reasonable profit margin.

- Claims: The claims are the payments made by the insurance company to the policyholders when they file a claim. The claims can be for a variety of reasons, such as medical expenses, property damage, or lost income.

- Expenses: The expenses are the costs incurred by the insurance company in operating the business. The expenses can include things such as salaries, rent, and marketing costs.

2. What are the different types of actuarial models used in practice?

- Deterministic models: Deterministic models assume that all of the input parameters are known with certainty. These models are relatively simple to develop, but they can be less accurate than stochastic models.

- Stochastic models: Stochastic models allow for uncertainty in the input parameters. These models are more complex to develop, but they can be more accurate than deterministic models.

3. How do you validate an actuarial model?

- Data analysis: The data used to develop the model should be carefully analyzed to ensure that it is accurate and complete.

- Sensitivity analysis: A sensitivity analysis can be used to assess the impact of changes in the input parameters on the model output.

- Peer review: The model should be reviewed by other actuaries to ensure that it is sound and reasonable.

4. How do you communicate actuarial results to non-actuaries?

- Use clear and concise language.

- Avoid technical jargon.

- Use visual aids to help explain the results.

5. What are the ethical responsibilities of actuaries?

- To act with integrity and objectivity.

- To maintain confidentiality of client information.

- To avoid conflicts of interest.

6. What is the role of the actuary in the insurance industry?

- Pricing and reserving: Actuaries help insurance companies price their products and set their reserves.

- Product development: Actuaries help insurance companies develop new products that meet the needs of their customers.

- Risk management: Actuaries help insurance companies manage their risk exposures.

7. What is the difference between an actuary and a statistician?

- Actuaries are focused on the financial implications of risk, while statisticians are focused on the mathematical analysis of data.

- Actuaries use a variety of techniques to assess risk, including probability theory, statistics, and financial mathematics.

- Statisticians use a variety of techniques to analyze data, including probability theory, statistical inference, and data mining.

8. What are the challenges facing the actuarial profession?

- The increasing complexity of financial products.

- The globalization of the insurance industry.

- The increasing use of data and technology.

9. What are your strengths and weaknesses as an actuarial manager?

- Strengths: I have a strong understanding of actuarial principles and practices. I am also a skilled communicator and have a proven track record of success in managing actuarial teams.

- Weaknesses: I am sometimes too detail-oriented and can get bogged down in the minutiae of a project. I am also not as comfortable with public speaking as I would like to be.

10. What are your career goals?

- I would like to continue to grow my career in the actuarial profession. I am particularly interested in leadership roles, and I hope to eventually become an Actuarial Executive.

- I am also interested in giving back to the profession. I am a member of the Actuarial Society of America, and I volunteer my time to mentor other actuaries and promote the profession to students.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Actuarial Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Actuarial Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Actuarial Manager is a senior actuary responsible for leading and managing a team of actuaries and/or other financial professionals. They are responsible for developing, implementing, and monitoring actuarial models and analyses to assess and manage financial risks and opportunities. This may include tasks such as:

1. Providing actuarial advice and guidance

Actuarial Managers provide actuarial advice and guidance to clients, including businesses, governments, and individuals.

- Advise clients on how to manage financial risks, such as the risk of death, disability, or loss of income.

- Help clients develop and implement financial plans, such as retirement plans and investment portfolios.

2. Developing and implementing actuarial models and analyses

Actuarial Managers develop and implement actuarial models and analyses to assess and manage financial risks and opportunities.

- Use actuarial techniques to model and analyze financial data.

- Develop and implement actuarial models to predict future financial outcomes.

3. Preparing and presenting actuarial reports and presentations

Actuarial Managers prepare and present actuarial reports and presentations to clients and other stakeholders.

- Write actuarial reports that summarize the results of actuarial analyses.

- Give presentations to clients and other stakeholders to explain the results of actuarial analyses.

4. Managing a team of actuaries and/or other financial professionals

Actuarial Managers may manage a team of actuaries and/or other financial professionals. In this role, they are responsible for:

- Leading and motivating a team of actuaries and/or other financial professionals.

- Assigning tasks and projects to team members.

- Reviewing and evaluating the work of team members.

Interview Tips

Following are some interview tips to help you ace the interview for an Actuarial Manager position:

1. Research the company and the position

Before the interview, it is important to research the company and the position you are applying for. This will help you to understand the company’s culture, values, and goals. It will also help you to understand the specific responsibilities and expectations of the position.

- Visit the company’s website to learn about its history, mission, and products or services.

- Read news articles and press releases about the company to learn about its recent developments and financial performance.

- Talk to people who work at the company to get their insights into the company culture and the position you are applying for.

2. Prepare for common interview questions

There are a number of common interview questions that you can expect to be asked in an interview for an Actuarial Manager position. It is important to prepare for these questions so that you can answer them confidently and effectively.

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What is your experience in actuarial science?

- What are your career goals?

3. Practice your answers

Once you have prepared for the common interview questions, it is important to practice your answers. This will help you to deliver your answers confidently and smoothly.

- Practice answering the questions out loud in front of a mirror.

- Ask a friend or family member to ask you the questions and give you feedback on your answers.

- Record yourself answering the questions and then play back the recording to identify areas for improvement.

4. Dress professionally

It is important to dress professionally for an interview for an Actuarial Manager position. This will show the interviewer that you are serious about the position and that you are committed to making a good impression.

- Wear a suit or dress pants and a button-down shirt or blouse.

- Make sure your clothes are clean and pressed.

- Avoid wearing clothing that is too revealing or too casual.

5. Be confident and enthusiastic

It is important to be confident and enthusiastic during an interview for an Actuarial Manager position. This will show the interviewer that you are excited about the position and that you are confident in your abilities.

- Make eye contact with the interviewer and speak clearly and confidently.

- Be enthusiastic about the position and the company.

- Show the interviewer that you are confident in your abilities and that you are eager to learn and grow.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Actuarial Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!