Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Actuarial Mathematician position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

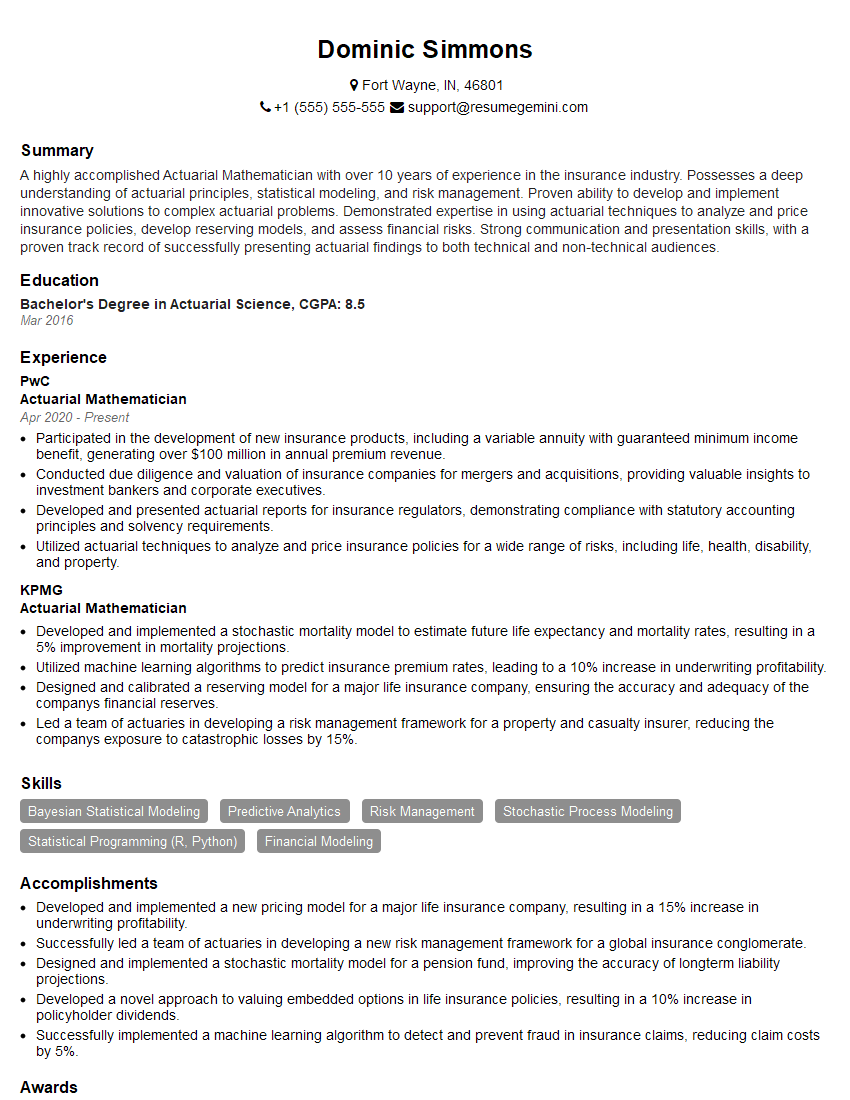

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Actuarial Mathematician

1. Describe the role of an actuary in the insurance industry.

- Analyze and interpret data to assess financial risks

- Develop and implement pricing models for insurance policies

- Monitor and manage insurance portfolios to mitigate risks

- Provide advice and recommendations to insurance companies on risk management strategies

2. Explain the principles of probability theory and how they apply to actuarial science.

- Probability theory provides a mathematical framework for quantifying uncertainty

- Actuaries use probability models to estimate the likelihood of future events

- These estimates are used to calculate insurance premiums, reserves, and other financial metrics

3. What are the different types of actuarial models?

- Pricing models: Determine the appropriate premiums for insurance policies

- Reserving models: Estimate the amount of money an insurer needs to hold to cover future claims

- Risk management models: Evaluate the financial impact of potential risks and develop strategies to mitigate them

4. Explain the concept of discounted cash flow (DCF) analysis and its applications in actuarial science.

- DCF analysis is a method of valuing future cash flows

- Actuaries use DCF analysis to calculate the present value of future insurance premiums and benefits

- This information is essential for pricing policies and managing insurance portfolios

5. Describe the role of actuarial judgment in the actuarial profession.

- Actuarial judgment is the application of professional expertise and experience to make informed decisions

- Actuaries use judgment to interpret data, develop models, and make recommendations

- The ability to exercise sound actuarial judgment is essential for success in the profession

6. Discuss the ethical responsibilities of actuaries and how they impact professional practice.

- Actuaries have a duty to maintain high ethical standards

- The Actuarial Code of Professional Conduct outlines the ethical principles that actuaries must follow

- Ethical considerations play a role in all aspects of actuarial practice, from data analysis to decision-making

7. Explain the concept of risk management and its importance in the insurance industry.

- Risk management is the process of identifying, assessing, and mitigating potential risks

- Insurance companies use risk management to protect themselves against financial losses

- Actuaries play a key role in risk management by developing and implementing risk assessment models

8. What are the different types of insurance products?

- Life insurance: Provides financial protection for the beneficiaries in the event of the insured’s death

- Health insurance: Covers the costs of medical expenses

- Property insurance: Protects against damage to property

- Liability insurance: Covers the costs of legal liability

9. Explain the regulatory environment for the insurance industry and the role of actuaries in it.

- The insurance industry is regulated by government agencies to ensure financial stability and protect consumers

- Actuaries play a key role in ensuring compliance with regulatory requirements

- Actuaries provide regulators with data and analysis to support regulatory decision-making

10. Describe the career path of an actuary and the opportunities for professional development.

- Actuaries typically start their careers as analysts or associates

- With experience and education, actuaries can progress to senior roles such as managers and directors

- Actuaries can also specialize in different areas, such as life insurance, health insurance, or risk management

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Actuarial Mathematician.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Actuarial Mathematician‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Actuarial Mathematician uses mathematical and statistical methods to assess financial risk and make informed decisions. Key responsibilities include:

1. Risk Assessment and Modeling

Evaluating financial data to identify, quantify, and model potential risks. Developing statistical models to predict the likelihood and impact of future events.

- Applying probability theory, statistics, and econometrics to assess the risk of financial events.

- Developing predictive models to forecast the financial impact of different scenarios.

2. Product Development and Pricing

Assisting in the design and pricing of financial products, such as insurance policies, investments, and pensions. Determining appropriate premiums and coverage based on risk analysis.

- Collaborating with product managers to develop new financial products.

- Using actuarial techniques to determine the pricing of insurance policies and investment products.

3. Reserving and Financial Analysis

Calculating and managing financial reserves to ensure solvency and protect against potential liabilities. Conducting financial analysis to assess the health and performance of insurance companies and pension funds.

- Determining the appropriate amount of reserves to hold based on actuarial calculations.

- Performing financial analysis to assess the financial performance of insurance companies and pension funds.

4. Compliance and Reporting

Ensuring compliance with regulatory requirements and industry standards. Preparing actuarial reports and providing expert testimony. Communicating complex financial concepts to stakeholders.

- Staying up-to-date on regulatory changes and ensuring compliance.

- Preparing actuarial reports and providing expert testimony to support financial decisions.

- Presenting complex financial concepts to clients and stakeholders in a clear and concise manner.

Interview Tips

To ace an interview for an Actuarial Mathematician role, consider the following tips:

1. Education and Credentials

Highlight your strong academic background in mathematics, statistics, and economics. Emphasize any relevant certifications, such as the Associate of the Society of Actuaries (ASA) or Fellow of the Society of Actuaries (FSA).

- Review the job description and identify any specific educational requirements or desired certifications.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

2. Technical Skills

Demonstrate your proficiency in financial modeling, risk assessment, and statistical analysis. Provide examples of projects or assignments where you applied these skills.

- Practice solving actuarial problems and review statistical concepts to refresh your memory.

- Be prepared to discuss your understanding of actuarial principles and methodologies.

3. Communication and Interpersonal Skills

Emphasize your ability to communicate complex financial concepts clearly and effectively to both technical and non-technical audiences. Highlight your teamwork and presentation skills.

- Prepare examples of presentations you have given or reports you have written.

- Practice communicating actuarial concepts in a simplified manner for non-actuaries.

4. Industry Knowledge and Market Trends

Demonstrate your understanding of the insurance or financial services industry. Discuss current market trends and how they impact actuarial practices. Stay informed about recent developments in the field.

- Read industry publications and attend conferences to stay abreast of the latest trends.

- Be prepared to share your insights on how industry developments will affect the role of actuaries.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Actuarial Mathematician, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Actuarial Mathematician positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.