Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Actuarial Technician position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

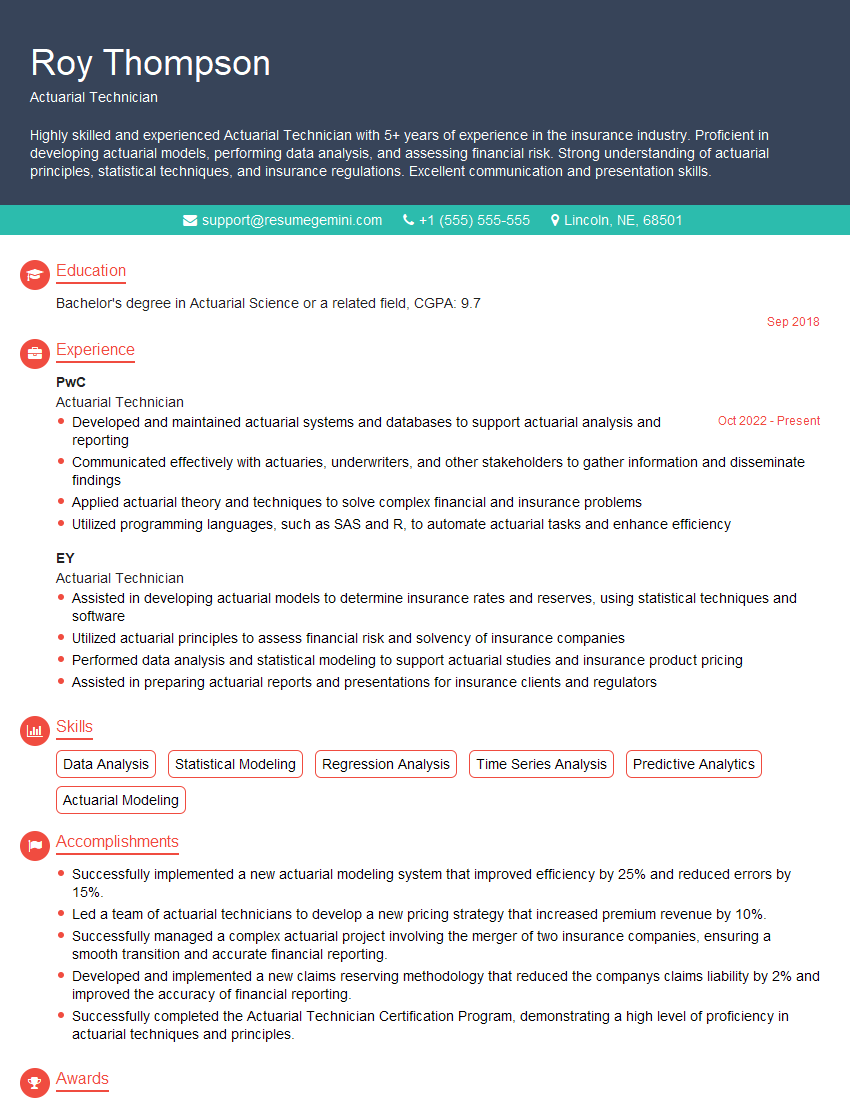

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Actuarial Technician

1. Calculate the net present value (NPV) of a project that has the following cash flows:

- Year 0: -$10,000

- Year 1: $5,000

- Year 2: $6,000

- Year 3: $7,000

Assume the discount rate is 10%.

- NPV = -$10,000 + $5,000/(1+0.1)^1 + $6,000/(1+0.1)^2 + $7,000/(1+0.1)^3

- NPV = -$10,000 + $4,545.45 + $5,041.32 + $5,580.29

- NPV = $5,166.06

2. What is the difference between a deterministic and a stochastic model?

Deterministic model

- Assumes that all variables are known with certainty.

- Produces a single, fixed output.

Stochastic model

- Assumes that some or all variables are random.

- Produces a range of possible outputs.

3. What are the key components of a reserve study?

- Population data: This includes the number of people covered by the plan, their ages, and their expected lifespans.

- Claims data: This includes the number of claims made, the amounts paid, and the reasons for the claims.

- Assumptions: These are the assumptions made about future events, such as mortality rates, inflation, and investment returns.

- Methodology: This is the method used to calculate the reserves.

4. What are the different types of insurance policies?

- Life insurance: This provides a death benefit to the beneficiary of the policyholder.

- Health insurance: This provides coverage for medical expenses.

- Property insurance: This provides coverage for damage to property.

- Liability insurance: This provides coverage for legal liability.

5. What are the key factors that affect the price of insurance?

- The type of insurance: Different types of insurance have different levels of risk.

- The amount of coverage: The more coverage you have, the higher the premium will be.

- The deductible: The deductible is the amount you have to pay out of pocket before the insurance company starts paying.

- The age of the policyholder: Older policyholders are more likely to make claims, so they pay higher premiums.

- The health of the policyholder: Policyholders with poor health are more likely to make claims, so they pay higher premiums.

6. What are the different types of actuarial models?

- Deterministic models: These models assume that all variables are known with certainty.

- Stochastic models: These models assume that some or all variables are random.

- Simulation models: These models use computer simulations to generate possible outcomes.

7. What are the different types of actuarial software?

- Spreadsheets: These are used for simple calculations and analysis.

- Database software: These are used for storing and managing data.

- Statistical software: These are used for analyzing data and developing models.

- Actuarial software: These are specialized software programs that are designed for actuarial work.

8. What are the different types of actuarial jobs?

- Life insurance actuaries: These actuaries work with life insurance companies to calculate premiums and reserves.

- Health insurance actuaries: These actuaries work with health insurance companies to calculate premiums and reserves.

- Property and casualty actuaries: These actuaries work with property and casualty insurance companies to calculate premiums and reserves.

- Pension actuaries: These actuaries work with pension plans to calculate benefits and contributions.

9. What are the educational requirements for becoming an actuary?

- Bachelor’s degree in mathematics, statistics, economics, or a related field.

- Pass the actuarial exams: There are a series of actuarial exams that you must pass in order to become an actuary.

- Complete an actuarial internship: You must complete an actuarial internship in order to gain practical experience.

10. What are the career prospects for actuaries?

- Actuaries are in high demand, as they are needed to calculate premiums and reserves for insurance companies and pension plans.

- Actuaries can earn a good salary and benefits, and they have the opportunity to work in a variety of settings.

- Actuaries can advance their careers by becoming certified, taking on leadership roles, and continuing their education.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Actuarial Technician.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Actuarial Technician‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Actuarial Technicians are responsible for providing technical support to actuaries and other professionals in the insurance industry. They perform a variety of tasks, including:

1. Data Collection and Analysis

Actuarial Technicians collect and analyze data from a variety of sources, including insurance policies, claims, and financial statements. They use this data to create statistical models that can be used to predict future events, such as the likelihood of a claim being filed or the cost of a future insurance policy.

2. Model Development and Implementation

Actuarial Technicians develop and implement statistical models that are used to calculate insurance rates, reserves, and other financial metrics. They also work with actuaries to develop and implement new insurance products and services.

3. Reporting and Presentation

Actuarial Technicians prepare reports and presentations that communicate the results of their analysis to actuaries, other professionals, and clients. They also present their findings to regulatory agencies and other stakeholders.

4. Other Duties

In addition to the tasks listed above, Actuarial Technicians may also perform a variety of other duties, such as:

- Assisting with the development and implementation of new insurance products and services

- Providing technical support to actuaries and other professionals

- Conducting research on insurance-related topics

- Preparing reports and presentations on insurance-related topics

Interview Tips

To help candidates ace their interview for an Actuarial Technician position, here are some tips:

1. Research the company and the position

Before you go to your interview, take some time to research the company and the position you’re applying for. This will help you understand the company’s culture and values, and it will also help you answer questions about the position and your qualifications.

2. Practice your answers to common interview questions

There are a number of common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?”. Take some time to practice your answers to these questions so that you can deliver them confidently and concisely.

3. Be prepared to talk about your skills and experience

The interviewer will want to know about your skills and experience, so be prepared to talk about them in detail. Be sure to highlight your skills in data analysis, model development, and reporting. You should also be prepared to talk about your experience working with actuaries and other professionals in the insurance industry.

4. Dress professionally and arrive on time

First impressions matter, so be sure to dress professionally and arrive on time for your interview. This will show the interviewer that you’re serious about the position and that you’re respectful of their time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Actuarial Technician interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.