Feeling lost in a sea of interview questions? Landed that dream interview for Adjuster but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Adjuster interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

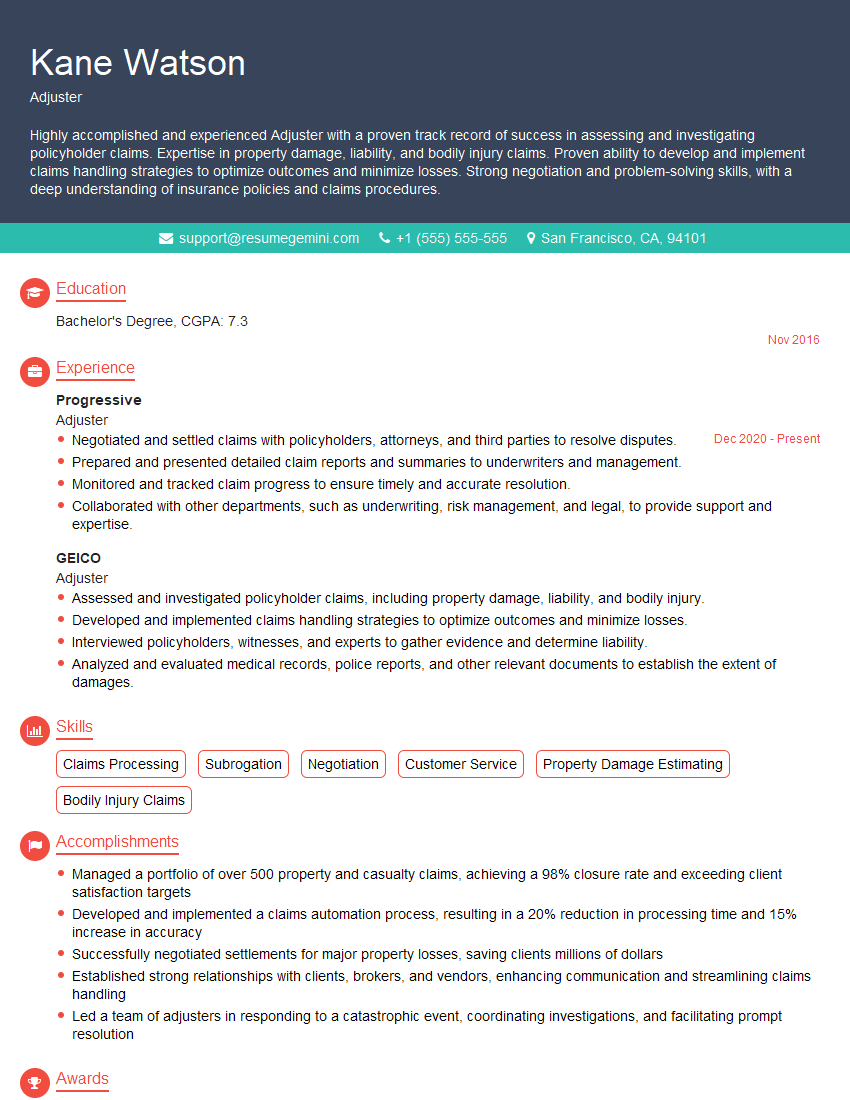

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Adjuster

1. How would you prioritize and manage multiple claims with varying degrees of severity and urgency?

- Triage claims based on severity and urgency, prioritizing life-threatening and critical injuries or damages.

- Establish a system for tracking and monitoring claim status, ensuring timely and efficient handling.

- Delegate responsibilities and communicate priorities clearly to team members to ensure optimal workload distribution.

- Utilize technology to streamline communication, documentation, and claim processing, improving efficiency and reducing redundancy.

- Stay informed about industry best practices and regulations to ensure compliance and maintain a high level of professionalism.

2. Describe your approach to evaluating and settling claims accurately and fairly.

Understanding Policy Provisions

- Thoroughly review the insurance policy and relevant endorsements to determine coverage and exclusions.

- Analyze policy terms, conditions, and limitations to ensure a comprehensive understanding of the insured’s rights and obligations.

Investigating Claims

- Conduct thorough investigations, gathering evidence and documentation to support claim assessments.

- Interview witnesses, inspect damages or injuries, and review medical records to establish the facts of the case.

Assessing Damages

- Utilize industry-standard techniques to assess and quantify damages, including repair costs, medical expenses, and lost income.

- Consult with experts, such as contractors, medical professionals, and attorneys, to ensure accurate and defensible valuations.

Negotiating Settlements

- Engage in fair and ethical negotiations with claimants and their representatives to reach mutually acceptable settlements.

- Consider factors such as liability, coverage limits, and the strength of the evidence when determining settlement offers.

3. How do you stay up-to-date on changes in insurance regulations and industry best practices?

- Attend industry conferences, workshops, and training programs to gain knowledge and insights from experts.

- Subscribe to industry publications, newsletters, and online resources to stay informed about regulatory updates and best practices.

- Network with other professionals in the field to exchange ideas and learn about emerging trends.

- Actively participate in professional organizations and associations to contribute to the development and dissemination of industry knowledge.

- Obtain and maintain relevant certifications and licenses to demonstrate commitment to professional development and ethical standards.

4. Explain your understanding of subrogation and how you would manage subrogation claims.

- Identify and investigate potential subrogation opportunities to recover expenses paid on behalf of the insured.

- Establish relationships with third-party administrators and legal professionals to facilitate subrogation recoveries.

- Negotiate settlements with liable parties or their insurers to maximize recovery while protecting the insured’s interests.

- Document subrogation claims thoroughly, including supporting evidence and communication with relevant parties.

- Monitor subrogation cases to ensure timely resolution and optimal recovery outcomes.

5. How would you handle a difficult or irate claimant?

- Remain calm and professional, demonstrating empathy and understanding.

- Actively listen to the claimant’s concerns and acknowledge their feelings.

- Explain the claims process and provide clear and concise information.

- Be patient and responsive, addressing the claimant’s questions and concerns in a timely manner.

- Maintain a positive and respectful demeanor, even in challenging situations.

6. Describe your experience in using technology to improve efficiency and accuracy in claims handling.

- Utilize claims management software to streamline workflows, track progress, and manage documentation.

- Leverage data analytics tools to identify trends, improve decision-making, and enhance customer service.

- Implement electronic communication channels to facilitate efficient and secure interactions with claimants and other stakeholders.

- Employ mobile technology to enable remote access to claim-related information and facilitate on-site inspections.

- Stay abreast of emerging technologies and explore opportunities to integrate innovative solutions into claims handling processes.

7. What are your strengths and weaknesses as an adjuster?

Strengths

- Excellent communication and interpersonal skills.

- Strong understanding of insurance policies and regulations.

- Proven ability to investigate claims thoroughly and accurately.

- Skilled in negotiating settlements and managing subrogation.

- Committed to providing exceptional customer service.

Weaknesses

- Limited experience in handling complex or high-value claims.

- Working under pressure and meeting tight deadlines can be challenging at times.

8. Why are you interested in this adjuster position?

- Interested in contributing my skills and experience to a reputable insurance company.

- Excited about the opportunity to handle a diverse range of claims and challenges.

- Committed to providing excellent customer service and supporting the company’s mission.

- Passionate about the insurance industry and eager to grow professionally.

- Confident that my qualifications and work ethic make me a valuable asset to your team.

9. What are your salary expectations for this role?

- Research industry benchmarks and consider my experience and qualifications.

- State a salary range that is competitive and commensurate with my value to the company.

- Be prepared to negotiate and demonstrate my worth through my skills and contributions.

- Remain open to discussing benefits and perks that align with my career goals.

- Emphasize my commitment to delivering exceptional performance and exceeding expectations.

10. Do you have any questions for me about the position or the company?

- Questions about the specific responsibilities and expectations of the adjuster role.

- Inquiries about the company’s claims handling process and technology.

- Requests for information about the company’s culture, values, and commitment to diversity and inclusion.

- Questions about opportunities for professional development and career advancement.

- Inquiries about the company’s financial stability and reputation in the industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Adjusters play a pivotal role in the insurance industry, investigating claims, assessing damages, and determining appropriate settlements.

1. Claims Investigation

Adjusters meticulously examine claims, gathering evidence and interviewing claimants to ascertain the extent of losses and determine liability.

- Reviewing insurance policies and relevant documentation

- Interviewing policyholders, witnesses, and other involved parties

2. Damage Assessment

Adjusters thoroughly assess damages to property or individuals, evaluating the nature and severity of the loss.

- Inspecting damaged property or injuries

- Estimating repair or replacement costs

3. Settlement Determination

Based on their investigation and damage assessment, adjusters determine the appropriate settlement amount within the policy limits.

- Calculating fair and reasonable compensation

- Negotiating settlements with claimants

4. Reporting and Documentation

Adjusters meticulously document their findings, preparing detailed reports that summarize the investigation, damage assessment, and settlement agreement.

- Submitting reports to insurance companies

- Maintaining accurate records for future reference

Interview Tips

Preparing for an Adjuster interview requires thorough research, practice, and a strategic approach.

1. Research the Company and Position

Thoroughly research the insurance company and the specific Adjuster position you are applying for.

- Review the company’s website, news articles, and social media pages

- Familiarize yourself with the company’s products, services, and target market

2. Highlight Relevant Experience and Skills

In your resume and interview answers, emphasize your experience and skills that directly align with the key responsibilities of an Adjuster.

- Quantify your accomplishments using specific metrics

- Showcase your ability to investigate claims, assess damages, and negotiate settlements

3. Demonstrate Industry Knowledge

Interviewers will be impressed if you demonstrate a deep understanding of the insurance industry.

- Stay up-to-date on industry trends and regulations

- Familiarize yourself with insurance policies and claim procedures

4. Practice Answering Common Interview Questions

Prepare for common interview questions by practicing your answers in advance.

- Research potential questions and practice answering them concisely and effectively

- Use the STAR method (Situation, Task, Action, Result) to structure your answers

5. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview shows your interest and engagement.

- Research the company’s culture and specific challenges the industry is facing

- Ask questions about the company’s approach to customer service and claim handling

6. Dress Professionally and Arrive Punctually

First impressions matter. Dress professionally and arrive for your interview on time.

- Choose attire that is appropriate for an office setting

- Arrive a few minutes early to show your punctuality and respect for the interviewer’s time

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Adjuster interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!