Are you gearing up for a career in Administrative Underwriter? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Administrative Underwriter and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

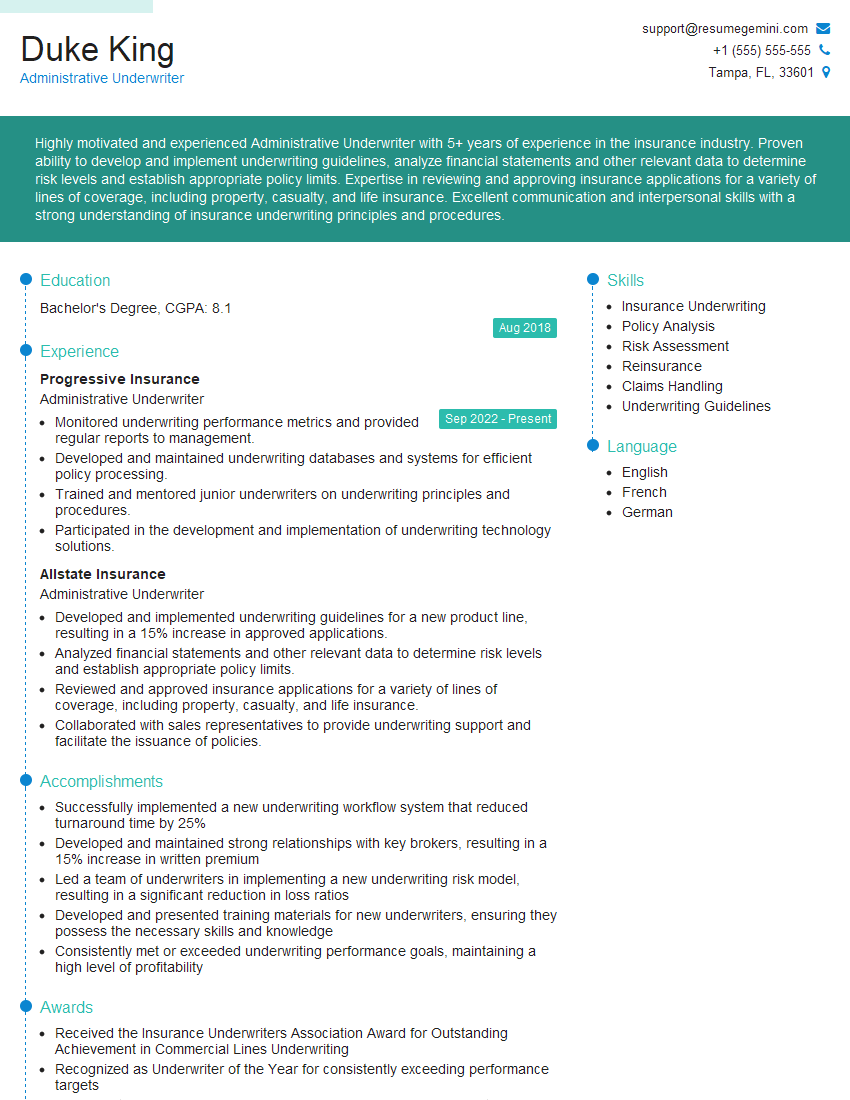

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Administrative Underwriter

1. What are the key responsibilities of an Administrative Underwriter?

As an Administrative Underwriter, I would be responsible for:

- Providing administrative support to the underwriting department.

- Preparing and maintaining underwriting files.

- Analyzing and evaluating insurance applications.

- Calculating premiums and issuing policies.

- Responding to inquiries from policyholders and agents.

2. What is the difference between an Underwriter and an Administrative Underwriter?

Underwriter

- Evaluates risk and determines whether to issue a policy

- Assesses the financial stability of the applicant

- Sets the terms and conditions of the policy

Administrative Underwriter

- Provides administrative support to the underwriting department

- Prepares and maintains underwriting files

- Calculates premiums and issues policies

3. What are the essential qualities of a successful Administrative Underwriter?

The essential qualities of a successful Administrative Underwriter include:

- Strong organizational and time management skills.

- Excellent communication and interpersonal skills.

- Proficient in Microsoft Office Suite.

- Knowledge of insurance principles and practices.

- Attention to detail and accuracy.

4. What is your experience with underwriting software?

I have experience with the following underwriting software:

- PolicyWorks

- Underwriting Manager

- Guidewire

5. What is your understanding of the underwriting process?

The underwriting process involves the following steps:

- Application submission

- Risk assessment

- Premium calculation

- Policy issuance

6. What are the different types of insurance policies?

The different types of insurance policies include:

- Property insurance

- Liability insurance

- Health insurance

- Life insurance

7. What factors do you consider when evaluating an insurance application?

When evaluating an insurance application, I consider the following factors:

- The applicant’s financial stability

- The applicant’s claims history

- The applicant’s risk profile

- The underwriting guidelines of the insurance company

8. What are the common underwriting issues that you have encountered?

Some of the common underwriting issues that I have encountered include:

- Incomplete or inaccurate applications

- Unclear or ambiguous information

- High-risk applicants

- Fraudulent applications

9. How do you stay up-to-date on changes in the insurance industry?

I stay up-to-date on changes in the insurance industry by:

- Reading industry publications

- Attending industry events

- Taking continuing education courses

10. What is your career goal?

My career goal is to become an Underwriter. I believe that my experience and skills would allow me to be successful in this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Administrative Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Administrative Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Administrative Underwriter fulfills a pivotal role in the underwriting process, contributing to risk assessment and efficient insurance operations.

1. Policy Processing and Issuance

Meticulously review and analyze applications, ensuring they align with underwriting guidelines.

- Scrutinize risk factors, gather relevant data, and assess insurability.

- Determine appropriate coverage limits, premiums, and policy terms.

2. Risk Assessment and Evaluation

Evaluate insurance applications, leveraging expertise to assess and mitigate risk.

- Analyze loss history, financial statements, and other relevant information.

- Identify potential areas of concern and propose underwriting recommendations.

3. Underwriting Support and Collaboration

Provide proactive support to underwriting teams, contributing to efficient decision-making.

- Assist underwriters with complex or challenging applications.

- Collaborate on risk analysis, policy issuance, and claim handling.

4. Data Management and Reporting

Maintain accurate records and compile data, ensuring compliance and supporting decision-making.

- Process and archive insurance policy documentation.

- Generate reports and extract data for underwriting analysis and planning.

Interview Tips

Ace your Administrative Underwriter interview by following these tips and preparing effectively.

1. Research the Company and Industry

Demonstrate your knowledge of the insurance industry and the company you’re applying to.

- Visit the company website, read industry publications, and attend webinars.

- Connect with current or former employees to gain insights into the company culture and work environment.

2. Review Job Description and Responsibilities

Thoroughly review the job description and ensure you understand the key responsibilities and expectations.

- Highlight relevant skills and experiences that align with the job requirements.

- Prepare concise examples that demonstrate your proficiency in those areas.

3. Practice Common Interview Questions

Prepare for common interview questions and develop well-structured answers.

- Anticipate questions about your understanding of insurance principles, risk assessment, and underwriting guidelines.

- Prepare examples of your problem-solving abilities, attention to detail, and collaborative work style.

4. Showcase Your Soft Skills

Emphasize your soft skills that are crucial for success in this role, such as communication, teamwork, and analytical thinking.

- Explain how you effectively communicate with colleagues, clients, and stakeholders.

- Highlight examples of your teamwork experiences and contributions.

Next Step:

Now that you’re armed with the knowledge of Administrative Underwriter interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Administrative Underwriter positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini