Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Advice Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Advice Clerk so you can tailor your answers to impress potential employers.

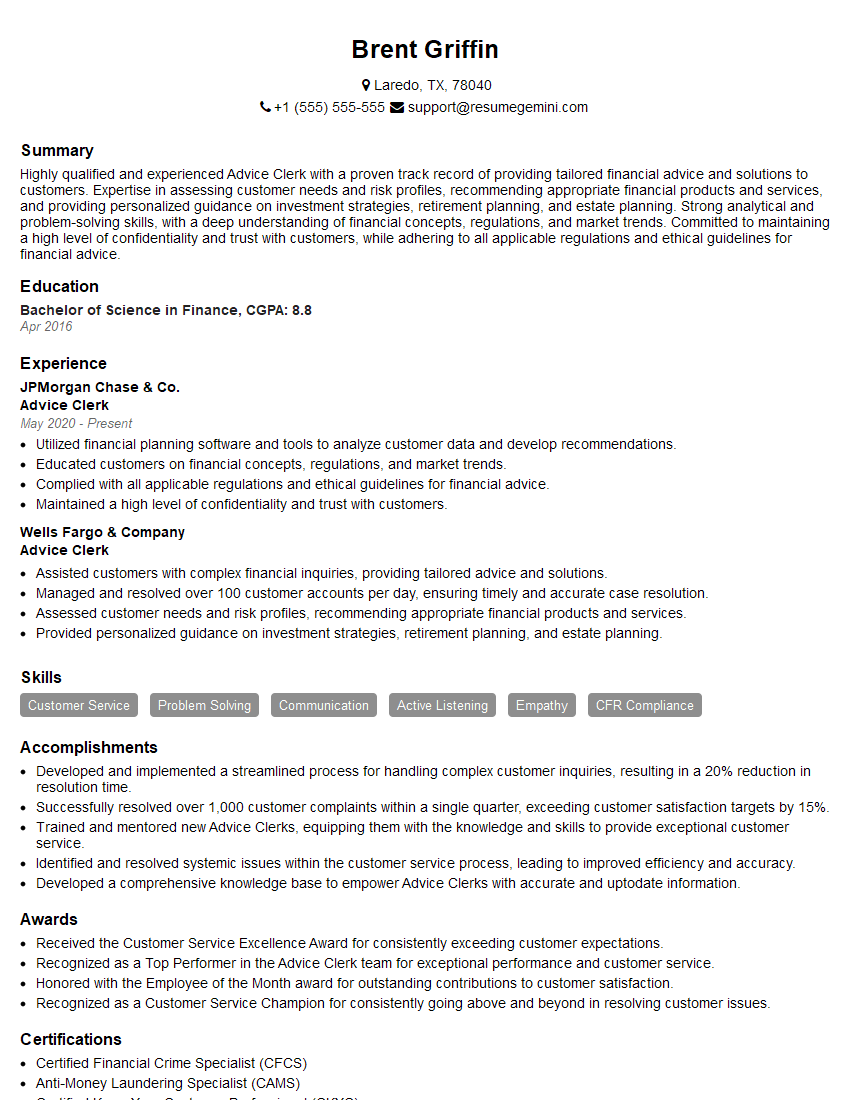

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Advice Clerk

1. What are the key responsibilities of an Advice Clerk?

- Providing information and advice to customers on a range of financial products and services.

- Assessing customers’ financial needs and recommending suitable products.

- Processing financial transactions and opening accounts.

- Maintaining accurate records and providing reports.

- Building and maintaining relationships with customers.

2. What are the qualifications and experience required for this role?

- Typically, a high school diploma or equivalent qualification is required.

- Previous experience in a customer service role is beneficial.

- Strong communication and interpersonal skills are essential.

- Knowledge of financial products and services is advantageous.

- Ability to work independently and as part of a team.

3. What are the challenges of working as an Advice Clerk?

- Dealing with difficult customers.

- Keeping up with changing financial regulations.

- Meeting sales targets.

- Working long hours.

- Stressful environment.

4. What are the rewards of working as an Advice Clerk?

- Helping customers achieve their financial goals.

- Building strong relationships with customers.

- Learning about financial products and services.

- Working in a challenging and rewarding environment.

- Earning a competitive salary and benefits package.

5. How do you stay up-to-date on the latest financial products and services?

- Reading industry publications.

- Attending conferences and webinars.

- Networking with other professionals.

- Taking online courses.

- Following financial news and commentary.

6. How do you build and maintain relationships with customers?

- Providing excellent customer service.

- Going the extra mile to meet customer needs.

- Building rapport with customers.

- Communicating regularly with customers.

- Following up with customers after transactions.

7. How do you handle difficult customers?

- Remaining calm and professional.

- Listening to the customer’s concerns.

- Trying to understand the customer’s perspective.

- Offering solutions to the customer’s problems.

- Escalating the issue to a supervisor if necessary.

8. What are your strengths as an Advice Clerk?

- Excellent communication and interpersonal skills.

- Strong knowledge of financial products and services.

- Ability to build and maintain relationships with customers.

- Ability to work independently and as part of a team.

- Commitment to providing excellent customer service.

9. What are your weaknesses as an Advice Clerk?

- I can be a bit too detail-oriented at times.

- I am still learning about some of the more complex financial products.

- I am not always the most comfortable with cold calling.

- I can sometimes be a bit too trusting of people.

- I am not always the best at managing my time.

10. Why are you interested in working as an Advice Clerk at our company?

- I am passionate about helping people achieve their financial goals.

- I am confident that I have the skills and experience necessary to be successful in this role.

- I am eager to learn more about the financial industry.

- I am impressed by your company’s commitment to customer service.

- I believe that I would be a valuable asset to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Advice Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Advice Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Advice Clerks are responsible for providing professional guidance and support to individuals who are seeking assistance or advice on a range of personal, financial, and legal issues. They play a crucial role in helping people navigate challenging situations and making informed decisions.

1. Providing Information and Guidance

Advice Clerks provide accurate and up-to-date information on a wide range of topics, including legal rights, financial aid, housing, and employment.

- Respond to inquiries from clients via phone, email, or in-person

- Conduct research and gather information on relevant topics

- Provide clear and concise explanations of complex legal, financial, or personal issues

2. Assessing Clients’ Needs

Advice Clerks assess clients’ needs and circumstances to determine the best course of action.

- Conduct confidential interviews with clients

- Identify underlying issues and concerns

- Develop and implement support plans tailored to individual needs

3. Problem-Solving and Crisis Management

Advice Clerks assist clients in problem-solving and crisis management.

- Provide emotional support and guidance during difficult times

- Collaborate with other professionals to address clients’ needs

- Identify and address potential risks or threats

4. Maintaining Confidentiality

Advice Clerks maintain the confidentiality of client information.

- Adhere to strict privacy policies

- Handle sensitive information with discretion

- Respect client rights and boundaries

Interview Tips

Preparing thoroughly for an Advice Clerk interview can increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Organization and Role

Familiarize yourself with the organization’s mission, values, and services. Learn about the specific role you are applying for and its responsibilities.

- Visit the organization’s website and social media pages

- Read articles and news about the organization

- Contact the hiring manager or recruiter to ask questions

2. Practice Your Communication Skills

Advice Clerks must have excellent communication skills. Practice your ability to convey information clearly and concisely, both verbally and in writing.

- Role-play scenarios with a friend or family member

- Record yourself giving advice and evaluate your delivery

- Take a public speaking class or join a Toastmasters club

3. Highlight Your Empathy and Compassion

Empathy and compassion are essential qualities for Advice Clerks. Demonstrate your ability to understand and relate to clients’ situations.

- Share examples of times when you have helped others in need

- Describe your experiences providing emotional support

- Explain your understanding of the challenges faced by individuals seeking advice

4. Prepare for Common Interview Questions

Research common interview questions and prepare thoughtful answers that showcase your skills and experience.

- Tell me about a time you helped someone resolve a problem.

- How do you handle difficult or emotional clients?

- What are your strengths and weaknesses as an Advice Clerk?

5. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive on time for your interview. Be polite and respectful to everyone you meet.

- Choose conservative clothing in neutral colors

- Arrive at the interview location 10-15 minutes early

- Bring a portfolio or resume to showcase your skills and experience

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Advice Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Advice Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.