Are you gearing up for an interview for a Advisor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Advisor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

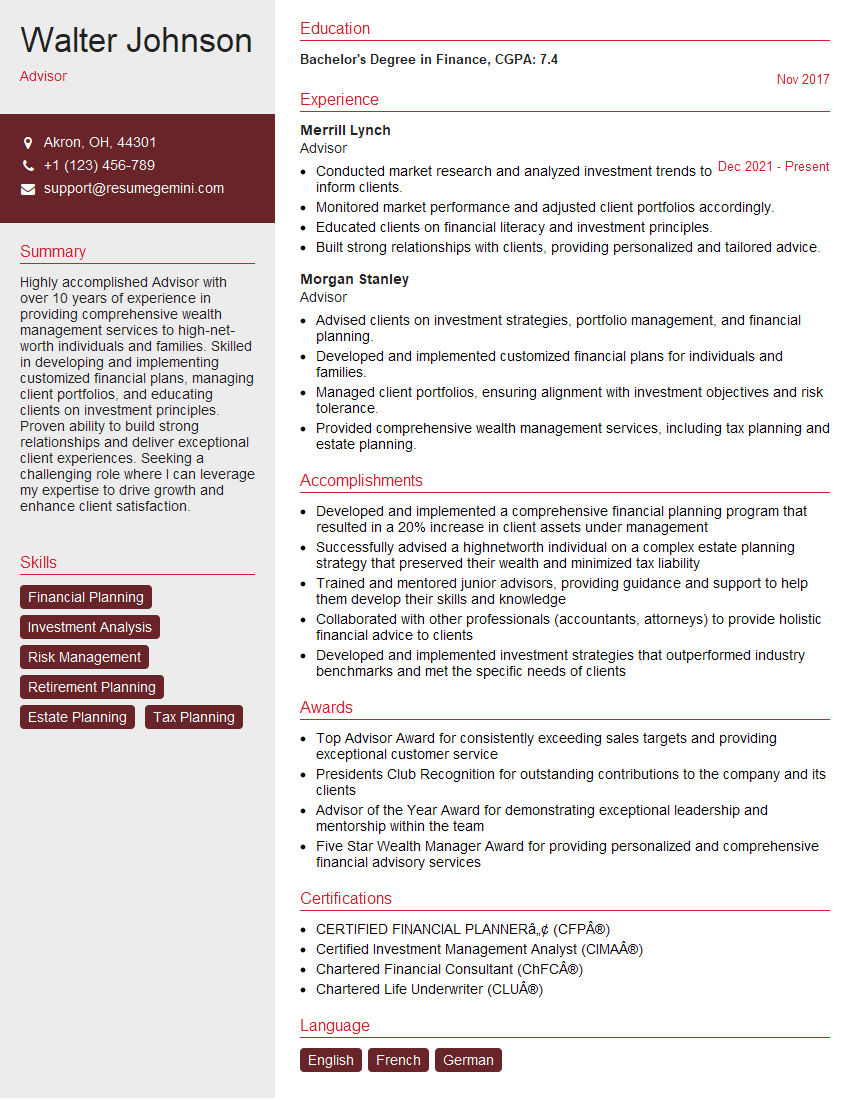

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Advisor

1. What are the key elements of a financial plan?

- Investment strategy

- Retirement planning

- Estate planning

- Tax planning

- Insurance planning

2. How do you determine a client’s risk tolerance?

subheading of the answer

- Discuss the various factors that can affect a client’s risk tolerance, such as age, investment goals, and financial situation.

- Describe the different risk tolerance assessment tools that can be used.

subheading of the answer

- Explain how you use the information gathered from the risk tolerance assessment to develop an appropriate investment strategy for the client.

- Provide an example of how you have used risk tolerance assessment to help a client make informed investment decisions.

3. What are the different types of investment accounts and how do you recommend them to clients?

- Taxable brokerage accounts

- Retirement accounts (IRAs, 401(k)s, etc.)

- Education savings accounts (529 plans, Coverdell ESAs)

- Health savings accounts (HSAs)

- Annuities

4. How do you stay up-to-date on the latest financial trends and regulations?

- Read industry publications and attend conferences.

- Network with other financial professionals.

- Take continuing education courses.

- Stay informed about changes in tax laws and regulations.

- Monitor economic data and market trends.

5. What is your investment philosophy and how do you apply it to your clients’ portfolios?

- Long-term oriented

- Diversified

- Risk-managed

- Goal-based

- Tax-efficient

6. How do you handle clients who are emotional about their investments?

- Stay calm and empathetic.

- Listen to the client’s concerns.

- Explain the risks and potential rewards of the investment.

- Help the client develop a realistic investment plan.

- Reassure the client that you are there to help them achieve their financial goals.

7. What is your favorite investment strategy and why?

- Buy and hold

- Value investing

- Growth investing

- Income investing

- Alternative investments

8. What is the most important thing you look for when evaluating a potential investment?

- Strong fundamentals

- Reasonable valuation

- Growth potential

- Competitive advantage

- Management team

9. What is your experience with financial planning software?

- Experience with multiple financial planning software programs, such as MoneyGuidePro, eMoney Advisor, and RightCapital.

- Ability to use financial planning software to create comprehensive financial plans for clients.

- Knowledge of the different features and benefits of financial planning software.

- Ability to use financial planning software to generate reports and presentations for clients.

10. What is your fee structure?

- Hourly rate

- Asset-based fee

- Retainer fee

- Commission-based

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Advisors play a crucial role in guiding individuals and organizations towards informed decision-making and optimal outcomes.

1. Client Relationship Management

Establish and maintain strong relationships with clients by understanding their needs, goals, and aspirations.

- Conduct in-depth client assessments to identify financial, investment, and other objectives.

- Provide personalized advice tailored to each client’s unique circumstances and risk tolerance.

2. Financial Planning and Analysis

Analyze financial data, market trends, and economic indicators to develop comprehensive financial plans.

- Create customized investment portfolios that align with client goals and risk appetite.

- Monitor investments, assess performance, and make necessary adjustments to optimize returns.

3. Education and Empowerment

Educate clients on financial concepts, investment strategies, and market dynamics.

- Provide clear and concise explanations to enhance clients’ financial literacy.

- Empower clients to make informed decisions and take ownership of their financial well-being.

4. Communication and Reporting

Communicate effectively with clients, providing regular updates, performance reports, and market insights.

- Maintain accurate records and documentation to ensure transparency and accountability.

- Attend industry conferences and stay up-to-date on financial regulations and best practices.

Interview Tips

Interview preparation is crucial for success. Here are some valuable tips and hacks to help you ace the interview for an Advisor position.

1. Research the Company and Position

In-depth research about the company and the specific job role will give you an edge during the interview.

- Review the company’s website, LinkedIn profile, and recent news articles.

- Understand the company’s mission, values, and areas of expertise.

- Analyze the job description to identify the key responsibilities and desired qualifications.

2. Practice Common Interview Questions

Anticipate and prepare for common interview questions related to the Advisor role.

- Describe your experience in financial planning and investment management.

- How do you establish and maintain strong client relationships?

- Tell us about your approach to educating and empowering clients.

3. Highlight Relevant Experience and Skills

Connect your qualifications and experience to the key job responsibilities.

- Quantify your accomplishments using specific metrics and results whenever possible.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

4. Prepare Questions of Your Own

Asking thoughtful questions shows that you are interested and engaged in the opportunity.

- Inquire about the company’s growth plans and industry outlook.

- Ask about the team you would be working with and the company culture.

- Request specific details about the mentorship and professional development opportunities available.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Advisor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!