Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Advisory Title Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

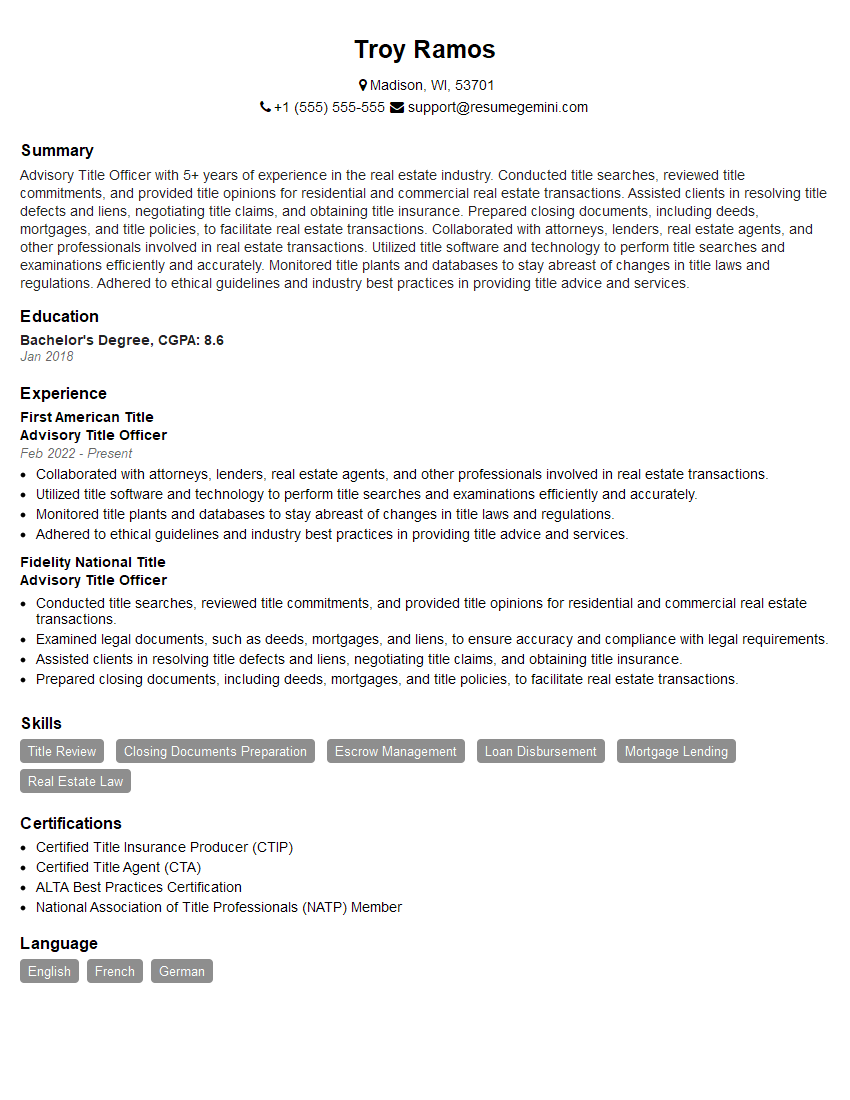

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Advisory Title Officer

1. Describe the process of conducting a title search.

- Identify the property and its legal description.

- Search public records for documents that affect the property’s title.

- Review and analyze the documents to determine the current ownership and any encumbrances.

- Issue a title report that summarizes the findings of the search.

2. What are the different types of title insurance policies?

Owner’s policy

- Protects the homeowner against defects in the title to the property.

- Covers claims for ownership disputes, liens, and other issues that could affect the title.

Lender’s policy

- Protects the lender in the event of a title defect that affects the value of the property.

- Ensures that the lender’s interest in the property is protected.

3. What are the factors that affect the cost of title insurance?

- The value of the property.

- The complexity of the title.

- The location of the property.

- The type of title insurance policy.

4. What are the duties and responsibilities of an Advisory Title Officer?

An Advisory Title Officer is responsible for:

- Providing advice and guidance on title insurance matters to clients.

- Conducting title searches and issuing title reports.

- Explaining the terms and conditions of title insurance policies.

- Assisting in the closing of real estate transactions.

5. What is the importance of title insurance?

- Protects homeowners and lenders from financial loss due to defects in the title to a property.

- Provides peace of mind and assurance that the property ownership is secure.

- Facilitates the closing of real estate transactions.

6. What are the common issues that can affect the title to a property?

- Ownership disputes.

- Liens and judgments.

- Easements and encumbrances.

- Forged or fraudulent documents.

7. What are the steps involved in resolving a title issue?

- Identify the nature of the issue.

- Research the issue and gather evidence.

- Negotiate with the other party or parties involved.

- Obtain a court order or other legal document to resolve the issue.

8. What are the ethical considerations for Advisory Title Officers?

- Maintain confidentiality of client information.

- Provide unbiased advice and guidance.

- Act in the best interests of the client.

- Follow all applicable laws and regulations.

9. What is the difference between a title search and a title examination?

- A title search is a preliminary review of public records to identify potential issues that could affect the title to a property.

- A title examination is a more in-depth review of public records and other documents to determine the current ownership and any encumbrances on a property.

10. What are the emerging trends in the title insurance industry?

- Increased use of technology to streamline the title search and closing process.

- Growing demand for title insurance in international real estate transactions.

- Increased focus on cybersecurity and data protection.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Advisory Title Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Advisory Title Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Advisory Title Officers are responsible for several key tasks that contribute to the smooth operation of real estate transactions. These responsibilities include:

1. Title Examination

Advisory Title Officers meticulously examine title documents to identify any potential issues or encumbrances that may affect the property’s ownership or value. This involves reviewing deeds, mortgages, liens, and other relevant records to ensure that the title is clear and marketable.

- Reviewing and analyzing title documents to identify potential risks and issues

- Conducting thorough title searches to uncover any liens, judgments, or other encumbrances on the property

2. Title Insurance Issuance

After examining the title, Advisory Title Officers issue title insurance policies that protect lenders and homeowners from financial loss resulting from title defects or liens. They assess the risks associated with the title and determine the appropriate coverage for each transaction.

- Preparing and issuing title insurance policies that protect property owners and lenders against title defects

- Explaining the terms and conditions of title insurance policies to clients

3. Real Estate Transaction Coordination

Advisory Title Officers coordinate and facilitate real estate transactions by working closely with buyers, sellers, lenders, and real estate agents. They ensure that all necessary documentation is in order, the closing process runs smoothly, and all parties’ interests are protected.

- Coordinating and managing real estate transactions from start to finish

- Preparing and reviewing closing documents, including deeds, mortgages, and title insurance policies

4. Customer Service and Relationship Building

Advisory Title Officers provide excellent customer service by answering questions, addressing concerns, and building strong relationships with clients. They explain complex legal concepts in clear terms and ensure that clients understand the process and their rights.

- Providing exceptional customer service to clients and other parties involved in real estate transactions

- Building and maintaining strong relationships with clients, real estate agents, and lenders

Interview Tips

To ace your interview for an Advisory Title Officer position, consider the following tips:

1. Research the Company and Position

Before the interview, take time to thoroughly research the company and the specific Advisory Title Officer position. Familiarize yourself with the company’s values, mission, and services. Understand the responsibilities and qualifications required for the role, and tailor your answers accordingly.

- Visit the company’s website and social media pages.

- Read industry articles and news to stay up-to-date on current trends and best practices.

2. Highlight Your Expertise and Experience

During the interview, emphasize your knowledge and experience in title examination, title insurance, and real estate transactions. Provide specific examples that demonstrate your skills in identifying title defects, preparing legal documents, and coordinating closing processes. Quantifying your accomplishments and using metrics to support your claims will strengthen your application.

- Quantify your results with specific numbers and percentages whenever possible.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide context.

3. Demonstrate Your Customer Service Skills

Advisory Title Officers play a vital role in providing excellent customer service. Emphasize your ability to communicate effectively, build rapport, and resolve issues promptly and professionally. Share examples of how you have gone above and beyond to meet the needs of clients and ensure their satisfaction.

- Describe a time when you successfully resolved a complex issue for a client.

- Explain how you build and maintain strong relationships with clients and other stakeholders.

4. Prepare Thoughtful Questions

At the end of the interview, you will likely have an opportunity to ask questions. Prepare thoughtful questions that demonstrate your interest in the company and the role. This is an excellent way to show your enthusiasm and engagement. Consider asking about the company’s growth plans, professional development opportunities, or any specific projects or initiatives related to the position.

- Ask questions about the company’s culture and values.

- Inquire about opportunities for professional growth and development.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Advisory Title Officer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Advisory Title Officer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.