Feeling lost in a sea of interview questions? Landed that dream interview for Agent Contract Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Agent Contract Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

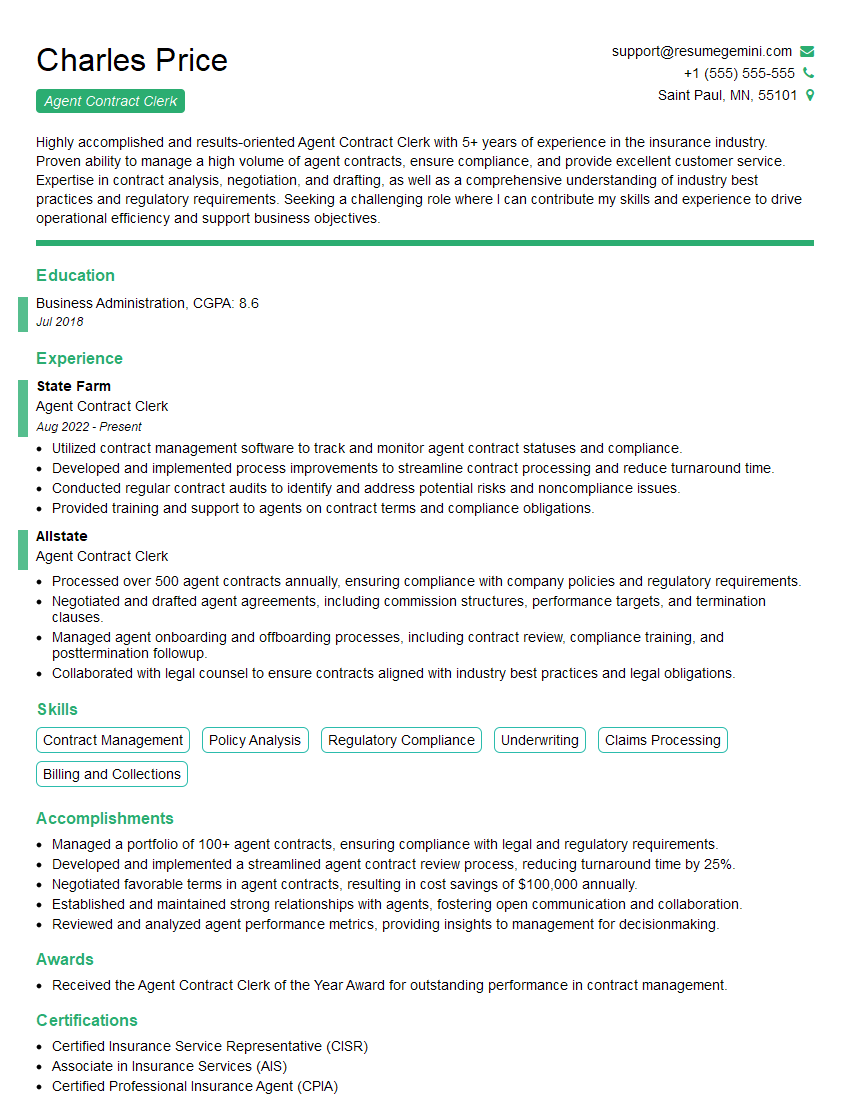

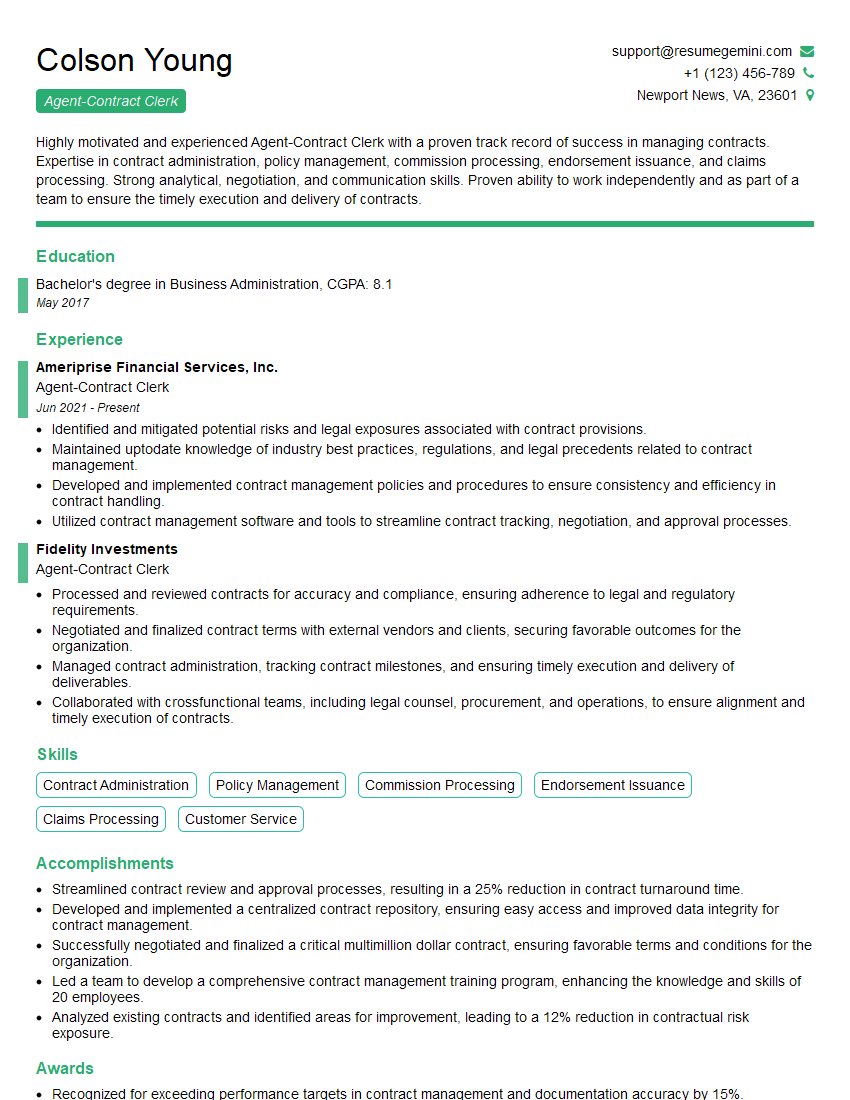

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Agent Contract Clerk

1. What are the types of insurance contracts you have worked with in your previous role?

In my previous role, I was responsible for handling various types of insurance contracts, including:

- Property insurance

- Casualty insurance

- Commercial general liability (CGL) insurance

- Professional liability insurance

- Workers’ compensation insurance

2. What steps do you take when preparing an insurance contract for a client?

Pre-Proposal Activities

- Review the client’s needs and objectives

- Identify the appropriate insurance carriers

- Request and review insurance quotes

Proposal Preparation

- Draft the insurance contract

- Review the contract with the client

- Finalize the contract and obtain the client’s signature

3. What are the key provisions of an insurance contract that you should be aware of?

The key provisions of an insurance contract that I am familiar with include:

- Insured’s obligations

- Insurer’s obligations

- Conditions and exclusions

- Limits of liability

- Cancellation provisions

4. What is the difference between an insurance contract and an insurance policy?

An insurance contract is a legally binding agreement between an insurer and an insured. It outlines the terms and conditions of the insurance coverage, including the insured’s obligations and the insurer’s responsibilities.

An insurance policy is the document that provides evidence of the insurance contract. It contains the details of the coverage, such as the policy number, the insured’s name, the coverage period, and the limits of liability.

5. What are the steps you take to renew an insurance contract for a client?

Renewal Process

- Notify the client of the upcoming renewal date

- Review the current contract and identify any changes that need to be made

- Request and review renewal quotes from insurance carriers

- Negotiate the terms of the renewal contract with the selected carrier

- Issue the renewal contract to the client

6. What is your experience with claims processing?

In my previous role, I was responsible for processing insurance claims. My responsibilities included:

- Receiving and reviewing claims

- Investigating claims and determining coverage

- Negotiating and settling claims

- Maintaining claims records and reporting

7. What are the common challenges you have faced as an Agent Contract Clerk and how did you overcome them?

Challenge: Time constraints

Insurance contracts are often complex and time-consuming to prepare. To overcome this challenge, I prioritize my work and use efficient methods to streamline the contract preparation process.

Challenge: Dealing with difficult clients

Some clients may be demanding or difficult to work with. To overcome this challenge, I remain professional and maintain a positive attitude. I actively listen to their concerns and work to find solutions that meet their needs.

8. What is your experience with using insurance software or technology?

In my previous role, I used various insurance software and technology, including:

- Agency management systems (AMS)

- Insurance policy administration systems

- Claims processing systems

- Digital signature platforms

I am proficient in using these systems to perform my job duties effectively and efficiently.

9. What is your understanding of the ethical responsibilities of an insurance professional?

As an insurance professional, I understand that I have a duty to act in the best interests of my clients. My ethical responsibilities include:

- Providing accurate and unbiased information

- Maintaining confidentiality

- Avoiding conflicts of interest

- Acting in a fair and equitable manner

10. What are your salary expectations for this position?

My salary expectations for this position are in line with the industry average for similar roles. I am confident that I possess the skills and experience to add value to your organization and am willing to negotiate a salary that is fair and commensurate with my contributions.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Agent Contract Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Agent Contract Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Agent Contract Clerk is primarily responsible for the efficient and accurate processing of contracts and related documents, ensuring compliance with legal, regulatory, and company policies.

1. Contract Management

Process and maintain a comprehensive record of all contracts, including; creation, amendment, and termination

- Prepare, review, and negotiate contracts with agents, ensuring adherence to established legal and company guidelines

- Monitor and track contract deadlines, milestones, and deliverables, ensuring timely execution and fulfillment

2. Document Processing and Review

Manage and track all contract-related documentation throughout the lifecycle of the contract

- Review and analyze contracts for accuracy, completeness, and compliance with legal and company requirements

- File, organize, and maintain all contract documents for easy retrieval and reference

3. Compliance and Reporting

Ensure adherence to internal and external regulatory guidelines and industry best practices

- Monitor and report on contract performance, identify potential risks, and recommend corrective actions

- Maintain a comprehensive understanding of relevant laws, regulations, and policies pertaining to contract management

4. Communication and Collaboration

Effectively communicate with internal and external stakeholders, including agents, attorneys, and clients

- Provide clear and concise explanations of contract terms and conditions to all parties

- Collaborate with cross-functional teams to ensure a seamless contract management process

Interview Tips

To ace an interview for an Agent Contract Clerk position, it’s crucial to tailor your preparation to the specific responsibilities of the role.

1. Research the Company and Role

Thoroughly research the company and the specific Agent Contract Clerk position you’re applying for.

- Understand the company’s industry, business model, and values.

- Review the job description to identify the key responsibilities and qualifications required.

2. Highlight Contract Management Skills

Emphasize your expertise in contract management, including negotiation, drafting, and review.

- Provide examples of complex contracts you’ve successfully negotiated or drafted.

- Explain how you ensure compliance with legal and regulatory requirements.

3. Demonstrate Attention to Detail

Showcase your strong attention to detail and accuracy in handling contracts and related documents.

- Highlight your ability to review and analyze contracts thoroughly, identifying potential risks and areas of improvement.

- Emphasize your proficiency in organizing and maintaining contract files for easy retrieval.

4. Communicate Effectively

Demonstrate your ability to communicate effectively with both internal and external stakeholders.

- Provide examples of how you effectively explained complex contract terms to clients or colleagues.

- Highlight your skills in building rapport and maintaining positive relationships with agents, attorneys, and other professionals.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Agent Contract Clerk, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Agent Contract Clerk positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.