Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Agricultural Loan Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

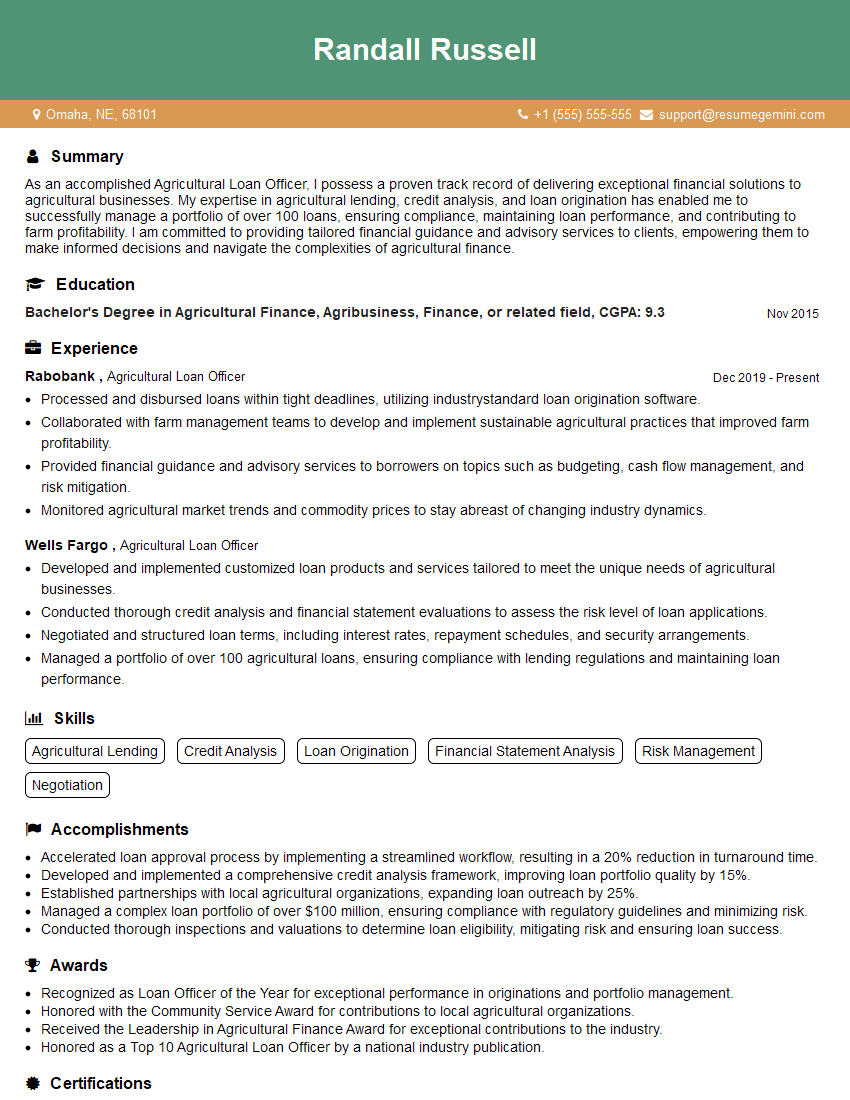

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Agricultural Loan Officer

1. How do you assess the creditworthiness of an agricultural loan applicant?

I begin by evaluating the applicant’s financial stability through examining their income, assets, and liabilities. This helps me understand their capacity to repay the loan. I also consider their experience in agriculture, as it indicates their knowledge of the industry and potential risks. Additionally, I assess their character and reputation within the community, as this can provide insights into their reliability as a borrower.

2. What are the key factors you consider when determining the interest rate on an agricultural loan?

Market Conditions

- Current interest rates in the financial market

- Government regulations and policies

- Economic outlook and agricultural trends

Applicant’s Creditworthiness

- Credit score and history

- Debt-to-income ratio

- Repayment capacity and cash flow

Loan Characteristics

- Loan amount and term

- Purpose of the loan

- Collateral offered

3. How do you manage the risk associated with agricultural loans?

I employ a comprehensive risk management strategy that includes the following measures:

- Thorough due diligence and assessment of loan applicants

- Diversification of loan portfolio across different crops, borrowers, and regions

- Regular monitoring and analysis of loan performance

- Establishment of loan covenants and restrictions to mitigate potential risks

- Collaboration with insurance providers to protect against unforeseen events

4. How do you stay up-to-date on the latest developments in agricultural lending?

I continuously engage in professional development activities to enhance my knowledge and skills. This includes:

- Attending industry conferences and workshops

- Reading trade publications and research articles

- Participating in online courses and webinars

- Networking with other agricultural loan officers and professionals

- Seeking mentorship and guidance from experienced colleagues

5. What is your approach to working with agricultural clients who are facing financial difficulties?

I adopt a proactive and supportive approach when dealing with clients who encounter financial challenges. I begin by understanding their situation and identifying the underlying causes of their difficulties. Together, we explore various options to address the situation, such as:

- Restructuring loan terms

- Providing additional financing or assistance programs

- Connecting them with financial counseling or support services

- Collaborating with other stakeholders, such as extension agents or financial advisors

6. How do you ensure compliance with all applicable laws and regulations?

Maintaining compliance is paramount in my role. I regularly review and adhere to the following measures:

- Federal and state lending regulations

- Anti-discrimination and fair lending laws

- Privacy and data protection requirements

- Internal policies and procedures

I also attend compliance training programs and consult with legal professionals as needed to ensure my practices align with current regulations.

7. Tell me about a situation where you successfully resolved a loan default.

In one instance, a borrower experienced severe crop damage due to extreme weather. I worked closely with them to assess the situation, explore available options, and restructure their loan. I also connected them with disaster relief programs and provided guidance on mitigating future risks. As a result, the borrower was able to recover and continue their agricultural operations.

8. How do you handle loan applications from borrowers who have limited credit history?

When dealing with borrowers who have limited credit history, I rely on alternative methods to evaluate their creditworthiness. These include:

- Analyzing their cash flow and income sources

- Considering their experience and expertise in agriculture

- Seeking references from previous landlords, suppliers, or business associates

- Exploring government-backed loan programs that offer support to beginning farmers

9. What strategies do you use to cross-sell additional products and services to existing loan customers?

I identify opportunities to cross-sell relevant products and services based on my understanding of my customers’ needs and financial situation. These may include:

- Offering crop insurance or other risk management products

- Recommending investment or savings accounts to enhance their financial stability

- Providing access to financial planning services to help them manage their overall finances

- Connecting them with other professionals, such as agricultural consultants or marketing specialists

10. How do you measure your success as an Agricultural Loan Officer?

I measure my success based on the following criteria:

- Loan portfolio growth and profitability

- Customer satisfaction and retention rates

- Contribution to the overall financial health of the bank

- Support and guidance I provide to agricultural clients

- Recognition and feedback from colleagues and superiors

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Agricultural Loan Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Agricultural Loan Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Agricultural Loan Officers play a pivotal role in supporting the agricultural industry by providing financial assistance to farmers and agribusinesses. Their core responsibilities include:

1. Loan Analysis and Processing

Conducting thorough credit analyses of loan applications, assessing the financial health, cash flow, and collateral of potential borrowers.

- Evaluating loan proposals and determining loan terms, including interest rates, repayment schedules, and collateral requirements.

- Processing loan applications, ensuring compliance with regulatory guidelines and bank policies.

2. Relationship Management

Building strong relationships with farmers, ranchers, and agribusinesses, understanding their unique financial needs and business goals.

- Conducting regular farm visits and meetings to stay informed about clients’ operations and financial performance.

- Providing guidance and advice on financial management, risk mitigation, and farm planning.

3. Risk Management

Assessing and mitigating risks associated with agricultural lending, including weather events, commodity price fluctuations, and economic downturns.

- Developing and implementing risk management strategies, such as loan covenants, insurance requirements, and regular monitoring of loan portfolios.

- Working closely with agricultural experts and underwriters to stay informed about industry trends and potential risks.

4. Regulatory Compliance

Ensuring compliance with all applicable laws, regulations, and industry best practices related to agricultural lending.

- Maintaining up-to-date knowledge of agricultural lending regulations and reporting requirements.

- Conducting regular reviews and audits to ensure compliance.

Interview Tips

To ace your Agricultural Loan Officer interview, consider the following tips:

1. Research the Organization and Role

Thoroughly research the bank or lending institution, its agricultural lending portfolio, and the specific role you’re applying for.

- Visit the organization’s website, read industry publications, and connect with current or former employees to gain insights.

- Identify specific examples of your experience that align with the key responsibilities of the role.

2. Highlight Your Agricultural Expertise

Emphasize your knowledge and experience in the agricultural industry. Highlight your understanding of agricultural finance, farm management practices, and risk factors unique to the sector.

- Describe instances where you have successfully analyzed and managed agricultural loan portfolios.

- Discuss your experience with farm visits, financial projections, and risk mitigation strategies.

3. Demonstrate Strong Communication and Relationship-Building Skills

Agricultural Loan Officers act as trusted advisors to their clients. Showcase your ability to build rapport, communicate effectively, and establish long-term relationships with farmers and agribusinesses.

- Share examples of how you have successfully managed client relationships and resolved complex issues.

- Highlight your ability to listen actively, understand client needs, and provide tailored financial solutions.

4. Prepare for Common Interview Questions

Prepare for common interview questions and formulate thoughtful responses that showcase your qualifications and passion for agricultural lending.

- Tell me about your experience in agricultural lending and your understanding of the industry.

- Describe a challenging loan application you encountered and how you resolved it.

- How do you stay informed about industry trends and regulatory changes related to agricultural lending?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Agricultural Loan Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!