Are you gearing up for a career in Alarm Adjuster? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Alarm Adjuster and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

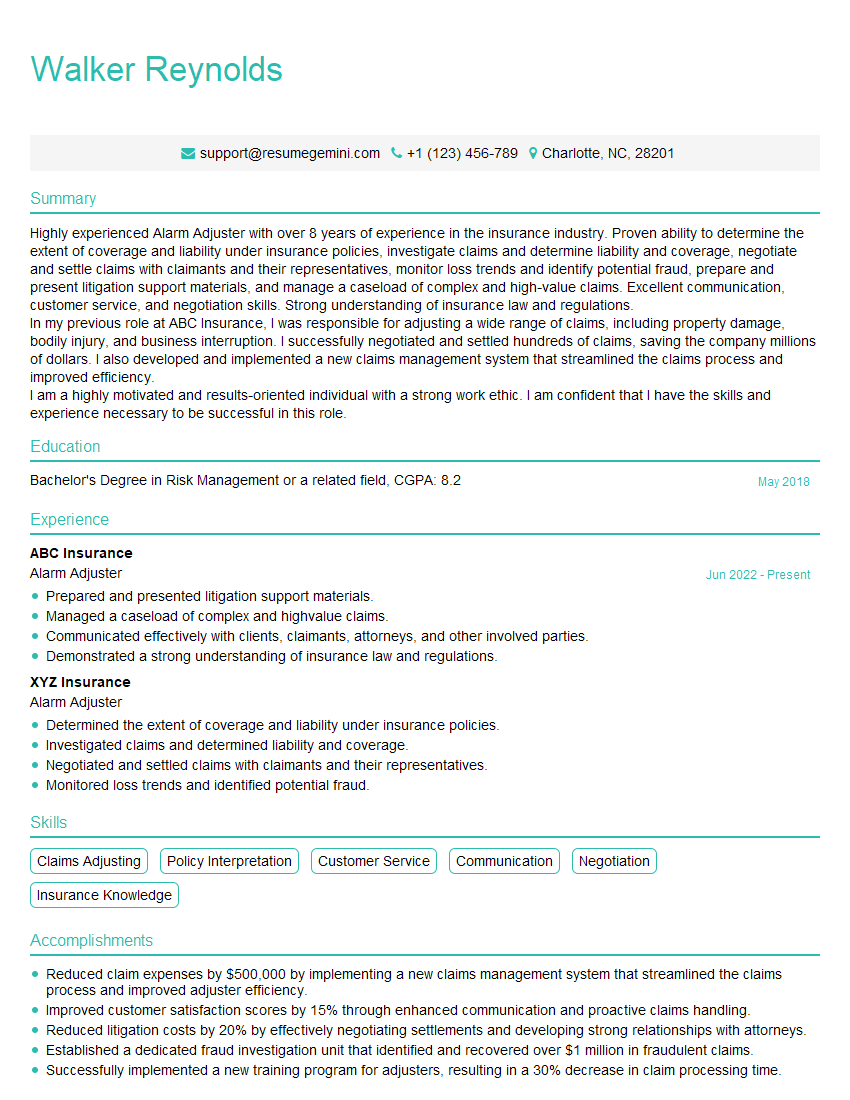

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Alarm Adjuster

1. Describe the process of evaluating an alarm system for an insurance policy.

- Review the policyholder’s insurance policy to determine coverage and requirements.

- Conduct a site visit to inspect the alarm system.

- Evaluate the system’s components and functionality.

- Identify any deficiencies or areas for improvement.

- Provide recommendations to the policyholder for system upgrades.

2. What are the key components of an effective alarm system?

Hardware Components

- Control panel

- Sensors (motion, glass break, etc.)

- Keypad

- Alarm siren

- Communication device (cellular, Wi-Fi, etc.)

Software Components

- User interface

- Programming and configuration tools

- Monitoring platform

- Remote control software

3. How do you troubleshoot common alarm system issues?

- False alarms: Check sensor alignment, sensitivity, and environment.

- No alarms: Inspect power supply, sensor integrity, and communication.

- Communication failures: Troubleshoot cellular or Wi-Fi connectivity, test backup systems.

- Battery issues: Replace batteries regularly, check wiring connections.

- Zone faults: Identify faulty sensor or malfunctioning component.

4. What are the latest technologies used in alarm systems?

- AI-powered motion detection

- Facial recognition

- Cloud-based monitoring and control

- Smart home integration

- Remote access via mobile apps

5. How do you stay up-to-date with industry standards and regulations?

- Attend industry conferences and workshops

- Read trade publications and technical journals

- Participate in professional organizations (e.g., NFPA, SIA)

- Complete continuing education courses

- Review updates from manufacturers and insurance carriers

6. Describe a situation where you identified and resolved a complex alarm system issue.

- Provide details of the issue and its symptoms.

- Explain how you diagnosed the root cause.

- Describe the steps you took to resolve the problem.

- Discuss the impact of the issue and how your resolution benefited the customer.

7. What is your preferred method for communicating findings and recommendations to policyholders?

- Written reports with detailed explanations

- Verbal presentations using visual aids

- Email communication with attached documentation

- Follow-up phone calls to answer questions

- On-site meetings to discuss findings in person

8. How do you handle conflicts or disagreements with policyholders regarding alarm system recommendations?

- Listen attentively to the policyholder’s perspective.

- Present facts and evidence to support recommendations.

- Explain the potential risks and benefits of different options.

- Negotiate and compromise when possible.

- Maintain a professional and respectful demeanor.

9. What are the ethical considerations involved in your profession?

- Confidentiality of policyholder information

- Objectivity in evaluating alarm systems

- Avoiding conflicts of interest

- Adhering to industry standards and regulations

- Maintaining professional integrity

10. Why are you interested in working as an Alarm Adjuster?

- Passion for the security industry

- Desire to contribute to the safety and peace of mind of policyholders

- Interest in evaluating and improving alarm systems

- Commitment to upholding ethical standards

- Belief that your skills and experience can add value to the organization

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Alarm Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Alarm Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Alarm Adjusters are responsible for handling claims arising from burglaries, thefts, and other incidents.

1. Investigating Claims

Investigating claims thoroughly, including reviewing police reports, interviewing witnesses, and inspecting damaged property.

2. Evaluating Damages

Assessing the extent of damages and determining the appropriate amount of compensation.

3. Negotiating Settlements

Negotiating settlements with claimants, insurance companies, and other parties involved.

4. Documenting Claims

Preparing and maintaining detailed records of all claims, including investigation findings, settlement agreements, and correspondence.

5. Providing Customer Service

Providing excellent customer service to claimants throughout the claims process, answering questions and addressing concerns.

Interview Tips

Preparing thoroughly for an Alarm Adjuster interview is crucial. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Familiarize yourself with the company’s history, mission, and current projects. Research the insurance industry, industry trends, and best practices.

- Visit the company’s website and LinkedIn page.

- Read industry publications and articles.

2. Prepare to Discuss Your Experience

Highlight your experience in claims handling, investigations, and customer service. Quantify your accomplishments using specific examples.

- Example: “I successfully investigated over 100 claims, resulting in a 95% customer satisfaction rate.”

3. Demonstrate Strong Problem-Solving Skills

Alarm Adjusters are often faced with complex and challenging claims. Showcase your ability to identify problems, analyze data, and develop effective solutions.

- Example: “In a recent case, I encountered conflicting witness statements. I used my investigative skills to uncover inconsistencies and resolve the discrepancies.”

4. Emphasize Your Communication and Negotiation Skills

Effective communication and negotiation skills are essential for success in claims adjustment. Highlight your ability to build rapport with clients, communicate clearly, and negotiate favorable settlements.

- Example: “I am highly skilled in active listening and empathy. I can effectively communicate complex information to both technical and non-technical audiences.”

5. Be Prepared for Technical Questions

Be familiar with insurance policies, claims processing software, and industry-specific terminology. You may be asked technical questions to assess your knowledge of the field.

- Example: “Explain the difference between a homeowner’s policy and a renter’s policy.”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Alarm Adjuster interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!