Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Amortization Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Amortization Clerk so you can tailor your answers to impress potential employers.

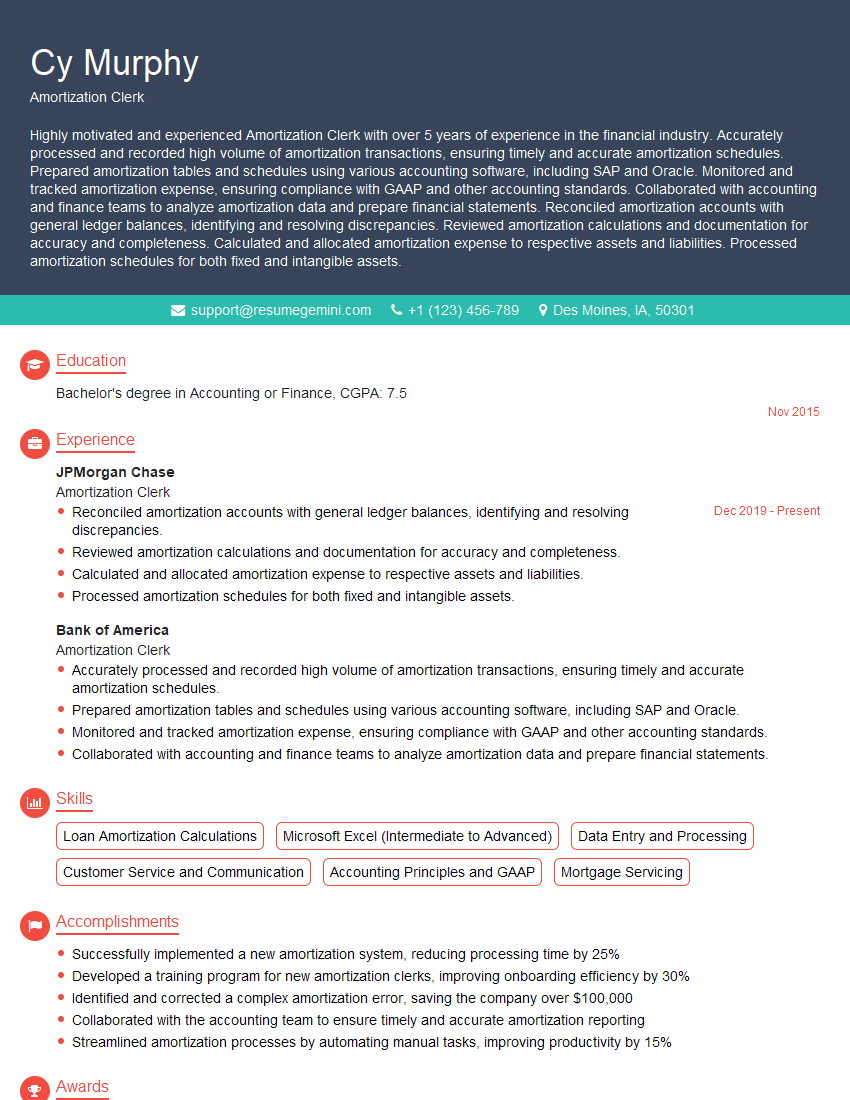

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Amortization Clerk

1. What is amortization?

Amortization is the systematic allocation of the cost of an asset over the period of its useful life. It involves distributing the cost of the asset into equal periodic payments, which are recorded as expenses on the income statement.

2. What are the different methods of amortization?

Straight-line method

- Depreciation expense is the same for each period of the asset’s life.

- Calculated as: (Cost of asset – Residual value) / Useful life

Declining-balance method

- Depreciation expense is higher in the early years and decreases over time.

- Calculated using a fixed depreciation rate that is applied to the book value of the asset.

Sum-of-the-years’-digits method

- Depreciation expense is highest in the first year and decreases over time.

- Calculated using a fraction that represents the remaining life of the asset.

3. What factors should be considered when selecting an amortization method?

- Nature of the asset

- Expected pattern of usage

- Company accounting policies

- Tax implications

4. What are the journal entries involved in amortization?

- Amortization expense is debited

- Accumulated amortization is credited

5. What is the impact of amortization on the financial statements?

- Decreases the carrying value of the asset on the balance sheet.

- Recognizes depreciation expense on the income statement, reducing net income.

6. What are the differences between depreciation and amortization?

- Depreciation is for tangible assets, while amortization is for intangible assets.

- Depreciation allocates the cost of an asset over its useful life, while amortization allocates the cost of an asset over its expected useful life.

7. What are some common mistakes to avoid in amortization?

- Failing to consider the expected useful life of the asset

- Using an inappropriate amortization method

- Not recording amortization expenses as required

8. What software or tools do you use to perform amortization calculations?

- Excel or Google Sheets

- Accounting software (e.g., QuickBooks, NetSuite)

9. What is the role of the Amortization Clerk in ensuring accurate and timely amortization?

- Calculating and recording amortization expenses

- Maintaining amortization schedules

- Monitoring and reconciling amortization accounts

10. How do you stay up-to-date on the latest accounting standards and regulations related to amortization?

- Reading industry publications

- Attending training and webinars

- Consulting with accounting professionals

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Amortization Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Amortization Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Amortization Clerks play a crucial role in the accounting and finance department, handling the intricate task of calculating and recording amortization schedules.

1. Amortization Calculation and Recording

Their primary responsibility involves meticulously calculating amortization schedules for various intangible assets such as patents, trademarks, and software.

- Utilize approved amortization methods and industry-specific guidelines to determine the appropriate amortization period and expense for each asset.

- Accurately record amortization entries in the general ledger and ensure compliance with accounting standards.

2. Data Management and Reporting

Amortization Clerks are responsible for maintaining and managing data related to amortization schedules and asset depreciation.

- Compile and analyze data on assets to assess their value and adjust amortization schedules as necessary.

- Generate reports detailing amortization expenses and provide relevant information to stakeholders, including management, auditors, and tax authorities.

3. Internal Controls and Compliance

They play a vital role in ensuring the accuracy and reliability of amortization calculations.

- Implement and adhere to internal controls and policies to prevent errors and maintain the integrity of financial records.

- Review and reconcile amortization schedules regularly to identify and correct any discrepancies or inconsistencies.

4. Stakeholder Communication

Amortization Clerks effectively communicate amortization-related information to various stakeholders.

- Collaborate with accountants, auditors, and management to provide insights into amortization schedules and their impact on financial statements.

- Respond to inquiries and provide clarifications on amortization calculations and accounting principles.

Interview Tips

Succeeding in an Amortization Clerk interview requires preparation and a thorough understanding of the role’s responsibilities and industry-specific knowledge.

1. Research and Practice

Before the interview, conduct thorough research on the company, the industry, and the specific role of Amortization Clerk.

- Familiarize yourself with industry-standard amortization methods and the relevant accounting principles.

- Practice calculating amortization schedules using different methods and scenarios to demonstrate your proficiency.

2. Highlight Skills and Experience

Emphasize your skills in financial analysis, data management, and accounting software. Highlight any experience or projects that showcase your ability to work accurately and efficiently with large datasets.

- Share examples of your experience in maintaining and analyzing amortization schedules or related projects.

- Quantify your accomplishments and demonstrate how your contributions impacted the organization.

3. Understanding of Accounting Standards

Demonstrate your understanding of the relevant accounting standards and regulations related to amortization. This includes the ability to interpret and apply these standards to practical scenarios.

- Familiarize yourself with the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP) as applicable to amortization.

- Provide examples of how you have successfully applied these standards in your work.

4. Communication and Teamwork

Amortization Clerks often collaborate with various teams within the organization. Highlight your communication and teamwork skills, emphasizing your ability to effectively interact with stakeholders.

- Describe your experience in presenting complex financial information to non-financial audiences.

- Emphasize your ability to build and maintain strong working relationships with colleagues.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Amortization Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!