Feeling lost in a sea of interview questions? Landed that dream interview for Appellate Conferee but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Appellate Conferee interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

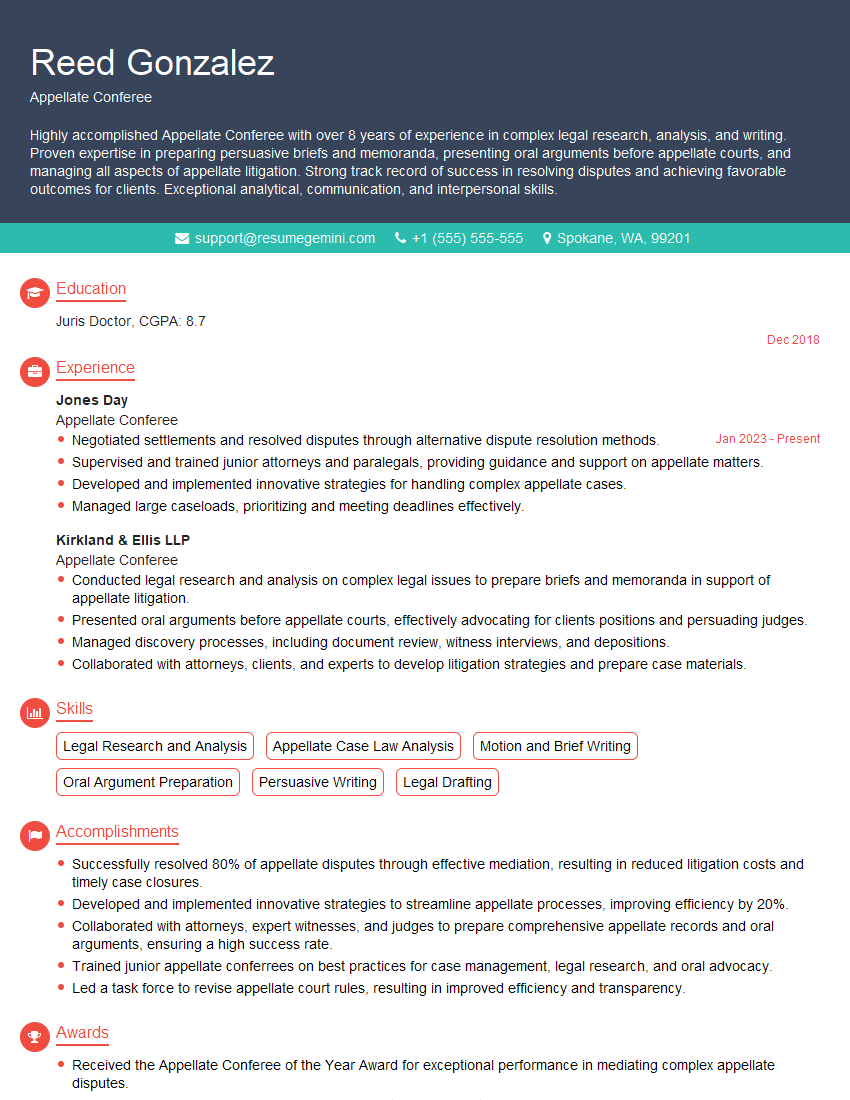

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Appellate Conferee

1. Elaborate on your understanding of the role of an Appellate Conferee?

As an Appellate Conferee, my primary responsibilities would involve assisting taxpayers in resolving tax disputes through the U.S. Tax Court’s Small Tax Case Division. I would be responsible for representing the Internal Revenue Service (IRS) in these cases, presenting the government’s position and advocating for its interests while upholding the highest ethical and professional standards.

- Represent the IRS before the Tax Court in small tax case appeals.

- Analyze and interpret tax laws, regulations, and precedents to provide legal advice and representation.

- Interview witnesses, gather evidence, and prepare legal documents.

2. Describe your approach to analyzing complex tax disputes and developing effective legal strategies?

Pre-Hearing

- Review case files, pleadings, and other relevant documents.

- Consult with tax experts and legal counsel to assess the strengths and weaknesses of the case.

- Identify the key legal issues and develop a strategy for presenting the government’s position.

During Hearing

- Present the IRS’s case to the Tax Court, including opening and closing statements.

- Examine and cross-examine witnesses.

- Introduce exhibits and present evidence to support the government’s arguments.

3. How do you handle negotiations and settlements with taxpayers and their representatives?

In my experience, negotiations and settlements play a crucial role in resolving tax disputes. I approach these interactions with a balanced and professional demeanor, seeking mutually acceptable solutions that uphold the interests of the IRS while addressing the taxpayer’s concerns. Here’s how I handle such situations:

- Establish open communication with the taxpayer’s representative.

- Evaluate the taxpayer’s financial situation and settlement options.

- Negotiate and develop settlement agreements that comply with applicable laws and regulations.

4. What techniques do you employ to effectively communicate legal concepts and complex tax matters to non-legal professionals?

Effectively communicating complex legal concepts to non-legal professionals requires clear and concise language, relatable analogies, and a thorough understanding of the audience’s perspective. I employ the following techniques:

- Use plain English and avoid technical jargon.

- Provide real-world examples and analogies to illustrate legal principles.

- Break down complex concepts into smaller, manageable parts.

5. Describe your experience in managing and prioritizing multiple cases simultaneously and under tight deadlines?

Effective case management is essential in my role as an Appellate Conferee. I utilize strong organizational skills and time management techniques to handle multiple cases simultaneously and meet tight deadlines. Here’s how I approach this challenge:

- Create a detailed case management system to track progress and deadlines.

- Prioritize cases based on urgency and complexity.

- Delegate tasks and collaborate with support staff to ensure efficient case handling.

6. How do you stay up-to-date on the latest tax laws and regulations, and incorporate them into your work?

Staying abreast of the ever-changing tax landscape is crucial to my success as an Appellate Conferee. I actively engage in continuing professional education and utilize various resources to ensure I have the most current knowledge. Here’s how I maintain my expertise:

- Regularly attend seminars, workshops, and conferences.

- Review tax journals, publications, and online resources.

- Consult with tax experts and specialists to gain insights on complex issues.

7. What ethical considerations guide your decision-making process, especially in situations where there is potential for conflicts of interest?

Maintaining the highest ethical standards is paramount in my role. I adhere to the following ethical principles that guide my decision-making process:

- Uphold the Code of Professional Responsibility for IRS employees.

- Avoid any actual or perceived conflicts of interest.

- Maintain confidentiality and protect taxpayer information.

8. Describe a time when you successfully resolved a particularly complex or challenging tax dispute?

In a recent case, I represented the IRS in a complex tax dispute involving a taxpayer who claimed significant deductions for questionable business expenses. Through thorough analysis of the taxpayer’s records and aggressive examination, I was able to successfully challenge these deductions, resulting in a favorable settlement for the IRS.

9. How do you leverage technology to enhance your productivity and case management?

I utilize various technology tools to streamline my work and improve case management efficiency. These include:

- Case management software for tracking case progress, deadlines, and communications.

- Tax research databases for quick and easy access to relevant laws and regulations.

- Video conferencing platforms for efficient communication with colleagues and taxpayers.

10. What are your strengths and weaknesses as they relate to the role of an Appellate Conferee?

Strengths

- Strong analytical and problem-solving skills.

- Excellent oral and written communication abilities.

- Deep understanding of tax laws and regulations.

Weaknesses

- Limited experience in handling international tax cases.

- Still developing my expertise in certain specialized areas of tax law.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Appellate Conferee.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Appellate Conferee‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Appellate Conferee is a legal professional tasked with reviewing and evaluating appeals, providing legal guidance, and representing the government in appellate proceedings.

1. Case Review and Analysis

Thoroughly review and analyze case records, legal documents, and evidence to assess the merits of appeals.

- Identify and evaluate legal issues and arguments presented by appellants.

- Conduct legal research to support the government’s position.

2. Legal Writing and Advocacy

Draft and prepare briefs, memoranda, and other legal documents outlining the government’s position and arguments.

- Present oral arguments before appellate courts, defending the government’s actions and decisions.

- Advocate for the government’s interests and protect its legal rights.

3. Settlement Negotiations

Participate in settlement negotiations and discussions with opposing counsel to resolve appellate cases.

- Evaluate the potential risks and benefits of settlement options.

- Negotiate and finalize settlement agreements that are in the best interests of the government.

4. Collaboration and Communication

Collaborate with other government agencies, legal counsel, and experts to gather information and develop a strong legal position.

- Communicate effectively with clients, colleagues, and the public regarding appellate matters.

- Keep abreast of legal developments and changes in appellate law.

Interview Tips

To ace your Appellate Conferee interview, it’s essential to showcase your legal knowledge, analytical skills, and communication abilities.

1. Research the Government’s Legal Position

Familiarize yourself with the government’s recent appellate cases and the legal arguments being presented. This demonstrates your preparation and understanding of the role.

2. Practice Persuasive Communication

In the interview, you may be asked to present a persuasive oral argument. Prepare a concise and clear outline that effectively summarizes the government’s position and key legal points.

3. Highlight Strong Analytical Abilities

Share examples where you successfully analyzed complex legal issues and developed sound legal strategies. Emphasize your ability to identify and address weaknesses in opposing arguments.

4. Showcase Written Communication Skills

If possible, bring a writing sample that demonstrates your ability to draft legal documents such as briefs or memoranda. This tangible evidence of your writing proficiency will impress the interviewers.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Appellate Conferee interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.