Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Asset Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

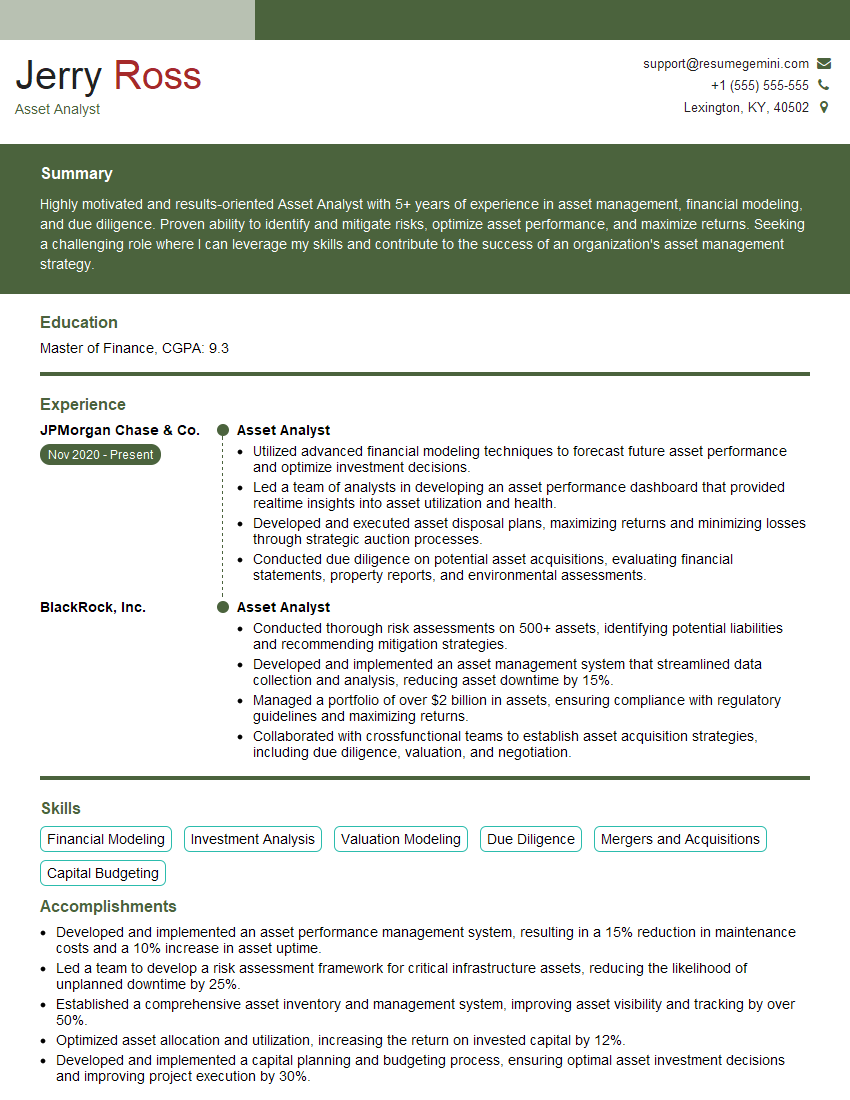

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Asset Analyst

1. How would you approach the valuation of a complex asset, such as a portfolio of real estate properties?

- Gather data on the properties, including their location, size, age, and condition.

- Analyze the market to determine comparable properties and develop appropriate valuation metrics.

- Consider the unique characteristics of the portfolio, such as the presence of multiple property types and the potential for synergies.

- Develop multiple valuation scenarios and weigh the pros and cons of each approach.

- Provide a clear and well-supported valuation conclusion.

2. What are the key factors to consider when evaluating the creditworthiness of a potential borrower?

Financial factors

- Debt-to-income ratio

- Credit score

- Cash flow

- Profitability

Non-financial factors

- Industry experience

- Management team

- Business model

- Competitive landscape

3. How do you stay up-to-date on the latest trends in asset valuation?

- Attend industry conferences and webinars.

- Read professional journals and publications.

- Network with other asset valuation professionals.

- Participate in continuing education programs.

- Stay informed about new regulations and standards.

4. What are the ethical considerations that you must be aware of when performing asset valuations?

- Conflicts of interest

- Objectivity and independence

- Data integrity

- Confidentiality

- Professional conduct

5. How do you handle situations where there is limited or unreliable data available for an asset valuation?

- Make assumptions based on industry knowledge and experience.

- Use alternative data sources, such as market research or peer group analysis.

- Conduct sensitivity analysis to assess the impact of different assumptions.

- Clearly disclose any limitations in the data and their potential impact on the valuation.

6. What are the different types of asset valuation methods?

- Income approach

- Market approach

- Cost approach

- Asset-based approach

- Hybrid approaches

7. What are the advantages and disadvantages of using a discounted cash flow (DCF) analysis for asset valuation?

Advantages

- Considers the time value of money.

- Provides a detailed analysis of future cash flows.

- Can be used to value a wide range of assets.

Disadvantages

- Requires accurate cash flow projections.

- Choosing a discount rate can be challenging.

- Can be time-consuming and complex.

8. How would you value a business that is not yet profitable?

- Use a revenue multiple approach based on comparable companies.

- Develop a discounted cash flow model that projects future profitability.

- Consider the stage of the business’s development and its potential growth prospects.

9. What are the key differences between a liquidation value and a fair market value?

- Liquidation value is the price that an asset can be sold for in a forced sale.

- Fair market value is the price that an asset would sell for in an orderly transaction between a willing buyer and a willing seller.

- Liquidation value is typically lower than fair market value because of the time pressure and lack of competition in a forced sale.

10. How do you ensure the quality of your asset valuations?

- Follow a rigorous valuation process.

- Use reliable and up-to-date data.

- Apply appropriate valuation methods.

- Get input from other professionals, such as auditors or engineers.

- Document your assumptions and conclusions clearly.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Asset Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Asset Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Asset Analyst plays a crucial role in providing analytical support and insights for effective asset management within an organization. Their key responsibilities typically include:

1. Asset Valuation and Analysis

Conduct thorough valuations of assets, including fixed assets, intangible assets, and financial instruments, utilizing appropriate valuation techniques and models.

- Estimate fair market value, book value, and other relevant asset values.

- Analyze historical and current financial performance to assess asset profitability and risk.

2. Asset Risk Management

Identify and evaluate risks associated with various asset classes, such as market risk, credit risk, and operational risk.

- Develop and implement risk management strategies to mitigate potential losses.

- Monitor and track risk exposure to ensure compliance with internal policies and regulatory requirements.

3. Asset Portfolio Management

Advise on the allocation of assets across different asset classes and investment vehicles to achieve optimal risk-adjusted returns.

- Conduct due diligence on potential investments and recommend asset acquisition or disposal.

- Monitor and evaluate portfolio performance against benchmarks and market trends.

4. Reporting and Analysis

Prepare and present comprehensive reports on asset performance, risk exposure, and investment recommendations to management and external stakeholders.

- Conduct trend analysis and forecasting to identify emerging opportunities and risks.

- Communicate complex financial information effectively to non-financial audiences.

Interview Tips

To excel in an Asset Analyst interview, it’s essential to demonstrate your technical proficiency, analytical skills, and ability to communicate complex financial concepts effectively. Here are some tips to help you prepare:

1. Research the Industry and Company

Familiarize yourself with the asset management industry, current market trends, and the specific company you’re interviewing with. This will enable you to speak intelligently about the industry and demonstrate your interest in the role.

2. Review Key Concepts and Valuation Methods

Refresh your knowledge of asset valuation techniques, risk management principles, and investment analysis frameworks. Be prepared to discuss specific valuation models and their applications.

3. Practice Your Communication Skills

As an Asset Analyst, you’ll need to communicate complex financial information to various audiences. Practice explaining technical concepts in a clear and concise manner. You may consider using examples from your previous work or research.

4. Prepare for Case Studies and Technical Questions

Many asset analyst interviews involve case studies or technical questions. Analyze real-world scenarios and prepare to discuss your approach to solving problems and making investment decisions.

5. Highlight Your Analytical Skills and Attention to Detail

Emphasize your ability to gather, analyze, and interpret financial data. Showcase your attention to detail and ability to identify patterns and trends in complex datasets.

6. Research the Company’s Asset Portfolio

If possible, research the company’s asset portfolio and investment strategy. This demonstrates your interest in the company and allows you to ask informed questions during the interview.

7. Be Prepared to Discuss Your Experience and Qualifications

Review your resume and be prepared to discuss your relevant experience, skills, and qualifications. Quantify your accomplishments whenever possible and highlight your contributions to previous projects.

8. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive on time for your interview. Demonstrate respect for the interviewers and the company by being punctual and well-prepared.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Asset Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!