Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Asset Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Asset Manager so you can tailor your answers to impress potential employers.

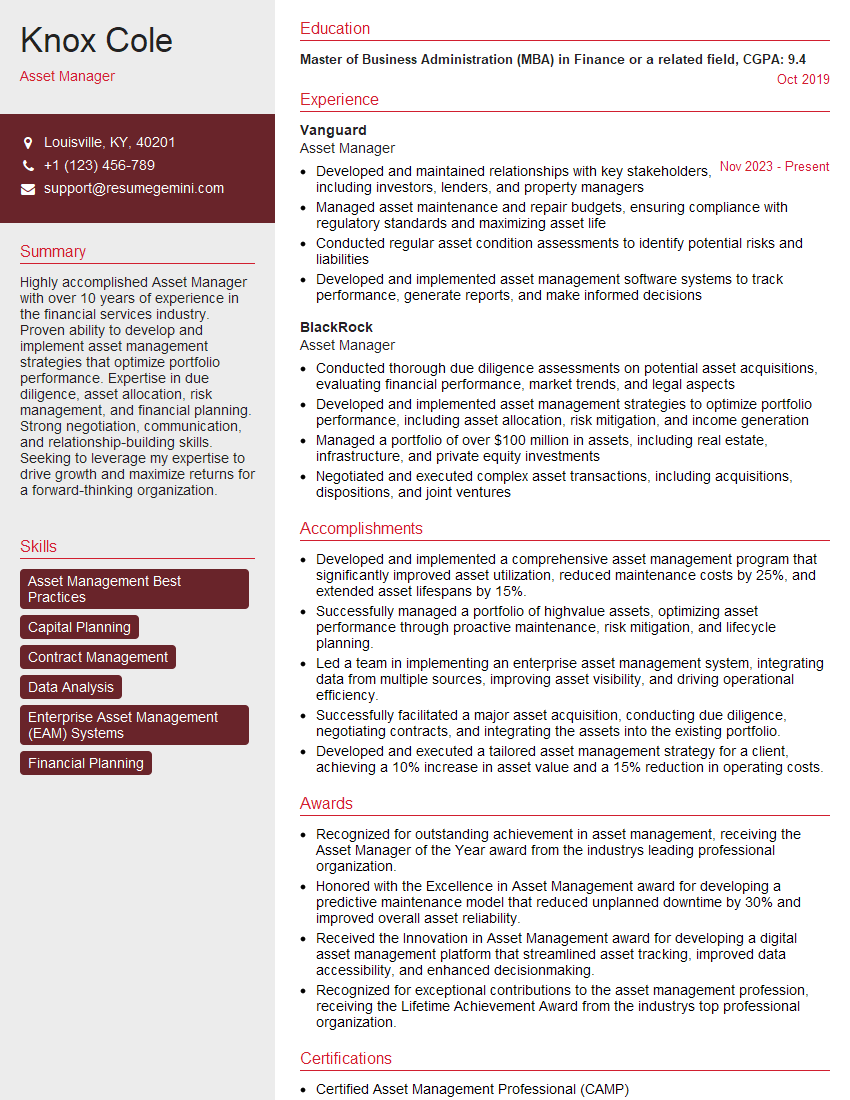

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Asset Manager

1. Describe the process you would follow to develop an asset management plan for a new client?

- Establish clear objectives and goals with the client.

- Conduct a thorough assessment of the client’s current asset portfolio, including an evaluation of risks and opportunities.

- Develop a strategic asset allocation plan that aligns with the client’s risk tolerance, time horizon, and financial goals.

- Identify and recommend specific investment vehicles and strategies to implement the plan.

- Regularly monitor and review the plan’s performance, making adjustments as needed.

2. How do you stay up-to-date on the latest trends and developments in the asset management industry?

Conferences and Seminars

- Attend industry conferences and seminars to learn about new strategies, regulations, and market trends.

- Network with other asset managers to exchange ideas and insights.

Publications and Research

- Regularly read industry publications, research reports, and white papers to stay informed on the latest developments.

- Follow thought leaders and experts on social media and online platforms.

Continuing Education

- Pursue professional certifications and continuing education courses to enhance knowledge and skills.

- Participate in workshops and training programs to stay current on industry best practices.

3. How do you handle the challenge of managing assets in a volatile market environment?

- Regularly monitor market conditions and identify potential risks.

- Develop and implement strategies to mitigate risks, such as diversification and hedging.

- Communicate with clients transparently about market volatility and potential impacts on their portfolios.

- Remain calm and disciplined during periods of market uncertainty, avoiding emotional decision-making.

4. What is your approach to performance measurement and evaluation?

- Establish clear performance benchmarks and targets aligned with the client’s goals.

- Regularly track and measure performance against benchmarks.

- Analyze performance data to identify areas for improvement and make informed decisions.

- Provide clients with transparent and detailed performance reports, explaining the reasons for any underperformance.

5. How do you build and maintain relationships with clients?

- Foster open and honest communication, building trust and rapport.

- Understand the client’s unique needs, goals, and risk tolerance.

- Provide personalized advice and tailored solutions that align with the client’s objectives.

- Be available and responsive to client inquiries and concerns.

- Deliver exceptional service and go the extra mile to exceed expectations.

6. What are the key regulatory and compliance considerations in asset management?

- Adhere to all applicable laws and regulations, including those governing investment advisory activities, anti-money laundering, and cybersecurity.

- Maintain a high level of ethical conduct and avoid conflicts of interest.

- Regularly review and update compliance policies and procedures.

- Cooperate with regulatory authorities and provide timely and accurate information.

7. How do you manage risk and ensure the safety of client assets?

- Develop and implement a comprehensive risk management framework.

- Identify and assess potential risks, including market, operational, and regulatory risks.

- Implement strategies to mitigate risks and reduce potential losses.

- Maintain a strong internal control system and audit function.

- Safeguard client assets through robust security measures and data protection protocols.

8. How do you handle client requests for unconventional or potentially risky investment strategies?

- Thoroughly evaluate the request and assess the potential risks and benefits.

- Discuss the risks and potential consequences with the client transparently.

- Provide alternative investment options that align with the client’s risk tolerance and goals.

- Document all discussions and decisions made in writing.

9. Describe a situation where you successfully resolved a client complaint or dispute.

- Actively listen to the client’s concerns and try to understand their perspective.

- Investigate the matter thoroughly to gather all relevant facts and information.

- Work with the client to find a mutually acceptable solution that addresses their concerns and aligns with the terms of the agreement.

- Communicate the resolution to the client clearly and promptly.

- Document the entire process and outcome thoroughly.

10. What are your strengths and weaknesses as an asset manager?

Strengths

- Strong analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

- Proven track record of managing assets and achieving client goals.

- Deep understanding of financial markets and investment strategies.

- Commitment to ethical conduct and compliance.

Weaknesses

- Limited experience in managing alternative investment classes.

- Tendency to be detail-oriented, which can sometimes slow down decision-making.

- Not as strong in portfolio management software as I would like to be.

- I am still relatively new to the asset management industry.

- I am eager to learn and grow, and am always looking for ways to improve my skills and knowledge.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Asset Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Asset Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Asset managers are financial professionals responsible for the day-to-day management, oversight, and performance of investment portfolios for individuals, organizations, and institutions.

1. Portfolio Management

Develop and execute investment strategies that align with client objectives and risk tolerance.

- Researching and selecting investments (e.g., stocks, bonds, real estate)

- Monitoring and evaluating portfolio performance

2. Investment Analysis

Conduct thorough financial analysis and due diligence on potential investments.

- Assessing companies’ financial health and prospects

- Evaluating market trends and economic conditions

3. Client Relationship Management

Build and maintain strong relationships with clients.

- Understanding their financial goals, time horizons, and risk appetite

- Providing regular investment updates and personalized advice

4. Risk Management

Identify and mitigate investment risks.

- Conducting stress tests and scenario analyses

- Implementing diversification strategies

Interview Tips

Preparing for an asset manager interview requires thorough research and understanding of the role and industry.

1. The STAR Method

When answering behavioral questions starting with “Tell me about a time when,” use the STAR method:

- Situation: Describe the specific situation or task.

- Task: Explain your role and responsibilities.

- Action: Describe the actions you took to overcome the challenge.

- Result: Highlight the positive outcomes and impact of your actions.

2. Research the Company and Industry

Familiarize yourself with the company’s investment philosophy, portfolio performance, and industry trends.

3. Quantify Your Accomplishments

Provide specific metrics and data to support your claims about your investment performance and client outcomes.

4. Practice Problem-Solving and Case Studies

Expect questions that test your analytical and critical thinking skills. Be prepared to discuss how you would solve complex investment challenges.

Next Step:

Now that you’re armed with the knowledge of Asset Manager interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Asset Manager positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini