Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Assistant Director for Financial Literacy interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Assistant Director for Financial Literacy so you can tailor your answers to impress potential employers.

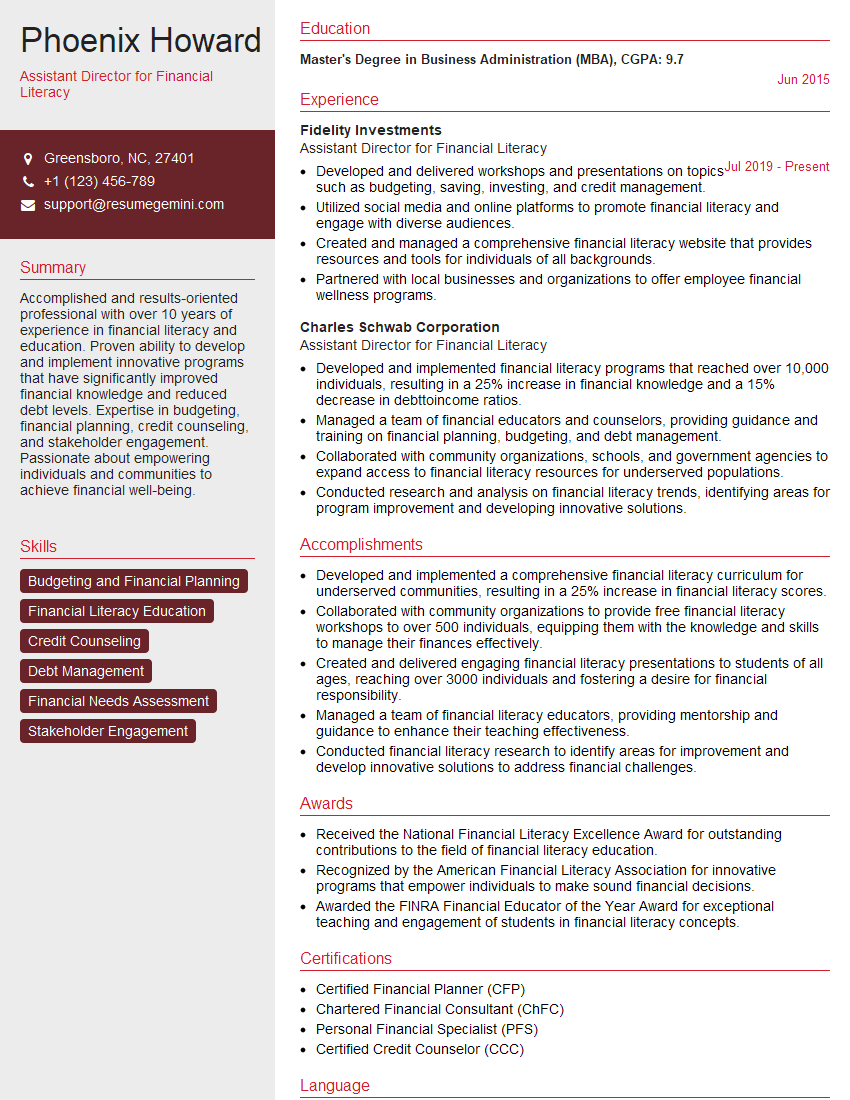

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Assistant Director for Financial Literacy

1. What do you understand by the term Financial Literacy?

Financial literacy is the ability to understand and effectively manage financial resources, including income, expenses, savings, investments, and debt. It empowers individuals to make informed financial decisions, plan for their financial future, and achieve their financial goals.

2. What are the key components of financial literacy?

- Understanding personal finance: Basic financial concepts, budgeting, cash flow management, and financial planning.

- Investing and risk management: Assessing investment options, diversifying portfolios, and managing financial risk.

- Consumer protection and fraud prevention: Recognizing scams, understanding financial regulations, and safeguarding personal information.

- Credit and lending: Types of credit, credit scores, loan terms, and managing debt.

- Retirement planning and financial security: Planning for retirement, understanding retirement savings options, and managing retirement income.

3. How do you ensure that your audience understands the financial concepts you present?

- Use clear and concise language: Avoid jargon and technical terms that may be unfamiliar to the audience.

- Provide real-life examples: Relate financial concepts to situations that the audience can easily understand.

- Use visual aids: Charts, graphs, and presentations can help illustrate complex concepts and make them more engaging.

- Encourage active participation: Ask questions, facilitate discussions, and invite feedback to ensure understanding.

- Emphasize the practical benefits: Explain how financial literacy can help individuals achieve their financial goals.

4. What are the most common financial challenges faced by your target audience?

- Budgeting and managing expenses: Difficulty in tracking income and expenses, resulting in overspending.

- Debt management: High levels of debt, including credit card debt and student loans, leading to financial stress.

- Investing for the future: Lack of knowledge and confidence in investing, leading to missed opportunities for financial growth.

- Retirement planning: Insufficient savings and lack of understanding about retirement options, resulting in financial insecurity.

- Financial scams and fraud: Susceptibility to financial scams and identity theft due to lack of consumer protection knowledge.

5. How do you assess the effectiveness of your financial literacy programs?

- Pre- and post-program surveys: Measuring changes in knowledge, attitudes, and behaviors related to financial literacy.

- Participant feedback: Gathering qualitative feedback from participants to identify areas of improvement.

- Financial outcomes: Tracking changes in financial behaviors, such as increased savings rates or reduced debt.

- Long-term follow-up: Assessing the sustainability of the program’s impact on participants’ financial well-being.

6. What are the emerging trends in financial literacy?

- Financial technology (FinTech): Utilizing mobile apps, online platforms, and artificial intelligence to simplify and enhance financial management.

- Financial inclusion: Expanding access to financial services and education for underserved communities.

- Personalized financial advice: Using technology and data analysis to provide tailored financial guidance to individuals.

- Cross-generational financial literacy: Addressing the financial literacy needs of different generations, from young adults to seniors.

- Behavioral economics: Applying insights from behavioral psychology to design financial literacy programs that are more effective and engaging.

7. How do you stay up-to-date with the latest developments in financial literacy?

- Attend industry conferences and workshops: Participate in events that provide insights into best practices and emerging trends.

- Read financial publications and research: Keep abreast of the latest research and analysis in the field of financial literacy.

- Network with experts and professionals: Collaborate with other professionals in the financial literacy field to exchange ideas and learn from their experiences.

- Seek continuing education opportunities: Pursue additional certifications or training programs to enhance knowledge and skills.

8. How do you collaborate with other stakeholders to promote financial literacy?

- Build partnerships with financial institutions: Collaborate with banks, credit unions, and investment firms to offer financial education programs to their customers.

- Engage with community organizations: Partner with non-profits, schools, and community centers to deliver financial literacy workshops and resources.

- Leverage government initiatives: Support government programs that promote financial literacy, such as the FDIC’s Money Smart for Young People program.

- Collaborate with financial advisors and educators: Exchange knowledge and perspectives with financial advisors and educators to enhance the effectiveness of financial literacy programs.

9. How do you measure the impact of your financial literacy programs on the target population?

- Conduct pre- and post-program assessments: Evaluate changes in knowledge, attitudes, and behaviors related to financial literacy.

- Track financial outcomes: Measure changes in financial behaviors, such as increased savings rates or reduced debt.

- Collect qualitative feedback: Gather testimonials and feedback from participants to assess the effectiveness and impact of the programs.

- Use data analysis to identify trends: Analyze data to identify patterns and trends in financial literacy levels and program effectiveness.

10. Describe a successful financial literacy program that you have implemented.

- Target audience: High school students in underserved communities.

- Program objectives: Enhance financial literacy, improve financial decision-making, and prepare students for future financial success.

- Program elements: Interactive workshops, financial simulations, mentoring from financial professionals, and online resources.

- Program outcomes: Significant improvement in financial literacy, increased confidence in managing finances, and positive changes in financial behaviors.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Assistant Director for Financial Literacy.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Assistant Director for Financial Literacy‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Assistant Director for Financial Literacy is responsible for developing and implementing financial literacy programs and initiatives for a wide range of audiences, including low- and moderate-income individuals, seniors, and youth. The ideal candidate will have a deep understanding of financial literacy principles and best practices, as well as experience in program development, implementation, and evaluation.

1. Program Development and Implementation

Lead the development and implementation of financial literacy programs and initiatives that meet the needs of diverse audiences.

- Conduct needs assessments to identify the financial literacy needs of target populations.

- Design and develop curricula and materials that are accessible, engaging, and effective.

- Implement financial literacy programs and initiatives through a variety of channels, including workshops, presentations, and online resources.

2. Partnership Development and Collaboration

Build and maintain partnerships with community organizations, financial institutions, and other stakeholders to support financial literacy initiatives.

- Identify and establish partnerships with organizations that share similar goals.

- Collaborate with partners to develop and implement joint financial literacy programs.

- Leverage partnerships to increase the reach and impact of financial literacy initiatives.

3. Program Evaluation and Reporting

Monitor and evaluate the effectiveness of financial literacy programs and initiatives to ensure that they are meeting their objectives.

- Develop and implement evaluation plans to track program outcomes.

- Analyze data to assess the impact of financial literacy programs.

- Prepare reports and presentations on program findings to stakeholders.

4. Advocacy and Outreach

Advocate for financial literacy and promote awareness of financial literacy resources.

- Speak at conferences and events to raise awareness of financial literacy issues.

- Write articles and blog posts on financial literacy topics.

- Develop and distribute outreach materials to promote financial literacy.

Interview Tips

To ace the interview for the Assistant Director for Financial Literacy position, it is important to prepare thoroughly and demonstrate your knowledge of financial literacy principles and best practices, as well as your experience in program development and implementation. Here are a few tips to help you prepare:

1. Research the Organization and Position

Take the time to learn about the organization’s mission, values, and financial literacy initiatives. This will help you understand the context of the position and how your skills and experience can contribute to the organization’s goals.

2. Review Your Resume and Practice Answering Common Interview Questions

Make sure you are familiar with your resume and can articulate your skills and experience in a clear and concise way. Practice answering common interview questions, such as “Tell me about yourself” and “Why are you interested in this position?”

3. Prepare Questions to Ask the Interviewers

Asking thoughtful questions at the end of the interview shows that you are interested in the position and the organization. It also gives you an opportunity to learn more about the role and the organization’s culture.

4. Dress Professionally and Arrive on Time

First impressions matter, so make sure you dress professionally and arrive on time for your interview. This shows that you respect the interviewer’s time and that you are serious about the position.

5. Be Yourself and Be Enthusiastic

The most important thing is to be yourself and be enthusiastic about the position. The interviewers want to get to know the real you and see if you are a good fit for the organization. So relax, be confident, and let your personality shine through.

Next Step:

Now that you’re armed with the knowledge of Assistant Director for Financial Literacy interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Assistant Director for Financial Literacy positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini