Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Assistant Vice President, Investment Analysis interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Assistant Vice President, Investment Analysis so you can tailor your answers to impress potential employers.

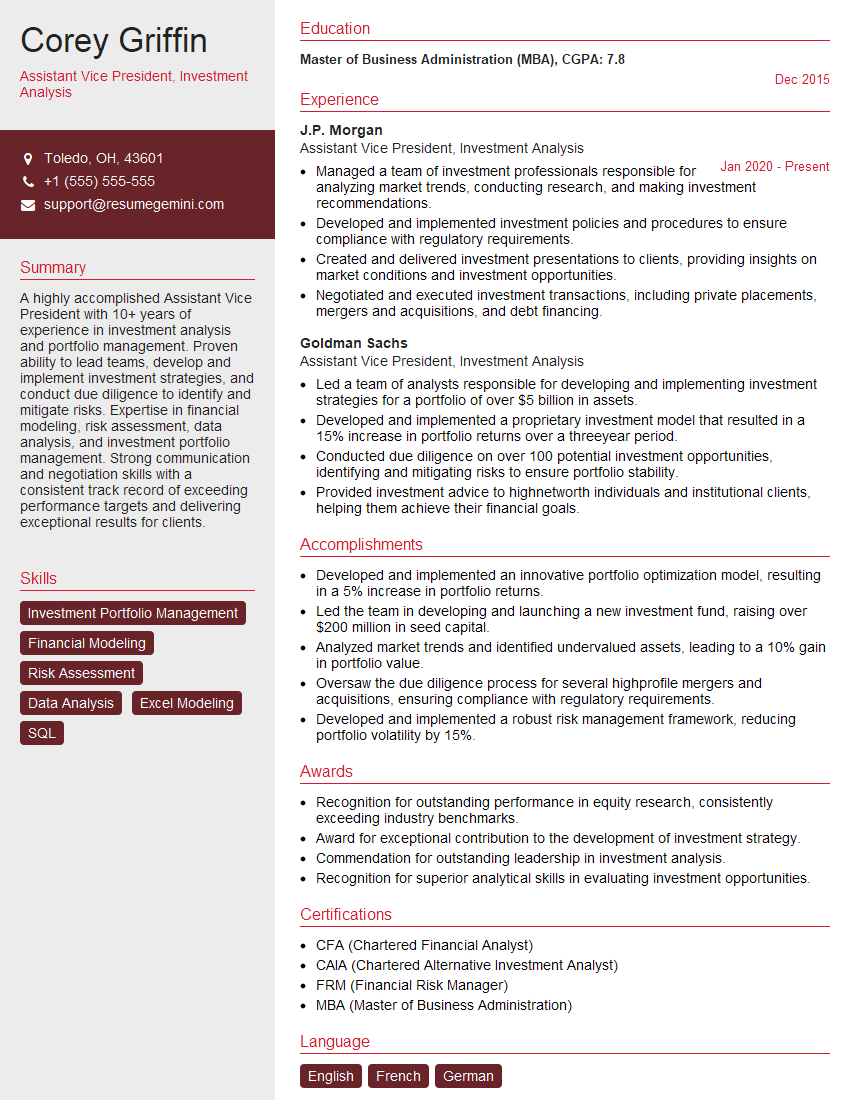

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Assistant Vice President, Investment Analysis

1. Describe the process you follow to analyze and evaluate potential investments?

- Identify potential investments through industry research and company analysis.

- Conduct financial due diligence, including examining financial statements, market data, and industry analysis.

- Assess the investment’s risk-return profile using various valuation techniques and quantitative models.

- Review qualitative factors such as management team, market position, and competitive landscape.

- Make investment recommendations based on analysis and evaluation.

2. How do you stay updated on the latest trends and developments in the investment industry?

Continuing Education and Professional Development

- Attend industry conferences and workshops.

- Complete professional development courses and certifications.

- Read industry publications and research reports.

Networking and Collaboration

- Engage with peers and analysts at industry events.

- Join professional associations.

- Seek mentorship and guidance from experienced professionals.

3. What are some of the common challenges you have faced in your role as an investment analyst?

- Dealing with market volatility and uncertain economic conditions.

- Accessing timely and accurate information for investment evaluation.

- Balancing risk and return considerations in investment recommendations.

- Staying ahead of the competition and identifying undervalued opportunities.

- Communicating complex investment concepts to clients and stakeholders.

4. How do you prioritize and manage your workload as an investment analyst?

- Set daily and weekly to-do lists and prioritize tasks based on importance and urgency.

- Use time management tools and techniques to maximize efficiency.

- Delegate responsibilities to team members when possible.

- Stay organized and keep track of ongoing projects and deliverables.

- Communicate regularly with team members and stakeholders to manage expectations and avoid overlap.

5. Can you describe a time when you successfully identified an undervalued investment opportunity and how you approached it?

- Explain how you identified the opportunity through research and analysis.

- Describe the valuation techniques and metrics used to assess the investment’s potential.

- Highlight the risks and mitigating factors considered in your analysis.

- Explain the investment recommendation you made and the rationale behind it.

- Quantify the performance of the investment and discuss the impact of your analysis.

6. What are your thoughts on the use of ESG factors in investment analysis?

- Explain the importance of considering ESG factors in investment decision-making.

- Describe the different ESG frameworks and methodologies used in investment analysis.

- Discuss how ESG factors can impact investment performance and risk.

- Provide examples of how you have incorporated ESG analysis into your investment process.

7. How do you assess the credibility and reliability of financial information provided by companies?

- Explain the importance of due diligence and independent verification.

- Describe the techniques used to identify red flags and potential misrepresentations.

- Discuss the role of external auditors, regulators, and industry experts in assessing financial information.

- Provide examples of how you have evaluated the credibility of financial statements.

8. How do you manage conflicts of interest in your role as an investment analyst?

- Explain the ethical guidelines and regulations surrounding conflicts of interest.

- Describe the company’s policies and procedures for managing conflicts of interest.

- Discuss how you identify and disclose potential conflicts of interest.

- Provide examples of how you have handled conflicts of interest in the past.

9. What are your strengths and weaknesses as an investment analyst?

- Highlight quantitative and analytical skills, industry knowledge, research capabilities, and attention to detail.

- Acknowledge areas for improvement and discuss plans for professional development.

- Provide specific examples to support your strengths and weaknesses.

10. Why are you interested in this role with our company?

- Research the company and industry to show genuine interest.

- Explain how your skills and experience align with the company’s needs.

- Discuss your career aspirations and how the role fits into your long-term goals.

- Express enthusiasm for the company’s mission, values, and investment philosophy.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Assistant Vice President, Investment Analysis.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Assistant Vice President, Investment Analysis‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Assistant Vice President, Investment Analysis, plays a pivotal role in driving the organization’s investment decisions through in-depth financial analysis and strategic insights.

1. Investment Analysis and Due Diligence

Conduct comprehensive financial analysis of potential investment opportunities, including market research, industry analysis, and company evaluation.

- Develop financial models and projections to assess the risk and return potential of investments.

- Perform due diligence to evaluate the financial health, management team, and competitive landscape of target companies.

2. Portfolio Management and Strategy

Contribute to the development and implementation of investment strategies, ensuring alignment with the organization’s overall investment objectives.

- Monitor and evaluate existing investments, recommending adjustments to portfolio allocation and risk management.

- Collaborate with portfolio managers to optimize investment performance and achieve desired investment outcomes.

3. Research and Market Analysis

Conduct industry and market research to identify emerging trends, growth opportunities, and potential investment risks.

- Stay abreast of economic and financial developments that impact investment decisions, including interest rates, inflation, and political events.

- Develop and maintain proprietary research databases to support investment analysis and decision-making.

4. Risk Management and Compliance

Assess and manage investment risks, including market risks, credit risks, and operational risks.

- Implement risk management policies and procedures to mitigate investment losses and protect portfolio integrity.

- Ensure compliance with regulatory guidelines and industry best practices.

Interview Tips

Preparing thoroughly for an interview is crucial for showcasing your qualifications and making a positive impression. Here are some valuable tips to help you ace your interview for the Assistant Vice President, Investment Analysis position:

1. Research the Company and Position

Demonstrate your interest and knowledge by researching the organization’s investment strategy, recent investment decisions, and industry reputation.

- Visit the company’s website to gather information about their business model, investment philosophy, and key executives.

- Read industry publications and news articles to stay updated on the latest developments and trends in the investment management sector.

2. Highlight Your Analytical and Financial Skills

Emphasize your strong analytical capabilities, including financial modeling, valuation techniques, and statistical analysis.

- Quantify your accomplishments with specific examples of how your analysis contributed to successful investment decisions.

- Discuss your proficiency in using financial software and databases, such as Bloomberg, FactSet, and Capital IQ.

3. Showcase Your Portfolio Management Experience

If applicable, highlight your track record in managing investment portfolios, including asset allocation, risk management, and performance monitoring.

- Present data-driven evidence of your portfolio’s performance and how it exceeded benchmarks or achieved investment goals.

- Discuss your experience in evaluating and selecting investment opportunities, as well as your decision-making process.

4. Prepare for Behavioral Questions

Prepare for common behavioral questions that assess your teamwork, leadership, and problem-solving abilities.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples.

- Emphasize situations where you demonstrated strong analytical skills, attention to detail, and the ability to work effectively under pressure.

5. Be Confident and Professional

Maintain a confident and professional demeanor throughout the interview. Dress appropriately and arrive on time.

- Make eye contact, ask thoughtful questions, and show genuine interest in the position and organization.

- Be prepared to articulate your career goals and explain how this role aligns with your aspirations.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Assistant Vice President, Investment Analysis interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!