Are you gearing up for a career in Associate Financial Representative? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Associate Financial Representative and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

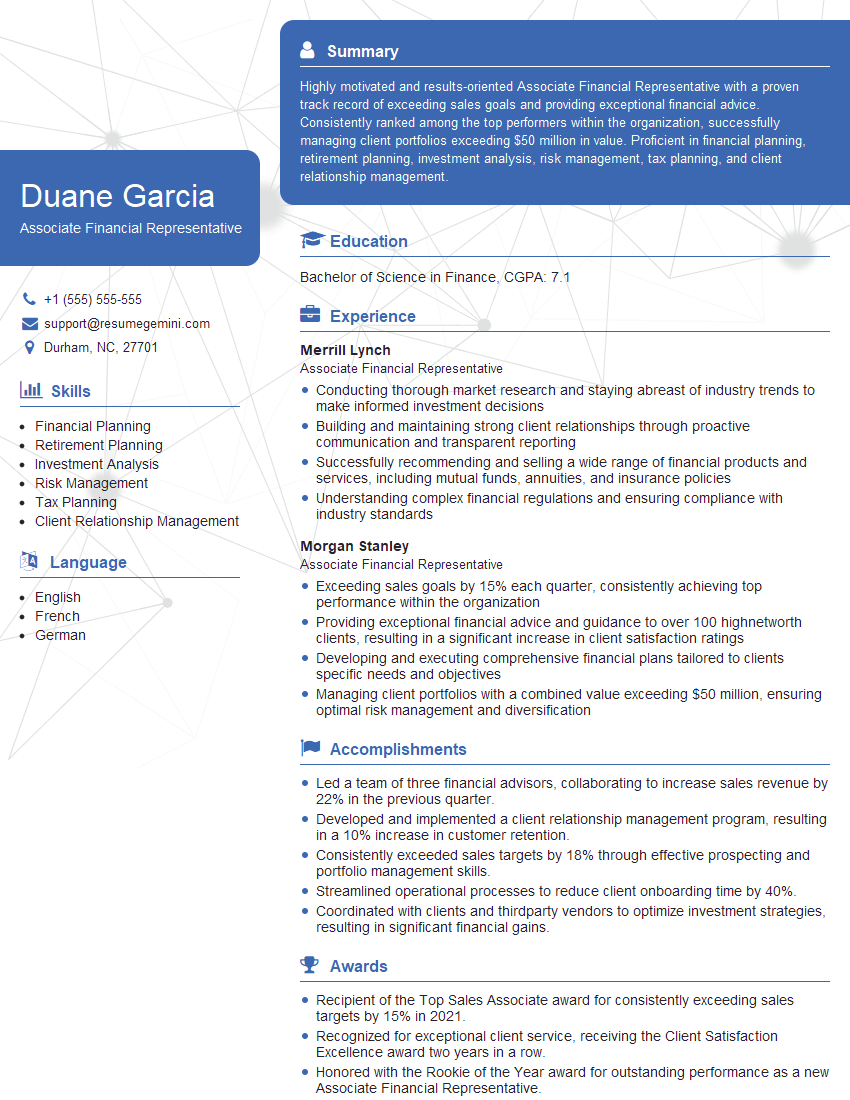

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Associate Financial Representative

1. Describe the process of suitability assessment for financial products.

The suitability assessment process for financial products involves:

- Understanding the client’s needs, objectives, and risk tolerance.

- Conducting a thorough analysis of the product, including its features, risks, and returns.

- Presenting the product to the client in a clear and concise manner.

- Ensuring that the product is aligned with the client’s financial situation and goals.

- Documenting the suitability assessment and providing it to the client for review.

2. How do you determine a client’s investment risk tolerance?

- Using questionnaires to assess their financial knowledge, experience, and comfort with risk.

- Conducting interviews to gather information about their financial situation and investment goals.

- Evaluating their capacity for loss and time horizon.

- Assessing their emotional tolerance for risk.

- Utilizing risk tolerance assessment tools and models.

3. Describe the different types of financial products available and their key features.

Mutual Funds:

- Offer diversification and professional management.

- Can invest in stocks, bonds, or a combination of both.

- Carry varying levels of risk.

Exchange-Traded Funds (ETFs):

- Similar to mutual funds but traded on exchanges like stocks.

- Offer greater flexibility and intraday liquidity.

Stocks:

- Represent ownership in a company.

- Can offer high growth potential but also carry significant risk.

Bonds:

- Represent loans made to companies or governments.

- Provide fixed income payments and are generally less risky than stocks.

Insurance Products:

- Provide financial protection against risks such as death, disability, and property damage.

- Can be life insurance, health insurance, property insurance, or liability insurance.

4. How do you stay up-to-date on industry regulations and best practices?

- Attending industry conferences and seminars.

- Reading trade publications and financial news.

- Taking continuing education courses.

- Consulting with mentors and peers.

- Staying informed through regulatory body websites and professional organizations.

5. Describe your experience in developing and presenting financial plans to clients.

My process for developing and presenting financial plans involves:

- Establishing a comprehensive understanding of the client’s financial situation and goals.

- Creating a customized plan that aligns with their objectives.

- Presenting the plan clearly and concisely, including the rationale behind recommendations.

- Collaborating with the client to implement the plan.

- Monitoring and reviewing the plan regularly to ensure it remains relevant and effective.

6. How do you build and maintain relationships with clients?

- Active listening and understanding their needs.

- Personalized communication and tailored advice.

- Regular check-ins and proactive follow-ups.

- Building trust through transparency and integrity.

- Providing value beyond financial services, such as financial literacy resources and community involvement.

7. How do you handle objections or concerns raised by clients?

- Active listening and empathizing with their perspective.

- Clearly explaining the rationale behind recommendations.

- Providing supporting data or evidence to address any skepticism.

- Exploring alternative solutions or compromises that meet both the client’s and my objectives.

- Maintaining a professional and respectful demeanor.

8. Describe your understanding of fiduciary responsibility.

- Acting in the best interests of the client.

- Putting the client’s interests above my own.

- Exercising care, prudence, and diligence in managing the client’s assets.

- Disclosing any potential conflicts of interest.

- Adhering to all applicable laws and regulations.

9. How do you prioritize and manage your workload?

- Using a task management system or planner.

- Setting clear priorities and deadlines.

- Delegating responsibilities when appropriate.

- Taking regular breaks to avoid burnout.

- Seeking support from colleagues or mentors when needed.

10. Why are you interested in becoming an Associate Financial Representative and what sets you apart from other candidates?

I am passionate about helping individuals and families achieve their financial goals. I believe that my strong understanding of financial concepts, commitment to ethical practices, and ability to build relationships make me an ideal candidate for this role. Additionally, my dedication to continuous learning and my desire to make a positive impact in the lives of others sets me apart.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Associate Financial Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Associate Financial Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Associate Financial Representative is responsible for providing financial advice and services to individuals and businesses. The key job responsibilities include:

1. Client Relationship Management

Meeting with clients to understand their financial needs and goals, and recommending suitable financial products and services.

- Building and maintaining strong relationships with clients, providing excellent customer service, and resolving any issues promptly.

- Conducting regular reviews of clients’ financial situations to ensure their investments and strategies are aligned with their goals.

2. Financial Planning

Developing and implementing financial plans for clients, including investment strategies, retirement planning, and estate planning.

- Analyzing clients’ financial situations, investment objectives, and risk tolerance to recommend tailored financial solutions.

- Conducting research on financial products and market trends to make informed investment recommendations.

3. Investment Management

Managing clients’ investment portfolios, including buying and selling securities, monitoring performance, and making adjustments as needed.

- Staying up-to-date on market conditions and investment trends to make informed investment decisions.

- Regularly reviewing and rebalancing portfolios to ensure diversification and meet clients’ risk tolerance.

4. Insurance and Risk Management

Providing insurance and risk management advice to clients, including life insurance, health insurance, and disability insurance.

- Assessing clients’ insurance needs and recommending appropriate coverage options.

- Collaborating with insurance companies to ensure clients’ claims are processed smoothly and efficiently.

Interview Tips

An Associate Financial Representative interview is an opportunity to showcase your knowledge of the financial industry, client relationship skills, and commitment to providing exceptional customer service. To prepare for the interview, consider the following tips:

1. Research the Company and Industry

Demonstrate your interest in the company by researching its financial services, target market, and industry trends. This will enable you to ask informed questions and demonstrate your understanding of the financial landscape.

2. Highlight Your Skills and Experience

Emphasize your relevant skills and experience in client relationship management, financial planning, investment management, and insurance. Provide specific examples of how you have successfully assisted clients in achieving their financial goals.

3. Prepare for Common Interview Questions

Practice answering common interview questions such as “Why are you interested in this role?” “What is your investment philosophy?” and “How do you build rapport with clients?” Prepare thoughtful and concise responses that highlight your strengths.

4. Dress Professionally and Arrive on Time

First impressions do matter. Dress professionally and arrive at the interview on time to demonstrate your respect for the interviewer and the opportunity. Your appearance and punctuality will reflect your professionalism and commitment to the job.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Associate Financial Representative role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.