Are you gearing up for a career in ATM Manager (Automatic Teller Machine Manager)? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for ATM Manager (Automatic Teller Machine Manager) and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

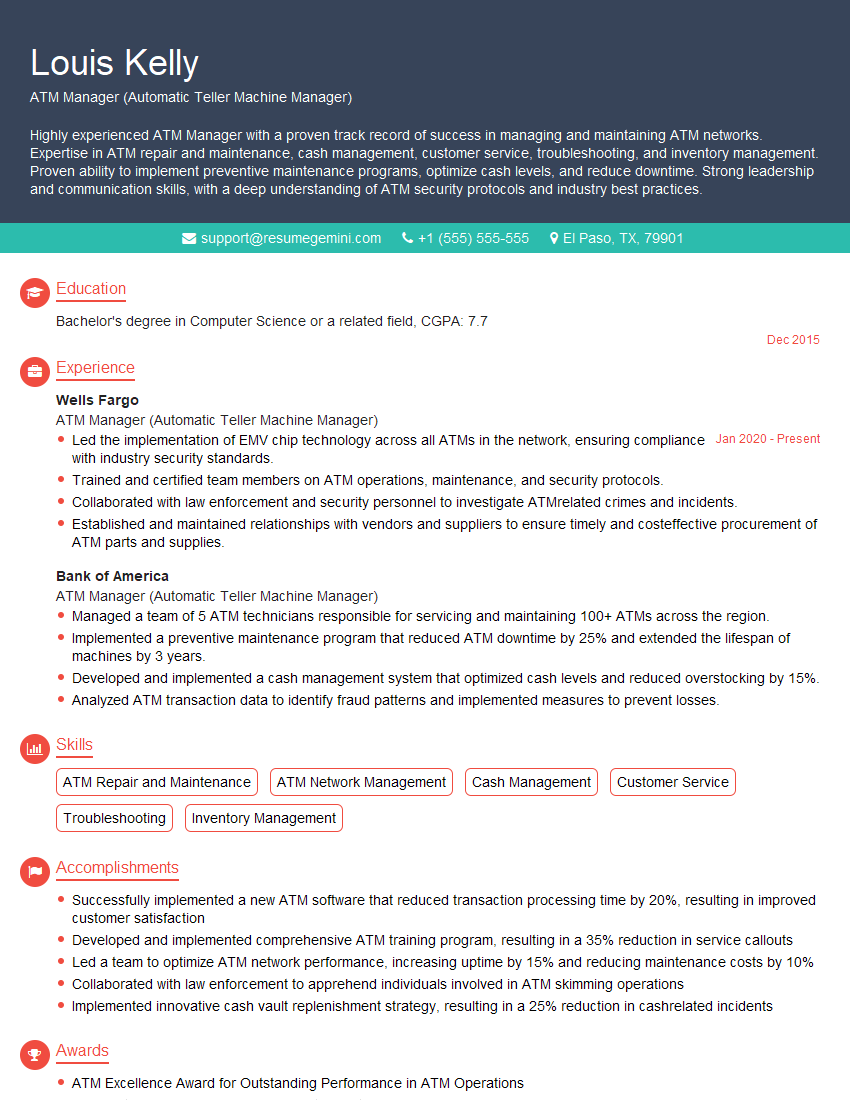

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For ATM Manager (Automatic Teller Machine Manager)

1. How do you ensure the efficient operation of ATMs in your network?

- Conduct regular preventive maintenance to detect and resolve potential issues promptly.

- Monitor ATM performance through advanced monitoring systems to identify any anomalies or performance degradations.

- Establish clear service level agreements (SLAs) with vendors and service providers to ensure timely response and resolution of issues.

- Provide training and support to field technicians to ensure they have the necessary skills and knowledge to handle ATM-related incidents effectively.

- Implement remote monitoring and diagnostics capabilities to enable proactive identification and resolution of issues.

2. How do you manage the security of ATMs in your network?

Physical Security

- Ensure ATMs are placed in well-lit, secure locations with surveillance cameras and alarms.

- Implement physical barriers such as security cages or bollards to prevent unauthorized access.

- Maintain access control systems to limit access to ATMs to authorized personnel.

Transaction Security

- Deploy end-to-end encryption for all ATM transactions to protect sensitive customer information.

- Use fraud detection systems to identify and mitigate potential fraudulent activities.

- Enforce strong authentication mechanisms, such as chip-and-PIN or biometric identification, to prevent unauthorized access to accounts.

3. How do you manage ATM cash levels and replenishment?

- Use cash forecasting tools to predict ATM cash needs based on historical data and current trends.

- Establish optimal cash levels for each ATM to minimize the risk of running out of cash while also reducing the frequency of unnecessary replenishments.

- Coordinate with armored car services or cash-in-transit providers to ensure timely and secure cash replenishment.

- Implement cash recycling ATMs to reduce the frequency of cash replenishments and increase operational efficiency.

- Monitor cash levels remotely and receive alerts when ATMs reach predetermined thresholds to facilitate timely replenishment.

4. How do you handle customer inquiries and complaints related to ATMs?

- Establish a dedicated customer support team to assist customers with ATM-related issues.

- Use automated systems, such as interactive voice response (IVR) or chatbots, to handle common inquiries and provide quick resolutions.

- Provide clear instructions and guidance to customers on how to resolve simple ATM issues independently.

- Escalate complex or unresolved issues to the appropriate channels, such as technical support or branch personnel, for further assistance.

- Maintain a record of all customer inquiries and complaints for analysis and improvement of ATM operations.

5. How do you stay up-to-date on the latest ATM technologies and industry best practices?

- Attend industry conferences and seminars to learn about emerging ATM technologies and solutions.

- Read trade publications and research papers to stay informed on the latest trends and best practices.

- Network with other ATM professionals and industry experts to exchange knowledge and experiences.

- Participate in online forums and discussion groups to engage in discussions and stay updated on industry developments.

- Seek opportunities for professional development and training to enhance knowledge and skills related to ATM management.

6. How do you measure and evaluate the performance of ATMs in your network?

- Establish key performance indicators (KPIs) related to ATM availability, transaction success rate, cash levels, and customer satisfaction.

- Collect data from various sources, such as ATM monitoring systems, transaction logs, and customer surveys, to track KPI performance.

- Analyze data to identify trends, patterns, and areas for improvement.

- Provide regular reports to management and stakeholders on ATM performance and make recommendations for optimization.

- Implement continuous improvement initiatives based on performance evaluation findings to enhance ATM efficiency and customer experience.

7. How do you handle ATM-related incidents, such as malfunctions, cash shortages, and security breaches?

- Establish clear incident response procedures to ensure a prompt and effective response to ATM-related incidents.

- Train staff on incident response procedures and ensure they have the necessary knowledge and skills to handle various types of incidents.

- Use remote monitoring systems to detect and diagnose ATM malfunctions and take appropriate actions, such as rebooting the ATM or dispatching technicians.

- Collaborate with law enforcement agencies and security personnel to investigate and mitigate security breaches.

- Communicate with customers and stakeholders about ATM incidents and provide timely updates on resolution progress.

8. How do you collaborate with other departments within the organization to ensure the smooth operation of ATMs?

- Work closely with the IT department to ensure network connectivity, software updates, and security measures are in place.

- Collaborate with the operations department to manage cash replenishment, handle ATM malfunctions, and maintain physical security.

- Partner with marketing and communications to promote ATM services and educate customers on ATM usage.

- Engage with risk and compliance departments to ensure adherence to industry regulations and best practices related to ATM operations.

- Coordinate with finance and accounting to track ATM-related expenses and revenues.

9. How do you stay informed about industry regulations and compliance requirements related to ATM operations?

- Regularly review and stay updated on industry guidelines and regulations issued by regulatory bodies.

- Attend webinars and training sessions on regulatory compliance for ATMs.

- Subscribe to industry publications and newsletters to stay informed about regulatory changes and best practices.

- Seek legal counsel or consult with compliance experts to ensure adherence to all applicable laws and regulations.

- Implement robust policies and procedures to ensure compliance and mitigate risks.

10. How do you handle ATM network upgrades and migrations?

- Plan and coordinate ATM network upgrades in a phased manner to minimize disruptions to customers.

- Thoroughly test and validate new software and hardware before deployment to ensure compatibility and performance.

- Provide clear communication to customers about upcoming upgrades and migration timelines.

- Train staff on new ATM functionality and ensure they are well-equipped to assist customers during the transition.

- Monitor the network closely during and after upgrades to identify and resolve any issues promptly.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for ATM Manager (Automatic Teller Machine Manager).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the ATM Manager (Automatic Teller Machine Manager)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

ATM Managers play a critical role in maintaining a high level of customer satisfaction and smooth daily operations of ATM networks. Their responsibilities cover a wide range of technical and managerial aspects.

1. ATM Operations and Maintenance

ATM Managers oversee the day-to-day operation and maintenance of a network of ATMs. They are responsible for ensuring that ATMs are functioning properly, dispensing cash and processing transactions accurately.

- Monitor ATM performance, detect and troubleshoot technical issues promptly.

- Coordinate with technicians and vendors for repairs and maintenance.

- Maintain inventory of cash and supplies, ensuring sufficient availability.

2. Cash Management

ATM Managers are responsible for the accurate management of cash assets. They ensure that ATMs are properly loaded and balanced to meet customer demand.

- Determine cash requirements based on historical data and forecast.

- Coordinate with cash replenishment service providers.

- Perform regular cash audits and reconciliations.

3. Security and Compliance

ATM Managers play a vital role in ensuring the security and compliance of ATM operations. They must adhere to industry regulations and standards.

- Implement security measures to prevent fraud, theft, and vandalism.

- Comply with PCI DSS and other security regulations.

- Conduct regular security assessments and audits.

4. Customer Service

ATM Managers are often the first point of contact for customers experiencing issues with ATMs. They must provide prompt and courteous assistance.

- Respond to customer inquiries and resolve issues effectively.

- Educate customers on ATM usage and security practices.

- Maintain a positive customer experience.

Interview Tips

Preparing for an ATM Manager interview requires a combination of technical knowledge, management skills, and a strong understanding of the industry. Here are some tips to ace the interview:

1. Research the Company and Position

Familiarize yourself with the company’s profile, industry presence, and the specific responsibilities of the ATM Manager role. This will demonstrate your interest and understanding of the position.

- Visit the company’s website, read industry news, and check social media profiles.

- Review the job description thoroughly and identify key qualifications.

2. Highlight Technical Expertise

Be prepared to discuss your technical knowledge and experience in ATM operations and maintenance. Emphasize your ability to troubleshoot and resolve technical issues efficiently.

- Provide specific examples of how you have successfully identified and resolved ATM malfunctions.

- Discuss your understanding of ATM networking, security protocols, and cash management systems.

3. Demonstrate Management Skills

ATM Managers oversee a team of technicians and are responsible for daily operations. Highlight your management skills, such as leadership, communication, and problem-solving.

- Share examples of how you have effectively managed a team and motivated individuals to achieve goals.

- Discuss your approach to resolving conflicts and maintaining a positive work environment.

4. Emphasize Customer Focus

ATM Managers interact with customers daily. Emphasize your customer service skills and ability to handle customer inquiries and complaints professionally.

- Provide examples of how you have resolved customer issues effectively and maintained customer satisfaction.

- Discuss your understanding of the importance of maintaining a high level of customer trust and confidence.

5. Prepare for Industry-Specific Questions

Be prepared to discuss industry trends and regulations related to ATM operations. This will demonstrate your knowledge of the industry and your commitment to compliance.

- Stay up-to-date on ATM security best practices and industry standards.

- Review the latest PCI DSS requirements and discuss how you would implement them in an ATM network.

Next Step:

Now that you’re armed with the knowledge of ATM Manager (Automatic Teller Machine Manager) interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for ATM Manager (Automatic Teller Machine Manager) positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini