Are you gearing up for a career in ATM Mechanic (Automatic Teller Machine Mechanic)? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for ATM Mechanic (Automatic Teller Machine Mechanic) and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

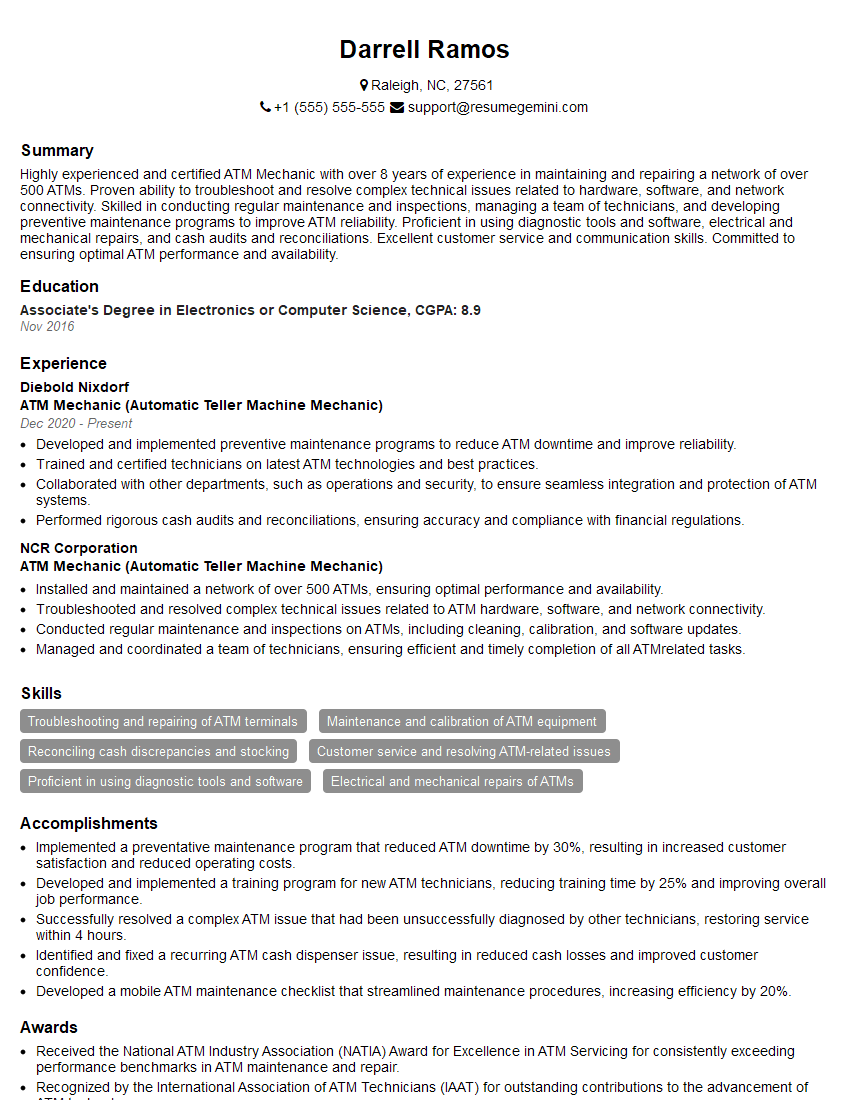

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For ATM Mechanic (Automatic Teller Machine Mechanic)

1. What are the common types of ATMs and their key differences?

There are several types of ATMs, each with its own unique features and functionalities. Some of the most common types include:

- Through-the-wall ATMs: These ATMs are installed inside a wall, with only the front panel exposed to customers. They are typically found in banks and other financial institutions.

- Stand-alone ATMs: These ATMs are free-standing units that can be placed anywhere, such as in shopping malls, gas stations, and convenience stores.

- Mobile ATMs: These ATMs are mounted on vehicles, such as vans or trucks, and can be moved to different locations as needed. They are often used for special events or to provide banking services in remote areas.

- Cash-dispensing ATMs: These ATMs only dispense cash, and do not accept deposits or other transactions. They are often found in areas where there is a high demand for cash, such as casinos and convenience stores.

2. What are the standard safety protocols you follow when servicing an ATM?

Personal Safety

- Wear appropriate safety gear, including gloves, safety glasses, and a hard hat.

- Be aware of your surroundings and potential hazards.

- Do not work alone if possible.

ATM Safety

- Power down the ATM before performing any service.

- Lock out the ATM to prevent unauthorized access.

- Use proper tools and techniques to avoid damaging the ATM.

3. How do you troubleshoot a cash jam in an ATM?

- Check the cash cassettes: Make sure that the cash cassettes are properly seated and that there are no obstructions preventing the cash from being dispensed.

- Examine the cash path: Inspect the cash path for any foreign objects or debris that may be causing the jam.

- Check the sensors: Ensure that the sensors that detect the presence of cash are working properly.

- Reset the ATM: If all else fails, reset the ATM to its default settings.

4. How do you maintain the software and firmware of an ATM?

- Regularly check for software updates: Software updates are released periodically to fix bugs and improve the functionality of the ATM.

- Install software updates as soon as possible: Installing software updates promptly ensures that the ATM is running the latest and most secure version of the software.

- Back up the ATM’s firmware before making any changes: Firmware updates can sometimes cause problems, so it is important to back up the ATM’s firmware before making any changes.

- Follow the manufacturer’s instructions when updating the firmware: Each manufacturer has their own specific instructions for updating the firmware of their ATMs.

5. What are the different types of transaction errors that can occur in an ATM and how do you resolve them?

- Card read errors: These errors can occur if the ATM cannot read the customer’s card. They can be caused by a number of factors, such as a dirty card reader, a damaged card, or a problem with the ATM’s software.

- PIN entry errors: These errors can occur if the customer enters their PIN incorrectly. They can be caused by a number of factors, such as a typographical error, a forgotten PIN, or a problem with the ATM’s keypad.

- Transaction timeout errors: These errors can occur if the customer takes too long to complete their transaction. They can be caused by a number of factors, such as a slow network connection, a problem with the ATM’s software, or a problem with the customer’s card.

6. How do you handle a situation where the ATM is experiencing a power outage?

- Check the power source: Ensure that the ATM is plugged into a power outlet and that the power switch is turned on.

- Check the circuit breaker: If the ATM is plugged into a circuit breaker, check to see if the circuit breaker has tripped. If it has, reset the circuit breaker.

- Contact the service provider: If you are unable to resolve the power outage, contact the ATM’s service provider for assistance.

7. How do you ensure that the ATM is EMV compliant?

- Install an EMV-compliant card reader: The first step is to install an EMV-compliant card reader on the ATM.

- Update the ATM’s software: The ATM’s software must also be updated to support EMV transactions.

- Obtain an EMV certificate: An EMV certificate is required to process EMV transactions. This certificate can be obtained from a trusted third party.

- Test the ATM: Once the EMV hardware and software are installed, the ATM should be tested to ensure that it is functioning properly.

8. What are the common causes of ATM vandalism and how do you prevent it?

- Physical attacks: Physical attacks on ATMs can include breaking the glass, damaging the keypad, or pulling the ATM out of the wall.

- Electronic attacks: Electronic attacks on ATMs can include skimming, shimming, and malware attacks.

Prevention

- Install security cameras: Security cameras can deter vandals and help identify them if they do vandalize the ATM.

- Use strong physical security measures: Strong physical security measures, such as heavy steel doors and windows, can make it more difficult for vandals to damage the ATM.

- Implement electronic security measures: Electronic security measures, such as anti-skimming devices and malware protection, can help prevent electronic attacks on the ATM.

9. Describe the steps involved in replacing a malfunctioning ATM component.

- Identify the malfunctioning component: The first step is to identify the component that is malfunctioning. This can be done by running diagnostic tests on the ATM.

- Order the replacement component: Once the malfunctioning component has been identified, it must be ordered from the manufacturer.

- Prepare the ATM for the replacement: The ATM must be prepared for the replacement component by powering it down and disconnecting it from the network.

- Install the replacement component: The replacement component can now be installed. This should be done according to the manufacturer’s instructions.

- Test the ATM: Once the replacement component has been installed, the ATM should be tested to ensure that it is functioning properly.

10. How do you stay up-to-date on the latest ATM technology and best practices?

- Attend industry conferences and workshops: Attending industry conferences and workshops is a great way to stay up-to-date on the latest ATM technology and best practices.

- Read industry publications: There are a number of industry publications that cover the latest ATM technology and best practices.

- Network with other ATM professionals: Networking with other ATM professionals is a great way to learn about new technologies and best practices.

- Take online courses: There are a number of online courses that can provide you with up-to-date information on ATM technology and best practices.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for ATM Mechanic (Automatic Teller Machine Mechanic).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the ATM Mechanic (Automatic Teller Machine Mechanic)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

ATM Mechanics, also known as Automatic Teller Machine Mechanics, are responsible for the upkeep, maintenance, and repair of Automated Teller Machines (ATMs).

1. Maintenance and Repair

Inspect, diagnose, and troubleshoot ATM malfunctions and defects.

- Repair and replace faulty components, including hardware, software, and peripherals.

- Perform preventative maintenance to prevent future issues.

2. Cash Handling

Ensure proper cash loading and dispensing operations.

- Load and replenish cash in the ATM.

- Monitor cash levels and reconcile discrepancies.

3. Customer Support

Provide technical support to customers experiencing ATM issues.

- Resolve customer queries and assist with troubleshooting.

- Educate customers on ATM usage and security measures.

4. Security and Compliance

Maintain ATM security and compliance with industry standards.

- Monitor and investigate security breaches.

- Follow established procedures for ATM maintenance and handling.

Interview Tips

Preparing for an ATM Mechanic interview requires thorough research, practice, and a strong understanding of the job responsibilities. Here are some tips to help you ace the interview:

1. Research the Company and Role

Research the company’s background, values, and current projects. Familiarize yourself with the specific role and its requirements.

2. Practice Answering Common Questions

Prepare for common interview questions related to your skills, experience, and knowledge of ATM systems. Practice your answers to demonstrate your expertise.

3. Showcase Your Technical Skills

Highlight your technical skills in hardware and software troubleshooting, electrical wiring, and mechanical repairs. Provide examples of successful ATM repairs you have performed.

4. Emphasize Customer Service Orientation

ATM Mechanics often interact with customers. Emphasize your customer service skills, including your ability to resolve queries promptly and effectively.

5. Share Your Understanding of Security Protocols

Discuss your understanding of ATM security protocols and your experience in handling cash transactions. Explain how you ensure the confidentiality and integrity of customer data.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the ATM Mechanic (Automatic Teller Machine Mechanic) interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!