Are you gearing up for an interview for a ATM Servicer position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for ATM Servicer and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

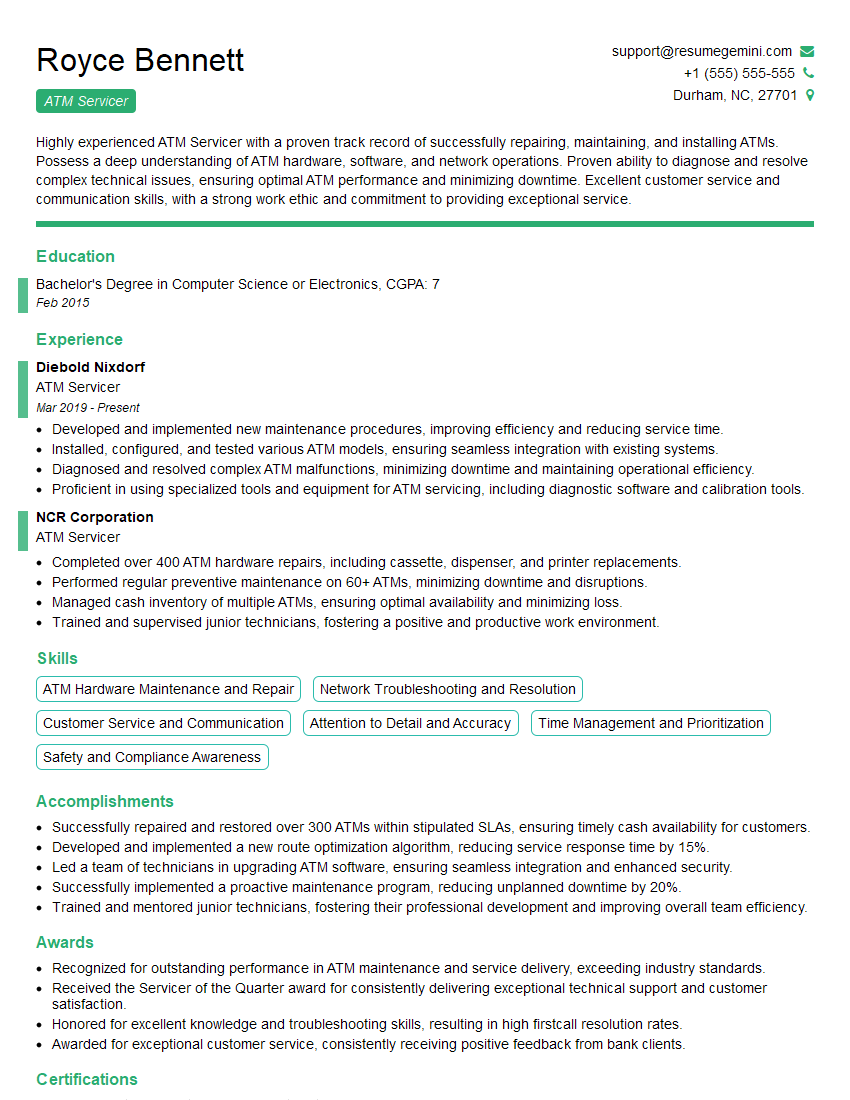

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For ATM Servicer

1. Describe the steps involved in troubleshooting an ATM machine that is experiencing a cash dispense error?

- Check the physical condition of the ATM, including the cash cassettes, sensors, and bill validator.

- Restart the ATM and check if the issue persists.

- Check the ATM’s logs for error messages.

- Inspect the cash cassettes for jams or foreign objects.

- Test the bill validator to ensure it is functioning correctly.

- Contact the ATM manufacturer for technical support if the issue cannot be resolved on-site.

2. Explain how to perform a preventative maintenance check on an ATM?

Daily Checks

- Check paper supply levels in receipt and transaction roll printers.

- Clean the exterior of the ATM with a disinfectant.

- Inspect the card reader for any damage or debris.

Weekly Checks

- Check the functionality of all keys on the keypad.

- Test the card reader with multiple cards.

- Ensure that the cash cassettes are properly aligned and secure.

Monthly Checks

- Clean the inside of the ATM, including the cash cassettes and bill validator.

- Check the security cameras and ensure they are functioning properly.

- Inspect all electrical connections and cables.

3. What are the common causes of ATM malfunctions?

- Power outages

- Hardware failures

- Software glitches

- Cash jams

- Card reader issues

- Environmental factors (e.g., extreme temperatures, humidity)

4. Describe the safety protocols that should be followed when servicing an ATM?

- Wear appropriate safety gear, including gloves and safety glasses.

- Ensure the ATM is powered down before performing any maintenance or repairs.

- Be aware of sharp edges and moving parts inside the ATM.

- Never attempt to access sensitive areas of the ATM, such as the cash vault.

- Follow all manufacturer’s instructions for servicing and maintenance.

5. Explain the process of balancing an ATM’s cash inventory?

- Count the cash in all cassettes and compare it to the ATM’s cash balance.

- If there is a discrepancy, investigate the cause (e.g., short or overdispense).

- Adjust the ATM’s cash balance accordingly.

- Record the cash balancing transaction in the ATM’s log.

6. What are the regulatory requirements that ATM servicers must comply with?

- PCI DSS (Payment Card Industry Data Security Standard)

- GLBA (Gramm-Leach-Bliley Act)

- ADA (Americans with Disabilities Act)

- EMV (Europay, Mastercard, Visa) chip card standards

- Local and state laws and regulations

7. Describe the different types of ATM transactions and how to process them?

- Withdrawals

- Deposits

- Balance inquiries

- Transfers

- Bill payments

Processing Procedures

- Verify the cardholder’s identity and PIN.

- Enter the transaction amount.

- Dispense cash or process the transaction as per the customer’s request.

- Print a receipt for the customer.

8. What are the customer service skills that are essential for an ATM servicer?

- Excellent communication skills

- Patience and empathy

- Problem-solving abilities

- Ability to work independently

- Strong attention to detail

9. Explain the importance of maintaining accurate records of ATM service and repairs?

- Track service history and identify recurring issues.

- Provide evidence of compliance with regulatory requirements.

- Facilitate troubleshooting and problem resolution.

- Ensure efficient and timely maintenance scheduling.

- Protect against fraud and unauthorized access.

10. Describe the latest technological advancements in ATM servicing and how they impact your work?

- Remote monitoring and diagnostics

- Mobile service applications

- Artificial intelligence and machine learning

- Biometric authentication

- Cashless ATMs

Impact on Work

- Increased efficiency and productivity

- Improved customer experience

- Reduced downtime and maintenance costs

- Enhanced security and fraud prevention

- Need for continuous learning and adaptation

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for ATM Servicer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the ATM Servicer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

ATM Servicers are responsible for the maintenance, installation, and repair of automated teller machines (ATMs). They must have a deep understanding of ATM technology and be able to troubleshoot and resolve issues quickly and efficiently.

1. Maintain and repair ATMs

This includes performing regular maintenance checks, cleaning and calibrating machines, and replacing parts as needed. ATM Servicers must also be able to diagnose and repair any problems that arise, such as cash jams, card reader malfunctions, or network connectivity issues.

- Inspect and clean ATMs on a regular basis.

- Replace empty cash cassettes and replenish receipt paper.

- Diagnose and repair ATM malfunctions, such as cash jams, card reader failures, and network connectivity issues.

- Perform software updates and security patches.

2. Install and configure ATMs

This involves working with vendors to select the right ATM for a particular location, installing the machine, and configuring it to meet the specific needs of the bank or financial institution. ATM Servicers must also be able to train staff on how to use the ATM and provide ongoing support.

- Work with vendors to select the right ATM for a particular location.

- Install and configure the ATM according to the manufacturer’s specifications.

- Train staff on how to use the ATM.

- Provide ongoing support to ensure that the ATM is operating properly.

3. Monitor ATM performance

This involves tracking ATM usage data, identifying trends, and making recommendations for improvements. ATM Servicers must also be able to work with other departments, such as IT and customer service, to resolve any issues that arise.

- Track ATM usage data, such as transaction volume, cash withdrawals, and deposits.

- Identify trends and make recommendations for improvements.

- Work with other departments, such as IT and customer service, to resolve any issues that arise.

- Prepare reports on ATM performance.

Interview Tips

Preparing for an ATM Servicer interview can be daunting, but with the right approach, you can increase your chances of success. Here are a few tips to help you ace your interview:

1. Research the company and the position

The more you know about the company and the position you’re applying for, the better prepared you’ll be to answer the interviewer’s questions. Take some time to research the company’s website, read industry publications, and talk to people who work in the field.

- Visit the company’s website and read about their history, products, and services.

- Read industry publications to learn about the latest trends and developments in the ATM industry.

- Talk to people who work in the field to get their insights on the job market and what it takes to be successful.

2. Practice answering common interview questions

There are a number of common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” Practice answering these questions in a clear and concise manner. You can also prepare for technical questions by reviewing your knowledge of ATM technology and troubleshooting procedures.

- Practice answering common interview questions, such as “Tell me about yourself” and “Why are you interested in this position?”

- Review your knowledge of ATM technology and troubleshooting procedures.

- Prepare examples of your work experience that demonstrate your skills and abilities.

3. Be prepared to talk about your experience

The interviewer will want to know about your experience in the ATM industry. Be prepared to talk about your skills and abilities, and how you’ve used them to be successful in your previous roles.

- Discuss your experience in installing, maintaining, and repairing ATMs.

- Highlight your skills in troubleshooting and problem-solving.

- Provide examples of how you’ve used your skills to improve ATM performance.

4. Ask questions

Asking questions at the end of the interview shows that you’re interested in the position and that you’ve put thought into your preparation. It also gives you an opportunity to learn more about the company and the position.

- Ask questions about the company’s culture and values.

- Ask about the company’s plans for the future.

- Ask about the specific responsibilities of the position.

Next Step:

Now that you’re armed with the knowledge of ATM Servicer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for ATM Servicer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini