Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the ATM Technician (Automated Teller Machine Technician) interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a ATM Technician (Automated Teller Machine Technician) so you can tailor your answers to impress potential employers.

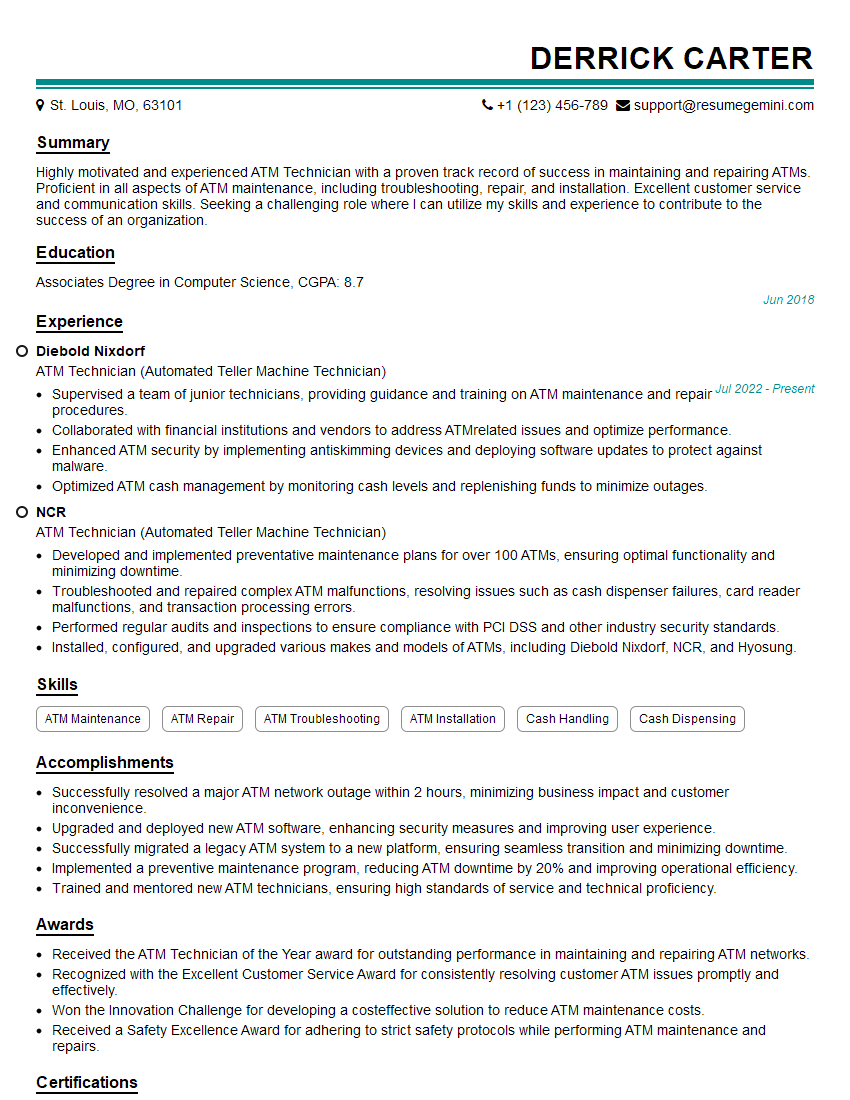

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For ATM Technician (Automated Teller Machine Technician)

1. Explain the process of troubleshooting an ATM machine that’s experiencing cash dispensing issues?

To troubleshoot an ATM machine experiencing cash dispensing issues, I would follow these steps:

- Run diagnostics on the ATM to identify any error messages or codes that may indicate the root cause of the issue.

- Check the physical components of the cash dispenser, such as the belts, rollers, and sensors, for any signs of damage or misalignment.

- Inspect the cash cassettes to ensure they are properly loaded and that the notes are arranged correctly.

- Check the communication between the ATM and the central processing system to ensure that transaction data is being transmitted and received correctly.

- Reset the ATM and perform a test transaction to verify if the issue has been resolved.

2. How do you prioritize and manage multiple ATM service calls effectively?

Triage and Prioritization

- Triage incoming calls to determine the severity and urgency of the issue.

- Prioritize calls based on factors such as impact on customers, potential financial loss, and regulatory compliance.

Scheduling and Dispatch

- Schedule appointments for non-urgent calls at the earliest available time.

- Dispatch technicians to high-priority calls immediately to minimize disruption.

Communication and Coordination

- Keep customers and stakeholders informed of the status of service calls.

- Coordinate with other teams, such as IT and security, if necessary.

3. Describe the steps involved in replenishing and balancing an ATM machine’s cash inventory?

To replenish and balance an ATM machine’s cash inventory, I would follow these steps:

- Unload the old cash from the ATM cassettes and count it accurately.

- Load the new cash into the cassettes, ensuring that the notes are arranged correctly and that the cassettes are securely locked.

- Update the ATM’s inventory system to reflect the new cash balance.

- Reconcile the physical cash count with the system balance to ensure accuracy.

- Seal the ATM and secure it to prevent unauthorized access.

4. Explain how you would handle a situation where an ATM is out of service due to a power outage?

If an ATM is out of service due to a power outage, I would take the following steps:

- Check if the power outage is affecting other equipment in the vicinity.

- Contact the utility company to report the outage and estimate the restoration time.

- Post a notice on the ATM informing customers of the outage and providing an alternate location for them to access their funds.

- Monitor the situation and coordinate with the utility company to ensure power is restored as quickly as possible.

- Once power is restored, perform a thorough inspection of the ATM to ensure it is functioning properly before reopening it for customer use.

5. How do you stay up-to-date with the latest ATM technology and security best practices?

To stay up-to-date with the latest ATM technology and security best practices, I engage in the following activities:

- Attend industry conferences and workshops to learn about new technologies and advancements.

- Read technical publications, white papers, and online forums to stay informed about emerging trends and threats.

- Participate in training programs conducted by ATM manufacturers and industry organizations.

- Network with other ATM professionals to share knowledge and experiences.

- Stay informed about regulatory updates and compliance requirements related to ATM security.

6. Describe your experience in handling fraudulent transactions at an ATM?

During my previous role as an ATM Technician, I encountered several instances of fraudulent transactions:

- Skimming: I identified and removed skimming devices attached to the ATM card reader to prevent unauthorized access to customer data.

- Counterfeit notes: I detected counterfeit notes using advanced note recognition technology and reported them to the authorities for investigation.

- Unauthorized withdrawals: I analyzed transaction logs to identify suspicious withdrawals and worked with the bank’s fraud department to track down the perpetrators.

- Phishing scams: I educated customers on phishing scams and advised them to be vigilant when using ATMs.

7. How do you ensure that ATM machines are compliant with PCI DSS (Payment Card Industry Data Security Standard)?

To ensure that ATM machines are compliant with PCI DSS, I perform the following tasks:

- Regularly update ATM software and firmware to address security vulnerabilities.

- Inspect ATMs for physical security measures, such as encryption devices and tamper-resistant seals.

- Monitor transaction logs for any suspicious activities that may indicate a breach.

- Perform penetration testing to identify potential security weaknesses.

- Educate customers on PCI DSS best practices and the importance of protecting their personal and financial information.

8. Describe your experience in installing and configuring new ATMs?

I have hands-on experience in installing and configuring new ATMs, including:

- Selecting the appropriate location and preparing the site for installation.

- Unloading the ATM from the delivery vehicle and positioning it securely.

- Connecting the ATM to power, network, and communication lines.

- Loading the ATM with cash and configuring its settings.

- Testing the ATM’s functionality and ensuring it meets operational requirements.

- Training staff on the operation and maintenance of the new ATM.

9. How do you approach the maintenance and preventive care of ATMs to minimize downtime?

To minimize ATM downtime, I follow a comprehensive maintenance and preventive care plan that includes:

- Regular cleaning and inspection: I clean and inspect ATMs regularly to identify any potential issues early on.

- Scheduled maintenance: I perform scheduled maintenance tasks, such as software updates, component replacements, and system checks.

- Monitoring and diagnostics: I monitor ATM performance remotely and use diagnostic tools to identify potential problems before they escalate.

- Spare parts inventory: I maintain an inventory of spare parts to ensure quick repairs in case of emergencies.

- Training and staff awareness: I train staff on proper ATM operation and maintenance procedures to minimize human errors.

10. Describe your experience in working with different ATM manufacturers and models?

I have experience working with a variety of ATM manufacturers and models, including:

- NCR

- Diebold Nixdorf

- Wincor Nixdorf

- Hyosung

- Triton

I am familiar with the specific features, troubleshooting procedures, and maintenance requirements of each manufacturer’s models.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for ATM Technician (Automated Teller Machine Technician).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the ATM Technician (Automated Teller Machine Technician)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

ATM Technicians are the backbone of any financial institution’s operations. They are responsible for keeping ATMs running smoothly and efficiently, providing a vital service to customers and businesses. Their meticulous attention to detail and strong technical skills ensure that customers can access their cash and conduct financial transactions quickly and securely.

1. ATM Maintenance and Repair

ATM Technicians are responsible for maintaining ATMs to ensure they are in optimal working condition. They perform regular preventive maintenance tasks, such as cleaning, testing, and replacing worn parts. They also respond to service calls to fix broken ATMs and resolve any issues that arise.

- Conduct regular preventive maintenance to keep ATMs running smoothly

- Troubleshoot and repair broken ATMs to minimize downtime

2. Inventory Management

ATM Technicians manage the inventory of cash and supplies for ATMs. They order cash and supplies as needed and ensure that ATMs are always stocked with the necessary items.

- Order cash and supplies to keep ATMs stocked

- Track and manage inventory levels to avoid shortages

3. Customer Service

ATM Technicians provide customer service to customers who encounter issues with ATMs. They assist customers with transactions, provide instructions on how to use ATMs, and resolve any complaints.

- Assist customers with ATM transactions

- Provide instructions on how to use ATMs

- Resolve customer complaints and escalate issues when necessary

4. Security

ATM Technicians play a vital role in ensuring the security of ATMs. They secure ATMs to prevent theft and vandalism, and they monitor ATMs for suspicious activity. They also comply with all security regulations and procedures.

- Secure ATMs to prevent theft and vandalism

- Monitor ATMs for suspicious activity

- Comply with all security regulations and procedures

Interview Tips

Preparing thoroughly for an ATM Technician interview can significantly increase your chances of making a positive impression and landing the job. Here are some tips to help you prepare for the interview:

1. Research the Company and Position

Before the interview, take the time to research the company and the specific ATM Technician position. This will give you a good understanding of the company’s culture, values, and the specific requirements of the role. You can research the company’s website, LinkedIn page, and Glassdoor reviews.

- Visit the company’s website to learn about their history, mission, and values

- Check the company’s LinkedIn page for updates on their business and industry

- Read Glassdoor reviews to get insights into the company culture and employee experiences

2. Practice Your Answers to Common Interview Questions

There are certain common interview questions that you are likely to be asked, such as “Tell me about yourself” or “Why are you interested in this position?” Practice answering these questions in a clear and concise manner, highlighting your relevant skills and experience.

- Prepare a brief introduction that highlights your key skills and experience

- Brainstorm specific examples of your work that demonstrate your abilities

- Practice answering questions out loud to improve your delivery and confidence

3. Be Prepared to Discuss Your Technical Skills

As an ATM Technician, you will need to have strong technical skills. Be prepared to discuss your experience with ATM repair, maintenance, and troubleshooting. You should also be familiar with the different types of ATMs and their components.

- Review your resume and identify your relevant technical skills

- Prepare examples of how you have used your technical skills to solve problems

- Research the different types of ATMs and their components

4. Emphasize Your Customer Service Skills

ATM Technicians often interact with customers who are experiencing problems with their transactions. It is important to have strong customer service skills to be able to assist customers effectively and resolve their issues.

- Highlight your experience in providing customer service

- Share examples of how you have handled difficult customers

- Emphasize your patience, empathy, and communication skills

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a ATM Technician (Automated Teller Machine Technician), it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for ATM Technician (Automated Teller Machine Technician) positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.