Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Audit Associate position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

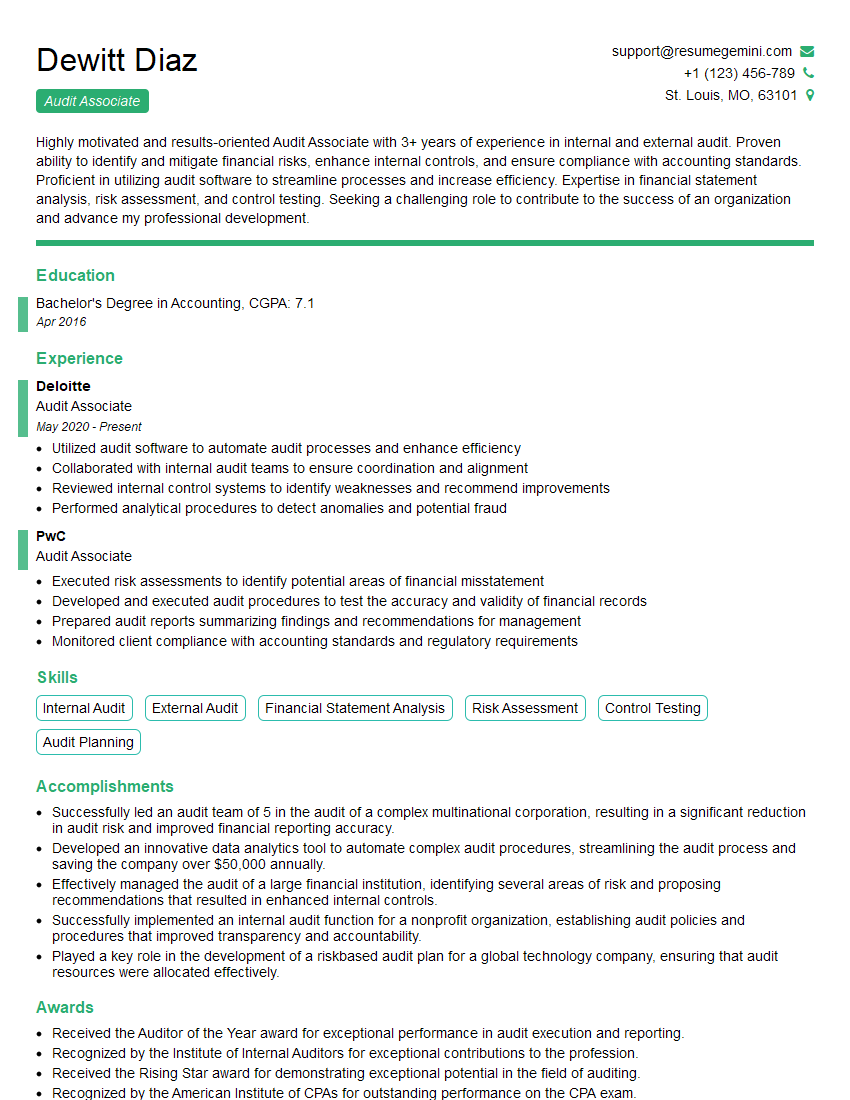

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Audit Associate

1. How would you plan and execute an audit of a company’s accounts payable process?

Sample Answer: – Plan the Audit: – Understand the company’s accounts payable process and identify any areas of potential risk. – Determine the scope of the audit, including the period to be audited and the specific accounts payable transactions to be examined. – Develop an audit program outlining the procedures to be performed and the evidence to be gathered. – Execute the Audit: – Review supporting documentation for a sample of accounts payable transactions, including invoices, receiving reports, and payment records. – Test the accuracy of payments made to vendors by comparing them to the goods and services received. – Identify any discrepancies or errors in the accounts payable process and evaluate their potential impact on the financial statements.

2. What are the key analytical procedures that you would perform during an audit of a company’s financial statements?

Sample Answer: – Vertical Analysis: – Compare financial statement line items from period to period to identify trends and changes. – Determine if changes are consistent with the company’s business and industry. – Horizontal Analysis: – Compare financial statement line items within a period to assess the company’s financial position and performance. – Identify any unusual relationships or ratios that may indicate potential issues. – Ratio Analysis: – Calculate financial ratios to evaluate liquidity, profitability, and financial leverage. – Compare these ratios to industry benchmarks and previous periods to identify any areas of concern.

3. How would you evaluate the effectiveness of a company’s internal control system?

Sample Answer: – Identify the Key Controls: – Determine the critical control points in the company’s accounting and financial reporting processes. – Focus on controls that prevent or detect material misstatements in the financial statements. – Assess the Design and Implementation of Controls: – Review documentation and observe processes to assess the adequacy of the controls’ design and implementation. – Determine if the controls are operating as intended and addressing the identified risks. – Test the Operating Effectiveness of Controls: – Perform sample tests to verify that the controls are functioning effectively and consistently. – Identify any weaknesses or areas where improvements can be made.

4. What are the different types of audit opinions that can be issued, and what factors would influence your choice of opinion?

Sample Answer: Types of Audit Opinions: – Unqualified Opinion: – Issued when the auditor has obtained sufficient appropriate evidence to conclude that the financial statements are presented fairly. – Qualified Opinion: – Issued when the auditor has reservations about a material aspect of the financial statements, but these reservations do not result in a materially misleading statement. – Adverse Opinion: – Issued when the auditor believes that the financial statements are materially misstated. – Disclaimer of Opinion: – Issued when the auditor is unable to form an opinion on the fairness of the financial statements due to lack of sufficient appropriate evidence. Factors Influencing Opinion Choice: – Materiality of misstatements – Nature of misstatements – Impact on financial statement users – Auditor’s ability to obtain sufficient appropriate evidence

5. What is the purpose of an audit quality control system, and what are its key components?

Sample Answer: Purpose: – Ensure that audits are performed in accordance with professional standards and regulatory requirements. – Improve the quality and consistency of audit work. – Reduce the risk of audit failures and enhance auditor independence. Key Components: – Independence policies and procedures – Risk assessment and quality control policies – Audit methodology and documentation standards – Human resource management practices – Quality monitoring and improvement programs

6. Describe the different types of internal audit reports and their intended audiences.

Sample Answer: Types of Reports: – Management Letters: – Communicate significant audit findings and recommendations directly to management. – Internal Audit Reports: – Provide a comprehensive overview of the audit process and findings to senior management and the audit committee. – Special Reports: – Address specific issues or areas of concern outside the scope of a regular audit. Intended Audiences: – Management: Primary recipients of management letters and internal audit reports. – Audit Committee: Receives and reviews internal audit reports. – Board of Directors: May receive key findings and recommendations from internal audit reports.

7. What are the ethical responsibilities of an auditor, and how do you ensure that you adhere to them?

Sample Answer: Ethical Responsibilities: – Integrity – Objectivity – Professional competence and due care – Confidentiality – Professional behavior Adherence to Ethical Responsibilities: – Maintaining independence and avoiding conflicts of interest – Objectively evaluating evidence and forming conclusions – Continuously updating professional knowledge and skills – Protecting client confidentiality – Acting with honesty and integrity in all professional dealings

8. How do you stay up-to-date on accounting and auditing best practices?

Sample Answer: – Continuing Professional Education: – Attend conferences and seminars – Complete online courses and workshops – Professional Publications: – Subscribe to industry magazines and journals – Read accounting and auditing standards updates – Networking: – Attend industry events and connect with other professionals – Seek guidance from senior colleagues and mentors

9. How would you handle a situation where you disagree with the audit partner’s assessment of a significant audit finding?

Sample Answer: – Respectfully Express Concerns: – Discuss the disagreement respectfully and provide evidence to support your position. – Seek Support: – Consult with other senior managers or independent experts if necessary. – Document the Disagreement: – Keep a record of the discussion, including your concerns and supporting evidence. – Escalate if Needed: – If the disagreement cannot be resolved, escalate it to the audit committee or board of directors if appropriate.

10. What are the emerging trends in auditing, and how do you see them impacting the future of the profession?

Sample Answer: Emerging Trends: – Data Analytics and Artificial Intelligence: – Data-driven audits and automated risk assessment tools – Continuous Auditing: – Real-time monitoring of systems and controls – Blockchain and Cryptocurrency: – Auditing digital assets and transactions – ESG Reporting: – Auditors playing a role in assuring environmental, social, and governance disclosures Impact on the Future: – Increased emphasis on data analysis and technology skills – Shift towards continuous and proactive audits – Enhanced transparency and accountability in financial reporting

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Audit Associate.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Audit Associate‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a main pillar of the finance team, Audit Associates are responsible for a wide range of duties that contribute to the overall success of the organization. These key responsibilities include but are not limited to:

1. Planning and Execution of Audits

Assisting in developing audit plans, designing audit procedures, and coordinating with internal and external stakeholders.

- Develop audit plans and programs based on risk assessments and audit objectives.

- Execute audit procedures, including testing of internal controls, financial records, and transactions.

2. Data Analysis and Reporting

Analyzing and interpreting audit findings, identifying potential risks and opportunities, and preparing audit reports that communicate the results.

- Analyze audit findings and evaluate their significance.

- Prepare audit reports that clearly communicate the audit results and recommendations.

3. Collaboration and Communication

Communicating effectively with clients, management, and other stakeholders to build relationships and ensure that audit findings are understood and acted upon.

- Present audit findings and recommendations to management and audit committees.

- Collaborate with internal and external stakeholders to gather information and resolve issues.

4. Continuous Professional Development

Staying abreast of auditing standards, best practices, and emerging trends in the field to maintain professional competence and ensure the highest quality of audits.

- Participate in continuing professional education courses and training programs.

- Stay informed about industry best practices and regulatory updates.

Interview Tips

Interviewing for an Audit Associate position can be a daunting task, but preparation is essential. Here are some tips and tricks to help you ace the interview:

1. Research the Company and the Role

Familiarize yourself with the company, its industry, and the specific Audit Associate role. Thorough research demonstrates your interest and understanding of the organization’s goals.

- Visit the company’s website and read recent press releases.

- Study the job description and make notes on the key responsibilities and qualifications.

2. Practice Your Answers

Prepare for common interview questions by rehearsing your responses. This will help you feel confident and organized during the interview.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers.

- Focus on highlighting your relevant skills and experiences.

3. Dress Professionally

First impressions matter, so make sure you dress appropriately for the interview. A professional appearance conveys respect and attention to detail.

- Consider wearing a suit or business attire.

- Make sure your clothes are clean, pressed, and fit well.

4. Show Your Enthusiasm

Enthusiasm is contagious, and it can make a positive impression on the interviewer. Show that you are genuinely interested in the role and the company.

- Ask thoughtful questions about the company and the position.

- Be prepared to share examples of why you are passionate about auditing.

5. Follow Up

After the interview, send a thank you email to the interviewer. This can help reiterate your interest and remind them of your qualifications.

- Mention specific aspects of the interview that you enjoyed.

- Reiterate your interest in the position and the company.

- Proofread your email carefully before sending it.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Audit Associate interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!