Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Auditor Appraiser interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Auditor Appraiser so you can tailor your answers to impress potential employers.

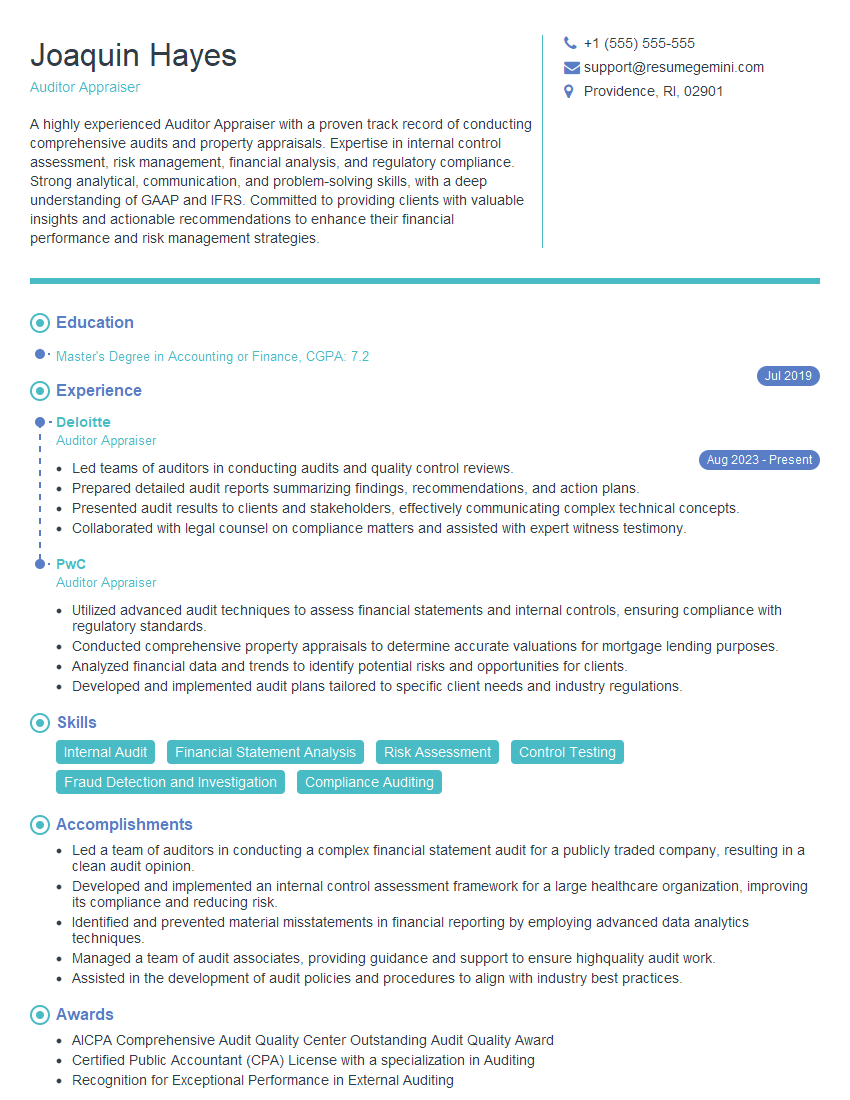

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Auditor Appraiser

1. Explain the key steps involved in the appraisal process for a property?

The key steps involved in the appraisal process for a property include:

- Data collection: This involves gathering information about the property, such as its location, size, condition, and recent sales prices of similar properties in the area.

- Site inspection: The appraiser will visit the property to inspect it and verify the information collected during data collection.

- Analysis: The appraiser will analyze the data collected and compare it to other properties in the area to determine the property’s value.

- Report writing: The appraiser will write a report that summarizes the appraisal process and states the property’s value.

2. Describe the different approaches to property valuation and when each approach is most appropriate?

The three main approaches to property valuation are:

Cost approach:

- This approach estimates the value of a property by considering the cost to replace or reproduce it.

- It is most appropriate when the property is new or has been recently renovated.

Sales comparison approach:

- This approach compares the property to similar properties that have recently sold in the area.

- It is most appropriate when there are a number of comparable sales available.

Income approach:

- This approach estimates the value of a property based on its potential income.

- It is most appropriate for income-producing properties, such as rental properties or commercial properties.

3. What are the factors that can affect the value of a property?

The factors that can affect the value of a property include:

- Location: The location of a property is one of the most important factors that can affect its value.

- Size: The size of a property can also affect its value, with larger properties typically being more valuable than smaller properties.

- Condition: The condition of a property can also affect its value, with properties in good condition typically being more valuable than properties in poor condition.

- Amenities: The amenities that a property has can also affect its value, with properties with more amenities typically being more valuable than properties with fewer amenities.

- Market conditions: The overall market conditions can also affect the value of a property, with properties in areas with strong economies typically being more valuable than properties in areas with weak economies.

4. What are the ethical responsibilities of an auditor appraiser?

The ethical responsibilities of an auditor appraiser include:

- Independence: Auditor appraisers must be independent of the parties involved in the appraisal.

- Objectivity: Auditor appraisers must be objective in their appraisals and not allow their personal biases to influence their work.

- Confidentiality: Auditor appraisers must keep the information they collect during the appraisal process confidential.

- Competence: Auditor appraisers must be competent in the field of appraisal and must stay up-to-date on the latest appraisal techniques.

- Professionalism: Auditor appraisers must conduct themselves in a professional manner and must adhere to the ethical standards of the appraisal profession.

5. What are the challenges faced by auditor appraisers in today’s market?

The challenges faced by auditor appraisers in today’s market include:

- The increasing complexity of the appraisal process: The appraisal process has become increasingly complex in recent years, due to factors such as the rise of new construction methods and the increasing number of regulations that govern the appraisal process.

- The need for appraisers to stay up-to-date on the latest appraisal techniques: The appraisal profession is constantly evolving, and appraisers need to stay up-to-date on the latest appraisal techniques in order to provide accurate and reliable appraisals.

- The need for appraisers to meet the demands of clients: Clients are becoming increasingly demanding, and appraisers need to be able to meet their needs in order to stay competitive.

- The need for appraisers to stay profitable: Appraisers need to be able to stay profitable in order to survive in today’s competitive market.

6. What are the trends that are shaping the future of the appraisal profession?

The trends that are shaping the future of the appraisal profession include:

- The increasing use of technology: Technology is playing an increasingly important role in the appraisal process, and appraisers need to be able to use technology effectively in order to stay competitive.

- The increasing demand for appraisers who have specialized expertise: Clients are increasingly demanding appraisers who have specialized expertise in certain areas, such as green building or commercial appraisal.

- The increasing need for appraisers to be able to communicate effectively with clients: Clients are becoming increasingly sophisticated, and appraisers need to be able to communicate effectively with them in order to provide them with the information they need.

- The increasing need for appraisers to stay up-to-date on the latest appraisal techniques: The appraisal profession is constantly evolving, and appraisers need to stay up-to-date on the latest appraisal techniques in order to provide accurate and reliable appraisals.

7. What are the key skills and qualities that an auditor appraiser needs to be successful?

The key skills and qualities that an auditor appraiser needs to be successful include:

- Technical skills: Auditor appraisers need to have a strong understanding of the appraisal process and the latest appraisal techniques.

- Communication skills: Auditor appraisers need to be able to communicate effectively with clients, both orally and in writing.

- Interpersonal skills: Auditor appraisers need to be able to build relationships with clients and other professionals.

- Problem-solving skills: Auditor appraisers need to be able to solve problems and make decisions.

- Analytical skills: Auditor appraisers need to be able to analyze data and draw conclusions.

8. What are the career opportunities for auditor appraisers?

The career opportunities for auditor appraisers are varied and include:

- Working for a bank or other financial institution: Auditor appraisers can work for banks or other financial institutions to provide appraisals for mortgage loans.

- Working for a government agency: Auditor appraisers can work for government agencies to provide appraisals for tax purposes or other purposes.

- Working for a real estate company: Auditor appraisers can work for real estate companies to provide appraisals for buyers and sellers of real estate.

- Working for an appraisal firm: Auditor appraisers can work for appraisal firms to provide appraisals for a variety of purposes.

- Starting their own appraisal business: Auditor appraisers can start their own appraisal business to provide appraisals for a variety of purposes.

9. What is the typical salary range for auditor appraisers?

The typical salary range for auditor appraisers varies depending on their experience, location, and the type of appraisal work they do. However, according to the Bureau of Labor Statistics, the median annual salary for appraisers and assessors was $65,270 in May 2021.

10. What is the job outlook for auditor appraisers?

The job outlook for auditor appraisers is expected to be good over the next few years. The demand for appraisers is expected to grow as the economy continues to improve and as more people buy and sell real estate.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Auditor Appraiser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Auditor Appraiser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Auditor Appraiser plays a critical role in ensuring the reliability and accuracy of financial reporting. Their primary duty involves examining and evaluating the financial records, internal controls, and operations of an organization to ascertain the validity and accuracy of its financial statements.

1. Audit Execution and Evaluation

Auditor Appraisers are entrusted with the task of planning, executing, and documenting audits. They thoroughly review financial records, analyze internal controls, and assess adherence to accounting principles and regulations.

- Plan and initiate audit procedures

- Investigate and resolve audit findings and discrepancies

- Prepare audit reports and communicate findings to management and stakeholders

2. Risk Assessment and Internal Controls

Understanding an organization’s risk profile is crucial for Auditor Appraisers. They evaluate the effectiveness of internal controls and provide recommendations for improvements based on identified weaknesses.

- Identify and assess potential financial risks

- Evaluate the reliability and adequacy of internal controls

- Recommend best practices for internal control enhancement

3. Compliance and Regulatory Knowledge

Auditor Appraisers must stay abreast of industry-specific laws and regulations. They ensure that the organization’s financial reporting adheres to the established standards and regulations.

- Monitor and interpret accounting and auditing standards (GAAP, IFRS, etc.)

- Review financial statements for compliance with applicable laws and regulations

- Provide guidance on regulatory reporting requirements

4. Communication and Reporting

Clear and effective communication is essential in this role. Auditor Appraisers must convey their findings and recommendations to management, boards of directors, and regulatory bodies.

- Present audit results and provide recommendations for corrective actions

- Write detailed audit reports, summaries, and presentations

- Testify in legal proceedings or provide expert opinions if required

Interview Tips

Preparing thoroughly is the key to a successful interview. Here are some valuable tips and hacks to help you ace the interview for an Auditor Appraiser position.

1. Research the Company and Position

Spend time researching the company, its industry, and the specific responsibilities of the Auditor Appraiser role. This will give you valuable insights into the organization’s culture, business objectives, and the skills and experience they seek in a candidate.

2. Quantify Your Experience

When describing your previous work experience, emphasize specific accomplishments and quantify your results whenever possible. For example, instead of saying “I performed audits,” you could say “I led a team of auditors in conducting financial statement audits for 10 major corporations, resulting in a 25% increase in audit efficiency.”

3. Highlight Your Communication Skills

Effective communication is imperative for Auditor Appraisers. Emphasize your ability to clearly articulate your findings and recommendations to stakeholders at all levels. Provide examples of situations where you effectively presented complex financial information in a concise and persuasive manner.

4. Practice Answering Behavioral Questions

Behavioral interview questions focus on your past experiences and behaviors. They are often used to assess your problem-solving, decision-making, and teamwork skills. Practice answering common behavioral questions such as “Tell me about a time you faced a challenging situation and how you resolved it.”

5. Be Prepared for Technical Questions

Auditor Appraisers are expected to possess strong technical knowledge. Prepare for technical questions related to auditing standards, financial reporting, and internal controls. Review your resume and identify areas where you may need to brush up on your knowledge.

6. Seek Feedback and Dress Professionally

After the interview, ask for feedback to gain insights into your performance and areas for improvement. Dress professionally and punctually for the interview, as it conveys respect and attention to detail.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Auditor Appraiser interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.