Are you gearing up for a career in Auditor (Backup)? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Auditor (Backup) and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

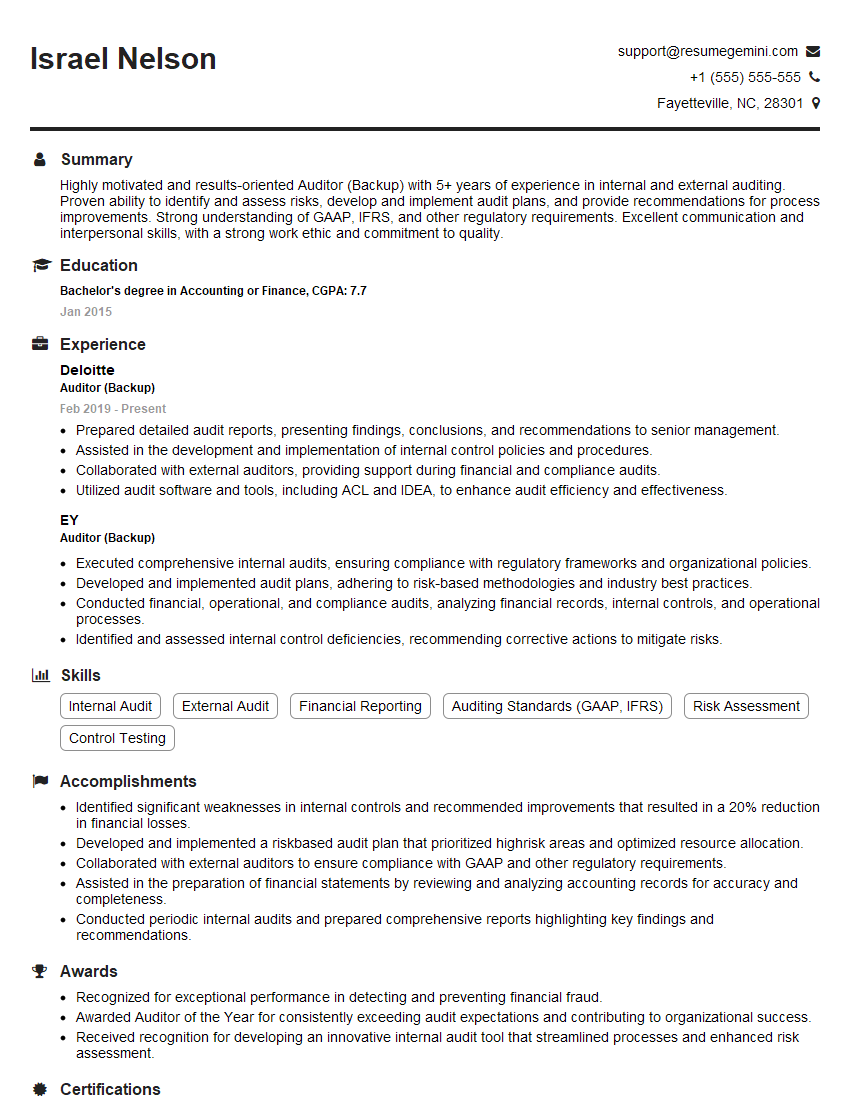

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Auditor (Backup)

1. Explain the key responsibilities of an Auditor (Backup)?

As an Auditor (Backup), key responsibilities include:

- Assisting the lead auditor in planning, executing, and reporting on audit engagements.

- Performing audit procedures to assess the accuracy and completeness of financial records.

- Evaluating internal controls and identifying areas for improvement.

- Preparing audit reports and communicating findings to management.

- Maintaining a strong understanding of accounting principles and auditing standards.

2. What are the different types of audit procedures?

: Substantive Procedures

- Vouching:

- Analytical procedures:

- Recalculation:

- Observation

Subheading: Analytical Procedures

- Trend analysis:

- Ratio analysis:

- Benchmarking

3. What are the qualities of an effective auditor?

An effective auditor possesses qualities such as:

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Attention to detail and accuracy

- Ethical and professional conduct

- Continuously updated knowledge of accounting and auditing standards

4. What is the purpose of internal control?

Internal control aims to provide reasonable assurance regarding the achievement of the following objectives:

- Effectiveness and efficiency of operations

- Reliability of financial reporting

- Compliance with applicable laws and regulations

5. What are the key components of internal control?

Key components of a sound internal control system comprise:

- Control environment

- Risk assessment

- Control activities

- Information and communication

- Monitoring

6. How do you assess the risk of fraud?

Assessing the risk of fraud involves considering factors such as:

- Industry-specific fraud risks

- Company’s financial performance and stability

- Management’s incentives and pressures

- Control environment and internal controls

7. What are the red flags of fraud?

Red flags of fraud may include:

- Unusual or complex transactions

- Inconsistent or missing documentation

- Management overrides of internal controls

- Unexplained wealth or lavish lifestyles

8. What are the common audit adjustments?

Common audit adjustments pertain to:

- Accruals and deferrals

- Estimation of reserves

- Reclassification of expenses and revenues

- Impairment of assets

9. What are the challenges of auditing in the digital age?

Auditing in the digital age presents challenges related to:

- Increased volume and complexity of data

- Reliability and security of electronic records

- Auditing of cloud-based systems

- Emerging technologies such as blockchain and artificial intelligence

10. How do you stay up-to-date with auditing standards and best practices?

To stay current with auditing standards and best practices, I engage in continuous professional development activities such as:

- Attending industry conferences and workshops

- Reading professional journals and publications

- Participating in online courses and certifications

- Seeking guidance from senior auditors and industry experts

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Auditor (Backup).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Auditor (Backup)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Auditor (Backup) plays a crucial role in ensuring the accuracy and completeness of an organization’s financial records. Key responsibilities of this position include:

1. Assisting in the Planning and Execution of Audits

Participating in the development of audit plans and assisting in the execution of audits in accordance with established procedures and regulations.

- Reviewing financial records, such as balance sheets, income statements, and cash flow statements.

- Performing analytical procedures to identify potential areas of concern or risk.

- Interviewing company personnel and management to gather information and evidence.

2. Evaluating Internal Controls and Processes

Assessing the effectiveness of internal controls and processes to ensure that they are adequate for safeguarding assets, preventing fraud, and maintaining accurate financial records.

- Documenting internal controls and processes.

- Identifying control weaknesses and recommending improvements.

- Providing guidance to management on how to strengthen internal controls.

3. Preparing and Reporting Audit Findings

Preparing audit reports that summarize findings, conclusions, and recommendations. Communicating audit results to management, the audit committee, and other stakeholders.

- Writing clear and concise audit reports.

- Presenting audit findings to management and the audit committee.

- Answering questions and providing additional information as needed.

4. Maintaining Professional Standards

Adhering to professional standards, including the International Standards on Auditing (ISA) and the AICPA Code of Professional Conduct. Continuously developing and maintaining knowledge and skills in accounting, auditing, and other relevant areas.

- Staying up-to-date on changes in auditing standards and regulations.

- Participating in continuing professional education programs.

- Maintaining a high level of integrity and professionalism.

Interview Tips

Preparing for an interview for an Auditor (Backup) position can enhance your chances of success. Consider the following tips:

1. Research the Company and the Position

Familiarize yourself with the company’s industry, size, financial performance, and recent news. Research the specific role of Auditor (Backup) within the organization and identify the key responsibilities and qualifications.

- Visit the company’s website and LinkedIn page.

- Read industry news and articles.

- Connect with current or former employees on LinkedIn.

2. Highlight Your Skills and Experience

Emphasize your relevant skills and experience in auditing, accounting, and financial analysis. Quantify your accomplishments whenever possible, using specific examples to demonstrate your impact.

- Discuss your experience in planning and executing audits.

- Describe your knowledge of auditing standards and regulations.

- Highlight your ability to identify and evaluate internal controls.

3. Practice Answering Common Interview Questions

Prepare for common interview questions by practicing your answers in advance. Consider questions about your motivation for pursuing a career in auditing, your understanding of the role of an Auditor (Backup), and your ability to work as part of a team.

- Prepare an introduction that highlights your key skills and experience.

- Practice answering questions about your strengths and weaknesses.

- Be prepared to discuss your career goals and how they align with the position.

4. Dress Professionally and Arrive Punctually

First impressions matter, so dress professionally and arrive for your interview on time. Maintain a polite and respectful demeanor throughout the interview process.

- Wear a suit or business casual attire.

- Be punctual and arrive early.

- Maintain eye contact and speak clearly.

5. Follow Up After the Interview

After the interview, send a thank-you note to the interviewer(s) reiterating your interest in the position. Briefly summarize your key qualifications and express your enthusiasm for the opportunity.

- Send the thank-you note within 24 hours of the interview.

- Proofread your note carefully before sending it.

- Reiterate your interest in the position and thank the interviewer for their time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Auditor (Backup) interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!