Are you gearing up for an interview for a Auditor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Auditor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

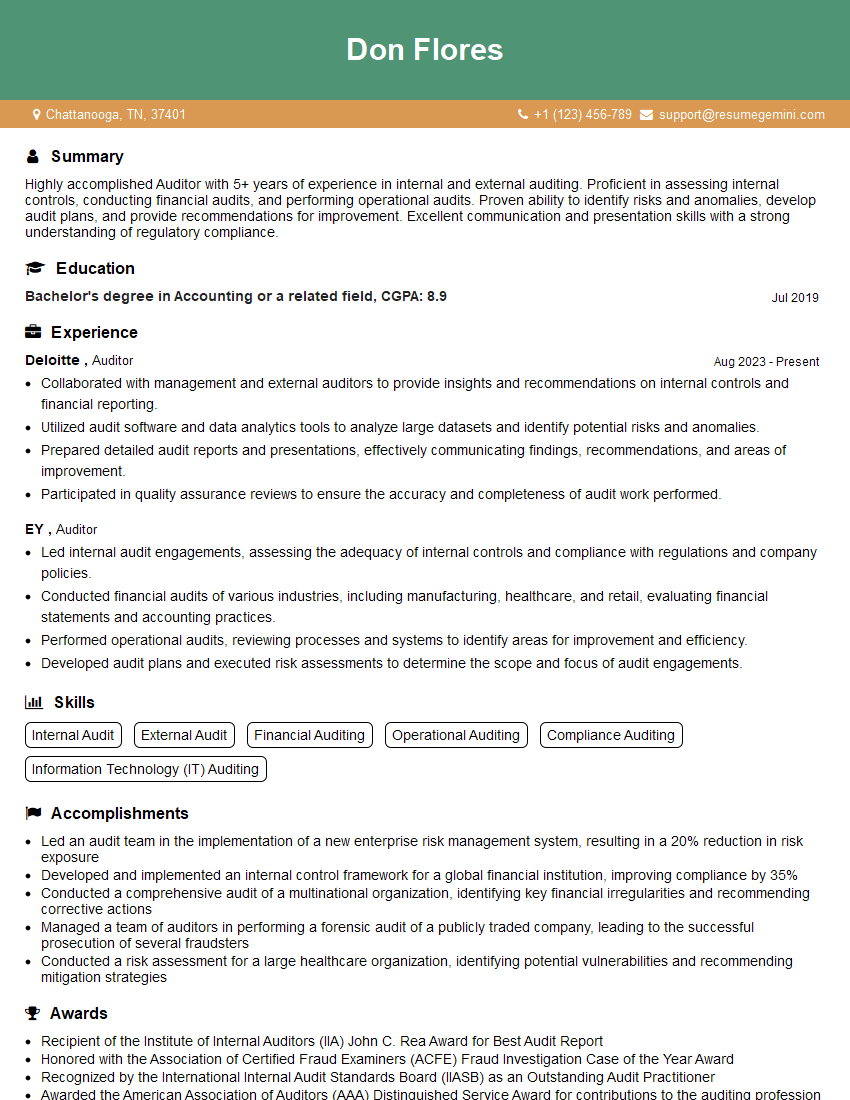

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Auditor

1. Describe the concepts of internal and external audit, and highlight the key differences between them.

Internal Audit:

- An independent, objective assurance and consulting activity designed to add value and improve an organization’s operations.

- Conducted by individuals within the organization, typically reporting to the audit committee or top management.

- Aims to provide assurance on internal controls, risk management, and governance processes.

- Can provide advisory services, such as risk management assessments and process improvement consultations.

External Audit:

- An independent examination of an organization’s financial statements by an external auditor.

- Conducted by an accounting firm, reporting to shareholders and other external stakeholders.

- Aims to express an opinion on the fairness and accuracy of the financial statements.

- Also includes additional services, such as forensic accounting, agreed-upon procedures, and internal control reviews.

2. Explain the significance of risk assessment in audit planning.

Significance of Risk Assessment in Audit Planning:

- Helps auditors identify areas where there is a higher risk of material misstatements.

- Allows auditors to allocate resources effectively and focus on areas with the greatest potential for errors or fraud.

- Supports the development of an appropriate audit strategy and audit procedures.

- Provides insights into the entity’s control environment and potential vulnerabilities.

- Contributes to the determination of the materiality levels for financial reporting purposes.

3. Describe the key principles of International Standards on Auditing (ISA).

Key Principles of International Standards on Auditing (ISA):

- Integrity: Auditors must be honest and ethical in their conduct.

- Objectivity: Auditors must be impartial and free from conflicts of interest.

- Professional Competence and Due Care: Auditors must possess the necessary knowledge and skills and exercise due care in performing their work.

- Confidentiality: Auditors must maintain the confidentiality of client information.

- Professional Behavior: Auditors must act in a responsible and professional manner.

4. Explain the concept of materiality in auditing.

Concept of Materiality in Auditing:

- The magnitude of an omission or misstatement of financial information that would influence the economic decisions of users.

- Materiality is usually judged in relation to the size and nature of the entity’s financial statements as a whole.

- Auditors use their professional judgment to determine materiality based on factors such as the nature of the business, its industry, and the expectations of users.

- Materiality levels are often established by management and the audit committee.

5. Discuss the role of audit evidence in expressing an audit opinion.

Role of Audit Evidence in Expressing an Audit Opinion:

- Audit evidence provides the basis for an auditor’s opinion on the financial statements.

- Auditors must obtain sufficient and appropriate evidence to support their conclusions.

- Evidence can be in the form of documentation, observations, inquiries, and analytical procedures.

- The type and quantity of evidence required vary depending on the risk assessment and the nature of the audit.

- Auditors use their professional judgment to evaluate the reliability and relevance of the evidence.

6. Explain the responsibilities of an auditor in detecting fraud.

Responsibilities of an Auditor in Detecting Fraud:

- Assess the Risk of Fraud: Auditors must assess the risk of fraud based on factors such as the industry, the entity’s size, and its governance structure.

- Design and Perform Audit Procedures: Auditors should design and perform audit procedures that are responsive to the risk of fraud identified.

- Evaluate Fraud Suspicions: If auditors identify any suspicions of fraud, they must evaluate the significance and investigate further.

- Report Fraud Findings: Auditors must report any material fraud findings to management and the audit committee.

- Communicate with Management: Auditors should communicate with management about their responsibilities and findings related to fraud detection.

7. Discuss the importance of internal control in financial reporting.

Importance of Internal Control in Financial Reporting:

- Provides reasonable assurance that the financial statements are reliable and accurate.

- Helps prevent and detect errors and fraud.

- Supports the efficiency and effectiveness of operations.

- Promotes compliance with laws and regulations.

- Contributes to investor confidence and the credibility of the financial reporting process.

8. Explain the concept of analytical procedures in auditing.

Concept of Analytical Procedures in Auditing:

- Logical comparisons and evaluations of financial and non-financial data to identify unexpected variations or trends.

- Used to assess the reasonableness of the financial statements and identify areas for further investigation.

- Can be applied to both historical data and prospective information.

- Involve using benchmarks, ratios, and trends to compare actual results with expectations.

- Provide insights into potential misstatements or areas of concern.

9. Discuss the ethical considerations for auditors.

Ethical Considerations for Auditors:

- Integrity: Adhering to ethical principles and maintaining honesty in all aspects of their work.

- Objectivity: Avoiding conflicts of interest and maintaining impartiality in their opinions.

- Confidentiality: Preserving the privacy and confidentiality of client information.

- Professionalism: Acting in a responsible and ethical manner, upholding the reputation of the profession.

- Due Care: Exercising appropriate care and diligence in the performance of their duties.

10. Explain the process of issuing a modified audit opinion.

Process of Issuing a Modified Audit Opinion:

- Identify the Material Misstatement: Auditors determine that the financial statements contain a material misstatement.

- Consider the Effect on the Financial Statements: Auditors assess the impact of the misstatement on the overall reliability of the financial statements.

- Modify the Audit Opinion: Auditors issue a modified opinion that reflects the material misstatement.

- Provide an Explanation: Auditors must clearly explain the nature and impact of the misstatement in the audit report.

- Type of Modified Opinion: The type of modified opinion issued depends on the severity of the misstatement and its impact on the financial statements.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Auditors are responsible for examining and verifying the accuracy of financial records. They work closely with businesses to ensure that financial data is reliable and complies with regulations. Key job responsibilities include:

1. Auditing Financial Statements

Auditors evaluate the accuracy and fairness of financial statements, including the balance sheet, income statement, and cash flow statement. They ensure that these statements are prepared in accordance with accounting principles and are free from material misstatements.

- Verify the accuracy of financial transactions

- Review supporting documentation, such as invoices and bank statements

2. Conducting Internal Audits

Auditors conduct internal audits to assess the effectiveness of a company’s internal controls. They evaluate the efficiency and effectiveness of business processes and identify areas for improvement.

- Assess the risk of fraud and misstatement

- Make recommendations for improving internal controls

3. Reviewing Financial Policies and Procedures

Auditors review and evaluate a company’s financial policies and procedures to ensure they are compliant with regulations. They also make recommendations for improving the efficiency and effectiveness of these policies.

- Identify and mitigate financial risks

- Develop and implement audit plans

4. Reporting on Audit Findings

Auditors prepare audit reports that summarize their findings and recommendations. These reports are submitted to the audit committee, management, and other stakeholders.

- Communicate audit results to management and stakeholders

- Respond to inquiries from regulators and other parties

Interview Tips

To ace an audit interview, candidates should:

1. Research the Company

Familiarize yourself with the company’s financial profile, industry, and recent news. This knowledge will help you demonstrate your understanding of the company and its audit needs.

- Visit the company’s website and read its financial reports

- Follow the company on social media and industry publications

2. Prepare for Technical Questions

Be prepared to answer questions about auditing standards, financial reporting, and internal controls. Practice answering these questions using the STAR method (Situation, Task, Action, Result).

- Review study guides and practice questions

- Engage in mock interviews with friends or colleagues

3. Highlight Your Skills and Experience

Emphasize your relevant skills and experience, such as your knowledge of accounting, auditing standards, and internal controls. Quantify your accomplishments whenever possible.

- Use numbers and specific examples to highlight your contributions

- Tailor your resume and cover letter to the specific requirements of the job

4. Ask Thoughtful Questions

Asking thoughtful questions shows that you’re engaged and interested in the position. Prepare a few questions about the company, the audit team, and the specific responsibilities of the role.

- Ask about the company’s financial goals and challenges

- Inquire about the audit team’s methodology and approach

5. Follow Up

After the interview, send a thank-you note to the interviewer. Reaffirm your interest in the position and reiterate your key qualifications. If you don’t hear back within a week, follow up with a phone call or email.

- Send a personalized thank-you note within 24 hours of the interview

- Reiterate your interest in the position and highlight any key points from the interview

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Auditor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!