Are you gearing up for an interview for a Automated Teller Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Automated Teller Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

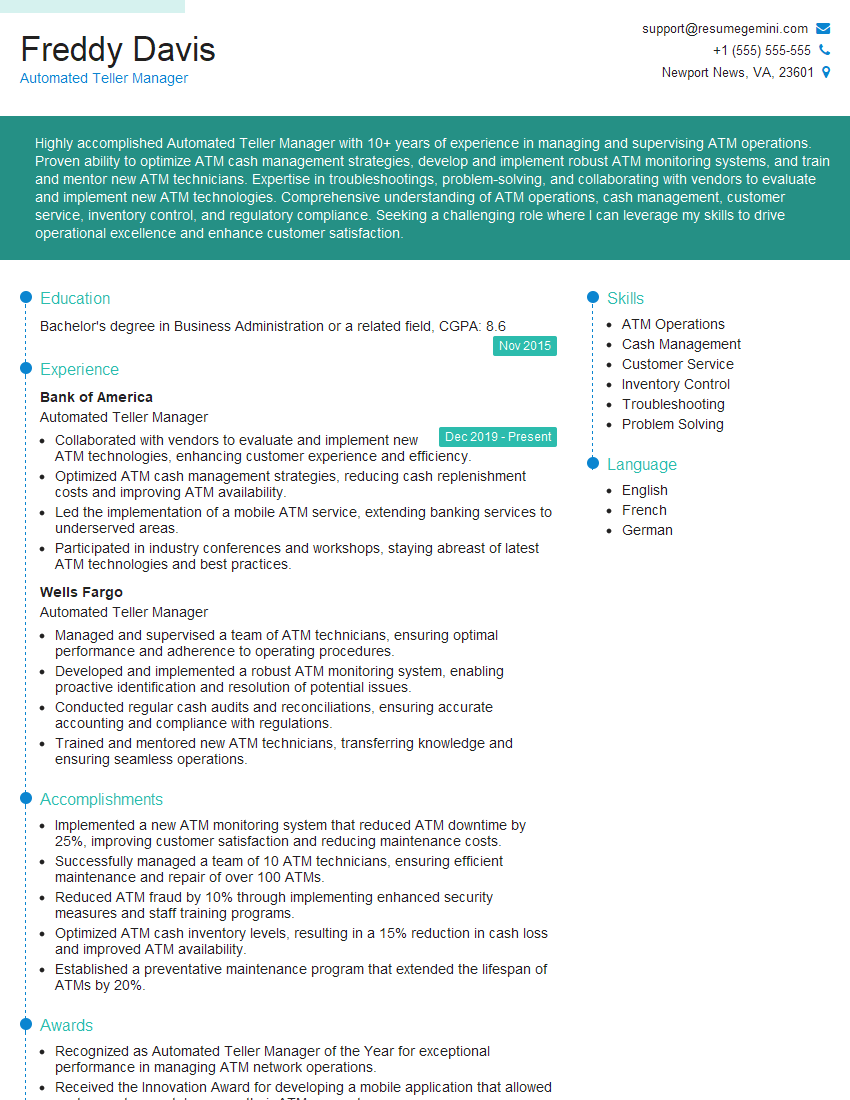

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Automated Teller Manager

1. How would you manage and resolve customer disputes related to ATM transactions?

In the case of an ATM-related dispute, I would follow these steps:

- Acknowledge and empathize with the customer: It’s important to show that you understand their frustration and concern.

- Gather information: Collect all relevant details, including the transaction date, time, amount, and ATM location.

- Review the transaction history: Check the system records to verify the details and identify any potential errors.

- Communicate findings: Clearly explain the findings to the customer, providing evidence if necessary.

- Resolve the dispute: If an error occurred, work with the customer to resolve it promptly and fairly. If no error is found, provide a clear explanation and document the resolution.

- Follow up: Contact the customer after the resolution to ensure their satisfaction and build trust.

2. How do you ensure the security and integrity of ATM machines under your supervision?

Physical Security

- Regularly inspect ATMs for any signs of tampering or damage.

- Monitor ATM surroundings for suspicious activity and report any incidents promptly.

- Ensure proper lighting and surveillance cameras around ATMs.

Transaction Security

- Implement robust encryption protocols to protect customer data.

- Monitor transaction patterns for anomalies that may indicate fraud.

- Adhere to PCI DSS and other industry standards for data security.

3. How would you handle a situation where multiple customers are experiencing ATM malfunctions simultaneously?

In such a situation, I would prioritize the following steps:

- Assess the extent of the issue: Determine the number of affected ATMs and the nature of the malfunction.

- Communicate to customers: Inform customers of the issue, apologize for the inconvenience, and provide an estimated resolution time.

- Dispatch technicians: Contact the ATM servicing team immediately and arrange for prompt repairs.

- Monitor progress: Track the progress of the repairs and keep customers updated.

- Provide alternative options: If necessary, redirect customers to nearby ATMs or offer alternative banking channels.

4. How do you stay up-to-date with the latest ATM technologies and industry best practices?

I actively pursue continuous learning through the following channels:

- Industry conferences and seminars: Attend industry events to learn about new technologies and best practices.

- Technical publications and webinars: Subscribe to industry magazines and participate in webinars to stay informed.

- Vendor training: Engage with ATM manufacturers and service providers for product updates and training.

- Online forums and groups: Connect with industry professionals and participate in online discussions to share knowledge and stay updated.

5. How would you improve the efficiency and customer experience of the ATM network under your management?

To enhance efficiency and customer experience, I would implement the following measures:

- Optimize ATM placement: Conduct market research to identify high-traffic locations and underserved areas.

- Implement self-service features: Upgrade ATMs with features like cash deposits, check scanning, and bill payments to enhance convenience.

- Reduce downtime: Establish a proactive maintenance schedule and partner with reliable service providers to minimize ATM malfunctions.

- Provide real-time support: Implement a 24/7 customer support channel for quick resolution of ATM issues.

- Conduct customer surveys: Regularly collect customer feedback to identify areas for improvement and enhance satisfaction.

6. How do you ensure compliance with regulatory and legal requirements related to ATM operations?

I maintain compliance with regulatory and legal requirements by:

- Staying informed: Regularly reviewing and understanding applicable laws, regulations, and industry guidelines.

- Implementing policies and procedures: Establishing clear policies and procedures to ensure compliance in all aspects of ATM operations.

- Conducting training: Providing comprehensive training to staff on compliance requirements and best practices.

- Monitoring and auditing: Regularly auditing ATM operations to identify and address any potential compliance risks.

- Working with external experts: Consulting with legal and regulatory professionals to ensure adherence to complex or evolving requirements.

7. How do you handle cash management and reconciliation for ATM machines?

I manage cash management and reconciliation for ATM machines through the following processes:

- Cash replenishment planning: Forecast cash demand based on usage patterns and schedule replenishments accordingly.

- ATM balancing: Regularly reconcile cash levels in ATMs with transaction records and cash-in-transit reports.

- Cash vault management: Maintain a secure and organized cash vault for ATM cash storage and replenishment.

- Cash handling procedures: Implement strict procedures for cash handling, including transportation and counting.

- Cash loss prevention: Develop and implement measures to minimize cash loss due to fraud, theft, or errors.

8. How do you ensure the accuracy and reliability of ATM transactions?

I maintain the accuracy and reliability of ATM transactions by:

- Regular maintenance: Regularly servicing and calibrating ATMs to ensure proper functionality.

- Transaction monitoring: Monitoring ATM transactions for anomalies or suspicious patterns.

- Fraud detection: Implementing fraud detection mechanisms to identify and mitigate potential fraudulent transactions.

- Customer support: Providing responsive customer support to address any transaction-related issues promptly.

- Redundancy and backup systems: Establishing redundant systems and backup procedures to minimize transaction downtime.

9. How would you address customer complaints or feedback related to ATM services?

To address customer complaints or feedback related to ATM services, I follow these steps:

- Acknowledge and apologize: Acknowledge the customer’s complaint and apologize for any inconvenience caused.

- Gather information: Collect details about the issue, including the date, time, location, and transaction details.

- Investigate and resolve: Investigate the issue thoroughly and take appropriate steps to resolve it, such as refunding incorrect withdrawals or repairing faulty machines.

- Communicate the outcome: Clearly communicate the outcome of the investigation and any actions taken to resolve the issue.

- Follow up: Follow up with the customer to ensure their satisfaction and take further action if needed.

10. How do you stay informed about industry best practices and technological advancements in ATM management?

I stay informed about industry best practices and technological advancements in ATM management through:

- Conferences and workshops: Attending industry conferences and workshops to learn about new technologies and trends.

- Trade publications: Subscribing to trade publications and industry newsletters for up-to-date information.

- Vendor partnerships: Collaborating with ATM vendors to gain insights into product updates and industry trends.

- Online resources: Exploring websites and online forums dedicated to ATM management for knowledge sharing and best practice discussions.

- Networking: Connecting with other professionals in the industry through LinkedIn, industry groups, and events.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Automated Teller Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Automated Teller Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Automated Teller Manager is responsible for the overall operation and maintenance of a network of automated teller machines (ATMs), ensuring their efficient, secure, and reliable functioning.

1. ATM Operations Management

Supervise and manage daily ATM operations, ensuring adherence to established policies and procedures.

- Monitor ATM performance, identify and resolve operational issues promptly.

- Replenish cash and supplies, maintain ATM inventory levels.

2. Cash Management

Manage cash flow, ensuring accurate and timely processing of cash transactions.

- Reconcile ATM transactions and cash balances.

- Monitor and report on cash discrepancies and suspicious activities.

3. Security and Compliance

Uphold the highest levels of security and compliance, safeguarding ATMs from fraud and unauthorized access.

- Implement and enforce ATM security measures, including surveillance, access control, and encryption.

- Maintain compliance with regulatory requirements, industry standards, and bank policies.

4. Customer Service

Provide excellent customer service, resolving ATM-related issues and providing assistance to customers.

- Respond to customer inquiries and complaints.

- Initiate and oversee customer outreach programs.

Interview Tips

Preparing thoroughly for an Automated Teller Manager interview can significantly increase your chances of success. Here are some essential tips to help you ace the interview:

1. Research the Company and Role

Before the interview, take the time to research the financial institution and the specific role you are applying for. Understand their business model, target market, and industry trends. Thorough preparation demonstrates your interest and commitment to the opportunity.

- Visit the company’s website and social media pages.

- Read industry news and articles to stay informed about current trends.

2. Highlight Your Technical Skills

ATM operations require a strong understanding of technology and cash handling procedures. Emphasize your proficiency in ATM maintenance, troubleshooting, and cash management. Provide specific examples of projects or initiatives where you successfully implemented technical solutions or improved operational efficiency.

- Quantify your accomplishments with specific metrics and results.

- Demonstrate your knowledge of industry best practices and emerging technologies.

3. Showcase Your Customer Service Orientation

Customer satisfaction is paramount in the role of an Automated Teller Manager. Showcase your ability to handle customer inquiries, resolve issues, and provide exceptional service. Highlight instances where you went above and beyond to assist customers or improved the overall customer experience.

- Share examples of positive customer feedback or recognition you received.

- Emphasize your communication skills, empathy, and ability to resolve conflicts effectively.

4. Prepare for Behavioral Questions

Behavioral interviewing is commonly used to assess your past experiences and how they relate to the job requirements. Be prepared to discuss specific examples of how you have demonstrated the following competencies:

- Problem-solving

- Teamwork and collaboration

- Attention to detail

- Adaptability and resilience

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Automated Teller Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.