Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bank Accountant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

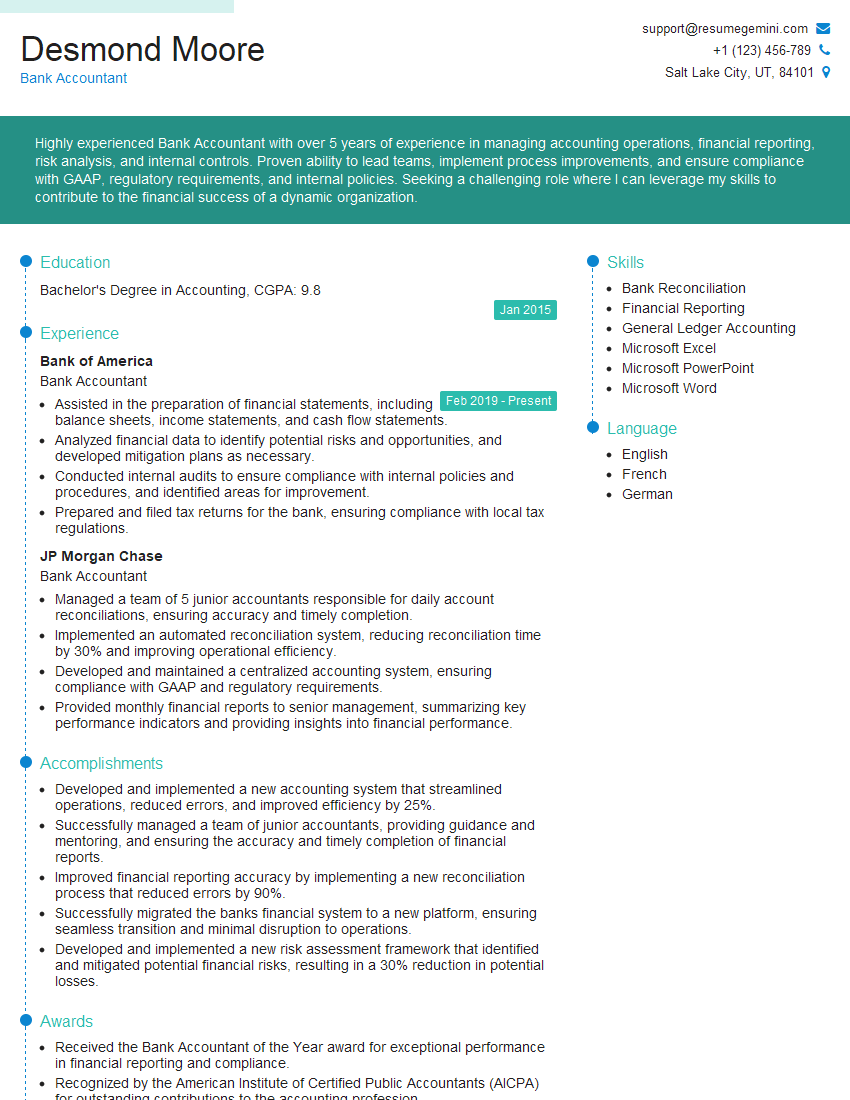

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Accountant

1. Explain the process of reconciling a bank statement.

- Gather all necessary documents, including the bank statement, check register, and deposit slips.

- Compare the bank statement balance to the check register balance.

- Identify any outstanding deposits or checks.

- Investigate and adjust for any errors or discrepancies.

- Document the reconciliation process and keep the records for future reference.

2. What are the different types of bank accounts and their features?

Current Account

- Designed for everyday transactions and business operations.

- Allows unlimited withdrawals and deposits.

- Offers cheque writing facilities and online banking.

Savings Account

- Intended for saving and earning interest on deposits.

- Usually has restrictions on withdrawals and deposits.

- Offers higher interest rates than current accounts.

Fixed Deposit Account

- Offers a fixed interest rate and term.

- Deposits cannot be withdrawn before the maturity date without penalty.

- Provides higher interest rates than savings accounts.

3. Explain the role of a bank accountant in fraud prevention.

- Monitoring transactions for suspicious activity.

- Analyzing financial data to identify potential fraud schemes.

- Implementing anti-fraud measures and policies.

- Collaborating with law enforcement and other departments to investigate and prevent fraud.

- Providing training to staff on fraud awareness and prevention.

4. Describe the key components of the Generally Accepted Accounting Principles (GAAP).

- Materiality: Focusing on significant financial information.

- Consistency: Using the same accounting methods from period to period.

- Good Faith: Assuming that transactions are legitimate and not fraudulent.

- Accrual Basis: Recording transactions when they occur, regardless of cash flow.

- Going Concern: Assuming that the business will continue operating indefinitely.

- Matching: Matching expenses with the revenues they generate.

5. What are the methods used to calculate depreciation?

- Straight-line method: Allocating the cost of an asset evenly over its useful life.

- Declining-balance method: Allocating a larger portion of the cost to the early years of an asset’s life.

- Units-of-production method: Allocating the cost of an asset based on the number of units produced.

- Sum-of-the-years’-digits method: Allocating the cost of an asset based on the sum of the digits representing its useful life.

6. Explain the process of preparing a trial balance.

- List all accounts and their balances as of a specific date.

- Total the debit balances and credit balances separately.

- Ensure that the total debits equal the total credits.

- Use the trial balance to check for errors in the accounting records and prepare financial statements.

7. What are the key differences between a debit and a credit?

- Debit: Increases asset and expense accounts; decreases liability, equity, and revenue accounts.

- Credit: Increases liability, equity, and revenue accounts; decreases asset and expense accounts.

8. How do you handle customer disputes and inquiries?

- Listen attentively to the customer’s concerns.

- Investigate the issue thoroughly and gather all relevant information.

- Explain the bank’s policies and procedures to the customer.

- Resolve the dispute or inquiry fairly and in a timely manner.

- Document the interaction for future reference.

9. Describe the different types of financial statements and their uses.

Balance Sheet

Income Statement

Cash Flow Statement

Statement of Changes in Equity

10. What is the importance of internal controls in a banking environment?

- Preventing fraud and errors.

- Ensuring the accuracy and reliability of financial information.

- Maintaining compliance with regulatory requirements.

- Protecting the bank’s assets and reputation.

- Improving operational efficiency.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bank Accountants are responsible for managing the day-to-day operations of a bank’s accounting department. They ensure that all financial transactions are recorded accurately and in accordance with GAAP and other accounting standards. Bank Accountants also prepare financial statements, manage budgets, and conduct audits. Key job responsibilities include:

1. Managing the day-to-day operations of the accounting department

This includes:

- Recording all financial transactions in the general ledger

- Preparing bank reconciliations

- Processing accounts payable and receivable

- Preparing payroll

- Managing cash flow

2. Preparing financial statements

This includes:

- Preparing the balance sheet

- Preparing the income statement

- Preparing the statement of cash flows

3. Managing budgets

This includes:

- Preparing the annual budget

- Tracking actual spending against the budget

- Making recommendations for budget adjustments

4. Conducting audits

This includes:

- Reviewing financial records for accuracy

- Identifying and reporting on any discrepancies

- Making recommendations for improvements to the accounting system

Interview Tips

To ace a Bank Accountant interview, it is important to prepare thoroughly and practice your answers to common interview questions. Here are some interview tips and hacks:

1. Research the bank and the position

This will help you understand the bank’s culture and the specific requirements of the position. You can find information about the bank on its website and in industry publications.

- Example: You could visit the bank’s website to learn about its history, mission, and values. You could also read articles about the bank in industry publications.

2. Practice answering common interview questions

Some common interview questions for Bank Accountants include:

- Tell me about your experience in accounting.

- Why are you interested in working for our bank?

- What are your strengths and weaknesses as an accountant?

- How do you stay up-to-date on accounting standards?

- What is your experience with auditing?

You can practice answering these questions by yourself or with a friend or family member.

- Example: You could practice answering the question “Tell me about your experience in accounting” by describing your previous accounting roles and responsibilities.

3. Dress professionally and arrive on time for your interview

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This shows the interviewer that you are respectful of their time and that you are serious about the position.

- Example: You could wear a suit or business casual attire to your interview. You should also arrive at the interview location at least 15 minutes early.

4. Be enthusiastic and positive

The interviewer will be able to tell if you are genuinely enthusiastic about the position. Be sure to smile, make eye contact, and speak clearly and confidently. This will show the interviewer that you are interested in the position and that you are confident in your abilities.

- Example: You could start your interview by saying “I am very excited to be interviewing for this position. I have been in the accounting field for five years, and I have a strong track record of success. I am confident that I have the skills and experience that you are looking for.”

5. Ask questions

At the end of the interview, be sure to ask the interviewer questions about the position and the bank. This shows that you are interested in the position and that you are eager to learn more about the company. It also gives you an opportunity to clarify any questions that you may have.

- Example: You could ask the interviewer about the bank’s culture, the training and development opportunities that are available, and the bank’s long-term goals.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bank Accountant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.