Are you gearing up for a career in Bank Cashier? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Bank Cashier and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

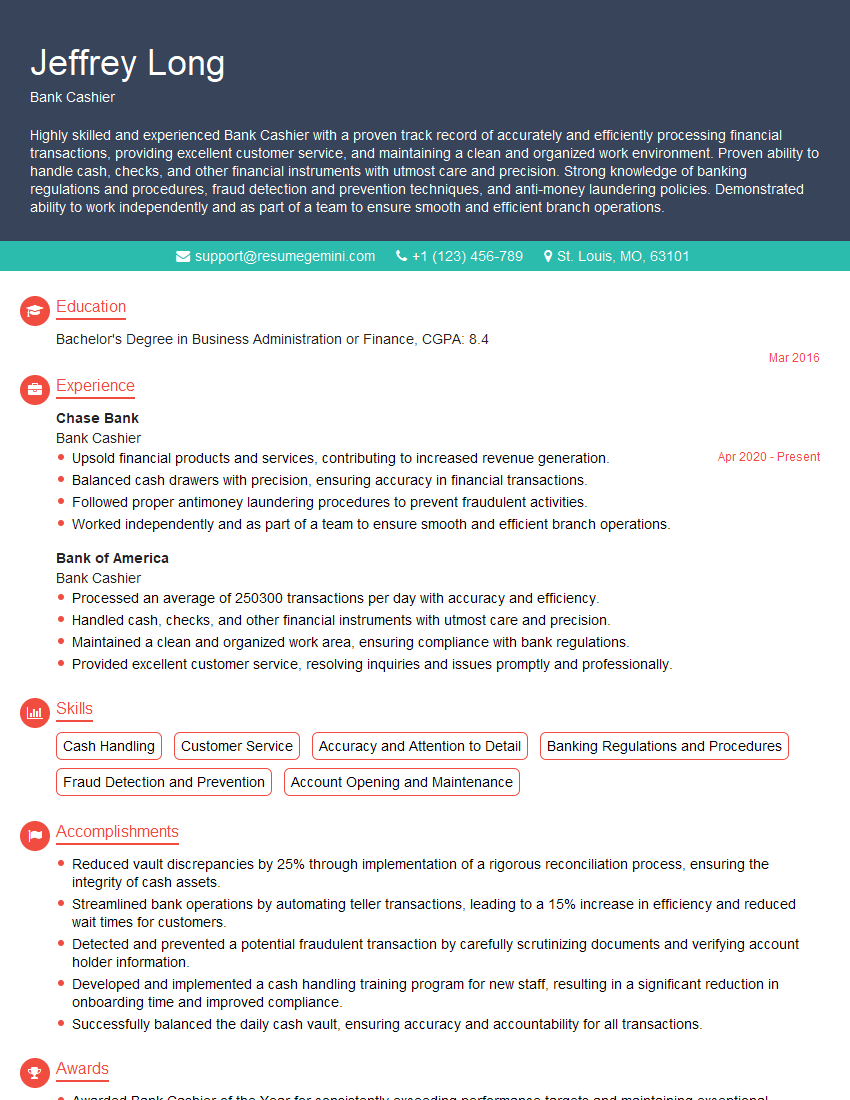

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Cashier

1. Explain the key responsibilities of a Bank Cashier?

As a Bank Cashier, I am responsible for a wide range of duties, including:

- Receiving and disbursing cash, checks, and other forms of payment

- Verifying the authenticity and accuracy of financial documents

- Processing deposits, withdrawals, and loan payments

- Maintaining accurate records of all financial transactions

- Providing excellent customer service

2. How do you manage large volumes of cash and ensure accuracy?

Internal Controls

- Implementing strict internal controls to prevent fraud and errors

- Establishing clear procedures for handling cash, including regular audits

Cash Handling Techniques

- Employing cash handling machines to count and verify large sums of money

- Utilizing dual control systems, such as requiring two staff members to count cash

Training and Supervision

- Providing regular training to cashiers on best practices and security measures

- Supervising cashiers and reviewing their work to ensure compliance

3. Can you describe the steps involved in processing a loan payment?

Sure, here are the steps involved in processing a loan payment:

- Receive the loan payment from the customer

- Verify the payment amount and loan account number

- Post the payment to the customer’s loan account

- Issue a receipt to the customer

- Update the customer’s loan payment history

4. How do you handle discrepancies in financial transactions?

When I encounter a discrepancy in a financial transaction, I follow these steps:

- Document the discrepancy and notify the appropriate supervisor

- Investigate the discrepancy and determine the cause

- Correct the discrepancy and make any necessary adjustments

- Follow up with the customer to ensure the discrepancy has been resolved

5. Can you explain the importance of providing excellent customer service as a Bank Cashier?

Providing excellent customer service is essential for several reasons:

- It builds relationships with customers and fosters loyalty

- It helps to resolve customer issues quickly and efficiently

- It creates a positive and welcoming environment for customers

- It represents the bank in a professional and trustworthy manner

6. How do you stay up-to-date on changes in banking regulations?

I stay up-to-date on changes in banking regulations by:

- Attending industry conferences and webinars

- Reading industry publications and newsletters

- Participating in online forums and discussion groups

- Consulting with legal and compliance experts

7. How do you handle irate or difficult customers?

When dealing with irate or difficult customers, I follow these principles:

- Remain calm and professional

- Listen to the customer’s concerns and try to understand their perspective

- Respond to the customer with empathy and respect

- Work with the customer to find a mutually acceptable solution

- Document the interaction for future reference

8. Can you describe the different types of financial instruments that you handle?

As a Bank Cashier, I handle a variety of financial instruments, including:

- Cash

- Checks

- Money orders

- Cashier’s checks

- Savings bonds

- Certificates of deposit

9. How do you balance accuracy and speed in your work as a Bank Cashier?

Balancing accuracy and speed is critical in my role as a Bank Cashier. I achieve this by:

- Following established procedures and checklists

- Utilizing technology and automation to streamline processes

- Prioritizing tasks based on importance and urgency

- Maintaining a clean and organized workspace

- Continuously seeking ways to improve efficiency

10. Can you provide me with an example of a time when you went above and beyond to help a customer?

Certainly. I recall an instance where a customer came in with a damaged check. The check was torn and difficult to read, but I took the time to carefully reconstruct it and process the transaction. The customer was extremely grateful for my assistance and praised me for my patience and professionalism.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Cashier.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Cashier‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bank Cashiers are generally responsible to cater to the financial dealings of customers. They handle cash transacations like withdrawals, deposits, and issuing cashier checks, among others. They must be well-versed in all the policies and procedures related to banking operations and maintain confidentiality of customers’ information. Following are some of the key responsibilities of a Bank Cashier:

1. Handling Cash Transactions

Bank Cashiers handle a wide range of cash transactions including but not limited to receiving deposits, issuing withdrawals, cashing checks, and processing money orders.

- Count and verify cash and checks

- Process cash advances and withdrawals

- Issue cashier’s checks and money orders

2. Customer Service

Bank Cashiers interact with customers on a daily basis. They must be able to provide excellent customer service in a fast-paced environment.

- Greet customers and answer their questions

- Resolve customer issues and complaints

- Maintain a clean and organized work area

3. Administrative Tasks

Bank Cashiers also perform a variety of administrative tasks like balancing their drawers at the end of each day, assisting other departments as needed and completing paperwork related to transactions.

- Maintain daily transaction records

- Balance cash drawers and reconcile accounts

- Order supplies and equipment

4. Compliance and Security

Bank Cashiers have a responsibility to comply with all bank policies and procedures. They must also be aware of security risks and take steps to prevent fraud.

- Follow all bank policies and procedures

- Identify and report suspicious activity

- Maintain the confidentiality of customer information

Interview Tips

Preparing for the interview is the key to making a positive impression on the hiring manager. Here are a few tips to help you ace the interview for a Bank Cashier position:

1. Research the bank and the position

Take some time prior to the interview to learn about the bank that you’re applying to and the specific position you’re interested in. This will allow you to speak intelligently about your qualifications and interest in the position.

- Visit the bank’s website

- Read articles about the bank on Glassdoor, LinkedIn, and other online resources

- Talk to your friends or family members who work in banking

2. Practice answering common interview questions

There are a few common interview questions that you’re likely to be asked. Take some time to practice answering these questions, such as:

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- What is your experience with cash handling?

- How would you handle a difficult customer?

3. Dress professionally

The way you dress for your interview will say a lot about you. Make sure to dress professionally in a way that is appropriate for the bank’s culture. This means wearing a suit or other business attire.

4. Arrive on time

Being on time for your interview is important. Make sure to give yourself plenty of time to get to the interview location. Arriving late will reflect poorly on you and could cost you the job.

5. Be confident

Confidence is key in any interview situation, and the interview for a Bank Cashier position is no different. Make sure to speak confidently and clearly, and try to maintain eye contact with the interviewer. Being confident will make you seem more capable and professional. Also remember to ask questions about the bank, the position, and the company during the interview.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bank Cashier, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bank Cashier positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.