Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Bank Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Bank Clerk so you can tailor your answers to impress potential employers.

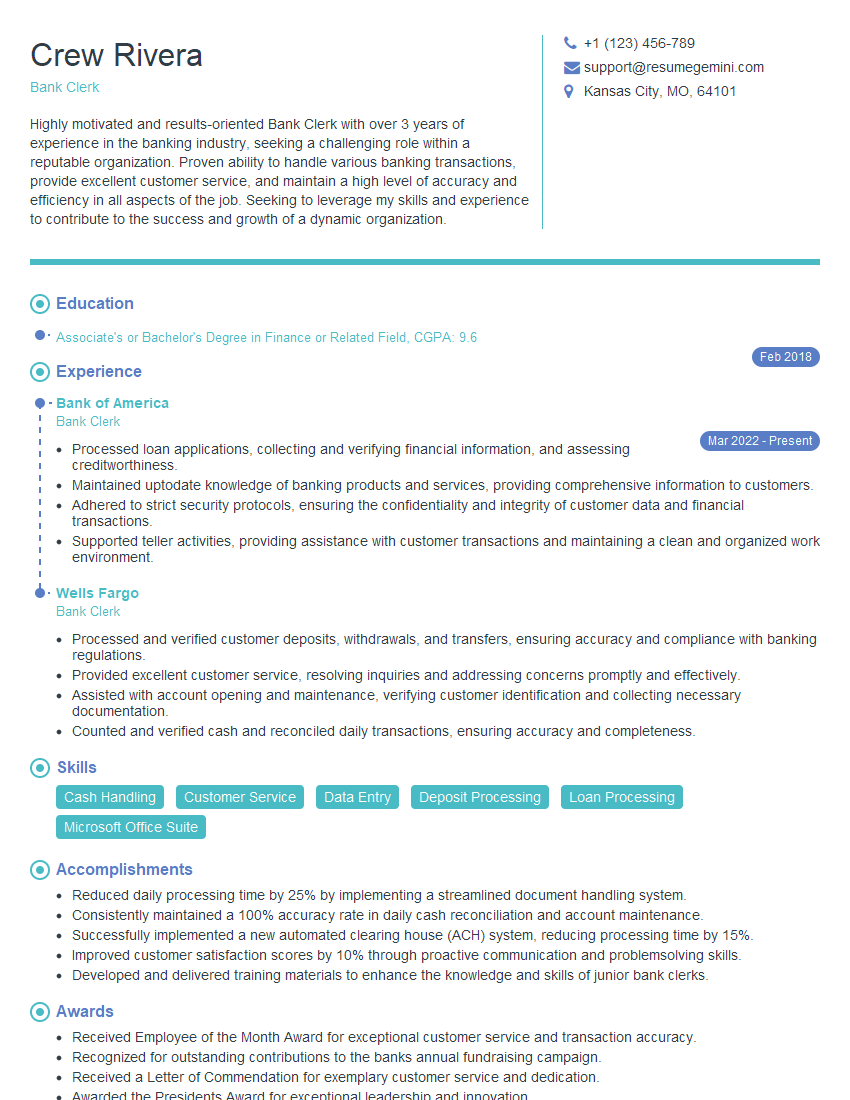

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Clerk

1. What are the different types of accounts that a bank can offer its customers?

• Current Account

• Saving Account

• Fixed Deposit Account

• Recurring Deposit Account

• Overdraft Account

• Loan Account

• Credit Card Account

• Insurance Account

• Demat Account

• NRI Account

2. What are the essential documents required while opening a bank account?

Documents Required for Indian Citizens:

- Passport size photograph

- Proof of Identity (a copy of Aadhaar card/Passport/Driving license/Voter ID)

- Proof of Address (a copy of Aadhaar card/Passport/Driving license/Voter ID)

- Income Proof/Bank Statement (for Savings Account)

- PAN Card (for transactions above INR 50,000)

Documents Required for Non-Resident Indians (NRIs):

- Passport size photograph

- Passport

- Residential Address proof in home country

- Overseas Address proof

- Proof of NRI Status

- PAN Card

3. Explain the process of issuing a cheque?

1. Fill in the date on the top right-hand corner of the cheque. 2. Write the name of the payee in the “Payee” line. 3. Write the amount in words and figures in the “Amount” section. 4. Sign the cheque in the bottom right-hand corner. 5. Enter the account number and IFSC code of the payee’s bank in the “Bank Details” section (for NEFT/RTGS transactions).

4. How do you handle a customer who is angry or upset?

• Stay calm and polite

• Listen to the customer’s concerns without interrupting

• Empathize with the customer’s situation

• Try to resolve the issue promptly and efficiently

• Follow up with the customer to ensure their satisfaction

5. What is the difference between a debit card and a credit card?

• Debit cards are linked to your bank account and deduct money directly from it when you make a purchase.

• Credit cards allow you to borrow money from the bank to make purchases and pay it back later, with interest.

6. What are the different ways to transfer money between bank accounts?

• NEFT (National Electronic Funds Transfer)

• RTGS (Real Time Gross Settlement)

• IMPS (Immediate Payment Service)

• UPI (Unified Payments Interface)

7. What is KYC and why is it important?

KYC (Know Your Customer) is a process banks use to verify the identity and address of their customers. It helps prevent financial fraud and money laundering.

8. What are the steps involved in opening a new bank branch?

- Conduct market research to identify potential locations

- Secure approval from the Reserve Bank of India (RBI)

- Acquire premises and obtain necessary licenses

- Hire and train staff

- Set up IT infrastructure and security systems

- Market the new branch and attract customers

9. Explain the role of a bank in the financial system?

Banks play a crucial role in the financial system by:

• Accepting deposits from customers

• Providing loans and advances to individuals and businesses

• Facilitating payments and money transfers

• Managing risk and ensuring financial stability

• Supporting economic growth and development

10. What are the challenges facing the banking industry today?

- Increasing competition from fintech companies

- Evolving regulatory landscape

- Cybersecurity threats

- Changing customer expectations

- Economic uncertainty

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of Bank Clerk

Bank Clerks are responsible for providing efficient and accurate customer service in a banking environment. Their key responsibilities include:

1. Cash Handling

Handling cash transactions, including deposits, withdrawals, and foreign exchange.

- Count and verify cash

- Process cash transactions efficiently and accurately

2. Customer Service

Providing excellent customer service by assisting customers with account inquiries, transactions, and account opening.

- Greet and help customers in a friendly and efficient manner

- Answer questions about banking products and services

- Resolve customer issues and complaints

3. Account Management

Opening and closing accounts, issuing debit cards and cheque books, and maintaining customer records.

- Verify customer identity and collect required documentation

- Process account opening requests and issue necessary documents

- Update and maintain customer account information

4. Compliance

Adhering to bank policies and procedures, including anti-money laundering and know-your-customer regulations.

- Verify customer identity and screen transactions for suspicious activity

- Report any suspicious transactions or activities to the appropriate authorities

- Stay up-to-date on regulatory changes and compliance requirements

Interview Preparation Tips for Bank Clerk

Preparing thoroughly for your Bank Clerk interview will increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Bank and Position

Take some time to learn about the bank you’re applying to and the specific role you’re interviewing for. Understand the bank’s values, products, and services, and how the position aligns with the bank’s goals.

- Visit the bank’s website and social media pages

- Read news articles and industry reports about the bank

- Study the job description carefully and identify the key responsibilities and qualifications

2. Practice Your Answers

Anticipate common interview questions and prepare your answers in advance. Practice speaking clearly and concisely, and focus on highlighting your relevant skills and experiences.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers

- Quantify your accomplishments whenever possible

- Get feedback from a friend or family member on your answers

3. Dress Professionally

First impressions matter, so dress appropriately for the interview. A neat and professional appearance will show the interviewer that you take the job seriously.

- Wear a suit or business attire in a neutral color

- Make sure your clothes are clean, pressed, and fit well

- Accessorize with a watch or simple jewelry

4. Be Punctual and Polite

Arrive on time for your interview and greet the interviewer with a firm handshake and a smile. Be respectful and polite throughout the interview, and thank the interviewer for their time at the end.

- Plan your route and leave early to avoid any delays

- Introduce yourself confidently and make eye contact

- Listen attentively to the interviewer’s questions and respond appropriately

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bank Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.