Are you gearing up for a career in Bank Manager? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Bank Manager and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

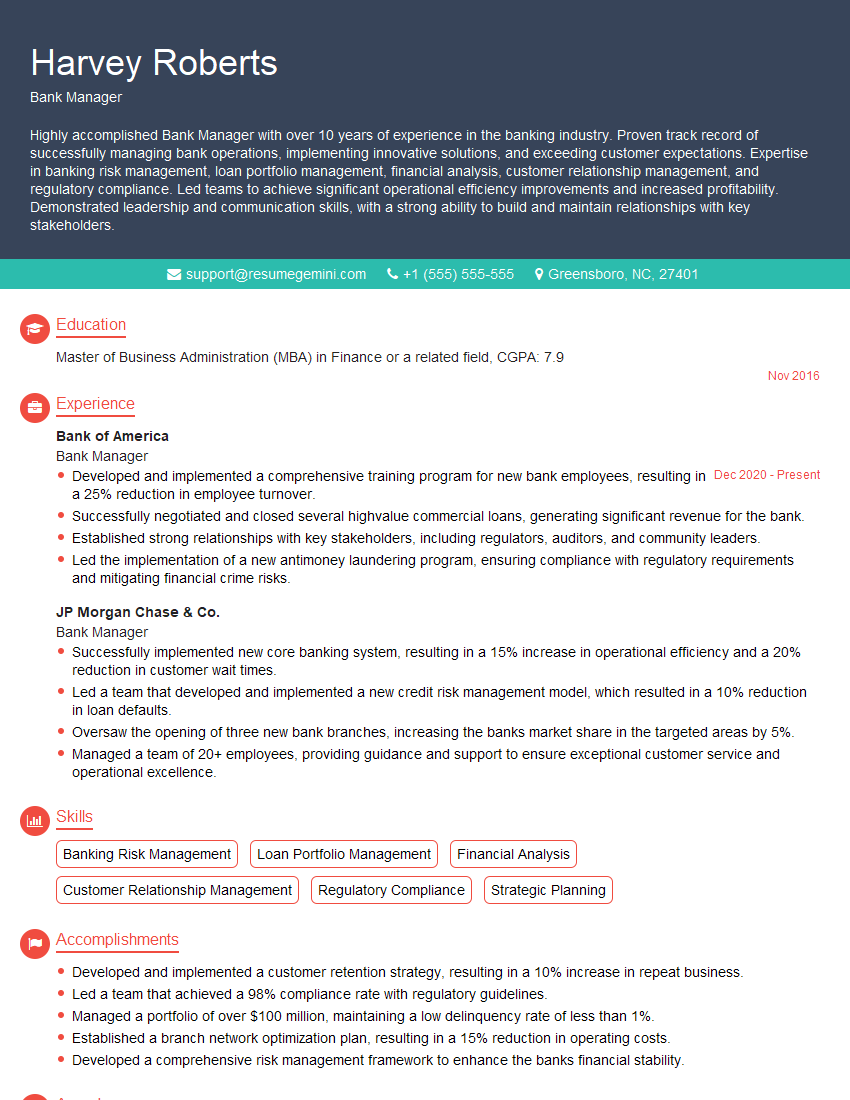

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Manager

1. What are the key responsibilities of a Bank Manager?

As a Bank Manager, I would be responsible for the overall operations of the bank branch, including:

- Managing a team of employees

- Developing and implementing business strategies

- Meeting financial targets

- Providing excellent customer service

- Maintaining compliance with all applicable laws and regulations

2. What are the different types of banking products and services that you are familiar with?

Retail Banking

- Checking accounts

- Savings accounts

- Loans

- Mortgages

- Credit cards

Commercial Banking

- Business loans

- Lines of credit

- Cash management services

- Trade finance

Investment Banking

- Underwriting

- Mergers and acquisitions

- Capital raising

3. What are the key challenges facing the banking industry today?

The banking industry is facing a number of challenges, including:

- Increased competition from fintech companies

- Changing customer expectations

- Regulatory pressures

- Economic uncertainty

- Cybersecurity threats

4. What are your strengths and weaknesses as a Bank Manager?

Strengths:

- Strong leadership skills

- Excellent communication and interpersonal skills

- Proven track record of success in meeting financial targets

- In-depth knowledge of banking products and services

- Commitment to providing excellent customer service

Weaknesses:

- Lack of experience in managing a large team

- Need to improve my technical skills

5. What are your career goals?

My career goal is to become a Vice President of a major bank. I believe that my skills and experience would be a valuable asset to any organization, and I am confident that I can make a significant contribution to the success of the bank.

6. Why should we hire you?

I have a strong track record of success in managing financial institutions. I am a highly motivated and results-oriented individual with a passion for the banking industry. I am confident that I have the skills and experience necessary to be a successful Bank Manager at your company.

7. What is your understanding of Basel III regulations?

Basel III is a set of international banking regulations that were introduced in response to the 2008 financial crisis. The regulations were designed to strengthen the resilience of the banking system and prevent future crises. Key elements of Basel III include:

- Increased capital requirements

- Improved liquidity standards

- Stricter stress testing

8. How do you manage risk in a banking environment?

Risk management is a critical aspect of banking. I would manage risk in a banking environment by:

- Identifying and assessing risks

- Developing and implementing risk mitigation strategies

- Monitoring risks on an ongoing basis

- Reporting risks to senior management

9. What are the different types of financial instruments that are used in the banking industry?

- Loans

- Bonds

- Stocks

- Derivatives

- Foreign exchange

10. What are the key trends that are shaping the future of the banking industry?

- The rise of fintech

- The increasing use of mobile banking

- The globalization of the banking industry

- The need for banks to become more customer-centric

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bank Managers oversee the daily operations of a bank branch, ensuring efficient and profitable functioning. Their responsibilities encompass a wide range of areas, from customer service to financial management.

1. Customer Service and Relationship Management

Bank Managers are the primary point of contact for customers, addressing their financial needs and queries.

- Meet with customers to discuss their financial goals and recommend appropriate products and services.

- Resolve customer complaints and issues promptly and effectively.

- Develop and nurture relationships with existing and potential customers.

2. Financial Management

Bank Managers are responsible for managing the financial operations of their branch, ensuring profitability and compliance with regulations.

- Set financial targets and monitor progress against them.

- Manage the branch’s budget and expenses.

- Ensure compliance with banking regulations and internal policies.

3. Team Leadership and Management

Bank Managers lead and motivate a team of employees, ensuring efficient and productive operations.

- Lead, motivate, and evaluate the performance of staff.

- Create and maintain a positive and productive work environment.

- Train and develop staff to enhance their skills and knowledge.

4. Risk Management

Bank Managers identify and mitigate risks to protect the bank’s assets and reputation.

- Assess and manage risks associated with lending, investments, and operations.

- Implement and maintain risk management policies and procedures.

- Report on risk exposure to senior management and regulatory authorities.

Interview Tips

Preparing for a Bank Manager interview requires both technical knowledge and an understanding of the interviewer’s perspective. Here are some key tips to help you ace the interview:

1. Research the Bank and Position

Thoroughly research the bank’s history, culture, and financial performance. Learn about the specific responsibilities of the Bank Manager position and how they align with your skills and experience.

- Visit the bank’s website, read industry news, and connect with current or former employees to gain insights.

- Identify key areas where your skills and experience match the job requirements and prepare specific examples to demonstrate your capabilities.

2. Practice Answering Common Interview Questions

Anticipate common interview questions and prepare thoughtful, concise answers that highlight your qualifications. Practice your responses in advance to build confidence and clarity.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers and provide specific examples of your accomplishments.

- Quantify your results whenever possible to demonstrate the impact of your work.

3. Be Prepared to Discuss Your Leadership Style

Bank Managers play a crucial leadership role. Be ready to discuss your leadership style, including how you motivate and empower your team, resolve conflicts, and create a positive work environment.

- Share examples of how you have successfully led and developed teams in the past.

- Explain how your leadership style aligns with the bank’s culture and values.

4. Ask Thoughtful Questions

Asking intelligent questions at the end of the interview shows that you are engaged and interested in the position and the bank. It also gives you an opportunity to clarify any remaining questions you have.

- Prepare questions about the bank’s strategic initiatives, their approach to customer service, and their commitment to employee development.

- Avoid asking questions that are easily found on the bank’s website or in the job description.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bank Manager, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bank Manager positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.