Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bank Operations Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

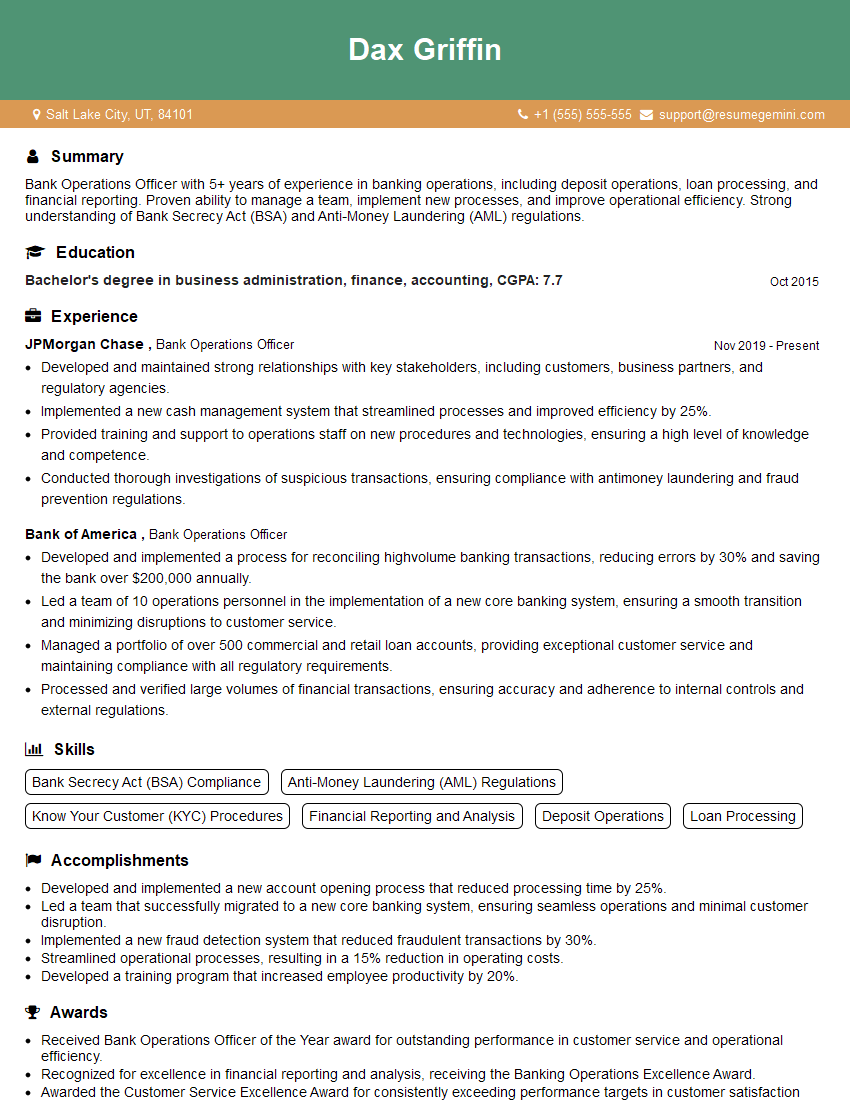

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Operations Officer

1. Elaborate on the process of account opening at your previous organization?

At my previous organization, the account opening process involved several key steps to ensure accuracy and compliance:

- Customer Identification: Verified customer identity through KYC documents and collected personal information.

- Account Type Determination: Assessed customer needs and recommended suitable account types based on their financial goals.

- Documentation Collection: Gathered necessary documents, such as proof of address, income, and identity.

- Due Diligence: Conducted thorough background checks to mitigate risks and ensure legal compliance.

- Account Setup: Created the account in the bank’s system and provided account details to the customer.

2. How do you handle complex and high-value transactions?

Internal Controls

- Segregation of Duties: Implemented strict controls to separate account opening and authorization functions.

- Multi-Level Approvals: Required multiple levels of authorization for high-value transactions to prevent fraud.

Customer Communication

- Thorough Advisories: Provided clear and comprehensive advisories to customers on the risks and responsibilities associated with complex transactions.

- Enhanced Monitoring: Closely monitored high-value transactions for suspicious activities.

3. Describe your role in the reconciliation process and how you ensured its accuracy.

As part of my responsibilities, I played a crucial role in the reconciliation process, ensuring its accuracy and completeness:

- Data Extraction: Extracted account balances and transaction details from internal and external sources.

- Matching and Analysis: Compared the extracted data to identify discrepancies and investigate any unmatched items.

- Documentation: Maintained detailed documentation of the reconciliation process and any adjustments made.

- Exception Handling: Investigated and resolved exceptions promptly, coordinating with relevant departments to address underlying issues.

4. How do you manage customer queries and complaints while adhering to bank policies and procedures?

In handling customer queries and complaints, I prioritized providing exceptional service while adhering to established bank policies and procedures:

- Active Listening: Actively listened to customer concerns and restated their issues to ensure understanding.

- Policy Knowledge: Thoroughly understood bank policies and procedures to provide accurate and consistent responses.

- Empathy and Resolution: Showed empathy and worked diligently to resolve issues promptly while meeting customer expectations.

- Escalation: Escalated complex or unresolved issues to appropriate departments for further assistance.

5. Tell us about a time when you identified and resolved a banking error. How did you handle the situation?

During a routine account reconciliation, I identified a significant discrepancy that indicated a banking error. I took the following steps to resolve the issue:

- Verification: Verified the discrepancy through multiple sources to confirm its accuracy.

- Investigation: Conducted a thorough investigation to determine the root cause of the error.

- Resolution: Worked with the relevant departments to implement a corrective action plan and resolve the issue promptly.

- Documentation: Documented the error, the investigation process, and the resolution to prevent similar errors in the future.

6. How do you stay updated on regulatory changes and industry best practices in banking operations?

To stay abreast of regulatory changes and industry best practices, I employ the following strategies:

- Industry Publications: Subscribe to industry magazines, newsletters, and journals to gain insights into regulatory updates and emerging trends.

- Associations and Conferences: Attend industry conferences and workshops hosted by banking associations to connect with experts and learn about new developments.

- Online Resources: Utilize reputable websites, such as regulatory agencies’ websites, to access official guidelines and circulars.

- Internal Training: Participate in internal training programs and workshops to enhance my knowledge and skills.

7. How do you prioritize and manage multiple tasks in a fast-paced banking environment?

In a fast-paced banking environment, I prioritize and manage multiple tasks effectively through the following techniques:

- Task Prioritization: Use the Eisenhower Matrix to categorize tasks based on urgency and importance, focusing on completing high-priority tasks first.

- Time Management: Plan my day using a to-do list or calendar to allocate time slots for specific tasks.

- Delegation: Delegate tasks to team members when appropriate to optimize efficiency and avoid burnout.

- Automation: Utilize technology and automation tools to streamline repetitive tasks and free up time for more complex responsibilities.

8. Tell us about your experience with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Having worked in the banking industry for several years, I have gained significant experience in complying with AML and KYC regulations:

- Customer Due Diligence: Conducted thorough customer due diligence to identify and verify customer identities, assess risk levels, and monitor transactions.

- Suspicious Activity Reporting: Identified and reported suspicious activities in accordance with regulatory requirements.

- AML Training: Regularly updated my knowledge through AML training programs and workshops to stay abreast of evolving regulations and best practices.

- Compliance Audits: Participated in internal and external compliance audits to ensure adherence to AML and KYC policies.

9. Describe your understanding of blockchain technology and its potential impact on banking operations.

Blockchain technology has the potential to revolutionize banking operations by offering the following advantages:

- Enhanced Security: Blockchain’s decentralized and immutable nature provides enhanced security, reducing the risk of fraud and cyberattacks.

- Improved Efficiency: Blockchain can automate and streamline processes, such as cross-border payments and trade finance, increasing efficiency and reducing costs.

- Transparency and Traceability: The transparent nature of blockchain allows for easy tracking and verification of transactions, improving transparency and accountability.

- New Product Development: Blockchain opens up opportunities for innovative financial products and services, such as digital currencies and smart contracts.

10. What are the key challenges you anticipate in the future of banking operations, and how do you plan to address them?

The future of banking operations presents several key challenges that require proactive measures:

- Technological Disruption: Embracing emerging technologies, such as AI and automation, while mitigating the risks they may pose.

- Regulatory Complexity: Staying abreast of evolving regulations and ensuring compliance to maintain trust and reputation.

- Cybersecurity Threats: Enhancing cybersecurity measures to protect sensitive customer data and financial assets from cyberattacks.

- Competition from Non-Traditional Players: Adapting to the evolving competitive landscape and leveraging technology to differentiate services.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Operations Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Operations Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Bank Operations Officer is ответствен for the smooth and efficient functioning of a bank’s operations.

1. Cash Management

Managing the bank’s cash flow, including deposits, withdrawals, and currency exchange.

- Processing and verifying cash transactions.

- Maintaining accurate cash records.

2. Account Management

Opening and closing customer accounts, processing transactions, and resolving account issues.

- Verifying customer identification and documentation.

- Providing customer service and resolving complaints.

3. Loan Processing

Processing and evaluating loan applications, including gathering documentation and conducting credit checks.

- Analyzing financial statements and credit reports.

- Making recommendations on loan approval or denial.

4. Compliance and Risk Management

Ensuring compliance with banking regulations and mitigating financial risks.

- Monitoring transactions for suspicious activity.

- Implementing and maintaining security measures.

Interview Tips

Preparing for a Bank Operations Officer interview requires careful planning and research.

1. Research the Bank and Position

Thoroughly research the bank you are applying to, including its history, structure, and financial performance.

- Review the bank’s website and social media pages.

- Read news articles and industry publications about the bank.

Understand the specific responsibilities and requirements of the Bank Operations Officer position.

2. Practice Common Interview Questions

Prepare for common interview questions related to banking operations, customer service, and risk management.

- “Describe your experience in cash management.”

- “How do you ensure compliance with banking regulations?”

- “Tell us about a time you had to resolve a complex customer issue.”

Practice answering these questions concisely and professionally, using the STAR method (Situation, Task, Action, Result).

3. Highlight Your Skills and Experience

Emphasize your skills and experience that are relevant to the Bank Operations Officer position.

- Quantify your accomplishments whenever possible.

- Use specific examples to demonstrate your abilities.

For example, instead of saying “Managed cash flow,” you could say “Managed a daily cash flow of over $1 million with 99% accuracy.”

4. Dress Professionally and Arrive Punctually

Make a positive first impression by dressing professionally and arriving on time for the interview.

- Wear a suit or business casual attire.

- Arrive at the interview location 15 minutes early.

Being well-prepared and respectful of the interviewer’s time will show that you are serious about the position.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Bank Operations Officer role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.