Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Bank Reconciliator interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Bank Reconciliator so you can tailor your answers to impress potential employers.

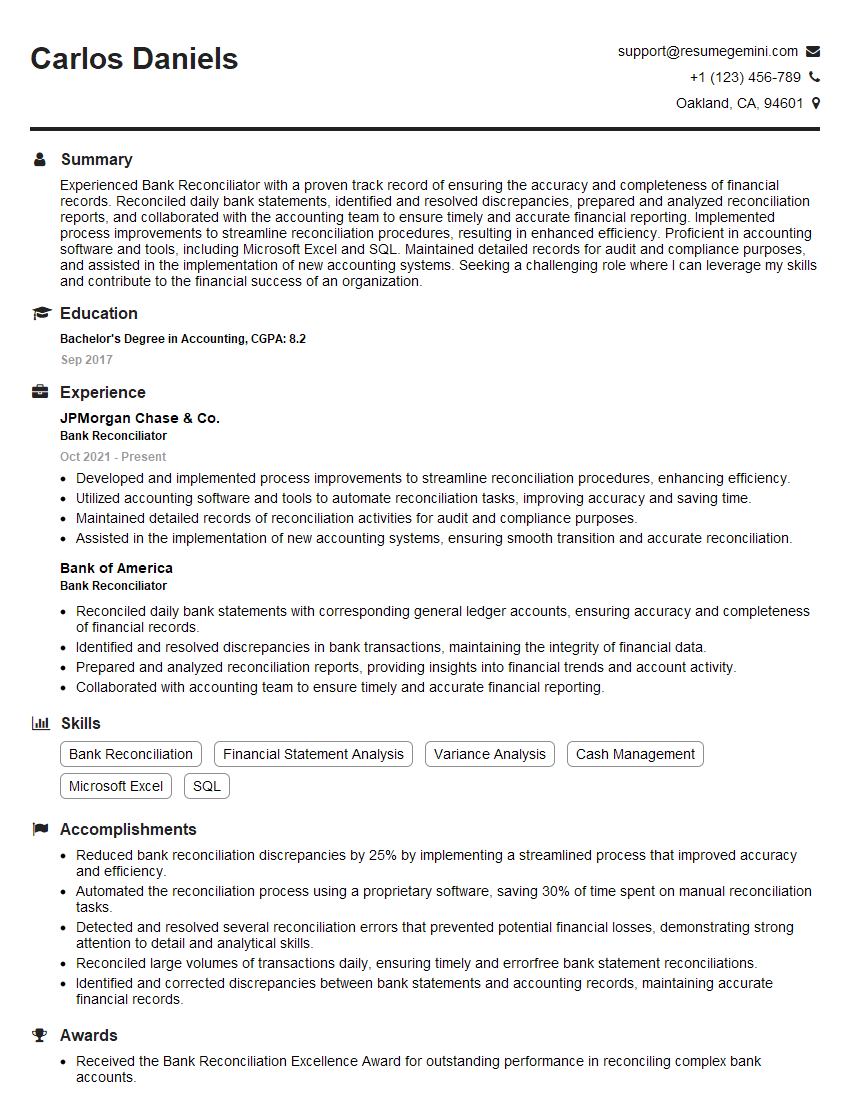

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Reconciliator

1. What is bank reconciliation?

Bank reconciliation is the process of matching the cash transactions recorded in the business’s accounting records with the bank statement.

2. What are the steps involved in bank reconciliation?

The steps involved in bank reconciliation are:

- Gather all the necessary documents: Bank statement, trial balance, supporting documents (i.e. canceled checks, deposit slips)

- Compare the bank statement to the trial balance: Identify any discrepancies between the two records

- Analyze the discrepancies: Determine the nature of the discrepancies and their impact on the financial records

- Correct the accounting records: Make adjustments to the accounting records to reflect the actual cash balance

- Finalize the reconciliation: Prepare a reconciliation statement that summarizes the adjustments made and the reconciled cash balance

3. What are some common reasons for bank reconciliation discrepancies?

Some common reasons for bank reconciliation discrepancies include:

- Outstanding checks: Checks that have been written but not yet cashed

- Unrecorded deposits: Deposits that have been made but not yet recorded in the accounting records

- Bank errors: Errors made by the bank in processing transactions

- Accounting errors: Errors made in recording transactions in the accounting records

4. What are the benefits of bank reconciliation?

The benefits of bank reconciliation include:

- Improved financial accuracy: Bank reconciliation helps to ensure that the financial records are accurate and reliable

- Reduced risk of fraud: Bank reconciliation can help to identify fraudulent transactions

- Enhanced decision-making: Bank reconciliation provides valuable insights into the company’s cash flow and financial position

5. What are some best practices for bank reconciliation?

Some best practices for bank reconciliation include:

- Perform reconciliations regularly: Reconciliations should be performed on a monthly or quarterly basis

- Use a checklist: A checklist can help to ensure that all of the necessary steps are completed

- Review supporting documents: Supporting documents should be reviewed to verify the accuracy of transactions

- Make adjustments promptly: Any necessary adjustments to the accounting records should be made promptly

6. What is a material discrepancy in bank reconciliation?

A material discrepancy is a discrepancy that is large enough to have a material impact on the financial statements.

7. What steps should be taken if a material discrepancy is identified?

- Investigate the discrepancy: Determine the cause of the discrepancy and its impact on the financial statements

- Correct the financial statements: Make any necessary adjustments to the financial statements

- Monitor the discrepancy: Monitor the discrepancy to ensure that it does not recur

8. What are the key accounting standards related to bank reconciliation?

- IAS 1: Presentation of Financial Statements: Requires that all material discrepancies be disclosed in the financial statements

- IFRS 7: Financial Instruments: Disclosures: Requires that banks disclose information about their reconciliation process and any material discrepancies

9. What are some of the challenges in bank reconciliation?

- Time-consuming: Bank reconciliation can be a time-consuming process, especially for large organizations

- Complex transactions: Bank reconciliations can be more complex for organizations that have multiple bank accounts or complex transactions

- Lack of documentation: Bank reconciliations can be more difficult if supporting documentation is not available

10. What is the future of bank reconciliation?

- Automation: Automation is increasingly being used to streamline the bank reconciliation process

- Artificial intelligence: Artificial intelligence (AI) is being used to improve the accuracy and efficiency of bank reconciliation

- Cloud computing: Cloud computing is making it easier to access and share bank reconciliation data

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Reconciliator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Reconciliator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Bank Reconciliator is a crucial financial professional responsible for ensuring the accuracy and integrity of an organization’s financial records by reconciling bank statements with internal accounting records. The primary responsibilities of a Bank Reconciliator include:

1. Matching Transactions

Comparing transactions recorded in the bank statement to those in the company’s accounting records, identifying and investigating any discrepancies or errors.

- Review bank statements and company records for completeness and accuracy.

- Identify and investigate outstanding checks, deposits in transit, and other reconciling items.

2. Identifying Errors

Analyzing discrepancies between bank statements and accounting records to identify and correct errors, such as incorrect entries, duplications, or omissions.

- Analyze bank fees, interest earned, and other adjustments.

- Research and resolve discrepancies between bank and company records.

3. Preparing Reconciliation Reports

Documenting the reconciliation process and its findings in a comprehensive reconciliation report, highlighting any errors or adjustments made.

- Prepare and maintain bank reconciliation workpapers.

- Generate monthly reconciliation reports to support financial reporting.

4. Enhancing Internal Controls

Identifying areas for improvement in internal controls related to cash management and bank reconciliations, recommending and implementing measures to mitigate risks.

- Review and evaluate cash management processes.

- Recommend and implement improvements to internal controls.

Interview Tips

To ace an interview for a Bank Reconciliator role, candidates should prepare thoroughly and demonstrate their proficiency in the key responsibilities and relevant skills. Here are some useful interview preparation tips:

1. Research the Company and Position

Research the company’s industry, recent financial performance, and specific requirements for the Bank Reconciliator role. This will provide valuable insights and show the interviewer that you’re genuinely interested in the opportunity.

- Visit the company’s website and review its financial statements.

- Read industry news and articles to stay informed about relevant trends.

2. Highlight Relevant Skills and Experience

Emphasize your experience in bank reconciliations, attention to detail, analytical abilities, and familiarity with relevant software tools. Provide specific examples to demonstrate your proficiency.

- Quantify your accomplishments, using specific metrics whenever possible.

- Prepare examples of complex reconciliations you’ve successfully completed.

3. Practice Case Studies

Prepare for case study questions that may test your problem-solving skills and understanding of bank reconciliations. Review common scenarios and practice analyzing discrepancies and recommending solutions.

- Familiarize yourself with different types of reconciling items.

- Practice preparing reconciliation reports and presenting your findings.

4. Be Prepared to Discuss Internal Controls

Bank reconciliations play a crucial role in internal controls. Be prepared to discuss your understanding of internal controls related to cash management and bank reconciliations, and how you’ve contributed to their improvement in previous roles.

- Review COSO (Committee of Sponsoring Organizations of the Treadway Commission) internal control framework.

- Share examples of how you’ve identified and mitigated risks in cash management processes.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bank Reconciliator, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bank Reconciliator positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.