Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bank Representative position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

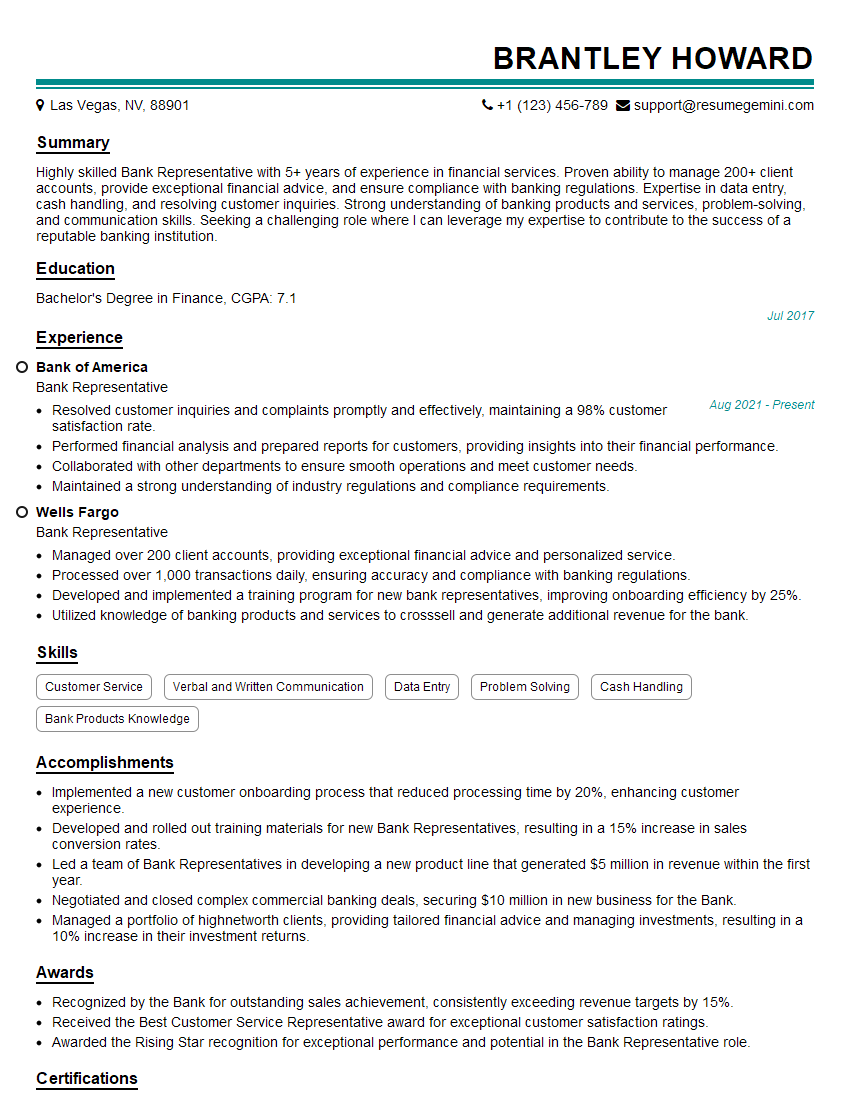

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Representative

1. Describe the different types of bank accounts and their features?

Bank accounts can be broadly categorized into the following types, each with its unique features:

- Checking Accounts: Designed for everyday transactions, offer easy access to funds through checks, debit cards, and online banking.

- Savings Accounts: Prioritize saving money and earn interest on balances, but may have restrictions on withdrawals.

- Money Market Accounts: Similar to savings accounts, but offer higher interest rates and check-writing privileges, though with potential penalties for excessive withdrawals.

- Certificates of Deposit (CDs): Offer fixed interest rates for a specified period, with penalties for early withdrawal.

- Trust Accounts: Hold assets for the benefit of another person or entity, with specific legal requirements and rules.

2. Explain the process of opening a new bank account?

Customer Verification

- Verify the customer’s identity through government-issued documents.

- Check for any potential fraud risks or sanctions.

Account Selection

- Discuss different account types and their features.

- Guide the customer to choose the account that best aligns with their financial goals.

Documentation and Setup

- Collect necessary documents, such as proof of address and income.

- Complete the account opening forms and obtain the customer’s signature.

- Set up the account and provide necessary instructions.

3. How do you handle customer inquiries and complaints?

When handling customer inquiries and complaints, I follow these steps:

- Active Listening: Listen attentively to the customer’s concerns and identify their needs.

- Empathy and Understanding: Show empathy and acknowledge their frustration or concerns.

- Gather Information: Ask clarifying questions to fully understand the situation.

- Problem Resolution: Explore potential solutions and work with the customer to find a mutually acceptable outcome.

- Documentation and Follow-up: Document the interaction and follow up with the customer to ensure their satisfaction.

4. Describe the different methods of transferring funds between bank accounts?

There are several methods for transferring funds between bank accounts:

- Online Banking: Log in to your online banking account and initiate a transfer.

- Mobile Banking: Use your mobile banking app to transfer funds.

- ACH Transfers: Send and receive funds electronically through the Automated Clearing House (ACH) network.

- Wire Transfers: Transfer funds quickly and securely using a wire transfer service, but may incur fees.

- Bank Checks: Write a check and deposit it into the recipient’s account.

5. Explain the concept of interest rates and how they affect banking products?

Interest rates represent the cost of borrowing money or the return on savings. In banking:

- Loan Interest Rates: Banks charge interest on loans, which borrowers must pay over the loan term. Higher interest rates increase the cost of borrowing.

- Deposit Interest Rates: Banks offer interest on deposit accounts, providing a return on savings. Higher interest rates make saving more attractive.

- Impact on Bank Products: Interest rates influence the pricing of loans, savings accounts, and other banking products.

6. What are the key regulations and compliance requirements that banks must adhere to?

Banks are subject to numerous regulations and compliance requirements, including:

- Anti-Money Laundering Laws: Prevent and detect money laundering activities.

- Know-Your-Customer (KYC) Requirements: Establish and verify the identity of customers.

- Bank Secrecy Act (BSA): Report large cash transactions and suspicious activities.

- Consumer Protection Laws: Ensure fair treatment and protect consumer rights.

- Financial Institution Regulatory Authority (FINRA) Rules: Regulate securities activities of banks.

7. Describe the role of technology in modern banking?

Technology has transformed banking, bringing:

- Online and Mobile Banking: Convenient account management and transactions from anywhere.

- Digital Payments: Contactless payments, mobile wallets, and other digital payment solutions.

- Data Analytics: Improved customer insights, personalized products, and risk management.

- Artificial Intelligence (AI): Automated processes, chatbot customer service, and fraud detection.

- Blockchain Technology: Secure and transparent record-keeping for transactions and other banking processes.

8. Explain the importance of customer service in the banking industry?

Excellent customer service is crucial in banking:

- Customer Satisfaction: Positive customer experiences foster loyalty and retention.

- Reputation Management: Unresolved customer complaints can damage a bank’s reputation.

- Sales and Growth: Satisfied customers are more likely to recommend the bank and use its products.

- Compliance: Banks are required to treat customers fairly and address their concerns promptly.

- Competitive Advantage: Banks with exceptional customer service can differentiate themselves in the competitive market.

9. What are some of the common challenges faced by bank representatives?

Bank representatives may encounter various challenges, such as:

- Complex Regulations: Staying updated on and adhering to numerous banking regulations can be challenging.

- Balancing Multiple Tasks: Managing a high volume of transactions, customer inquiries, and administrative tasks.

- Customer Service Issues: Resolving customer complaints and handling difficult interactions.

- Technology Issues: Troubleshooting and addressing technological problems that may impact customer transactions.

- Fraud and Scams: Identifying and preventing fraudulent activities to protect customers and the bank.

10. How do you stay updated on industry best practices and regulatory changes?

To stay updated on industry best practices and regulatory changes, I employ the following strategies:

- Continuing Education:Attend workshops, seminars, and webinars to expand my knowledge.

- Professional Development:Participate in professional organizations and read industry publications.

- Company Training:Complete internal training programs and stay informed through company updates.

- Regulatory Compliance:Subscribe to regulatory updates and closely monitor official announcements.

- Peer Collaboration:Network with colleagues and share information on emerging trends and best practices.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bank Representatives serve as the face of their financial institution, assisting customers with a wide range of financial services. They are responsible for:

1. Providing Exceptional Customer Service

Bank Representatives interact with customers in person, over the phone, and through email, providing courteous and professional service. They actively listen to customer needs and provide personalized solutions.

2. Managing Financial Transactions

Bank Representatives process various financial transactions, including deposits, withdrawals, loan applications, and account maintenance. They ensure the accuracy and confidentiality of all transactions.

3. Generating New Business

Bank Representatives are often responsible for generating new leads and acquiring new customers. They proactively identify potential customers, develop relationships, and cross-sell financial products.

4. Staying Up-to-Date on Financial Products and Services

Bank Representatives must stay abreast of the latest financial products and services offered by their institution. They attend regular training and update their knowledge to provide informed recommendations to customers.

Interview Tips

To ace an interview for a Bank Representative position, candidates should follow these tips:

1. Research the Bank and Role

Familiarize yourself with the bank’s history, mission, and current offerings. Review the job description thoroughly to understand the specific responsibilities of the role.

2. Highlight Customer Service Experience

Emphasize your ability to provide excellent customer service in a fast-paced environment. Share examples of how you have gone above and beyond to meet customer needs.

3. Demonstrate Financial Knowledge

Showcase your understanding of basic financial concepts, including different types of accounts, loans, and investments. Use examples from your personal experience or previous roles to illustrate your knowledge.

4. Practice Transaction Processing

Prepare for questions related to processing financial transactions, such as deposits, withdrawals, and account transfers. Practice executing these transactions accurately and efficiently.

5. Prepare for Sales Questions

Expect questions about your sales experience or ability to generate new business. Highlight your ability to build relationships, identify customer needs, and promote financial products.

6. Dress Professionally and Be Punctual

Make a positive first impression by dressing professionally and arriving on time for your interview. Maintain eye contact, speak clearly, and demonstrate confidence in your abilities.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bank Representative interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!