Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer) interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer) so you can tailor your answers to impress potential employers.

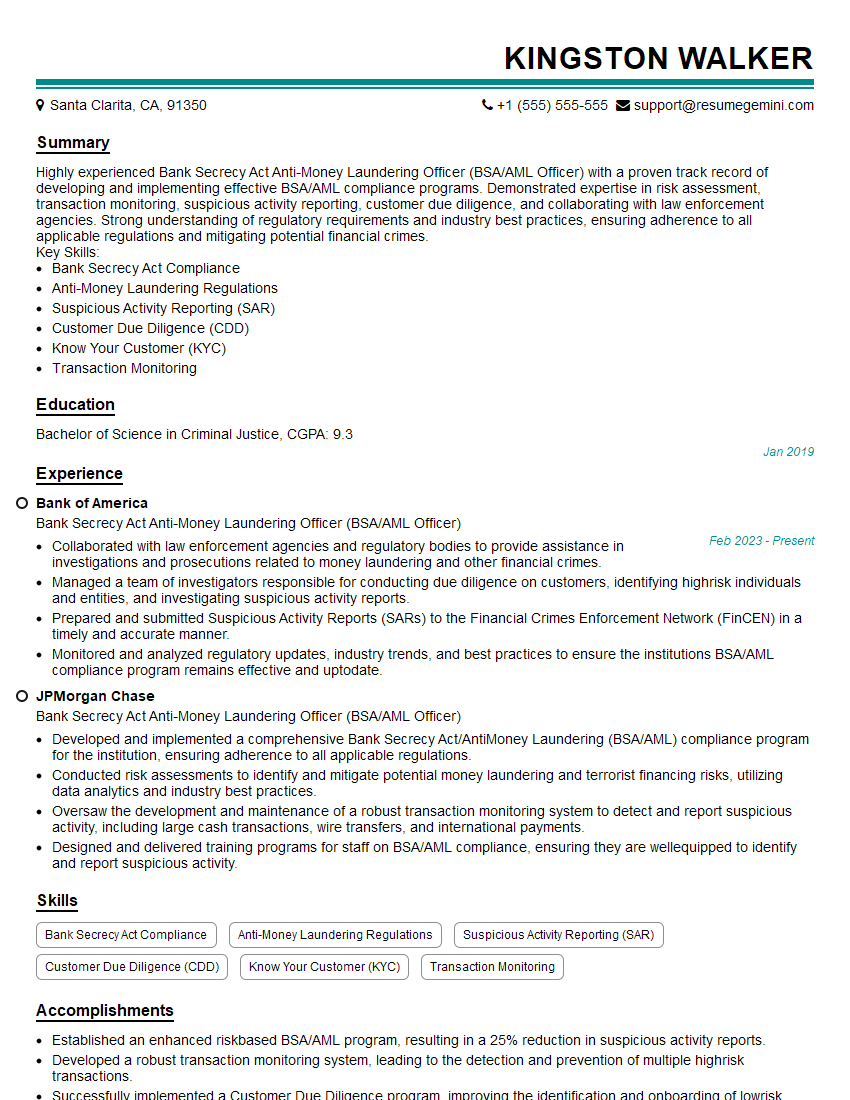

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer)

1. Describe the components of a Bank Secrecy Act (BSA) compliance program.

The components of a BSA compliance program include:

- Customer identification and verification

- Transaction monitoring

- Suspicious activity reporting

- Record keeping

- Training

2. How do you identify and evaluate potential money laundering risks?

Risk assessment

- Review customer profiles and transaction histories

- Identify red flags and suspicious activities

- Assess the risk level of each customer and transaction

Risk mitigation

- Develop and implement appropriate controls to mitigate identified risks

- Monitor the effectiveness of controls and make adjustments as needed

3. What are the key principles of the Anti-Money Laundering (AML) Act of 2020?

The key principles of the AML Act of 2020 include:

- Enhanced customer due diligence

- Expansion of the definition of money laundering

- Increased penalties for money laundering offenses

- Establishment of a national AML database

4. How do you stay up-to-date on changes in BSA/AML regulations and enforcement trends?

- Attend industry conferences and training sessions

- Read industry publications and newsletters

- Consult with regulatory agencies and law enforcement

- Participate in online forums and discussion groups

5. Describe the role of technology in BSA/AML compliance.

- Transaction monitoring and screening

- Customer identification and verification

- Suspicious activity reporting

- Risk assessment and management

- Data analysis and reporting

6. How do you deal with suspicious activity reports (SARs)?

- Review SARs for completeness and accuracy

- Investigate and assess the information provided in SARs

- Determine whether to file a SAR with the appropriate regulatory agency

- Maintain confidentiality and protect the integrity of SARs

7. What are the consequences of non-compliance with BSA/AML regulations?

- Civil penalties

- Criminal prosecution

- Reputational damage

- Loss of license

8. How do you balance the need for BSA/AML compliance with customer service expectations?

- Implement efficient and effective compliance processes

- Train staff on the importance of compliance

- Communicate compliance requirements to customers in a clear and concise manner

- Provide timely and responsive customer service

9. What are the emerging trends in BSA/AML compliance?

- Increased use of technology

- Focus on risk-based approaches

- Greater collaboration between financial institutions and law enforcement

- Increased regulation of virtual currencies

10. Why are you interested in working as a BSA/AML Officer?

I am passionate about preventing money laundering and other financial crimes. I believe that my skills and experience in compliance, law enforcement, and risk management would make me a valuable asset to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) Officer is responsible for ensuring that the bank complies with all applicable laws and regulations related to BSA and AML. This includes developing and implementing policies and procedures, training staff, and monitoring transactions for suspicious activity.

1. Develop and implement BSA/AML policies and procedures

The BSA/AML Officer is responsible for developing and implementing policies and procedures that ensure the bank complies with all applicable laws and regulations. These policies and procedures should be designed to prevent and detect money laundering and other financial crimes.

- Review and update BSA/AML policies and procedures

- Develop and implement training programs for staff on BSA/AML compliance

2. Train staff on BSA/AML compliance

The BSA/AML Officer is responsible for training staff on BSA/AML compliance. This training should cover the bank’s policies and procedures, as well as the laws and regulations that apply to BSA/AML compliance.

- Conduct risk assessments to identify areas where the bank is vulnerable to money laundering or other financial crime

- File Suspicious Activity Reports (SARs) with the Financial Crimes Enforcement Network (FinCEN)

3. Monitor transactions for suspicious activity

The BSA/AML Officer is responsible for monitoring transactions for suspicious activity. This activity may include large or unusual transactions, transactions that are inconsistent with the customer’s normal activity, or transactions that are conducted with known or suspected money launderers.

- Review customer accounts for suspicious activity

- Investigate suspicious activity and file SARs as necessary

4. Report suspicious activity to law enforcement

The BSA/AML Officer is responsible for reporting suspicious activity to law enforcement. This activity may include transactions that are suspected of being related to money laundering or other financial crimes.

- Cooperate with law enforcement investigations

- Maintain records of all BSA/AML compliance activities

Interview Tips

Here are some tips to help you ace your interview for a BSA/AML Officer position:

1. Research the bank and the BSA/AML industry

Before your interview, take some time to research the bank and the BSA/AML industry. This will help you understand the bank’s culture and the challenges that the BSA/AML industry is facing.

- Read the bank’s website and annual report

- Review the latest news and articles on BSA/AML compliance

2. Be prepared to discuss your experience and qualifications

Make sure you can clearly and concisely articulate your experience and qualifications for the BSA/AML Officer position. Be prepared to discuss your knowledge of BSA/AML laws and regulations, as well as your experience in developing and implementing BSA/AML policies and procedures.

- Highlight your skills in risk assessment, transaction monitoring, and SAR filing

- Emphasize your ability to work independently and as part of a team

3. Be prepared to answer questions about your motivation for working in the BSA/AML field

Why are you interested in working in the BSA/AML field? What do you find most rewarding about this work? What are your career goals? These are all common questions that you may be asked during your interview. Be prepared to answer these questions honestly and thoughtfully.

- Share your passion for combating financial crime

- Explain how your skills and experience make you a good fit for the BSA/AML field

4. Be confident and enthusiastic

Confidence and enthusiasm are key qualities for any successful BSA/AML Officer. Be confident in your abilities and enthusiastic about the opportunity to work in this field.

- Make eye contact with the interviewer

- Speak clearly and concisely

Next Step:

Now that you’re armed with the knowledge of Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer) interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Bank Secrecy Act Anti-Money Laundering Officer (BSA/AML Officer) positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini