Feeling lost in a sea of interview questions? Landed that dream interview for Bank Teller but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Bank Teller interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

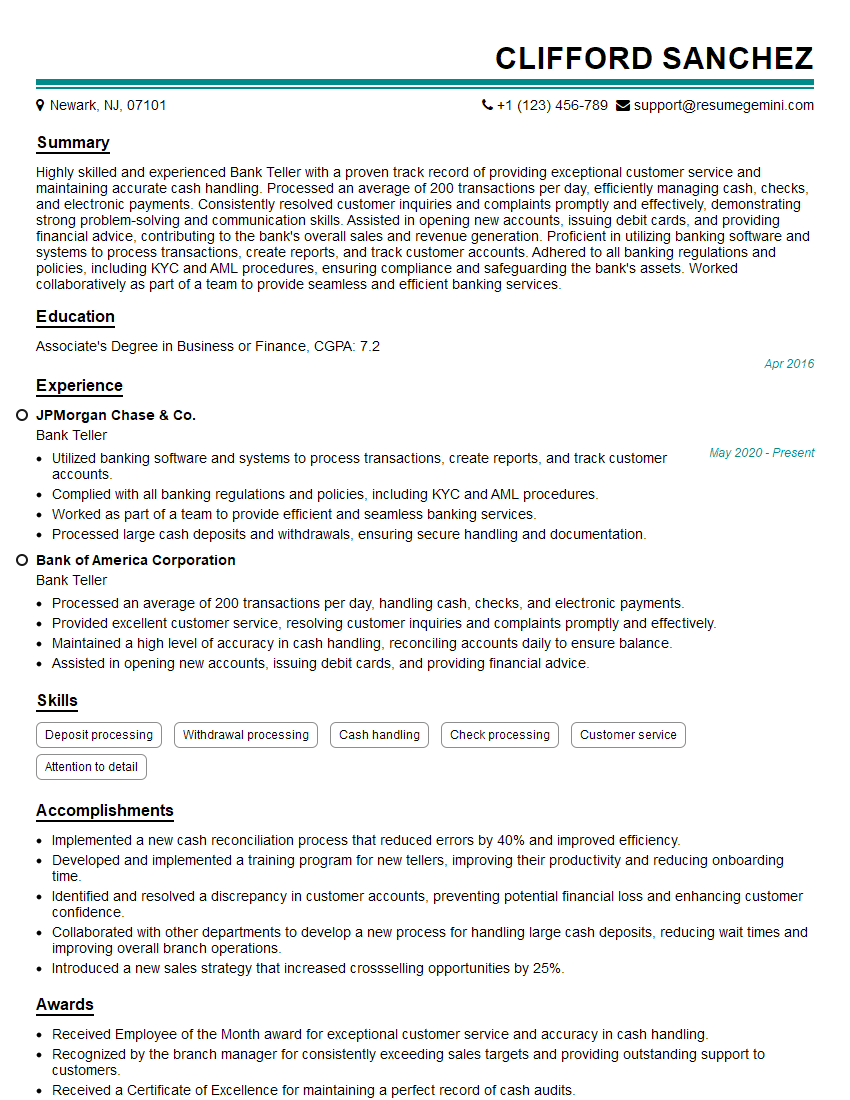

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Teller

1. What are the key responsibilities of a Bank Teller?

As a Bank Teller, I would be responsible for providing excellent customer service to the bank’s clients. This would include greeting customers, processing transactions, and answering any questions they may have about their accounts or the bank’s services. I would also be responsible for maintaining the teller line and ensuring that all transactions are processed accurately and efficiently.

2. What are the qualities and skills required to be an effective Bank Teller?

- Excellent customer service skills

- Accuracy and attention to detail

- Strong mathematical skills

- Ability to work quickly and efficiently under pressure

- Teamwork and communication skills

3. How would you handle a situation where a customer is angry or upset?

If a customer is angry or upset, I would first try to remain calm and professional. I would then try to understand the customer’s concern and address it in a respectful and helpful manner. I would also apologize for any inconvenience and try to resolve the issue as quickly as possible. If necessary, I would escalate the issue to my manager or supervisor for assistance.

4. What are the different types of transactions that a Bank Teller typically processes?

- Deposits

- Withdrawals

- Transfers

- Check cashing

- Money orders

- Cashier’s checks

5. What are the security procedures that a Bank Teller must follow?

- Verifying the identity of customers

- Counting and handling cash carefully

- Protecting customer information

- Following all bank policies and procedures

6. What are the different types of accounts that a Bank Teller may encounter?

- Checking accounts

- Savings accounts

- Money market accounts

- Certificates of deposit

- Individual retirement accounts

7. What are some of the challenges that a Bank Teller may face?

- Dealing with difficult customers

- Working under pressure

- Maintaining accuracy and efficiency

- Keeping up with new bank products and services

8. What are the opportunities for advancement for a Bank Teller?

- Customer service representative

- Bank manager

- Loan officer

- Financial advisor

9. Why are you interested in becoming a Bank Teller?

I am interested in becoming a Bank Teller because I am passionate about providing excellent customer service and I am confident that I have the skills and experience necessary to be successful in this role. I am also eager to learn more about the banking industry and to grow my career in this field.

10. What are your salary expectations?

My salary expectations are in line with the industry average for Bank Tellers in this area. I am confident that I can provide value to your bank and I am willing to negotiate a salary that is fair and competitive.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bank Tellers play a crucial role in the seamless operation of banks, providing essential services to customers and ensuring financial transactions are processed efficiently and accurately. Here are the key responsibilities of a Bank Teller:

1. Customer Service and Communication

Interact with customers: Welcome customers, greet them professionally, and assist them with various financial transactions such as deposits, withdrawals, and loan payments.

Respond to inquiries: Provide clear and concise information to customers regarding bank products, services, and account balances.

Maintain positive relationships: Build rapport with customers by being friendly, courteous, and attentive to their needs.

2. Transaction Processing

Receive and count cash: Accept deposits and withdrawals, verifying the accuracy of the amount and ensuring proper documentation.

Issue checks: Prepare and issue checks for customers, adhering to bank policies and procedures.

Process loans and other transactions: Assist customers with loan applications, payments, and other financial transactions.

3. Account Maintenance

Open new accounts: Guide customers through the account opening process, explaining account features and benefits.

Update account information: Assist customers with address changes, beneficiary updates, and other account-related inquiries.

Close accounts: Process account closures according to bank procedures and ensure proper documentation.

4. Security and Compliance

Maintain cash drawer: Ensure the accuracy and security of the cash drawer throughout the shift.

Follow bank policies: Adhere to all bank policies and procedures related to cash handling, customer service, and security.

Prevent fraud: Be vigilant in detecting and preventing fraudulent activities and report suspicious transactions promptly.

Interview Preparation Tips

Preparing for a Bank Teller interview requires careful planning and a thorough understanding of the role and responsibilities. Here are some tips to help candidates ace their interview:

1. Research the Bank and Position

Study the bank’s website: Learn about the bank’s history, products, services, and culture.

Review the job description: Carefully read and understand the key responsibilities and qualifications outlined in the job description.

Network with industry professionals: Connect with individuals working in the banking industry to gain insights and learn about potential interview questions.

2. Highlight Relevant Skills and Experience

Quantify your accomplishments: Use specific numbers and metrics to demonstrate your achievements in previous roles.

Showcase customer service skills: Emphasize your ability to interact with customers professionally and resolve their concerns.

Demonstrate attention to detail: Highlight your accuracy and attention to detail in handling financial transactions.

3. Prepare for Common Interview Questions

Practice STAR Method: Use the STAR (Situation, Task, Action, Result) method to structure your answers and provide specific examples of your work experience.

Anticipate behavioral questions: Prepare for questions that assess your customer service skills, problem-solving abilities, and work ethic.

Review technical questions: Familiarize yourself with basic banking terminology and concepts, such as account types, transaction processing, and fraud prevention.

4. Dress Professionally and Arrive on Time

Dress appropriately: First impressions matter, so dress professionally and conservatively.

Be punctual: Arrive for your interview on time to show respect for the interviewer’s schedule.

Be prepared with questions: Asking thoughtful questions at the end of the interview shows your interest in the position and the bank.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bank Teller interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!