Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Banker position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

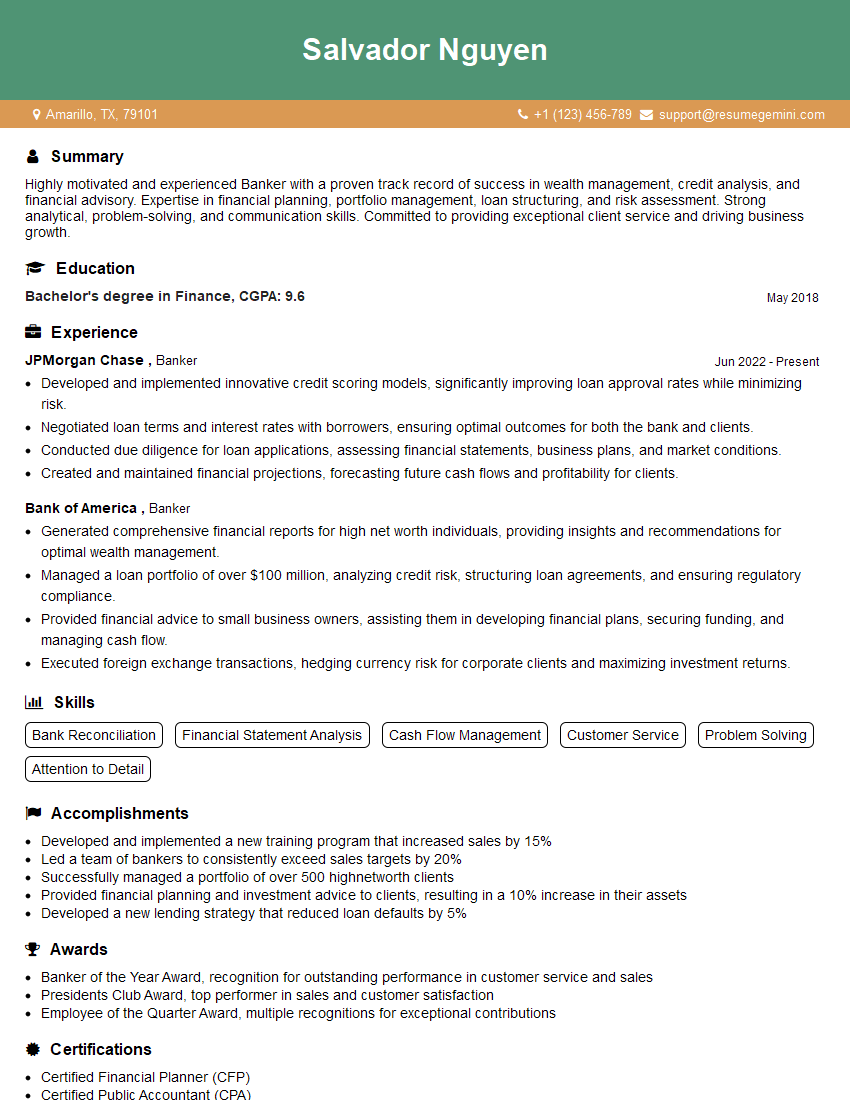

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Banker

1. Describe the key financial ratios that you would use to assess the financial health of a corporate borrower.

Answer:

- Liquidity ratios: These measure the company’s ability to meet its short-term obligations. Examples include the current ratio and quick ratio.

- Solvency ratios: These assess the company’s ability to meet its long-term obligations. Examples include the debt-to-equity ratio and times interest earned ratio.

- Profitability ratios: These measure the company’s ability to generate profits. Examples include gross profit margin and net profit margin.

- Efficiency ratios: These measure how efficiently the company is using its assets. Examples include inventory turnover ratio and accounts receivable turnover ratio.

2. Explain the process of credit risk assessment for a commercial loan.

: Quantitative Analysis

- Review the borrower’s financial statements to assess its financial health.

- Analyze industry trends and the borrower’s competitive position.

Subheading: Qualitative Analysis

- Meet with the borrower’s management to discuss its business strategy and financial projections.

- Assess the borrower’s character and experience.

3. What are the different types of collateral that can be used to secure a loan?

Answer:

- Real estate: Mortgages and deeds of trust

- Personal property: Motor vehicles, equipment, inventory

- Financial assets: Stocks, bonds, certificates of deposit

- Guarantees: Personal guarantees from individuals or corporations

4. Describe the process of loan origination from application to closing.

Answer:

- Application: Borrower completes a loan application and provides supporting documentation.

- Processing: Lender underwrites the loan and verifies the borrower’s information.

- Approval: Lender approves the loan and issues a loan commitment.

- Closing: Borrower signs the loan documents and receives the loan proceeds.

5. What are the key regulations that govern the banking industry?

Answer:

- The Dodd-Frank Wall Street Reform and Consumer Protection Act

- The Federal Deposit Insurance Act

- The Truth in Lending Act

- The Equal Credit Opportunity Act

6. Describe your experience in managing a loan portfolio.

Answer:

- Monitored the performance of loans and took appropriate action to mitigate risk.

- Worked with borrowers to restructure loans and prevent defaults.

- Managed the sale of non-performing loans.

7. What are the different types of banking products and services that you are familiar with?

Answer:

- Deposit accounts: Checking accounts, savings accounts, money market accounts, certificates of deposit

- Loan products: Commercial loans, consumer loans, mortgages

- Investment products: Mutual funds, exchange-traded funds, annuities

- Financial planning services: Retirement planning, estate planning

8. Describe a challenging situation that you faced in your previous role as a banker and how you resolved it.

Answer:

- Describe the situation and the challenges that you faced.

- Explain the steps that you took to resolve the situation.

- Discuss the outcome of the situation and what you learned from it.

9. What are your strengths and weaknesses as a banker?

Answer:

Strengths:

- Strong understanding of financial principles and banking regulations

- Excellent analytical and problem-solving skills

- Ability to build strong relationships with clients

Weaknesses:

- Limited experience in managing a large loan portfolio

- Could improve my public speaking skills

10. Why are you interested in this position and why do you think you are the best candidate for the role?

Answer:

- Explain your interest in the position and why you are a good fit for the role.

- Highlight your skills, experience, and qualifications that make you the best candidate.

- Express your enthusiasm for the opportunity to join the team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Banker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Banker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bankers are responsible for managing the financial transactions of individuals and businesses. They provide advice on financial products and services, and help customers with their banking needs.

1. Manage customer accounts

Bankers are responsible for opening and closing customer accounts, and for processing deposits and withdrawals. They also provide customers with information about their accounts and help them with any problems they may have.

- Open and close customer accounts

- Process deposits and withdrawals

- Provide customers with information about their accounts

- Help customers with any problems they may have

2. Provide financial advice

Bankers can provide financial advice to customers on a variety of topics, such as saving, investing, and retirement planning. They can also help customers with budgeting and managing their debt.

- Provide financial advice on saving, investing, and retirement planning

- Help customers with budgeting and managing their debt

3. Sell financial products and services

Bankers can sell financial products and services to customers, such as loans, mortgages, and insurance. They can also help customers with estate planning and other financial needs.

- Sell financial products and services such as loans, mortgages, and insurance

- Help customers with estate planning and other financial needs

4. Maintain customer relationships

Bankers are responsible for maintaining customer relationships. They can do this by providing excellent customer service, and by following up with customers on a regular basis.

- Provide excellent customer service

- Follow up with customers on a regular basis

Interview Tips

Preparing for a banking interview can be daunting, but by following these tips, you can increase your chances of success.

1. Research the bank and the position

Before you go to your interview, take some time to research the bank and the position you are applying for. This will help you understand the bank’s culture and what the job entails.

- Visit the bank’s website

- Read articles about the bank and the industry

- Talk to people who work at the bank

- Tell me about yourself.

- Why are you interested in banking?

- What are your strengths and weaknesses?

- What are your career goals?

2. Practice common interview questions

There are some common interview questions that you are likely to be asked. Take some time to practice answering these questions, so that you can deliver your answers confidently and clearly.

3. Dress professionally

First impressions matter, so it is important to dress professionally for your interview. This means wearing a suit or business dress, and making sure that your clothes are clean and pressed.

4. Be on time

Punctuality is important, so make sure that you arrive for your interview on time. If you are running late, call the bank to let them know.

5. Be prepared to talk about your experience

The interviewer will likely ask you about your experience in banking. Be prepared to talk about your skills and accomplishments, and how they can benefit the bank.

6. Ask questions

At the end of the interview, the interviewer will likely ask if you have any questions. This is your chance to learn more about the bank and the position. Ask thoughtful questions that show that you are interested in the job.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Banker, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Banker positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.