Feeling lost in a sea of interview questions? Landed that dream interview for Banker Mason but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Banker Mason interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

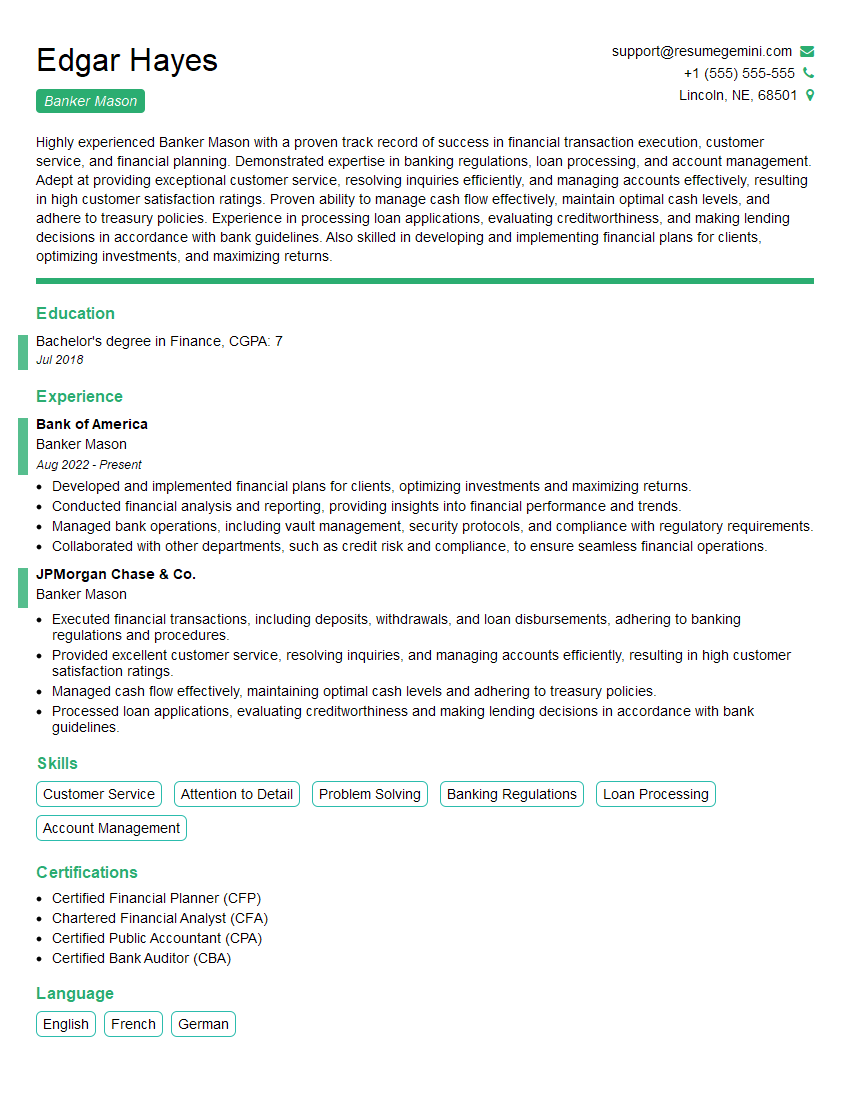

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Banker Mason

1. What is the process of determining the creditworthiness of a potential borrower?

The process of determining the creditworthiness of a potential borrower involves evaluating their credit history, income, assets, and debt obligations. The goal is to assess their ability to repay the loan on time and in full.

- Review credit history: Check credit reports for any negative items, such as missed payments or defaults.

- Evaluate income and employment: Assess the borrower’s income stability, employment history, and earning potential.

- Analyze assets and liabilities: Determine the borrower’s financial resources and obligations, including their assets (e.g., property, investments) and debts.

- Consider debt-to-income ratio: Calculate the percentage of the borrower’s income that goes towards debt payments. A high ratio may indicate a higher risk of default.

2. How do you assess the financial health of a company for loan approval?

Debt and Leverage

- Review debt-to-equity ratio: A high ratio indicates the company relies heavily on debt, which can increase risk.

- Examine interest coverage ratio: Calculates how well a company’s earnings cover its interest expenses. A low ratio may indicate difficulty repaying debt.

Profitability

- Analyze gross profit margin: Indicates the percentage of sales revenue that exceeds the cost of goods sold.

- Evaluate net profit margin: Shows the percentage of sales revenue that remains after all expenses are paid.

Liquidity

- Calculate current ratio: Assesses a company’s ability to meet short-term obligations.

- Examine quick ratio: A stricter measure of liquidity, excluding inventory from current assets.

3. What are the different types of financial instruments available for investment?

There are a wide range of financial instruments available for investment, each with its own risk and return profile.

- Stocks: Represent ownership in a company and offer potential for capital appreciation and dividends.

- Bonds: Loans made to companies or governments, providing fixed income payments and varying levels of risk.

- Mutual funds: Pooled investments that diversify risk across multiple underlying assets.

- Exchange-traded funds (ETFs): Baskets of securities that track an index or sector, providing exposure to a broad range of assets.

- Derivatives: Contracts that derive their value from an underlying asset, such as futures, options, and swaps.

4. How do you manage risk in a financial institution?

Risk management is essential in financial institutions to protect against potential losses and ensure financial stability.

- Identify and assess risks: Establish a comprehensive risk assessment framework to identify and evaluate potential risks.

- Develop and implement risk mitigation strategies: Implement measures to reduce or minimize the impact of identified risks.

- Monitor and control risks: Continuously monitor risks and make adjustments to strategies as needed.

- Establish risk limits: Set limits on the amount of risk the institution is willing to take.

- Maintain adequate capital and liquidity: Ensure sufficient capital and liquidity to absorb potential losses.

5. What is the difference between a bank and a credit union?

Banks and credit unions are both financial institutions that offer similar services, such as savings accounts, loans, and credit cards. However, there are some key differences.

- Ownership: Banks are typically owned by shareholders, while credit unions are owned by their members.

- Profit motive: Banks operate for profit, while credit unions are not-for-profit organizations that return earnings to their members.

- Membership: Banks are open to the general public, while credit unions typically require membership based on factors such as location or employer.

- Fees and interest rates: Credit unions often offer lower fees and interest rates on loans and higher interest rates on savings accounts than banks.

6. What are the current trends in the banking industry?

The banking industry is constantly evolving, with new trends emerging all the time.

- Digital banking: The rise of online and mobile banking has made it easier for customers to access banking services anytime, anywhere.

- Artificial intelligence (AI): AI is being used to automate tasks, improve customer service, and enhance risk management.

- Blockchain technology: Blockchain is being explored for use in various banking applications, such as faster and more secure payments.

- Open banking: Open banking initiatives allow customers to share their financial data with third-party providers, enabling new and innovative financial services.

7. What are the key challenges facing the banking industry?

The banking industry faces a number of challenges, including:

- Competition from non-traditional financial providers, such as fintech companies.

- Regulatory compliance: Banks must navigate a complex and constantly evolving regulatory landscape.

- Cybersecurity threats: Banks are prime targets for cyberattacks, which can result in data breaches and financial losses.

- Low interest rates: Low interest rates can squeeze bank margins and reduce profitability.

- Economic uncertainty: Economic downturns can lead to increased loan defaults and reduced demand for financial services.

8. How would you approach developing a financial plan for a client?

Developing a financial plan for a client involves a comprehensive process that typically includes the following steps:

- Gather client information: Collect information about the client’s financial situation, goals, and risk tolerance.

- Analyze financial situation: Review the client’s income, expenses, assets, and liabilities to assess their current financial health.

- Identify financial goals: Determine the client’s short-term and long-term financial goals, such as retirement, education funding, or homeownership.

- Develop a financial plan: Outline a roadmap for achieving the client’s goals, considering factors such as investment strategies, retirement planning, and estate planning.

- Implement and monitor the plan: Help the client put the plan into action and make adjustments as needed.

9. What is your understanding of ethical considerations in financial advisory?

Ethical considerations are paramount in financial advisory, and I adhere to the following principles:

- Fiduciary duty: Always acting in the best interests of my clients.

- Transparency: Disclosing all relevant information and potential conflicts of interest.

- Suitability: Recommending investments that are appropriate for my clients’ individual circumstances and risk tolerance.

- Objectivity: Avoiding bias and conflicts of interest in providing financial advice.

- Continuing education: Staying up-to-date on industry knowledge and best practices to provide informed advice.

10. Describe a situation where you had to balance the needs of multiple stakeholders while making a financial decision.

In my previous role, I was involved in a decision to invest in a new technology platform. There were multiple stakeholders with varying interests, including the CEO, CFO, and IT department.

- The CEO prioritized the potential for innovation and growth.

- The CFO focused on the financial implications and return on investment.

- The IT department emphasized the technical feasibility and compatibility with existing systems.

I facilitated discussions, gathered data, and presented various scenarios to align the stakeholders’ perspectives. By carefully considering the needs and concerns of each stakeholder, we reached a decision that balanced the potential benefits, financial impact, and technical requirements.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Banker Mason.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Banker Mason‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Banker Mason is responsible for various tasks that contribute to the smooth functioning of a bank or financial institution. Here are some key job responsibilities:

1. Customer Service

Interact with customers to open new accounts, process transactions, and provide financial advice.

- Greet customers and assist them with their banking needs.

- Open and close accounts, process deposits and withdrawals.

2. Account Management

Manage customer accounts, including opening, closing, and maintaining them.

- Create and update customer accounts as per bank policies.

- Monitor and track balances, transactions, and other account activities.

3. Lending and Credit Analysis

Evaluate loan applications and make recommendations on approvals or denials.

- Analyze financial statements and credit reports.

- Interview loan applicants and assess their creditworthiness.

4. Sales and Marketing

Promote bank products and services to potential customers.

- Meet with clients to discuss their financial needs.

- Identify and qualify potential customers.

Interview Tips

Preparing for an interview for a Banker Mason position is crucial to making a positive impression and increasing your chances of success. Here are some interview tips:

1. Research the Bank and Position

Research the bank you are applying to and the specific Banker Mason role. This will help you understand the company culture, its products and services, and the specific responsibilities of the position.

- Visit the bank’s website to learn about its history, mission, and values.

- Read industry publications and news articles to stay up-to-date on banking trends.

2. Practice Common Interview Questions

Practice answering common interview questions, such as “Why are you interested in this position?” and “Tell me about a time you provided excellent customer service.” You can prepare for these questions by reviewing sample interview questions and answers online or in books.

- Anticipate questions about your banking experience, skills, and knowledge.

- Prepare specific examples that demonstrate your abilities.

3. Be Prepared to Discuss Your Experience and Skills

Highlight your banking experience and skills that are relevant to the Banker Mason role. Quantify your accomplishments and provide specific examples of your success. You can use the STAR method to answer interview questions by providing a Situation, Task, Action, and Result.

- Emphasize your communication skills, customer service experience, and attention to detail.

- Quantify your achievements whenever possible.

4. Dress Professionally and Arrive on Time

Dress professionally and arrive on time for your interview. First impressions matter, so make sure you present yourself in a positive and polished manner.

- Wear a suit or business casual attire.

- Be punctual and respectful of the interviewer’s time.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Banker Mason interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!