Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Banking Center Manager (BCM) position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

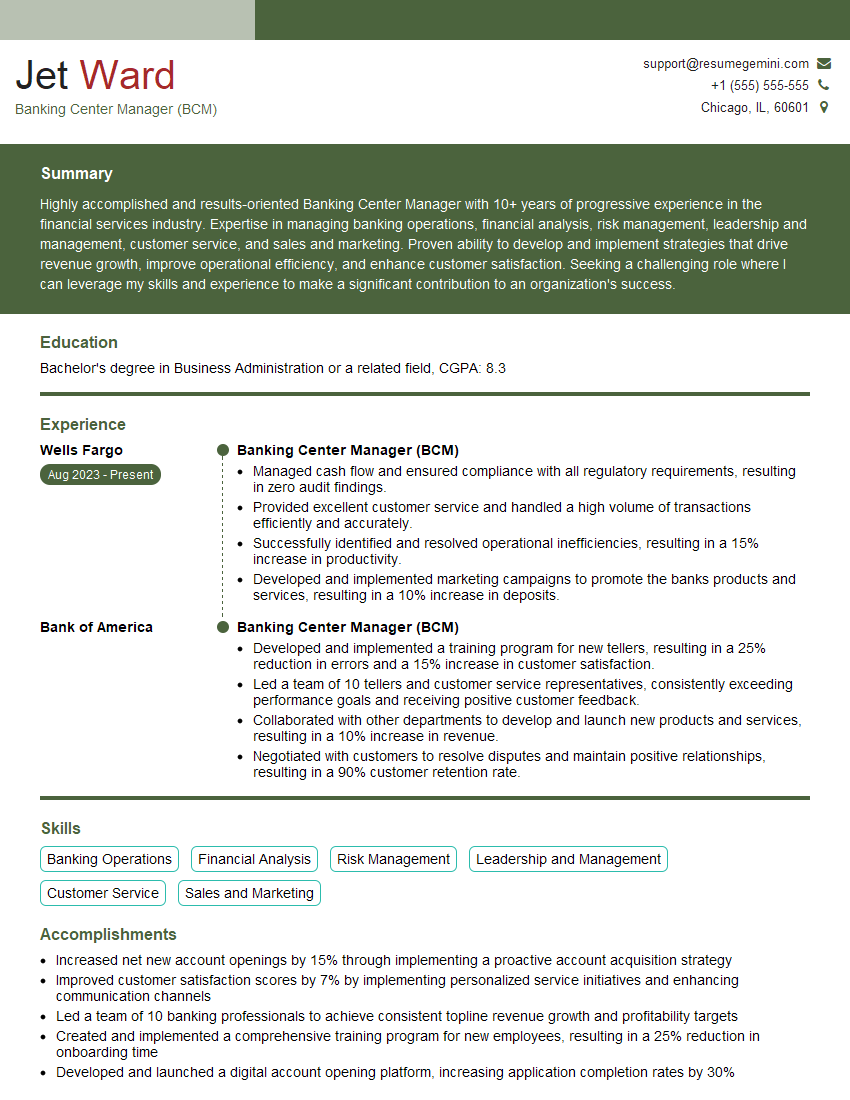

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Banking Center Manager (BCM)

1. What are the key responsibilities of a Banking Center Manager?

As a Banking Center Manager, my responsibilities encompass:

- Leading and motivating a team of tellers and customer service representatives.

- Ensuring the smooth and efficient operation of the branch, including compliance with all regulatory requirements.

- Developing and implementing strategies to increase revenue and customer satisfaction.

- Managing the branch’s budget and ensuring profitability.

- Representing the bank in the community and building relationships with local businesses and organizations.

2. How do you stay up-to-date on industry trends and best practices?

Attending conferences and workshops

- I regularly attend industry conferences and workshops to gain insights into the latest trends and best practices in banking. This allows me to stay informed about new products, services, and technologies.

Reading industry publications and research

- I subscribe to industry publications and research journals to stay abreast of the latest developments in the field. This helps me to identify emerging trends and understand the impact they may have on the banking industry.

Networking with other professionals

- I actively network with other banking professionals through industry associations and online forums. This allows me to exchange ideas, share best practices, and learn from the experiences of others.

3. What are some of the challenges you have faced as a Banking Center Manager?

One of the biggest challenges I have faced is managing the branch’s budget and ensuring profitability. In the current economic climate, it is essential to carefully control expenses and find ways to increase revenue. I have implemented a number of strategies to achieve this, such as cross-selling products and services to customers and finding ways to streamline operations.

Another challenge is keeping up with the ever-changing regulatory environment. The banking industry is heavily regulated, and it is important to stay up-to-date on the latest changes. I regularly attend training sessions and review regulatory updates to ensure that the branch is in compliance.

4. What are your strengths as a Banking Center Manager?

- Excellent leadership and communication skills.

- Proven ability to increase revenue and customer satisfaction.

- Strong understanding of the banking industry and regulatory environment.

- Ability to motivate and develop a team of employees.

5. What are your goals as a Banking Center Manager?

- To lead the branch to profitability and growth.

- To improve the customer experience and build strong relationships with the community.

- To develop and mentor a team of high-performing employees.

6. How would you handle a situation where a customer is angry or upset?

- Remain calm and professional.

- Listen to the customer’s concerns and try to understand their perspective.

- Apologize for any inconvenience and take steps to resolve the issue.

- Follow up with the customer to ensure that they are satisfied with the resolution.

7. What are your thoughts on the future of banking?

I believe that the future of banking is bright. The industry is constantly evolving, and new technologies are emerging that are making it easier for customers to bank with us. I am excited to see what the future holds for the banking industry and I am confident that I can continue to play a role in its success.

8. What are some of the most important qualities of a successful Banking Center Manager?

- Strong leadership skills.

- Excellent communication skills.

- Proven ability to increase revenue and customer satisfaction.

- Strong understanding of the banking industry and regulatory environment.

- Ability to motivate and develop a team of employees.

9. What are some of the challenges facing the banking industry today?

- The rising cost of regulation.

- The increasing competition from non-traditional financial institutions.

- The changing needs of customers.

- The impact of technology on the industry.

10. What are your thoughts on the use of technology in banking?

I believe that technology can be a powerful tool for banks to improve the customer experience and increase efficiency. However, it is important to use technology in a way that complements the human touch. I believe that the best banks will be those that are able to strike the right balance between technology and personal service.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Banking Center Manager (BCM).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Banking Center Manager (BCM)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Banking Center Managers (BCM) play a pivotal role in the success of a bank branch. They are responsible for leading a team of employees, managing daily banking operations, and ensuring that customers receive exceptional service.

1. Branch Operations Management

BCM oversees all aspects of branch operations, including cash handling, account openings, loan processing, and customer service.

- Ensures compliance with bank policies and procedures

- Monitors branch performance and identifies areas for improvement

2. Team Leadership and Development

BCMs are responsible for hiring, training, and motivating their team. They create a positive and productive work environment.

- Provides coaching and feedback to team members

- Promotes a culture of teamwork and collaboration

- Identifies training needs and develops training programs

3. Customer Relationship Management

BCM develops and maintains relationships with customers. They understand customer needs and provide personalized service.

- Resolves customer issues and complaints

- Provides financial advice and guidance

- Builds a loyal customer base

4. Financial Management

BCM is responsible for managing the branch’s budget. They track expenses and ensure that the branch is operating profitably.

- Prepares and monitors branch budget

- Forecasts revenue and expenses

- Identifies and implements cost-saving measures

Interview Tips

Preparing thoroughly for your BCM interview can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Bank and Position

Before the interview, take the time to research the bank and the specific BCM position you are applying for. Understand the bank’s mission, values, and products.

- Visit the bank’s website and read their annual report

- Check out the bank’s social media pages

- Network with people who work at the bank

2. Practice Answering Common Interview Questions

There are several common interview questions that you are likely to be asked in a BCM interview. Prepare thoughtful and concise answers to these questions, using the STAR method (Situation, Task, Action, Result) when applicable.

- Tell me about your experience in banking.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- How do you handle difficult customers?

- What are your goals for the future?

3. Emphasize Your Skills and Experience

In your interview, be sure to highlight the skills and experience that make you a qualified candidate for the BCM position.

- Quantify your accomplishments whenever possible.

- Use specific examples to illustrate your skills.

- Be prepared to discuss your experience in leading and motivating a team.

- Share your knowledge of banking products and services.

4. Be Enthusiastic and Professional

First impressions matter, so make sure you arrive at your interview on time and dress professionally. Be enthusiastic and positive throughout the interview. Demonstrate your interest in the position and the bank and let your personality shine through.

- Make eye contact with the interviewer.

- Be polite and respectful.

- Ask questions to show that you are engaged.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Banking Center Manager (BCM) interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.