Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Banking Services Officer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

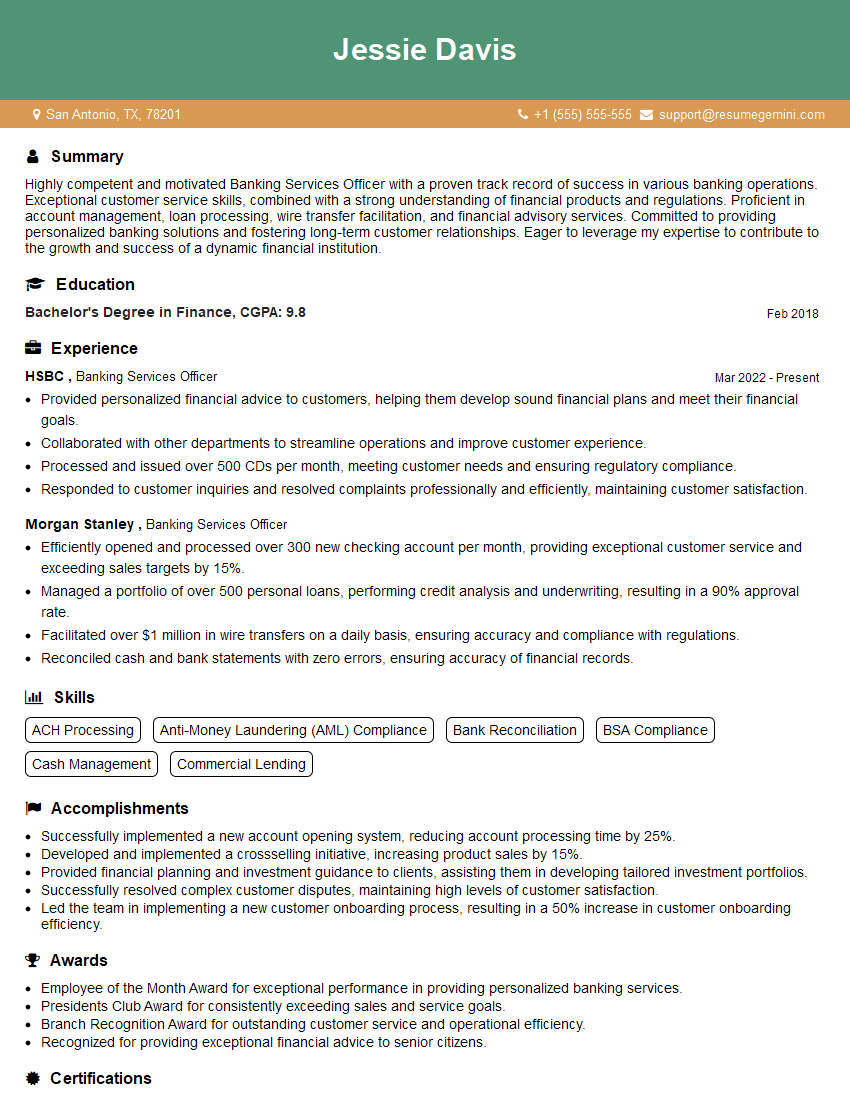

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Banking Services Officer

1. What is the difference between a demand loan and a term loan?

A demand loan is a loan that does not have a fixed maturity date and can be called due by the lender at any time. A term loan is a loan that has a fixed maturity date and must be repaid by that date.

2. What is the role of the Basel Accords in the banking industry?

Capital Adequacy

- Ensures that banks maintain sufficient capital to cover potential losses.

- Prevents banks from taking excessive risks that could destabilize the financial system.

Risk Management

- Requires banks to develop robust risk management frameworks.

- Helps banks identify and mitigate potential risks.

3. Explain the concept of net present value (NPV).

Net present value (NPV) is a financial metric that calculates the present value of a series of future cash flows. It is used to determine the profitability of an investment or project. A positive NPV indicates that the investment is expected to generate a positive return, while a negative NPV indicates that the investment is expected to lose money.

4. Discuss the different types of financial ratios and their uses.

Financial ratios are used to analyze a company’s financial performance and health. There are different types of financial ratios, including:

- Liquidity ratios: Measure a company’s ability to meet its short-term obligations.

- Solvency ratios: Measure a company’s ability to meet its long-term obligations.

- Profitability ratios: Measure a company’s profitability.

- Efficiency ratios: Measure a company’s efficiency in using its assets and resources.

5. Explain the process of bank reconciliation.

Bank reconciliation is the process of comparing a company’s bank statement to its own records to identify any discrepancies. It is important to perform bank reconciliation regularly to ensure that the company’s financial records are accurate and up-to-date.

6. What are the key elements of a strong internal control system?

- Tone at the top: Management must set the tone for ethical behavior and compliance.

- Risk assessment: Companies must regularly assess their risks and implement controls to mitigate those risks.

- Control activities: Companies must implement a variety of control activities, such as separation of duties, authorization procedures, and physical safeguards.

- Information and communication: Companies must have systems in place to collect, process, and communicate financial and non-financial information.

- Monitoring: Companies must regularly monitor their internal control systems to ensure that they are operating effectively.

7. Discuss the role of a Banking Services Officer in managing customer relationships.

Banking Services Officers play a crucial role in managing customer relationships. They are responsible for:

- Providing excellent customer service.

- Building and maintaining strong relationships with customers.

- Identifying and meeting customer needs.

- Cross-selling and up-selling products and services.

- Resolving customer complaints.

8. Explain the process of loan origination.

The loan origination process involves several steps:

- Loan application: The potential borrower submits a loan application to the lender.

- Credit analysis: The lender assesses the borrower’s creditworthiness.

- Loan approval: The lender decides whether to approve the loan.

- Loan closing: The borrower and lender sign the loan documents and the loan is funded.

9. Discuss the different types of lending products offered by banks.

Banks offer a wide variety of lending products, including:

- Personal loans: Loans to individuals for various purposes.

- Business loans: Loans to businesses for working capital, expansion, or investment.

- Commercial real estate loans: Loans to businesses for the purchase or development of commercial properties.

- Residential real estate loans: Loans to individuals for the purchase or refinance of homes.

10. Explain the process of credit risk management.

Credit risk management involves the following steps:

- Credit analysis: Assessing the creditworthiness of potential borrowers.

- Loan monitoring: Monitoring the performance of existing loans.

- Loan collection: Collecting overdue loans.

- Loan loss provisioning: Setting aside funds to cover potential loan losses.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Banking Services Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Banking Services Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Banking Services Officers are customer-facing professionals who manage a wide range of banking transactions and provide financial advice to clients. The key job responsibilities include:

1. Providing exceptional customer service

Greeting and assisting customers in a friendly and professional manner, establishing a rapport, and going above and beyond to meet their needs.

- Answering customer inquiries

- Handling customer complaints

2. Processing banking transactions

Accurately and efficiently processing cash transactions, checks, deposits, withdrawals, and loan payments, while adhering to bank policies and procedures

- Opening and closing accounts

- Issuing cashier’s checks

- Processing wire transfers

3. Providing financial advice

Assessing customer needs, providing guidance on financial products and services, and making recommendations to help them achieve their financial goals

- Discussing interest rates

- Explaining loan options

- Comparing investment products

4. Maintaining account records

Updating and maintaining customer account records, including balances, transactions, and contact information, ensuring accuracy and confidentiality.

- Creating account statements

- Maintaining account ledgers

- Processing account closures

Interview Tips

Preparing thoroughly for a Banking Services Officer interview is crucial to making a positive impression and increasing your chances of success. Here are some essential tips to help you ace the interview

1. Research the bank and position

Explore the bank’s website, read news articles, and gather information about their products, services, and culture. This will demonstrate your interest and knowledge, which will be well received by your interviewers

- Tailor your resume and cover letter to highlight the skills and experience most relevant to the position.

- Practice answering common interview questions specifically related to the banking industry.

2. Emphasize your customer service skills

Customer service is paramount for a Banking Services Officer. Explain how you build relationships with customers, resolve their concerns, and create a positive banking experience

- Share examples of how you have gone above and beyond to assist customers.

- Discuss your ability to handle difficult customers and maintain a professional demeanor.

3. Highlight your financial knowledge

Demonstrate your understanding of banking products, services, and financial concepts. Explain how you have helped customers make informed financial decisions

- Discuss your experience with different types of accounts, investments, and loans.

- Explain your knowledge of financial regulations and compliance.

4. Practice common interview questions

Anticipate common interview questions, such as “Why are you interested in working as a Banking Services Officer?” and “What are your strengths and weaknesses?” Prepare thoughtful and concise answers that highlight your skills

- Prepare questions to ask the interviewer, demonstrating your enthusiasm and interest.

- Dress professionally and arrive on time for your interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Banking Services Officer interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.