Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Banking Supervisor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

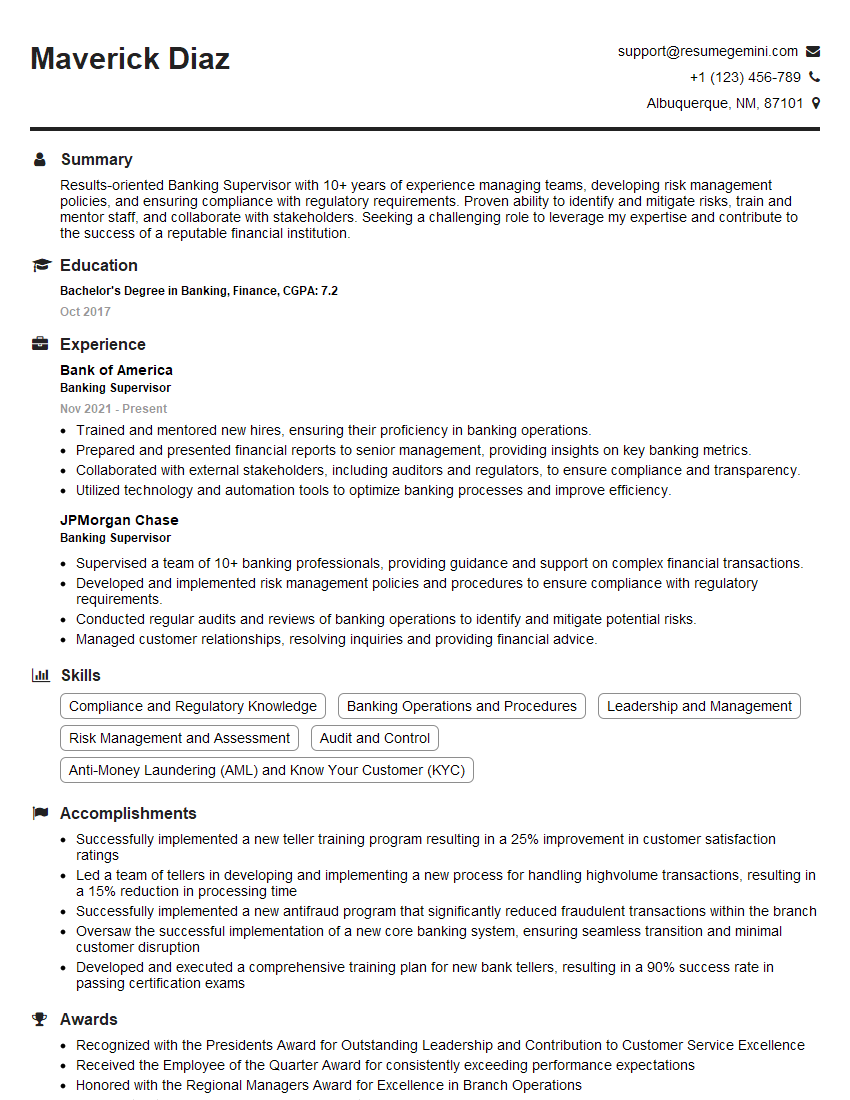

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Banking Supervisor

1. What are the key responsibilities of a Banking Supervisor?

As a Banking Supervisor, my primary responsibilities would encompass:

- Overseeing the financial performance and operations of banks to ensure compliance with regulations and prudent banking practices.

- Conducting risk assessments and implementing measures to mitigate potential risks to the bank and its customers.

2. Describe the different types of banking supervision and their respective objectives.

On-site Supervision

- Involves direct visits to banks to assess their operations, financial condition, and adherence to regulations.

- Objective: To gain a comprehensive understanding of the bank’s practices, identify potential risks, and provide guidance as needed.

Off-site Supervision

- Monitors banks remotely through the analysis of financial reports, regulatory filings, and other data.

- Objective: To identify trends, assess risks, and supplement on-site supervision.

Risk-Focused Supervision

- Tailors supervision to the specific risks faced by individual banks based on their size, complexity, and business model.

- Objective: To allocate supervisory resources effectively and focus on the most critical areas.

3. What are the main challenges faced by Banking Supervisors today?

Banking Supervisors face several key challenges in the current landscape, including:

- Increasing complexity and interconnectedness of the financial system.

- Rapid technological advancements and the emergence of new financial products.

- Heightened regulatory expectations and the need to balance safety and soundness with innovation.

4. Describe your approach to risk management in banking supervision.

My approach to risk management in banking supervision is comprehensive and proactive, encompassing the following steps:

- Identifying and assessing potential risks to the bank and its customers.

- Developing and implementing risk mitigation strategies to address identified risks.

- Monitoring and evaluating the effectiveness of risk management measures.

- Communicating risk management findings to senior management and regulatory authorities as appropriate.

5. How do you stay up-to-date with the latest developments in banking regulation and supervision?

I actively engage in continuous professional development to stay abreast of the latest developments in banking regulation and supervision, including:

- Attending industry conferences and seminars.

- Reading regulatory publications and research papers.

- Networking with other Banking Supervisors and professionals in the field.

6. Describe a situation where you had to make a difficult decision as a Banking Supervisor.

In a previous role, I encountered a situation where a bank under my supervision had engaged in questionable lending practices. After careful analysis, I determined that the bank’s actions posed a significant risk to its financial stability. I made the difficult decision to issue a cease-and-desist order to prevent further lending and protect depositors’ funds.

7. How do you handle conflicts of interest in your role as a Banking Supervisor?

Conflicts of interest are managed strictly through adherence to ethical guidelines and best practices, including:

- Disclosing any potential conflicts to senior management and regulatory authorities.

- Recusing myself from any supervisory activities where a conflict exists.

8. What are your strengths and weaknesses as a Banking Supervisor?

Strengths

- Strong understanding of banking regulations and supervisory practices.

- Proven ability to assess and mitigate financial risks.

- Excellent communication and interpersonal skills.

Weaknesses

- Lack of experience in international banking supervision.

- Could improve time management skills when dealing with multiple priorities.

9. Why are you interested in this Banking Supervisor position?

I am eager to contribute my skills and experience to your esteemed organization. I am particularly drawn to the reputation of your bank for its commitment to prudential banking and customer-centricity. I believe that my expertise in banking supervision can support your efforts in maintaining financial stability and protecting the interests of depositors.

10. What are your salary expectations for this role?

My salary expectations are commensurate with my experience and qualifications. I am confident that my contributions will bring value to your organization, and I am open to discussing a competitive compensation package that aligns with the market standards for this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Banking Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Banking Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Banking Supervisors oversee the daily operations of a bank or credit union and play a vital role in ensuring compliance with regulations. They are responsible for managing a team of tellers, loan officers, and other banking professionals. The key job responsibilities of a Banking Supervisor include:

1. Operations Management

Supervising and managing the day-to-day operations of a bank branch.

- Ensuring smooth and efficient functioning of all banking activities, including cash handling, account opening, loan processing, and customer service.

- Implementing and maintaining bank policies and procedures.

2. Staff Management

Leading, motivating, and developing a team of banking professionals.

- Providing training and support to staff on banking products, services, and regulations.

- Evaluating staff performance and providing feedback.

3. Compliance Oversight

Ensuring compliance with all applicable banking regulations and laws.

- Monitoring transactions for suspicious activity and reporting any potential fraud or money laundering.

- Maintaining accurate and up-to-date records of all banking activities.

4. Customer Relations

Providing excellent customer service and resolving any customer inquiries or complaints.

- Building and maintaining strong relationships with customers.

- Identifying and meeting customer needs.

Interview Tips

Preparing for a Banking Supervisor interview requires thorough research and a well-structured approach. Here are some tips to help you ace the interview:

1. Research the Bank and the Role

Before the interview, take the time to research the bank and the specific Banking Supervisor role you are applying for. Understand the bank’s products, services, and culture, as well as the key responsibilities and expectations of the position.

2. Practice Common Interview Questions

Prepare for common interview questions related to your skills, experience, and knowledge of the banking industry. Practice answering these questions using the STAR method (Situation, Task, Action, Result), providing specific examples from your previous roles.

3. Highlight your Leadership and Management Skills

Banking Supervisors are leaders who manage teams and ensure the smooth functioning of the branch. Emphasize your leadership, management, and communication skills, providing examples of how you have successfully motivated and developed your team in the past.

4. Showcase your Compliance Knowledge

Compliance is a critical aspect of banking operations. Showcase your knowledge of relevant banking regulations and your ability to identify and mitigate risks. Discuss your experience in implementing and maintaining compliance programs.

5. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview demonstrates your interest in the role and the bank. Prepare a few questions that show your enthusiasm and curiosity about the position and the organization.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Banking Supervisor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!