Are you gearing up for a career in Bankman? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Bankman and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

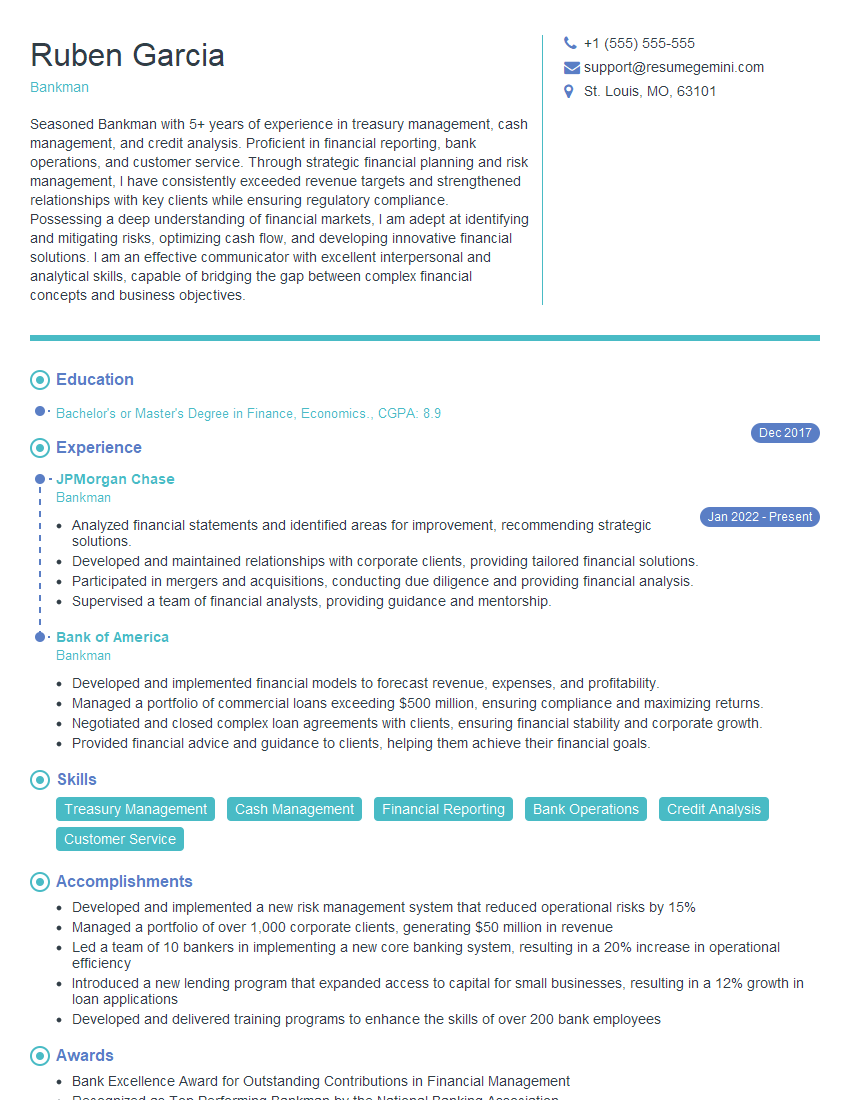

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bankman

1. What is the Basel Accords and how does it impact the risk management framework of banks?

- The Basel Accords are a set of international banking regulations that aim to strengthen the regulation, supervision, and risk management of banks.

- The Accords have been developed by the Basel Committee on Banking Supervision (BCBS), which is part of the Bank for International Settlements (BIS).

- The most recent Accord, Basel III, was finalized in 2010 and introduced a number of new requirements for banks, including:

- Increased capital requirements

- Enhanced liquidity standards

- Improved risk management practices

- The Basel Accords have had a significant impact on the risk management framework of banks, forcing them to adopt more conservative risk management practices and to hold more capital.

2. Can you explain the concept of Value at Risk (VaR) and its application in risk management?

VaR calculation methods

- Parametric VaR

- Non-parametric VaR

- Historical Simulation

- Monte Carlo simulation

Applications of VaR

- Measuring market risk

- Setting capital requirements

- Developing risk management strategies

3. What are the key components of a bank’s liquidity risk management framework?

- Liquidity risk assessment

- Liquidity risk limits

- Liquidity risk monitoring

- Liquidity risk contingency planning

4. Can you explain the difference between credit risk and market risk?

- Credit risk is the risk of loss due to a borrower’s default on a loan.

- Market risk is the risk of loss due to changes in market prices, such as interest rates, foreign exchange rates, and commodity prices.

5. What are the different types of financial instruments used to manage risk?

- Derivatives, such as forwards, futures, options, and swaps

- Insurance contracts

- Securitization

6. Can you explain the concept of operational risk and how it is managed in banks?

- Operational risk is the risk of loss due to operational failures, such as fraud, errors, system failures, and natural disasters.

- Banks manage operational risk through a variety of measures, including:

- Developing and implementing sound operational policies and procedures

- Conducting regular risk assessments

- Implementing risk controls

- Providing training to employees

7. What is the role of stress testing in risk management?

- Stress testing is a technique used to assess the resilience of a bank’s financial system to adverse economic conditions.

- Stress tests are typically conducted by simulating a variety of hypothetical scenarios, such as a recession, a sharp decline in asset prices, or a large increase in interest rates.

- The results of stress tests are used to identify potential vulnerabilities in a bank’s financial system and to develop strategies to mitigate these vulnerabilities.

8. What is the importance of risk appetite in bank risk management?

- Risk appetite is the amount of risk that a bank is willing to take in order to achieve its business objectives.

- Risk appetite is determined by a variety of factors, including the bank’s size, business model, and regulatory environment.

- It is important for banks to have a well-defined risk appetite and to ensure that their risk-taking activities are consistent with their risk appetite.

9. Can you explain the concept of risk culture and its importance in risk management?

- Risk culture is the set of values, beliefs, and behaviors that determine how an organization approaches risk.

- A positive risk culture is one in which risk is taken into account in all decision-making and where employees are encouraged to speak up about potential risks.

- A negative risk culture is one in which risk is ignored or downplayed and where employees are afraid to speak up about potential risks.

- A positive risk culture is essential for effective risk management.

10. What are the challenges and opportunities facing bank risk management in the current economic environment?

Challenges

- Low interest rates

- High levels of debt

- Increased regulatory scrutiny

- Cybersecurity risks

- Climate change

Opportunities

- Data analytics

- Artificial intelligence

- Fintech

- Collaboration with other stakeholders

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bankman.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bankman‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bankers are the lifeblood of the financial industry, providing essential services to individuals, businesses, and governments. They play a crucial role in managing financial transactions, advising clients on investments, and facilitating the flow of money throughout the economy.

1. Manage Financial Transactions

Bankers handle a wide range of financial transactions on behalf of their clients. This includes processing deposits and withdrawals, issuing loans, and executing trades. They must ensure that all transactions are accurate and compliant with regulatory requirements.

- Process deposits and withdrawals

- Issue loans and mortgages

- Execute trades

2. Advise Clients on Investments

Bankers provide financial advice and guidance to individuals and businesses. They help clients assess their financial goals, develop investment strategies, and make informed decisions about their investments.

- Recommend investment products

- Develop financial plans

- Manage investment portfolios

3. Facilitate the Flow of Money

Bankers play a vital role in facilitating the flow of money throughout the economy. They provide loans to businesses, allowing them to expand and create jobs. They also process payments between individuals and businesses, enabling commerce to take place.

- Provide loans to businesses

- Process payments

- Manage cash flow

4. Maintain Compliance with Regulations

Bankers must comply with a complex array of regulations governing the financial industry. These regulations are designed to protect consumers and ensure the stability of the financial system. Bankers must stay up-to-date on regulatory changes and take steps to ensure that their operations are compliant.

- Stay up-to-date on regulatory changes

- Implement compliance programs

- Conduct internal audits

Interview Tips

The interview process for a Bankman position can be daunting, but by following these tips, you can increase your chances of success:

1. Research the Bank and the Position

Before you go on your interview, take some time to research the bank and the specific position you are applying for. This will help you understand the bank’s culture, values, and goals. You should also be able to articulate how your skills and experience align with the requirements of the position.

- Visit the bank’s website

- Read the bank’s annual report

- Talk to people who work at the bank

2. Prepare for Common Interview Questions

There are certain questions that are commonly asked in Bankman interviews. By preparing for these questions in advance, you can increase your chances of giving confident and well-informed answers.

- “Tell me about yourself.”

- “Why are you interested in this position?”

- “What are your strengths and weaknesses?”

- “What is your experience in [specific area of banking]?”

- “What are your goals for your career?”

3. Dress Professionally

First impressions matter, so it is important to dress professionally for your interview. This means wearing a suit or business casual attire. You should also make sure that your clothes are clean and pressed.

- Wear a suit or business casual attire

- Make sure your clothes are clean and pressed

- Avoid wearing excessive jewelry or makeup

4. Be on Time

Punctuality is important for any interview, but it is especially important for Bankman interviews. Banks are typically very busy places, so arriving late can send the wrong message. Aim to arrive at the interview location at least 15 minutes early.

- Aim to arrive at the interview location at least 15 minutes early

- If you are running late, call the interviewer to let them know

- Be prepared to explain why you were late

5. Be Yourself

The most important thing is to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Just relax and be confident in your abilities.

- Be yourself

- Relax and be confident

- Don’t try to be someone you’re not

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Bankman interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!