Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Benefits Representative interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Benefits Representative so you can tailor your answers to impress potential employers.

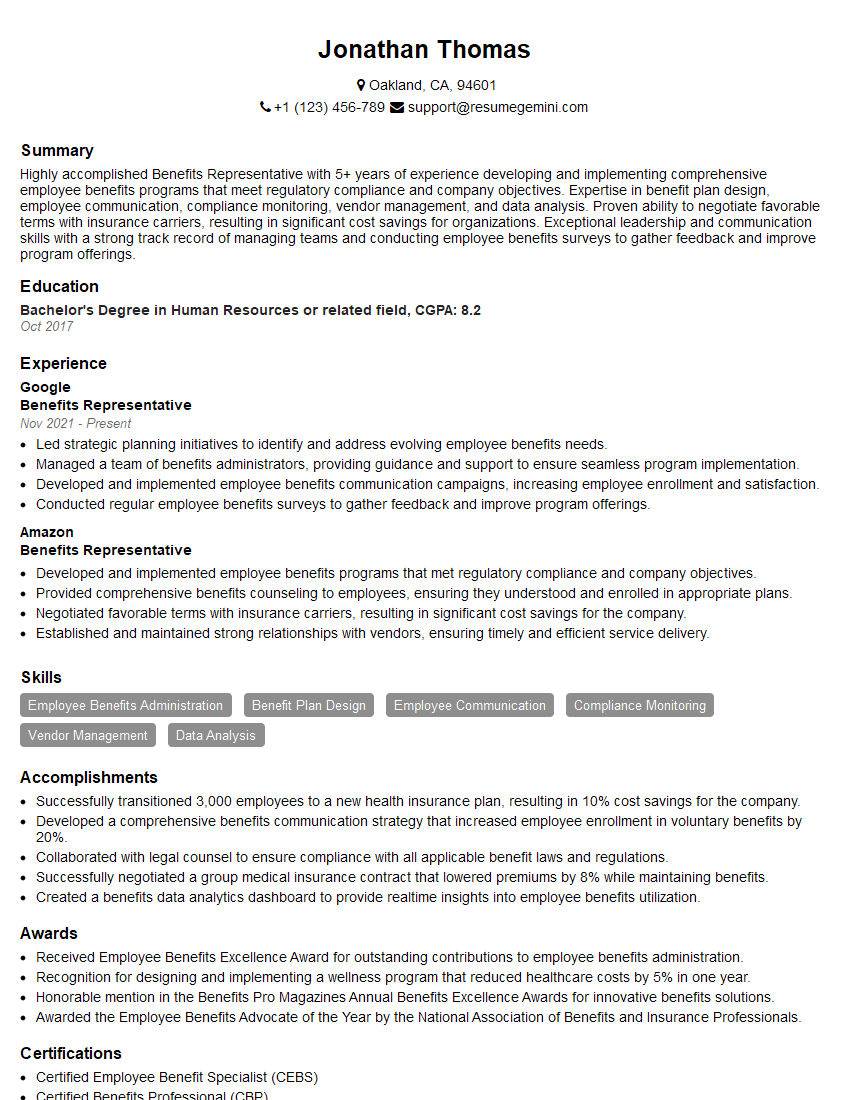

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Benefits Representative

1. What are the key components of a comprehensive employee benefits package?

A comprehensive employee benefits package typically includes the following components:

- Health insurance

- Dental insurance

- Vision insurance

- Life insurance

- Disability insurance

- Paid time off

- Retirement savings plan

- Tuition reimbursement

- Wellness programs

- Employee discounts

2. What are the different types of health insurance plans available to employees?

HMOs

- Health Maintenance Organizations (HMOs) are a type of managed care plan that provides comprehensive health care services to members for a fixed monthly premium.

- HMOs typically have a network of providers that members must use.

- HMOs often offer lower premiums than other types of health insurance plans.

PPOs

- Preferred Provider Organizations (PPOs) are a type of managed care plan that offers more flexibility than HMOs.

- PPOs have a network of providers that members can use, but members can also choose to see out-of-network providers.

- PPOs typically have higher premiums than HMOs.

POSs

- Point-of-Service (POS) plans are a type of managed care plan that combines features of HMOs and PPOs.

- POS plans typically have a network of providers that members must use, but members can also choose to see out-of-network providers for a higher cost.

- POS plans typically have lower premiums than PPOs.

EPOs

- Exclusive Provider Organizations (EPOs) are a type of managed care plan that is similar to HMOs.

- EPOs have a network of providers that members must use.

- EPOs typically have lower premiums than HMOs.

3. What are the advantages and disadvantages of self-funded health insurance plans?

Advantages

- Self-funded health insurance plans can be more cost-effective than fully-insured plans.

- Self-funded plans give employers more flexibility in designing their benefits package.

- Self-funded plans can help employers avoid premium increases.

Disadvantages

- Self-funded health insurance plans can be more risky than fully-insured plans.

- Self-funded plans require employers to have a large enough pool of employees to spread risk.

- Self-funded plans can be more complex to administer than fully-insured plans.

4. What are the key considerations when designing a retirement savings plan for employees?

- The type of plan (e.g., 401(k), 403(b), IRA)

- The investment options available

- The fees associated with the plan

- The employer’s matching contribution

- The employee’s risk tolerance

- The employee’s retirement goals

5. What are the different types of employee discounts that can be offered?

- Discounts on products and services from the employer

- Discounts on products and services from other businesses

- Discounts on travel and entertainment

- Discounts on health and wellness services

- Discounts on educational programs

6. What are the best ways to communicate employee benefits information to employees?

- Benefits fairs

- Online benefits portals

- Printed materials

- One-on-one meetings

7. What are the most common employee benefits compliance issues?

- ERISA

- COBRA

- ACA

- HIPAA

- FMLA

8. What are the best ways to stay up-to-date on employee benefits trends?

- Reading industry publications

- Attending conferences and webinars

- Networking with other benefits professionals

- Following industry experts on social media

- Taking continuing education courses

9. What are your strengths as a Benefits Representative?

- Strong knowledge of employee benefits

- Excellent communication and interpersonal skills

- Ability to complex benefits information in a clear and concise manner

- Experience in designing and implementing employee benefits programs

- Proficient in benefits administration software

- Up-to-date on employee benefits trends

10. What are your career goals?

- To become a more effective and successful Benefits Representative

- To make a strategic contribution to my organization

- To help my organization attract and retain top talent

- To stay up-to-date on employee benefits trends and best practices

- To build a successful and rewarding career in the employee benefits industry

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Benefits Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Benefits Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

As a Benefits Representative, you are the bridge between employees and their benefits. You support the HR department by assisting employees, answering their questions, and ensuring they maximize their benefits. Here are key responsibilities you will handle:

1. Employee Benefits Administration

You will be responsible for the day-to-day administration of employee benefits, including health insurance, dental insurance, vision insurance, retirement plans, and paid time off. You will ensure that employees are enrolled in the correct plans and that their benefits are processed accurately and timely.

- Process and maintain employee benefits enrollment and changes

- Assist employees with selecting and enrolling in benefits

- Coordinate with insurance carriers and third-party administrators on benefits-related issues

2. Employee Benefits Communication

You will be responsible for communicating with employees about their benefits. You will develop and deliver training materials, conduct presentations, and answer employees’ questions. You will also keep employees informed of changes to benefits plans.

- Develop and deliver employee benefits communication materials

- Conduct employee benefits training sessions

- Answer employee benefits questions

3. Employee Benefits Compliance

You will be responsible for ensuring that the company’s employee benefits plans comply with all applicable laws and regulations. You will also be responsible for maintaining records and filing reports as required by law.

- Monitor changes in benefits-related laws and regulations

- Ensure that the company’s employee benefits plans comply with all applicable laws and regulations

- Maintain records and file reports as required by law

4. Employee Benefits Technology

You will be responsible for using technology to support the administration of employee benefits. You will use software to process enrollment forms, track employee benefits, and communicate with employees. You will also be responsible for maintaining the company’s benefits website.

- Use software to process employee benefits enrollment forms

- Track employee benefits and maintain records

- Communicate with employees using email, text, and other electronic means

- Maintain the company’s benefits website

Interview Tips

Firstly, prior to the interview, research about the company and the position. This shows you’re invested and interested in the role. Here are some interview tips to help you ace your interview:

1. Be prepared to answer questions about your experience and qualifications.

The interviewer will want to know what you have done in the past that has prepared you for this role. Be sure to highlight your experience in employee benefits administration, communication, compliance, and technology. You can also share any relevant certifications or training you have completed.

- Example Outline

-

Question: Tell me about your experience in employee benefits administration.

Answer: In my previous role as a Benefits Representative at [Company Name], I was responsible for the day-to-day administration of employee benefits, including health insurance, dental insurance, vision insurance, retirement plans, and paid time off. I processed and maintained employee benefits enrollment and changes, assisted employees with selecting and enrolling in benefits, and coordinated with insurance carriers and third-party administrators on benefits-related issues.

2. Be prepared to answer questions about your knowledge of employee benefits laws and regulations.

The interviewer will want to know that you are knowledgeable about the laws and regulations that govern employee benefits. Be sure to brush up on the Affordable Care Act, the Employee Retirement Income Security Act (ERISA), and any other relevant laws.

- Example Outline

-

Question: What is you knowledge about the Affordable Care Act (ACA)?

Answer: The Affordable Care Act (ACA), also known as Obamacare, is a comprehensive health care reform law enacted by the US government in 2010. The ACA has a number of provisions designed to expand health insurance coverage, make health insurance more affordable, and protect consumers from unfair insurance practices.

3. Be prepared to answer questions about your customer service skills.

As a Benefits Representative, you will be interacting with employees on a daily basis. It is important to have strong customer service skills so that you can answer questions, resolve concerns, and build relationships with employees.

- Example Outline

-

Question: Tell me about a time when you had to resolve a difficult customer service issue.

Answer: In my previous role, I had to resolve a difficult customer service issue when an employee’s health insurance claim was denied. I worked with the employee to gather all of the necessary documentation and I appealed the decision with the insurance carrier. After several weeks of back-and-forth, I was able to get the claim approved and the employee received the benefits they were entitled to.

4. Be prepared to answer questions about your career goals.

The interviewer will want to know what your career goals are and how this position fits into those goals. Be sure to articulate your goals clearly and explain how this position will help you achieve them.

- Example Outline

-

Question: What are your career goals?

Answer: My career goal is to become a Human Resources Manager. I believe that this position will help me achieve my goal by providing me with the opportunity to develop my skills in employee benefits administration, communication, compliance, and technology. I am also eager to learn more about the HR field and to gain experience in other areas of HR, such as recruiting, training, and development.

Next Step:

Now that you’re armed with the knowledge of Benefits Representative interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Benefits Representative positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini